Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

|

Need a reliable goodwill valuations & testing partner? Click here to learn about our goodwill impairment services. |

When Amazon acquired Whole Foods for $13.7 billion, about $9 billion of that price was attributed to goodwill.

This wasn’t just a vague accounting figure; it represented Amazon’s valuation of Whole Foods’ brand strength, loyal customer base, and unique market position in organic groceries.

Despite this, many business owners and even some financial professionals still view goodwill as a mystery – a number that appears during acquisitions without much clarity.

But goodwill reflects real, valuable elements that give a company its distinctive appeal, from brand reputation to proprietary know-how.

In this article, we’ll explore what goodwill is, how to calculate it in acquisitions, the difference between inherent and purchased goodwill, and common triggers for impairment, providing a practical understanding of this key concept in business valuation.

Key Takeaways

|

Goodwill represents the premium paid over the fair value of a company’s net identifiable assets during an acquisition.

Identifiable assets include tangible items like property, machinery, and inventory, as well as specific intangible assets, such as patents or trademarks, that can be independently valued.

The portion of the purchase price that exceeds the fair value of these identifiable assets is recorded as goodwill, capturing valuable elements that enhance the acquired business’s worth. These include:

It’s important to clarify here that there’s a major difference between goodwill and other intangible assets, such as patents and trademarks.

While goodwill reflects intangible value that cannot be easily separated from the business (meaning: you can’t separate it off and sell it independently of the rest of the business), other intangible assets are distinct, identifiable, and can often be valued and transferred individually.

In accounting terms, goodwill is recorded as a single line item on the balance sheet and requires annual impairment testing, whereas other intangible assets are generally amortized over their useful lives, reflecting their gradual decrease in value.

Beyond just being an asset, goodwill also represents a commitment to transparency in financial reporting.

Compliance with accounting standards like the United States Generally Accepted Accounting Principles (U.S. GAAP) and the International Financial Reporting Standards (IFRS) ensures that goodwill isn’t just an arbitrary number but one that reflects the underlying strategic value a company brings to an acquisition.

These standards require companies to carefully measure and disclose goodwill, creating consistency in how goodwill is reported across industries.

This approach helps protect stakeholders by providing a fair representation of the company’s value, giving investors, regulators, and analysts confidence in the company’s financial integrity and the justification behind acquisition decisions.

Through strict compliance, companies emphasize the significance of goodwill as a reliable indicator of their acquired strengths and enduring potential.

While goodwill represents the premium paid above the fair value of a company’s net assets, negative goodwill (or “badwill”) occurs when a company is acquired for less than the fair value of its net assets.

This situation often arises in distressed sales, where the seller is under financial pressure to liquidate quickly, resulting in a bargain purchase for the buyer.

Common causes of negative goodwill include financial distress within the target company, a lack of market demand driving down the acquisition price, or a forced sale where the seller urgently needs capital.

In financial reporting, negative goodwill is typically recorded as a gain on the acquiring company’s income statement, reflecting the advantage gained by acquiring assets at below-market value.

