Private equity valuation is a process fraught with complex methodologies, nuanced financial information, and regulatory confinements.

But without it—or with an inaccurate one—you risk poor decision making, portfolio mismanagement, and even legal or financial consequences.

To help you make sense of it, I discuss what is private equity valuation, key valuation methods, and how to calculate each with examples in this article.

However, to get an accurate valuation in a timely manner, I recommend you work with a professional valuation partner, like Eton.

Our team of Big-4 trained valuation experts go above and beyond to deliver an accurate, reliable, and court-defensible valuation in as short as 10 days. Please get in touch with me for more information.

Key Takeaways:

Private equity valuation is the process of determining the value of a company (or its assets) that is not publicly traded.

Unlike public companies whose value is continuously reflected in stock prices, private companies require a more nuanced approach to valuation.

This involves analyzing the company’s financial performance, market trends, and comparing it with similar companies or assets that have been sold or are publicly traded.

The goal is to arrive at an accurate and fair estimation of the company’s or asset’s worth.

This valuation is crucial for 8 key areas, such as:

Private equity firms require accurate valuations to make informed investment decisions.

Valuation helps in assessing the current value of potential investment opportunities and determining the price they are willing to pay for an investment.

For private equity firms seeking to raise funds from limited partners or other investors, providing accurate and credible valuations of their current investments is crucial.

It demonstrates the firm’s ability to generate returns and manage investments effectively.

Regulatory requirements often mandate that private equity firms report the value of their investments to stakeholders.

Accurate valuations are necessary for financial reporting and compliance purposes, ensuring transparency and trust with investors.

Valuation is key to assessing the performance of investments over time.

By regularly valuing their portfolio companies, private equity firms can gauge the success of their strategic initiatives and make adjustments as necessary.

Understanding the value of a portfolio company is essential when planning for an exit, be it through a sale, IPO, or other means.

Valuations inform negotiation strategies and help set expectations for the potential proceeds from an exit.

For internal purposes, valuations help private equity firms manage their portfolios effectively. By understanding the value and performance of each investment, firms can allocate resources and attention to maximize returns.

Many private equity firms use the value of their investments as a basis for compensating their investment professionals.

Accurate valuations ensure fair and motivating compensation structures.

Valuation provides insight into the risk profile of investments. By understanding the value and volatility of their assets, private equity firms can better manage risk across their portfolios.

Investors or third-party valuators use three main methods for valuation:

Each method is distinct and chosen based on the investment strategy and development stage of the company.

Let’s look at each in more detail.

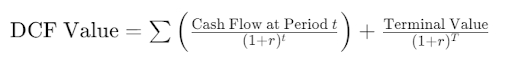

The Discounted Cash Flow (DCF) method estimates the value of an investment based on its expected future cash flows.

The core principle is that the value of an investment today is equal to the sum of its future cash flows, discounted back to their present value.

DCF is often used in scenarios where future cash flows are predictable and can be estimated with reasonable accuracy.

It’s most suitable for companies with stable and predictable earnings, and for long-term investments where the value primarily derives from future earnings.

This is the general formula for calculating DCF:

Where:

And here are the general steps to start the valuation process:

Example:

Assume a company is expected to generate $100,000 in cash flow each year for the next 5 years, and a terminal value at the end of 5 years is estimated at $500,000. If we use a discount rate of 10%, the DCF calculation would be:

Year 1: \frac{$100,000}{(1 + 0.10)^1} = $90,909

Year 2: \frac{$100,000}{(1 + 0.10)^2} = $82,645

Year 3: \frac{$100,000}{(1 + 0.10)^3} = $75,131

Year 4: \frac{$100,000}{(1 + 0.10)^4} = $68,301

Year 5: \frac{$100,000}{(1 + 0.10)^5} = $62,092

Terminal Value: \frac{$500,000}{(1 + 0.10)^5} = $310,461

Adding these together, the DCF value of the investment would be $90,909 + $82,645 + $75,131 + $68,301 + $62,092 + $310,461 = $689,539.

This calculated value represents the present value of the company based on its future cash flow projections.

