Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

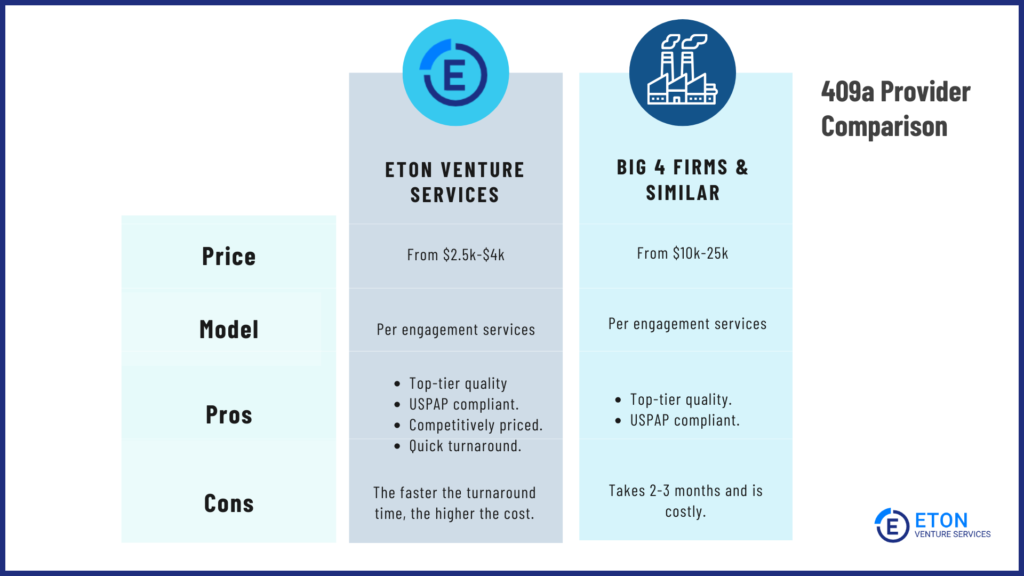

409A valuations typically cost anywhere from $2500 to $4000.

Where you fall in that range will depend on the complexity of your startup’s funding stage and the turn-around time required.

For early-stage startups that are happy with a turnaround time of 10 days, expect your 409A valuation to cost close to $2500.

However, if you’re a company with a more complex investment structure (such as a Series B company or later), then your fee will fall closer to the $4000 price bracket.

An expedited 409A valuation will incur a higher fee. So if you need your 409a valuation services sooner than 10 days then expect to pay a small premium.

We consider two things when pricing your 409a valuation:

Because no two 409a valuation needs will be the same, we always provide a custom quote and are happy to jump on a call to explain the cost and timeline of services.

“Complexity” comes down to your cap table which will tell us how many rounds of investment you have and what type of investment it is.

If you’re a new startup without outside investment, then your complexity level is low. But if you’re a Series B company or onward, you’ll have multiple levels of investment to analyze.

“Turnaround time” is as simple as it sounds. It’s the speed at which you need the service completed. Our standard service takes 10 days but we can do it as fast as one day.

Other providers may consider different factors.

These factors include:

Age, size, and industry don’t impact how we price your 409a valuation at Eton. Instead, we focus on share structure and company stage to define complexity.

You may have noticed some companies offer free 409A valuations, typically thrown in with their other services.

There are three reasons I’d recommend avoiding these:

Let’s look at each one in turn.

In terms of 409A valuations, a safe harbor is when your valuation is considered valid and defensible by the IRS. And unless the IRS can prove that your valuation is ‘ unreasonable’ your valuation cannot be found false.

A safe harbor is established when an independent third party with rigorous processes and audit-defensible skills conducts a 409A valuation. Automated cap table management companies often can’t provide a safe harbor 409A valuation due to the complexities and specific requirements involved in these valuations—it takes real human judgment and understanding of legal nuance.

It’s highly debatable whether Cap Table platforms follow reasonable methods and are USPAP compliant.

Here’s why:

If your 409A valuation doesn’t come with a safe harbor, which you’re at risk of with cap table providers, you will have to spend time and resources defending the valuation yourself.

If the valuation is proven unreasonable and does not meet fair market value, then you could face:

Why avoid cap table providers besides tax consequences?

Investors want to mitigate risk. Part of legal due diligence is 409a compliance and if you’re using a provider who can’t guarantee that safe harbor you could be delaying funding or even losing out on investment opportunities altogether.

That’s because automated 409A valuations are often rejected by audit firms and investors will often require an audit firm to look at your 409A history. This becomes more important the more complex your cap table is.

Even if automated cap table sourced reports satisfy the compliance checklist, they often inflate the value of common stock, sometimes by up to 30–50%.

When this reality comes to light, it only hurts and demoralizes employees.

They may find their options less attractive if they perceive them as unfairly high, which can undermine the very incentive schemes designed to motivate and retain them.

