Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

For late-stage startups (Series B, C, D, and pre-IPO), 409A valuations become significantly more complex than they were in the early rounds.

At this stage, you’re dealing with multiple financings, layered terms, and secondary transactions that need to be modeled carefully.

At the same time, auditors expect valuations to hold up under close review, and finance teams need them delivered fast enough to keep grants and board approvals moving.

At Eton, we work with late-stage companies facing these pressures every day. Backed by Big 4 consulting experience and Stanford Law expertise, we deliver rigorous audit-ready valuations at the speed finance teams need, all while keeping pricing accessible for late-stage teams.

In this article, I’ll break down how 409As change as companies mature, the process we follow, and the valuation methodologies we use for Series B, C, D, and pre-IPO companies, highlighting exactly why late-stage finance teams choose Eton as their valuation partner.

The goal of a 409A valuation is always compliance, but the way companies reach that goal changes as they grow.

If you’re unfamiliar with the compliance standards, see our guide to 409A valuation requirements.

Early-stage startups can often meet compliance with simpler methods and lighter documentation. By Series B and beyond, valuations demand advanced modeling, deeper analysis, and reports that hold up under multiple layers of review.

Here’s how early-stage and late-stage 409As compare across the areas that matter most:

Aspect | Early-Stage (Seed / Series A) | Late-Stage (Series B, C, D, Pre-IPO) |

Equity structure | Simple cap tables (founders’ common stock, SAFEs, one preferred round). | Multiple preferred rounds, layered terms, secondary transactions. |

Financial history | Limited or no revenue history, forecasts often uncertain. | Established revenue, track record, reliable forecasts. |

Methodologies | Market comparables, asset/cost approaches. | Backsolve, DCF, PWERM (scenario modeling). |

Scrutiny level | Primarily reviewed for IRS safe harbor, with minimal outside involvement. | Must satisfy IRS safe harbor while also withstanding review from auditors, investors, and in some cases the SEC. |

Frequency | Typically refreshed after funding rounds, or annually if options are being granted. | Refreshed every 6-12 months, often more frequently due to financings, secondaries, or audit requirements. |

Valuation partner needs | Provider focused on straightforward compliance for simple structures. | Provider with the expertise to handle complex equity and meet auditor-level standards. |

As startups mature, finance teams don’t have room for surprises, so there are a handful of things that are simply non-negotiable.

At Eton, we’ve built our entire approach around those priorities, delivering valuations that keep grants, audits, and board approvals moving without setbacks.

Here’s what you can count on when working with us:

Late-stage finance teams often need valuations in days, not weeks. At Eton, we deliver to your schedule, even offering 1-day turnarounds if needed.

And while our process is built for speed, every valuation is reviewed by senior appraisers and supported with clear documentation that satisfies audit standards, so you never have to choose between timeliness and quality.

Big 4 firms often charge $8,000+ per 409A to handle the complexity of multiple preferred rounds, layered terms, and secondary transactions.

Eton brings the same Big 4 training and rigor but operates as a boutique, allowing us to deliver defensible valuations at affordable pricing, with a flat fee that stays the same whether you’re early-stage or late-stage.

Eton brings the same Big 4 training and rigor but operates as a boutique, allowing us to deliver defensible valuations at pricing that stays affordable for late-stage teams.

For more details, please see our guide to 409A valuation costs.

For late-stage startups, one of the biggest concerns is whether a 409A will hold up under review. A weak report can put safe harbor protection at risk, delay equity grants and board approvals, and stall financial audits, often forcing costly rework at the worst possible time.

With a perfect audit record, Eton ensures every valuation meets IRS standards and the level of detail auditors and stakeholders expect.

Each report is signed by a qualified appraiser, a requirement for IRS safe harbor protection, and followed by a review call where we walk your team through the results to make sure your team fully understands how the valuation was determined.

The valuation needs of late-stage startups rarely stop at 409As. You also need ASC 718 valuations for stock-based compensation, purchase price allocations to support M&A, fair value measurements for complex assets, and gift or estate valuations for founders and executives.

Eton covers the full spectrum, so late-stage companies have one partner who understands their history, their cap table, and their growth trajectory. This continuity saves time and ensures every valuation is grounded in a deep understanding of your business.

At Eton, we’ve completed more than 10,000 valuations. That experience includes some of the most complex late-stage cap tables. Combined with Big 4 consulting backgrounds and Stanford Law expertise, our team delivers valuations trusted by auditors, boards, and investors alike.