Related Read: Understanding the Income Approach Valuation Method

As the name suggests, this method aims to identify public companies similar to a private asset, in terms of industry, sector, business characteristics, and size.

It then assesses the valuation multiples at which these public companies are trading in the market.

The essence of CCA is to provide a fair price estimation for illiquid positions, reflecting what the asset might be worth if sold in the current market conditions. This approach is grounded in the principle of market comparability.

CCA is often used when there are publicly traded companies that share similar characteristics with the private company or asset being valued.

This method is particularly useful for stakeholders in private companies or assets who wish to understand their potential market value, especially in preparation for events like a sale or public offering.

There is no set formula for CCA, but the calculation process typically looks like this:

Example:

For instance, if you’re valuing a private tech company, you might look at public tech companies with similar products, market presence, and revenue size.

Suppose the average EV/EBITDA multiple in this peer group is 12x, and the private company’s EBITDA is $20 million.

Applying the average multiple, the value estimation for the private company would be 12x * $20 million = $240 million.

The Precedent Transactions method involves valuing a private asset by looking at what similar companies have sold for recently.

This method relies on the concept that the value of a company can be gauged based on what investors have recently paid for comparable companies under similar circumstances.

It reflects the real-world market value that has been established through actual M&A activities, offering a practical benchmark for current valuations.

This method is particularly useful in scenarios where there have been recent transactions involving similar companies, especially in the same industry or sector.

It is most suitable for stakeholders in mergers and acquisitions (M&A), as it provides a realistic view of what the market has been willing to pay for similar assets.

This approach is favored in situations where market trends and recent transaction data are available and reliable.

The calculation process typically involves:

Example:

If a private manufacturing company is being valued, you might examine recent sales of similar manufacturing companies.

Assume two comparable companies were sold for 7x and 8x their EBITDA, respectively.

If the private company’s EBITDA is $30 million, the valuation could be approximated by averaging the multiples (7.5x) and applying it to the EBITDA.

Thus, the estimated value would be 7.5x * $30 million = $225 million.

These are the three most commonly used valuation methods in the industry. Other valuation methods include:

Here’s a summary table comparing each of these methods:

| Pros | Cons | |

| Discounted Cash Flow (DCF) Analysis: | Provides a detailed and intrinsic value based on future cash flow projections; considers the time value of money. | Requires accurate future cash flow forecasts, which can be highly speculative; sensitive to changes in assumptions. |

| Comparable Company Analysis (CCA): | Relatively straightforward; allows for market-based valuation through comparison with similar companies. | Market conditions may distort valuations; finding truly comparable companies can be challenging. |

| Precedent Transaction Analysis: | Reflects market reality by basing valuations on actual transaction prices; useful for M&A scenarios. | Relevant transaction data may be limited or confidential; past transactions may not reflect current market conditions. |

| Leveraged Buyout (LBO) Analysis: | Assesses investment viability based on potential returns; useful for determining maximum purchase price. | Heavily relies on financing structure and market conditions; not suitable for all types of companies. |

| Asset-Based Valuation: | Objective and straightforward, especially for asset-heavy companies; less speculation involved. | May undervalue companies with significant intangible assets or high growth potential. |

However, please note that there is no ‘best’ method to value private equity. It highly depends on:

Most valuators also use a combination of different methods to arrive at a more nuanced and accurate valuation.

If you don’t have prior investment or valuation experience, we recommend you work with a third-party valuation partner.

They will take into account all the important factors to choose the right valuation method that fits your situation.

If you need expert advice or a valuator to take you through the process, please get in touch with me here.

If you decide to work with a third-party valuation partner, this is what a typical process will look like:

Time taken: You can choose a provider in as little as 1-2 days.

Consider these factors when looking for a third-party valuation provider:

At Eton, our valuators are Big-4 trained and we take the time to understand the intricacies associated with each engagement, so you’ll get a tailored approach that meets your needs. We also provide on-going audit support whenever you need it.

We usually deliver a private equity valuation report in 10 days, although we can also do it in as short as 1 day for an extra fee.

