Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Goodwill plays a key role in the value of a business sale. It represents intangible assets like your brand’s reputation, customer loyalty, and efficient systems that make the business successful.

But how exactly is it taxed? Well, the answer largely depends on whether you choose an asset sale or a stock sale.

The treatment of goodwill in either structure can significantly affect the tax bills of both the buyer and seller. Understanding these differences will help you lower your tax bill and get the most out of the deal.

In this article, we’ll break down how goodwill is taxed in asset and stock sales, what it means for both parties, and how you can optimize taxes to make the most out of a sale.

Key Takeaways

|

Goodwill is taxable because it represents intangible assets like a business’s reputation, customer relationships, and efficient systems that help it generate income beyond its physical assets. For example, a business known for exceptional customer service may experience consistent revenue growth, making its goodwill a valuable asset for buyers.

Since buyers pay for these benefits, they’re included in the tax calculation—acknowledging their economic value.

These intangible elements include:

In essence, goodwill captures the value of these intangible elements, and its taxation ensures that the overall worth of the business is appropriately accounted for.

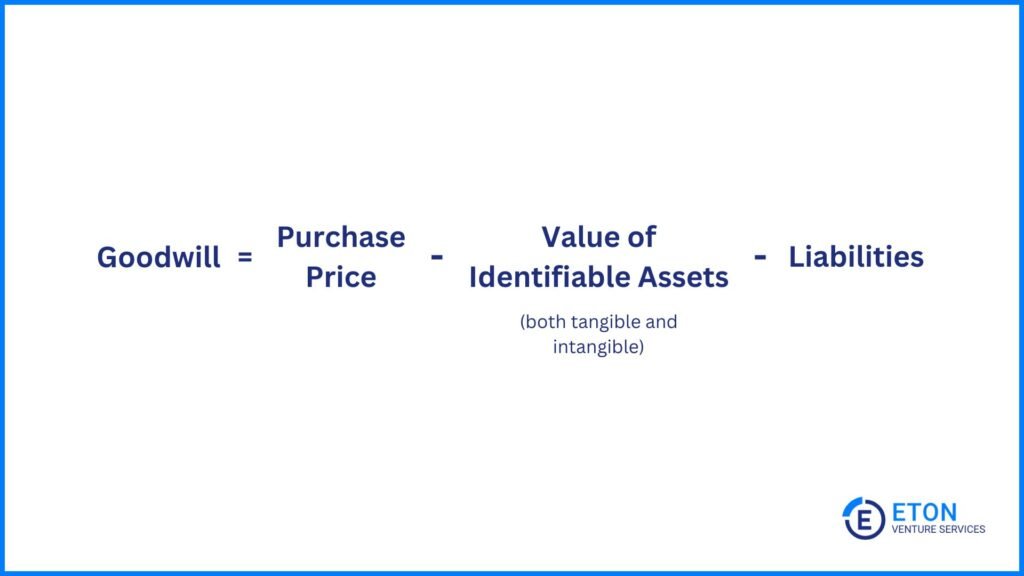

Goodwill is calculated by subtracting the value of the target company’s identifiable assets and liabilities from its purchase price.

This is usually done during purchase price allocation (PPA)—a process which involves assigning specific portions of the purchase price to different asset classes, as defined by the IRS.

The IRS groups business assets into seven classes, and purchase price must be allocated in sequential order:

Goodwill is typically the residual amount left after subtracting the value allocated to all the other six asset classes.

For example, if a business sells for $10M and the combined value of the first six asset classes is $7,000,000, the remaining $3,000,000 is allocated to goodwill.

Buyers and sellers must then report how they split up the purchase price on IRS Form 8594. This establishes how different assets, including goodwill, are treated for tax purposes.

If their reports don’t match, the IRS might step in and change the values, which could mean paying more in taxes. That’s why it’s important to work with Purchase Price Allocation experts who can help file these forms correctly.

For sellers, goodwill is classified as a capital asset. If held for more than a year, it’s taxed at long-term capital gains rates, which are lower than ordinary income taxes.

Here’s what the IRS outlines as long-term capital gains tax rates for the 2025 tax year:

So, if goodwill makes up $200,000 of a sale, and your taxable income is $50,000, you would pay 15% tax on the $200,000, amounting to $30,000.

The way goodwill is taxed also depends on whether the sale is structured as an asset sale or a stock sale.