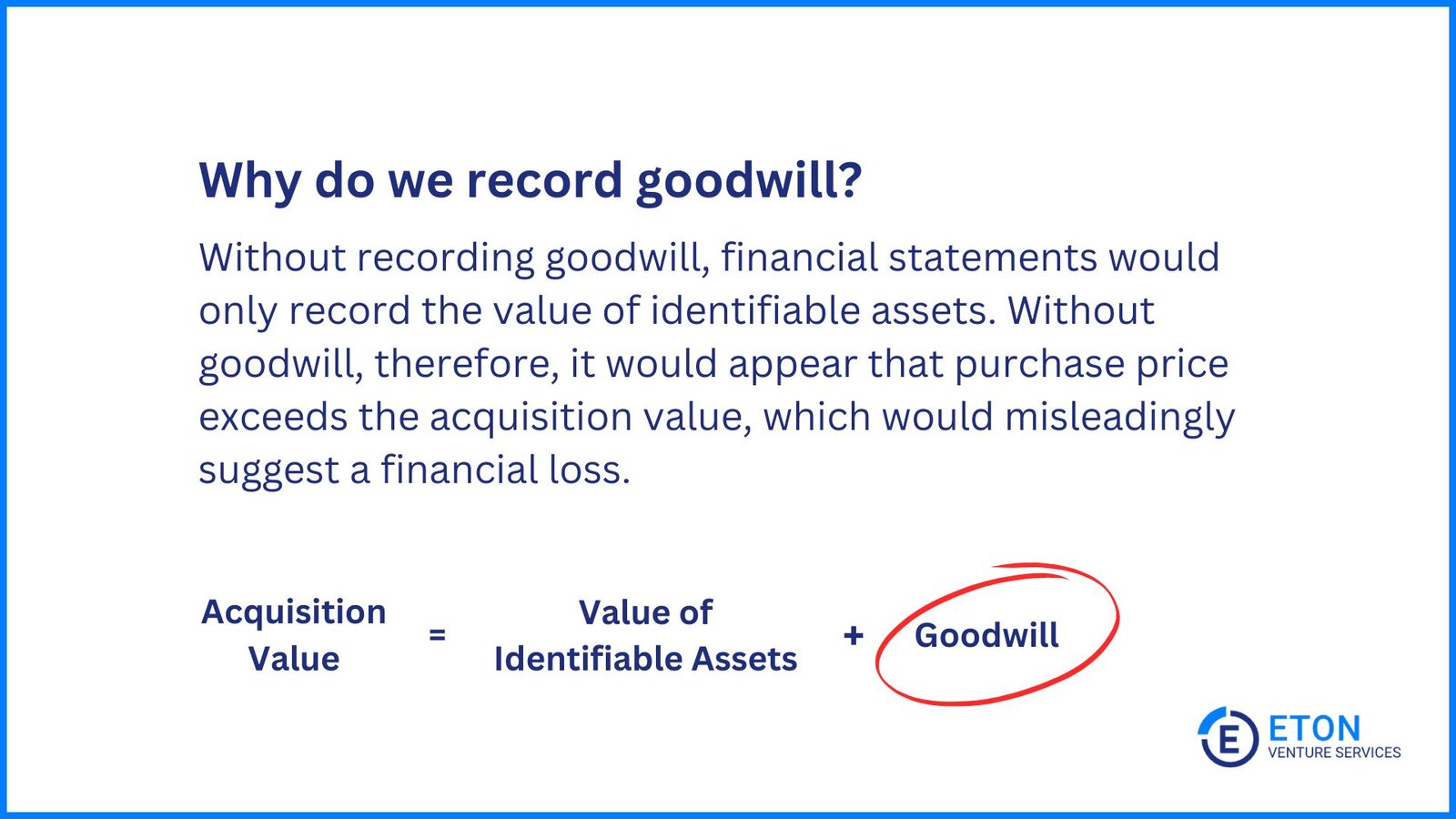

Calculating goodwill is an important part of an acquisition because it helps investors assess whether the premium paid in an acquisition is justified by intangible benefits like brand value, synergies, or future growth potential.

Calculating goodwill is an important part of an acquisition because it shows investors the portion of the purchase price that goes beyond identifiable assets.

Without this, financial statements would reflect only the identifiable assets, making it appear as though the purchase price exceeds the acquisition value, which could misleadingly suggest a financial loss.

Following IFRS and GAAP Acquisition Accounting Guidelines, goodwill is then recognized on the balance sheet to capture this intangible value.

Goodwill = Purchase Price – Fair Value of Net Identifiable Assets

1. Determine the purchase price: Identify the total amount the acquirer paid for the business, including cash, stock, and assumed liabilities.

2. Calculate the fair value of identifiable assets and liabilities: List and assess the fair market values of all tangible assets, identifiable intangible assets, and liabilities to determine the net identifiable assets.

3. Subtract to determine goodwill: Subtract the fair value of net identifiable assets from the purchase price. The remaining amount is goodwill, representing the intangible qualities that add distinct value.

