Portfolio valuation is a process fraught with complex calculations, availability of market data, and regulatory confinements.

But without it—or with an inaccurate one—you risk:

In this article, I’ll take you through the key principles of portfolio valuation and how to accurately value portfolios under the ASC 820 guidelines set by US GAAP.

Key Takeaways

Portfolio valuation is the process of determining the fair value of a collection of financial assets, which can include stocks, bonds, derivatives, and other investments.

It serves as a critical component in:

By valuing portfolios regularly, investors can assess the performance of their holdings and adjust their strategies accordingly.

This helps them meet legal standards and make sure they meet capital adequacy requirements.

“Capital adequacy requirement” refers to the minimum amount of capital a bank or financial institution must hold as required by its financial regulator, to cover potential losses and stay financially stable.

To understand portfolio valuation on a deeper level, let’s look at four key concepts involved in the valuation process:

The fair value is the cornerstone of portfolio valuation.

It represents the price at which an asset would be sold between informed parties in an open market.

You determine the fair value of assets using valuation inputs, such as market prices, interest rates, and other relevant factors.

Common assets in a portfolio include equities, bonds, and derivatives.

Market prices are key in figuring out the value of a portfolio.

They show what people are willing to pay for financial assets based on supply and demand.

You can find market prices through exchanges, brokers, or pricing services.

However, in some cases, market prices may not be readily available, especially for illiquid (assets that don’t sell often) or thinly traded assets (assets that aren’t in high demand).

In such situations, valuation specialists might use alternative valuation techniques to estimate fair value.

Interest rates also impact portfolio valuation. They influence the present value of future cash flows, affecting the valuation of fixed-income securities such as bonds.

Changes in interest rates can result in fluctuations in the fair value of these assets.

So, it’s important to keep an eye on interest rate changes when valuing portfolios.

Valuation techniques are another important aspect of portfolio valuation.

Different methods like market, income, and cost approaches are used to find out fair value.

We explain each method in detail later in this article.

Before I go into how to value your portfolio, it’s essential to understand what the ASC 820 is and how it impacts the valuation process.

ASC 820, also known as the Fair Value Measurement standard, defines how fair value should be measured under Generally Accepted Accounting Principles (GAAP).

It gives a uniform framework for portfolio valuation, ensuring consistency, comparability, and transparency.

ASC 820 aims to enhance financial reporting by providing clear standards for valuing financial instruments.

It applies to all entities that measure fair value and provides guidance on classifying assets and liabilities within a fair value hierarchy.

This hierarchy categorizes the inputs used to measure fair value, emphasizing reliable and observable market data.

Another key purpose of ASC 820 is to promote consistency in fair value measurement across different entities.

By providing a standardized framework, it ensures that financial statements reflect the true economic value of assets and liabilities.

This is particularly important for investors and stakeholders who rely on accurate and reliable financial information to make informed decisions.

Furthermore, the scope of ASC 820 extends to all financial instruments that are required to be measured at fair value.

This includes both financial assets and financial liabilities, such as derivatives, investments, and certain debt instruments.

By providing guidance on the valuation of these instruments, ASC 820 helps you accurately assess your financial position and performance.

Read more: Understanding ASC 820: A Comprehensive Guide to Fair Value Measurement

ASC 820 outlines three key principles for portfolio valuation:

The fair value hierarchy prioritizes the use of the most reliable information available.

Entities should use quoted prices in active markets whenever possible.

Within the fair value hierarchy, there are three levels of valuation inputs:

ASC 820 also requires you to consider what people in the market — buyers and sellers — think is a fair price.

This approach assumes that buyers and sellers act on their own and have reasonable knowledge of the asset or liability.

This principle makes sure that fair value measurements reflect the expectations and assumptions of buyers and sellers.

ASC 820 stresses the need to use observable inputs as much as possible.

Observable inputs are data or information that is readily available and can be independently verified.

Using these inputs makes fair values more trustworthy.

Now that you’re familiar with the key principles, let’s look at the steps involved in portfolio valuations under ASC 820.

Valuing portfolios under ASC 820 involves two key steps that ensure accurate and reliable fair value measurements.

The first step is to identify the valuation inputs for each asset or liability. These inputs vary based on the availability of observable market data.

ASC 820 categorizes valuation inputs into 3 levels as discussed here.

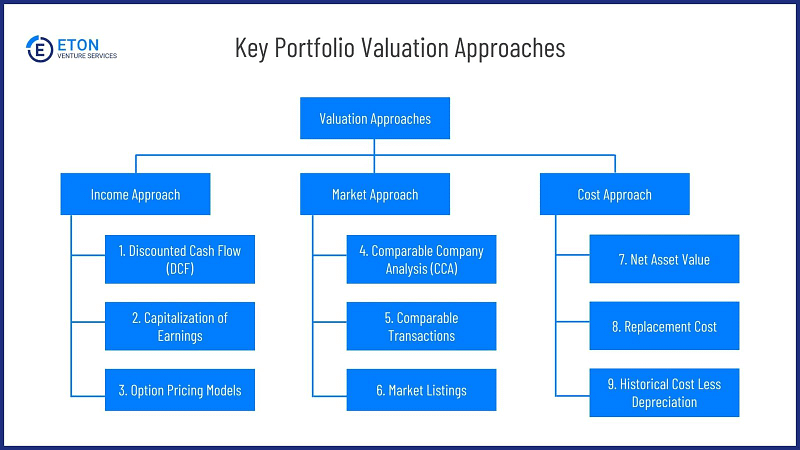

Valuators use three key valuation methods, with different valuation techniques under each. Here’s a summary:

Let’s look at each in detail:

The Income Approach estimates the value based on the future income the asset is expected to generate.