Here’s a full overview of how goodwill is treated for sellers in asset versus stock sales:

Asset sale | Stock sale | |

Definition | Seller transfers ownership of specific assets and liabilities of the business to the buyer. The seller retains ownership of the business but no longer owns the assets they’ve sold. | Buyer acquires the shares or ownership interests of the business directly from the target company’s shareholders, purchasing the entire company, including all of its assets, liabilities, contracts, and goodwill. |

Goodwill classification | Treated as a capital asset, subject to capital gains tax rates. | Included in the overall value of the stock being sold, with the entire transaction treated as a capital gain. |

Goodwill tax treatment | If goodwill is held for more than a year, gains are taxed at long-term capital gains rates (0%, 15%, or 20%), depending on taxable income. If goodwill is held for less than a year, gains are taxed as short-term capital gains at ordinary income tax rates (up to 37%). | If the stock is held for more than a year, gains on the entire sale, including goodwill, are taxed at long-term capital gains rates (0%, 15%, or 20%). If the stock is held for less than a year, gains on the entire sale, including goodwill, are taxed as short-term capital gains at ordinary income tax rates (up to 37%). |

Seller’s preference | In asset sales, sellers prefer to allocate more of the price to goodwill because it’s taxed at lower capital gains rates, unlike other assets (e.g., inventory or equipment) taxed at higher ordinary income rates. For C corporations, sellers typically prefer stock sales to avoid double taxation (corporate level and individual level). | |

For C corporations, the double taxation in asset sales works like this:

This double taxation makes asset sales a significant disadvantage for C corporation sellers, often prompting them to favor stock sales.

However, for smaller businesses (with less than $50 million in revenue), deals are typically still structured as asset sales. This is to avoid any unknown legal risks on the part of the seller’s entity and due to the tax advantages it offers for buyers compared to a stock sale. We’ll discuss this in the next section.

The tax treatment of goodwill when buying a business also depends on whether the purchase is structured as an asset sale or a stock sale.

In an asset sale, buyers can amortize goodwill over 15 years, while in a stock sale, goodwill retains the seller’s original tax basis, limiting the buyer’s tax advantages.

Here’s a breakdown of how goodwill is treated for buyers in asset sales compared to stock sales:

Asset sale | Stock sale | |

Goodwill classification | Treated as an intangible asset that can be amortized over time. | Inherited as part of the stock, with no step-up in basis; the buyer assumes the seller’s original tax basis for goodwill. |

Goodwill tax treatment | Amortized over 15 years, allowing 1/15th of the goodwill value to be deducted annually from taxable income. | The buyer continues amortizing goodwill based on the seller’s original tax basis, limiting the ability to deduct goodwill at its current market value. |

Buyer’s preference | Buyers generally prefer asset sales because goodwill can be amortized over 15 years, providing steady tax benefits. They may avoid stock sales because there’s no step-up in basis, meaning they inherit the seller’s lower tax basis and lose potential deductions. | |

For example, if goodwill is valued at $300,000 in an asset sale, the buyer can deduct $20,000 per year for 15 years ($300,000 ÷ 15).

While this provides steady tax deductions over time, buyers often prefer a smaller goodwill allocation and a higher allocation to assets that can be depreciated over shorter periods.

On the other hand, in a stock sale, if a business is sold for $1 million, and $200,000 is attributed to goodwill, but the seller’s tax basis is $100,000, the buyer will inherit the $100,000 tax basis and must amortize it over the next 15 years.

This creates a disadvantage for the buyer, as they cannot amortize the additional $100,000 of goodwill that would have been possible in an asset sale.

Similarly, other assets like equipment and property retain their original tax basis, limiting the buyer’s potential tax deductions.

Because of these limitations, buyers often prefer structuring the sale as an asset sale. However, they may still opt for a stock sale if it provides a smoother transition for the business’s ongoing contracts, licenses, and permits.

To sum up the main points we’ve discussed so far, here’s an overview of goodwill tax treatment for both buyers and sellers in asset and stock sales:

|

Asset Sale |

Stock Sale |

|

|

Goodwill Tax Treatment for Sellers |

Goodwill is treated as a capital asset, taxed at long-term capital gains rates if held for more than a year. |

Entire transaction is taxed as a capital gain, including the value attributable to goodwill. |

|

Goodwill Tax Treatment for Buyers |

Goodwill is amortized over 15 years, providing steady annual tax deductions. |

Buyer inherits the seller’s tax basis for goodwill, continuing with the existing amortization schedule, limiting deductions. |

To maximize the amount of money you keep from selling your business, we recommend strategies like installment sales, earnouts, tax harvesting, and utilizing QSBS exemptions.

Here are six ways sellers can defer, reduce, or offset goodwill taxation, giving you financial flexibility, more cash flow, and a larger share of the proceeds to reinvest in your next venture:

1. Opt for an Installment Sale to Spread Taxes Out

An installment sale spreads taxable gains over several years so that you’re paying taxes a bit at a time. Instead of paying taxes on the entire gain upfront, sellers report a portion with each payment received.

For example, if goodwill represents 50% of the sale price, 50% of each installment payment is taxable, reducing the immediate tax burden and aligning taxes with the payment schedule.

2. Negotiate Earnouts to Reduce Immediate Tax Burden

Earnouts tie part of the purchase price to the business’s future performance, such as revenue or profit milestones.