Every report is signed to qualify as an independent appraisal for IRS safe harbor, ensuring compliance and protecting companies from challenges that can disrupt grants or reporting.

Grants, board approvals, and reporting often hinge on valuations being both precise and delivered on time.

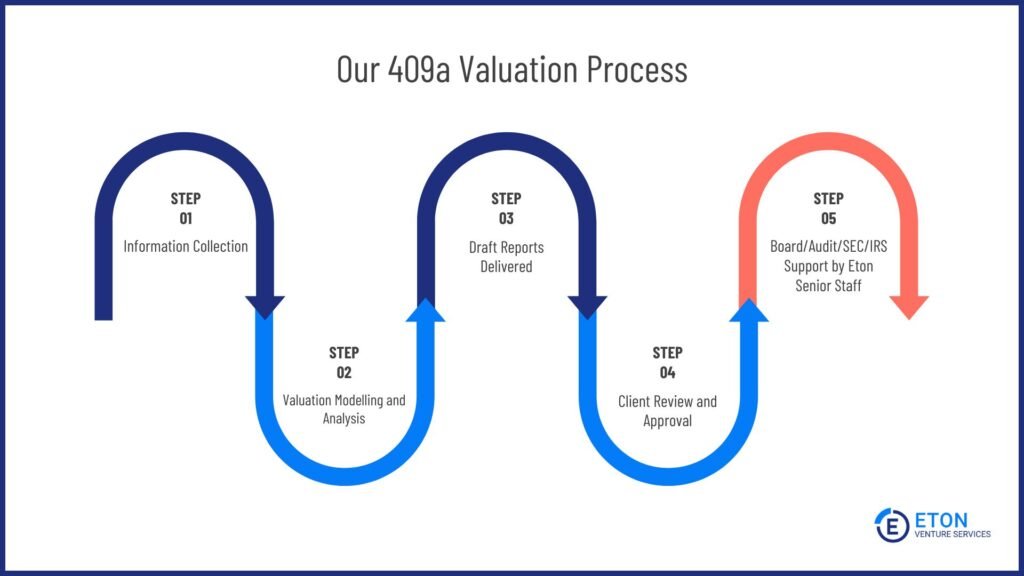

That’s why we’ve built an efficient, proven 409A valuation process, honed across more than 10,000 completed valuations, to guide companies through each step with confidence and without delays.

Time taken: 1-2 days

We start by gathering the core documents needed to build your valuation. At this stage, our team checks immediately for completeness so delays don’t fall back on you.

The documents we typically request include:

Time taken: 1 day

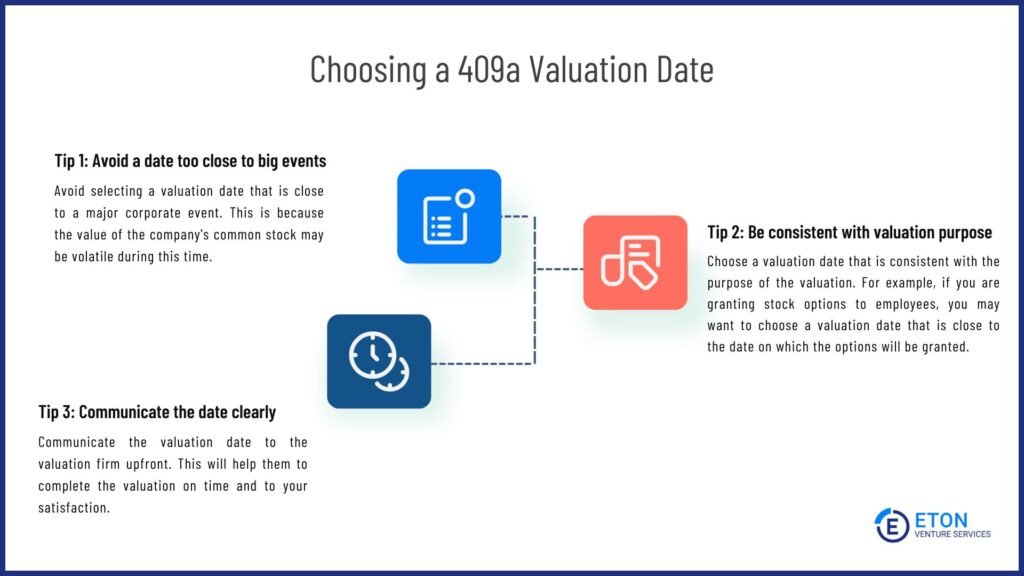

Once we’ve reviewed your materials, we’ll help you choose the right valuation date. This choice matters because the IRS ties safe harbor protection to the specific date of your appraisal, and the wrong date can create unnecessary risk or added cost. Here’s what you need to consider:

At Eton, we guide finance teams through these choices to ensure the date protects safe harbor, avoids duplicate work, and keeps grants and reporting on track.