It’s particularly useful for investments that produce regular income, such as rental properties or businesses with predictable cash flows.

This method leverages techniques like:

Additionally, Option Pricing Models can be employed, especially useful for valuing derivatives or securities with features of options.

These models, such as the Black-Scholes or binomial models, help assess the value of choices or flexibility embedded in investment decisions, such as the option to expand operations or defer a project.

The Market Approach compares the asset to similar assets that have recently been sold or listed. Market approaches utilize market prices of similar assets or liabilities.

Underneath this approach, there are three key valuation techniques:

The Cost or Asset Approach estimates the value of an asset based on the cost to replace it with a new one of similar kind and condition.

It is particularly relevant for assets that do not generate income directly, such as equipment or buildings.

Here are three key techniques explained:

While ASC 820 provides comprehensive guidelines for portfolio valuation, challenges can arise in practice.

A common issue in portfolio valuation is relying too much on Level 1 inputs, which may not be available for all assets or liabilities.

To avoid this:

Portfolio valuation can become complex due to the nature of financial instruments and the estimation of fair value.

For the most accurate results, we recommend you work with an experienced portfolio valuation service provider, like Eton.

When picking a portfolio valuation service provider, consider these four key factors:

Find out who the analysts are, how many years they’ve worked in portfolio evaluation, what processes they follow, and where they’ve worked before.

This expertise can greatly impact the accuracy and reliability of the valuation.

Check the provider’s history of successful valuations.

Look for testimonials, case studies, and any industry awards or recognitions they have received.

A proven track record shows that the provider consistently delivers high-quality valuations.

It also tells you about their reputation and reliability as a service provider.

Check how fast the service provider can complete a portfolio valuation.

An efficient provider shouldn’t take longer than ten days to deliver portfolio evaluations.

The ability to perform rapid valuations without sacrificing quality is crucial, especially when timely decision-making and reporting are required.

At Eton, we can complete it in as little as one day if necessary.

Ask about their pricing for valuation services.

Prices can vary depending on how complex the portfolio is and how quickly you need the valuation.

Knowing the cost helps manage your budget and compare what different providers offer.

At Eton, we’ve completed thousands of business valuations, including portfolio valuations, for leading startups, VC firms, and legal teams for 15 years.

We combine the accuracy and professionalism of Big-4 firms with the friendly and personalized approach of a boutique firm.

Our valuation services are fast, thorough, and affordable. We support our clients through the entire process and will be on hand to support them even after the valuation is delivered.

Should things turn contentious, our valuations are justifiable in court. We use expert human judgment and robust methodologies that no automated valuation services can deliver.

So, how do we compare according to the four factors?

| Factor 1: Specialization & Expertise | We specialize in most common types of valuations, from portfolio valuations to Mergers & Acquisitions. |

| Factor 2: Track Record | We’ve completed 3000+ business valuations in our 15 years as a firm. And we’ve never lost an audit. |

| Factor 3: Time to Completion | Our valuation services take no more than 10 days. If you need it faster, we can expedite the process for an additional fee. |

| Factor 4: Costs | Considering the wealth of experience that our valuators bring, we keep our costs competitive. It’s much lower than Big 4 firms. On the lower end, a portfolio valuation (not 409A) with Eton will cost around $5000. |

We’ve fine-tuned the portfolio evaluation process to be as smooth as possible for you.

This is how it will look like if you work with us:

Here is how the process looks in detail:

Time taken: 1 day

We get on an initial call to understand your needs.

Time taken: 1-2 days (client side)

At Eton, we usually require you to send us the following documents:

Time taken: Anywhere from 1-7 days (depending on specified turnaround time)

Now with all the information that you have provided, we conduct a detailed valuation analysis of your portfolio.

This involves assessing each component’s fair market value, based on three different methods as discussed above.

Delivered on: Day 7 (by valuation expert)

Your dedicated analyst will prepare the draft valuation calculations which include:

If you choose us as your service provider, we will let you know when you can expect to receive this draft.

That way you can reserve time in your schedule to review it.

Received on: Day 10 (Client to review and raise any concerns and questions)

Time taken to finalize: 1-2 days

Now that you have your draft report, you can review it.

Check that you understand the assumptions made and that you’re alright with the value numbers.

If anything is unclear or you have any concerns, we’re always ready to hop on a call to straighten things out.

After discussion, we’ll draw up the final report and sign off on the engagement.

If you’d like an accurate, fast, and court-defensible portfolio valuation, please reach out today.

Have more questions about portfolio valuations? I answered them below:

Portfolio valuation directly affects the balance sheet, income statement, and cash flow statement.

Accurate valuation of assets is crucial for presenting the company’s true financial position, calculating profitability, and determining cash flows from investments.

Inaccurate or outdated valuations can lead to misrepresentation and potential compliance issues with regulatory authorities.

The frequency of portfolio valuation for financial reporting purposes depends on the company’s reporting requirements and the nature of the assets held.

Publicly traded companies typically perform valuations at least quarterly, while private companies may do so annually or as required by their stakeholders.

It is important to update valuations whenever significant changes occur in the company’s assets or market conditions that could materially impact asset values.

Engaging a third-party valuation firm, like Eton, for portfolio valuation offers several benefits, including:

Additionally, third-party valuation reports can enhance the credibility of financial statements, and help mitigate potential risks associated with regulatory compliance and stakeholder concerns.

Schedule a free consultation meeting to discuss your valuation needs.

Chris co-founded Eton Venture Services in 2010 to provide mission-critical valuations to venture-based companies. He works closely with each client’s leadership team, board of directors, internal / external counsel, and independent auditor to develop detailed financial models and create accurate, audit-proof valuations.