“I have worked with Eton on several other companies, including Notion, Preset, and Convex, across various valuation needs at different companies and have consistently been amazed by their meticulous approach, swift delivery, and cost-effective solutions for all projects. Eton has always gone above and beyond, offering a unique combination of valuation expertise, legal insight, experience liaising with the C-suites and boards of directors, and seamless collaboration with us on any post-valuation questions.”

Time taken: 1-2 days (client side)

When you begin work with your chosen valuation provider, they’ll request certain financial and company documents to help them complete your valuation.

At Eton, we request:

This step is the one most likely to delay the private equity valuation process because most companies haven’t prepared the documents in advance. And delays can rack up additional costs.

Set yourself up for success by organizing these documents as soon as you can.

Time taken: 1 day (client and valuation firm)

The valuation date is the specific point in time at which a company’s value is assessed, serving as the reference for evaluating its financial, market, and operational conditions.

But it’s not necessarily the date we complete the valuation either. In fact, we often align it with a convenient financial time such as month or year-end.

The date can impact whether the valuation is compliant, strategic, and accurate.

Here are the factors we consider when choosing a valuation date:

Always approach the selection of a valuation date with a strategic mindset, considering both the internal needs of the company and the external regulatory and market environment.

It’s also important to document the rationale behind the date, particularly if the valuation is for a significant transaction or is likely to be scrutinized by external parties.

Time taken: 1 day (valuation firm side)

With your date chosen, you and your valuation firm can move on to applying sound private equity valuation methods.

At Eton, we consider all relevant factors to select the most accurate valuation method for your specific situation.

Time taken: Anywhere from 1-7 days (depending on specified turnaround time)

Next, your valuation firm will present a draft report, which includes the methods chosen, assumptions made, data pulled, and the draft fair market value conclusion.

This is an important step because it gives you time to review the work the firm has done and request adjustments before finalization.

With Eton, our experts are just a call away to discuss details and conclusions—whether that’s what amendments you need us to make, or if we can go ahead with finalization.

Time taken: Anywhere from 1 hr to 1 day depending on revisions (client & valuation firm)

Once revisions, if required, are made, your valuation firm will finalize the draft and send it to you for official sign off.

It’s the most straightforward step and the one that places your valuation, finally, in your hands.

At Eton Venture Services, we understand the complexities and nuances of private equity valuation. And we know what’s at stake—whether it’s if you’ll invest, identifying risk in your portfolio, or staying compliant with industry requirements.

Our team of financial and legal experts work together to value your company accurately and ensure you get the information you need to make strategic decisions.

We pride ourselves on our attention to detail and customer service, offering after-valuation support and being on call to give advice.

If you need private equity valuation services, get in touch with us here.

Have more questions on private equity valuation? I answered them below:

Valuing private equity investments involves several challenges. Here’s a list of common problems along with strategies to overcome them:

Lack of Transparency:

Subjectivity in Valuation:

Illiquidity of Assets:

Market Dynamics:

Dependence on Future Performance:

Variability in Industry Standards:

Regulatory and Compliance Issues:

Operational Risks in Target Companies:

Changes in Management or Strategy:

Integration Risks in Mergers and Acquisitions:

Each of these problems requires careful consideration and a tailored approach to ensure accurate and effective private equity valuation.

If you work with a third-party valuator, they will be able to give you targeted advice.

The fair value of a private equity fund is the estimated worth of all the investments it holds.

Imagine it like a basket containing different fruits, where each fruit represents an investment in a company. The fair value is what all these fruits, or investments, would sell for in the market right now.

It’s a way of adding up the current values of all these companies to figure out the total value of the fund.

Calculating this isn’t straightforward, as these companies aren’t sold on regular stock markets, so their prices aren’t listed daily.

Instead, the fund managers estimate each company’s value based on things like how well they’re doing, their financial health, and what similar companies are worth.

Schedule a free consultation meeting to discuss your valuation needs.

Chris co-founded Eton Venture Services in 2010 to provide mission-critical valuations to venture-based companies. He works closely with each client’s leadership team, board of directors, internal / external counsel, and independent auditor to develop detailed financial models and create accurate, audit-proof valuations.