Imagine Company A acquires Company B for $2 million. Company B’s identifiable assets have a fair value of $1.6 million, and its liabilities amount to $300,000. The fair value of net identifiable assets, therefore, is $1.3 million ($1.6 million – $300,000).

Goodwill = $2,000,000 – $1,300,000 = $700,000

In this example, Company A records $700,000 as goodwill on its balance sheet, reflecting the intangible strengths that differentiate Company B.

To see goodwill in action, here are a few high-profile acquisitions where goodwill captured intangible value beyond tangible assets:

When P&G acquired Gillette for $57 billion, the purchase price included an 18% premium for Gillette’s strong market position and brand loyalty in products like razors and Duracell batteries.

The goodwill recorded on P&G’s balance sheet reflected the anticipated synergies and expanded market influence gained through Gillette’s established presence and reputation.

In 2016, Microsoft acquired LinkedIn for $26.2 billion, paying a 50% premium that resulted in approximately $9 billion in goodwill.

Microsoft valued LinkedIn’s professional network of over 400 million users and its strategic fit with Microsoft’s productivity and cloud services.

The goodwill represented LinkedIn’s market influence, brand strength, and the expected synergies from integrating LinkedIn’s tools with Microsoft’s Office 365, Skype, and Dynamics platforms.

Facebook’s $1 billion acquisition of Instagram, despite Instagram’s minimal tangible assets, demonstrated goodwill’s role in valuing brand strength and growth potential in the digital space.

The goodwill represented Facebook’s belief in Instagram’s ability to attract a younger demographic and expand its mobile presence.

Each example illustrates how goodwill reflects intangible assets like brand reputation, market reach, and strategic growth potential that enhance an acquirer’s value beyond measurable assets.

The two types of goodwill – inherent and purchased – show how a business’s intangible value is built and accounted for. Understanding this difference is necessary for evaluating both the sources and stability of goodwill, especially during acquisitions or financial reviews.

Inherent goodwill, also known as “self-generated” or “internal” goodwill, develops organically as a business grows its brand reputation, customer base, and relationships. It isn’t acquired through an external transaction.

Since inherent goodwill doesn’t have a measurable acquisition cost, it isn’t recorded on the balance sheet. Still, it’s important to the business’s value as it usually indicates a competitive advantage.

Purchased goodwill, however, is what we’ve been discussing so far – goodwill that arises when one company acquires another at a price exceeding the fair value of its identifiable assets.

This form of goodwill is recorded in accounting as it represents the premium paid for a company’s intangible benefits during acquisition.

Purchased goodwill appears as an asset on the balance sheet and is subject to annual impairment testing to ensure it reflects current market value.