This can spread taxable gains over multiple years, reducing the immediate tax burden and potentially helping avoid higher tax brackets.

Because this approach can delay or reduce payments if targets aren’t met, though, it’s important to negotiate clear terms and metrics to avoid disputes.

3. Use Tax Harvesting to Offset Taxable Gains

Sell underperforming assets with capital losses to offset the taxable gains from your business sale, including goodwill. For example, if you have $50,000 in gains from goodwill and $20,000 in losses from other assets, you’ll only be taxed on $30,000 of gains.

Any unused losses can also be carried forward to offset future gains, helping you manage your overall tax liability effectively.

4. Claim the QSBS Exemption to Exclude Up to 100% of Capital Gains

Suppose your business qualifies as a small C-corporation under Section 1202. In that case, you may exclude up to 100% of capital gains from federal taxes on the sale using the Qualified Small Business Stock (QSBS) exemption. This includes the portion attributed to goodwill.

To qualify, the stock must be held for at least five years, and the business must meet specific size and operational criteria.

At Eton, our team can provide you with expert guidance and valuation services to maximize your QSBS tax benefits.

5. Defer Taxes with a 1031 Exchange

Another strategy is to reinvest the proceeds from your sale into like-kind business assets to defer capital gains taxes. This helps preserve cash flow and allows you to reinvest the full value of your sale into your next venture.

Taxes on the gains are deferred until you sell the replacement asset, unless another 1031 exchange is completed.

6. Gift Shares to Family Members to Reduce Taxable Estate

The IRS allows you to give up to $19,000 per recipient in 2025 without triggering a gift tax. Amounts above this are applied to your lifetime gift tax exemption, set at $13.99 million for 2025.

For example, gifting $30,000 in shares to one person means $19,000 is tax-free, and $11,000 counts toward your lifetime limit. This reduces your taxable estate while passing wealth to family tax-efficiently.

With extensive experience in diverse scenarios, our team at Eton provides estate and gift tax valuations that follow IRS rules and support your family’s generational wealth strategies.

If you’re interested in learning about more strategies to minimize capital gains tax, we recommend reading our full guide on this here.

As seen, properly valuing and allocating goodwill can significantly impact the tax outcome of a business sale. Engaging professionals ensures that you maximize the value of your intangible assets, reduce your tax liabilities, and strengthen your position in negotiations.

Having delivered thousands of valuations, our team of experts at Eton can help you unlock the full value of goodwill, ensuring you achieve the best possible outcome for your business.

We also provide purchase price allocations prepared with precision to comply with tax and reporting regulations.

With a proven track record, we simplify the complexities of goodwill tax treatment, making your transaction seamless and successful.

Yes, goodwill is deductible in the US, but only in an asset sale. The IRS treats goodwill as a Section 197 intangible asset, which must be amortized over 15 years on a straight-line basis.

For example, if $300,000 is allocated to goodwill, the buyer can deduct $20,000 annually for 15 years.

In a stock sale, however, goodwill is not revalued, and the buyer inherits the seller’s existing tax basis in goodwill and continues any remaining amortization schedule. This limitation often makes asset sales more favorable for buyers seeking new tax deductions.

If the buyer and seller fail to agree on the allocation, the IRS may intervene and reallocate the purchase price based on its own assessment.

This can result in less favorable tax outcomes for both parties. Engaging a professional to mediate and provide audit-defensible valuations can help avoid this issue.

Over-allocating to goodwill can create challenges for the buyer, such as limiting immediate tax benefits since goodwill must be amortized over 15 years.

It can also increase the risk of IRS scrutiny, especially if the allocation appears disproportionate to industry benchmarks. Accurate allocation is key to avoiding these risks.

Yes, in addition to federal capital gains taxes, many states impose taxes on the gain from the sale of goodwill.

State tax rates and rules vary, so it’s important to understand how your state treats goodwill in a business sale to accurately estimate your overall tax liability.

In accounting, goodwill is recorded as an intangible asset when a business is acquired for more than the fair value of its identifiable net assets.

Unlike tax laws, where goodwill is amortized over 15 years, under U.S. GAAP it is not amortized but tested annually for impairment. If impaired, the loss is recognized on the income statement.

Goodwill can be categorized as either personal or business. Personal goodwill is linked to an individual and exists separately from the business entity, while business goodwill is tied to the entity itself and reflects its overall value beyond its tangible assets.

Personal goodwill, owned by the individual, qualifies for long-term capital gains rates if held for over a year and avoids entity-level taxes.

Business goodwill, owned by the entity, is also taxed as a capital asset but varies by sale structure.

In an asset sale, C corporations face double taxation, while pass-through entities tax gains at the individual owners’ rates, typically long-term capital gains rates if eligible.

In a stock sale, business goodwill is taxed as part of the overall stock transaction at capital gains rates.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.