Our fee includes:

As part of your 409A valuation, we’ll follow a 6-step process:

1. Information Collection

2. Valuation Modelling and Analysis

3. Draft Reports Delivered

4. Client Review and Approval

5. Board/Audit/SEC/IRS Support by Eton Senior Staff

Remember, you’re also paying for an efficient timeline. The entire process can be done between 1 and 10 days from the delivery of your documents.

Selecting the right 409A valuation provider is a balancing act between cost, quality, and compliance.

Here’s what I’d avoid and what I’d look for in a provider:

Avoid:

Look for:

By following these guidelines, you’ll find a provider that offers not just a competitive price, but also the quality and safe harbor status essential for your peace of mind and compliance.

Our valuation team all come from Big 4 accounting firms. But what does that mean for you?

That means we can deliver the highest caliber of valuation (the same you would get with Deloitte, Ernst & Young (EY), KPMG, and PwC) without you paying the high ticket price that comes with one of the Big 4 firms.

409A valuations from a major firm like those I’ve listed can run you anywhere from 10k up to $25k. This is a lot of money when you can get the same, if not better quality from us, for less.

And in a much shorter time; those same firms take 2-3 months compared to our max of 10 days.

There are providers out there who use automated valuation methods and as a consequence can charge less for 409a valuation services. They usually come in at $2000 which will be one of the least expensive 409a valuation options on the market.

The issue here is that automated 409a valuation may not be (and is probably not) USPAP compliant. They don’t provide a safe harbor—a defensible, valid valuation to the IRS.

📕 USPAP = Uniform Standards of Professional Appraisal Practice.

If you’re audited by the IRS and your 409A doesn’t qualify for safe harbor, you will need to prove your 409a values your company shares at fair market value.

With Eton’s 409A valuations, you always get safe harbor status and the burden of proof is on the IRS.

So even if audited, your focus can stay where it needs to be: growing your business. Plus, we’ve never lost an audit.

In need of 409A valuation services that are fairly priced, high quality, and USPAP compliant?

Talk to our team here to find out exactly how much a 409A valuation would cost you at your stage of business.

Here are some common questions we get at Eton on this topic.

Your 409A valuation is like buying an insurance policy. It’s not just about cost—it’s about the value of compliance, the peace of mind it brings, and the avoidance of hefty penalties from the IRS.

It’s always worth paying for a dedicated specialist firm over a cheap, and potentially risky 409A provider such as from a cap table Platform. But at the same time, you don’t need to go to a major firm such as Deloitte and fork out more than $10k+.

Ask yourself:

If you can answer yes to those then the 409a valuation is worth the money.

At Eton, we ensure that our valuations are a smart investment, providing you with a robust defense in the unlikely event of an audit. And we’re competitively priced considering it’s the equivalent if not superior to the likes of Deloitte, Ernst & Young (EY), KPMG, and PwC.

A 409A valuator looks at the nitty-gritty of your company’s financials, market conditions, and complex cap tables to determine the fair market value of your company’s stock.

With every 409A valuation, they will assess which valuation method is most applicable and will get you a true, favorable fair market valuation.

It’s a meticulous process that ensures your stock option pricing aligns with IRS regulations and protects both you and your employees.

Technically, you could, but it’s akin to representing yourself in court—possible, but fraught with risk.

The IRS requires that the valuation be conducted by a qualified, independent appraiser, especially as your company grows.

Doing it yourself could lead to an IRS challenge, and without the proper expertise, you might find yourself in hot water.

At Eton, we’ve streamlined the process to be as efficient as possible. Our standard turnaround is 10 days, but we can do it in as few as one.

Compare that to Deloitte, Ernst & Young (EY), KPMG, and PwC where 409a valuation services take months.

We’ve explained the nuances behind timelines in our article here: “how long does a 409a valuation take?“.

The 409A valuation often comes in lower than what founders expect because it’s not a measure of future potential but a snapshot of current fair market value.

It’s a conservative estimate that takes into account various risk factors and market conditions to arrive at a value that is defensible and compliant with IRS regulations.

While there are many providers out there, it’s crucial to choose one that brings a blend of speed, accuracy, and compliance.

At Eton, we offer Big 4 expertise without the Big 4 price tag, all while ensuring USPAP compliance and safe harbor status.

Safe harbor status means your 409a valuation is presumed accurate unless the IRS can prove otherwise.

To get this status, your 409a valuation provider will need to follow USPAP standards and methodologies.

This is something that Eton Venture Services provides as a core part of our valuation process, ensuring that your valuation stands up to the most rigorous examination and that the burden of proof always lies with the IRS.

Still undecided? Take a read of our article comparing the top 409a valuation consultants for hire for further details on our services.

Schedule a free consultation meeting to discuss your valuation needs.

Chris co-founded Eton Venture Services in 2010 to provide mission-critical valuations to venture-based companies. He works closely with each client’s leadership team, board of directors, internal / external counsel, and independent auditor to develop detailed financial models and create accurate, audit-proof valuations.