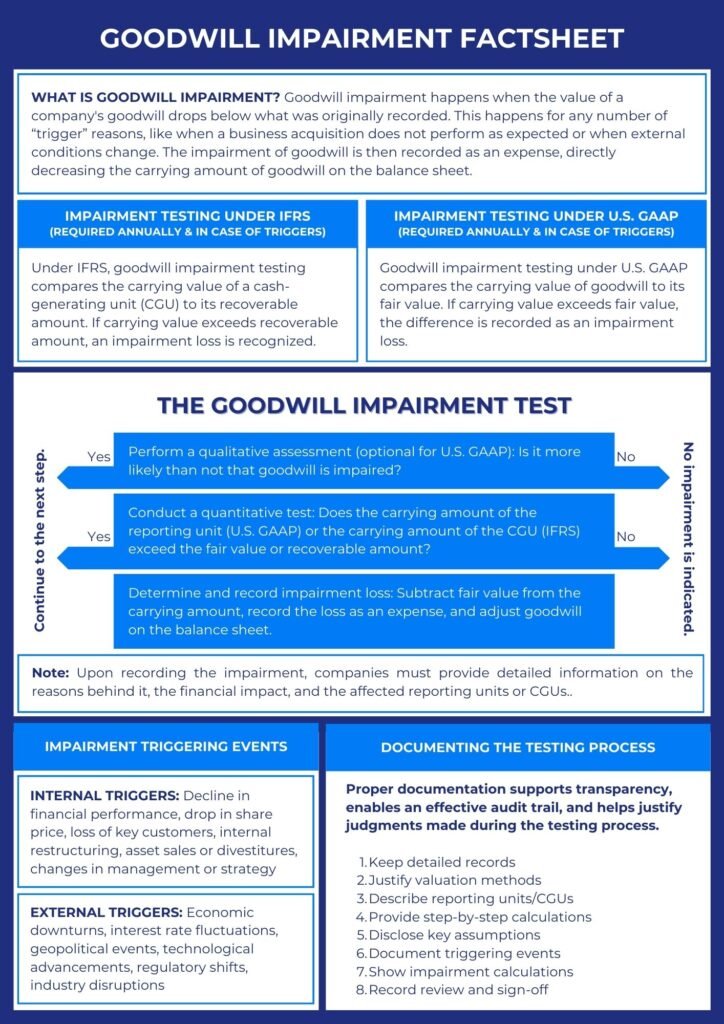

Goodwill impairment occurs when the current value of an acquired company’s goodwill falls below the amount recorded on the balance sheet.

This often reflects an acquisition that hasn’t performed as expected, or changes in the external environment that affect the value of the acquired business.

For business owners and financial professionals, goodwill impairment can be challenging, as it often raises concerns about previous acquisition decisions and investor confidence.

The following is a factsheet that captures the most important things you need to know about goodwill impairment:

Download the factsheet as a PDF file here.

Goodwill impairment can be triggered by both internal and external events, which signal the need to re-evaluate the recorded goodwill amount. Here are some common triggers:

Internal Triggers:

External Triggers:

If any of these triggering events occur, it’s mandatory under U.S. GAAP, specifically ASC 350, and IFRS to conduct a goodwill impairment test. The test is also required on an annual basis.

Testing is important because it ensures that the value of goodwill on a company’s balance sheet accurately reflects current market conditions and the ongoing economic benefits the business expects to generate.

This helps protect stakeholders by providing a realistic view of the company’s assets and financial health, especially when market or business conditions change.

Goodwill is more than a line item on the balance sheet; it represents the unique strengths and hidden value that make a business distinctive.

But effectively capturing goodwill goes beyond numbers – it requires a compelling narrative that communicates the intangible assets driving a company’s future potential, from brand reputation to customer loyalty.

This is where the role of valuation firms like Eton becomes important. Skilled valuation professionals bring both analytical precision and strategic insight, helping businesses tell the story behind their goodwill in a way that resonates with buyers.

By uncovering and articulating these intangible strengths, experts ensure that the true value of goodwill is recognized, setting the stage for favorable acquisition terms and positioning the business as an attractive investment.

In the end, goodwill is about more than price; it’s about demonstrating what makes a company exceptional and ensuring that this unique value is clearly understood by all stakeholders.

Unlike specific intangible assets like patents or trademarks that can be valued and sold separately, goodwill is an overall value tied to the company itself. Goodwill can’t be separated or sold individually and is listed as a single asset on the balance sheet, where it must be tested yearly to ensure it still reflects the company’s true value.

Negative goodwill occurs when a company is bought for less than the fair value of its assets, often in distressed sales, and is recorded as a gain for the buyer. Regular goodwill, on the other hand, reflects a premium paid above fair value for intangible benefits like brand reputation and is recorded as an asset.

Goodwill impairment can be caused by both internal and external factors. Internally, it may occur if the acquired business underperforms, loses key customers, or experiences significant management or strategic changes. Externally, economic downturns, new competitors, regulatory changes, or disruptions in the industry can decrease the expected value of goodwill, signaling the need for an impairment review.

Testing for goodwill impairment is necessary to ensure that the recorded value of goodwill on the balance sheet remains accurate and reflects current market conditions. Regular impairment testing provides a realistic view of the company’s financial health, ensuring that investors and stakeholders have a clear understanding of the company’s true asset value, especially if the business environment or performance has changed.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.