To explore this subject further, read our full guide to choosing your 409A valuation date here.

Time taken: Anywhere from 1-7 days (depending on specified turnaround time)

Once we have your documents and valuation date, we use established methods suited to late-stage startups to determine the fair market value of your common stock.

Depending on your situation, we may use one or a combination of the following methods:

We’ll cover each of these methodologies in more depth later in this article.

Delivered on: Day 7 or earlier (depending on specified turnaround time)

We prepare a draft valuation report that lays out the methods applied, the assumptions made, and the resulting fair market value of your common stock. This draft gives your finance team visibility into our process and the opportunity to review the details before anything is finalized.

We deliver it quickly, so you have time to review and align internally ahead of board approvals or other deadlines.

Received on: Day 10 or earlier (depending on specified turnaround time)

Once you’ve reviewed the draft, our analysts are available to discuss assumptions, methods, or edge cases. When the draft is approved, we finalize the report.

Every report is signed by a qualified appraiser, giving you IRS safe harbor protection and assurance the valuation will hold under scrutiny.

Related deep dive: How Long Does a 409a Valuation Take?

As you enter Series B and later stages, the stakes are higher: complex cap tables, investor scrutiny, and audit deadlines all demand more from your valuation partner. Eton is built for this.

Since 2010, we’ve completed more than 10,000 valuations across Series B, C, D, pre-IPO, and beyond. Finance teams choose us because we combine defensibility, speed, and affordability, the mix late-stage companies can’t compromise on.

Here’s what one of our clients had to say about working with us:

And our support doesn’t stop at 409As. We also deliver ASC 718 valuations for stock-based compensation, purchase price allocations for M&A, fair value for complex assets, and estate planning valuations for founders and executives. Partnering with Eton means you have one firm that can handle your valuation needs end to end.

If you’re preparing for your next board meeting, audit, or equity grant, Eton can get you there with confidence. Contact us to get started.

By Series B and later, annual valuations often aren’t enough. While the IRS only requires a refresh every 12 months, auditors typically expect valuations to be updated at least every 6-12 months, and more frequently when material events occur. These can include financing rounds, secondary transactions, or major changes in financial performance.

In practice, many late-stage companies move to a quarterly cadence to maintain continuous safe harbor protection and avoid delays with option grants or board approvals. This approach keeps valuations current, prevents compliance issues, and gives finance teams peace of mind during audits.

At Eton, we support that frequency, combining a one-day turnaround option with audit-ready rigor at a cost that works for late-stage teams. Contact us here to learn more.

If your report hasn’t been completed by a qualified appraiser with reasonable methodology, your company risks losing safe harbor protection and faces serious consequences:

If you’re a client of ours and, in the rare event, your 409A valuation is challenged, we’ll be with you every step of the way and ready to defend our report in court.

By the time a company reaches Series B or later, the cap table usually has more than just common stock and one round of preferred. You’ll often see multiple series of preferred stock, each with its own liquidation preference, conversion rights, or participation terms.

On top of that, you might see convertible notes, SAFEs, or secondary transactions that change how value is distributed.

All of these features have to be modeled carefully, because they directly affect how much of the company’s equity value flows to common stock versus preferred.

For example, liquidation preferences mean investors in later rounds get their money back before anyone else. If Series C investors put in $50M with a 1x preference, they must receive $50M in a sale before common shareholders see anything, which lowers the implied value of common.

To capture these dynamics, we use advanced methods like the Backsolve Method (anchored to the latest financing), Discounted Cash Flow (DCF) analysis, or the Probability-Weighted Expected Return Method (PWERM).

These approaches allow us to account for layered terms and scenario-based outcomes, ensuring the fair market value of common stock reflects the true economics of the capital structure.

Yes. By Series B and later, most companies need more than just 409As.

Finance teams often require ASC 718 valuations for stock-based compensation, purchase price allocations to support M&A, fair value measurements for complex assets, or even estate and gift valuations for founders and executives.

At Eton, we cover the full spectrum, giving you one partner who already knows your business and can deliver audit-ready valuations at every stage.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.