Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Selling your business is an exciting milestone, but the reality of capital gains tax can quickly dampen the celebration.

Imagine watching a significant portion of your hard-earned profits slip away—funds you could have reinvested, saved, or used to pursue new opportunities. It’s frustrating for many business owners who aren’t prepared for the tax implications.

Fortunately, there are strategies to reduce this burden and keep more of the proceeds from your sale. In this article, we’ll walk you through 11 methods to minimize capital gains tax and maximize your financial outcome.

For a pragmatic discussion about tax planning and strategies to reduce your capital gains burden in a business sale, reach out to our team here.

Key Takeaways

|

When you sell a capital asset, such as real estate or shares in a company, the profit you make—known as a capital gain—is subject to capital gains tax. This tax applies to the difference between the asset’s sale price and the cost you incurred to acquire it.

For example, if you bought real estate for $200,000 and sold it for $500,000, the $300,000 profit is your capital gain. Similarly, if you sell shares of a company for more than you paid, the profit is also considered a capital gain.

Of course, not all sales result in a profit. If you sell a capital asset for less than what you initially paid, that’s a capital loss.

Understanding this difference is important for calculating your net capital gains i.e your total capital gains for the tax year minus capital losses. The result—your net capital gains—is the amount subject to taxation.

For example, if you had $300,000 in capital gains from selling your business but also experienced a $50,000 capital loss from another investment, your net capital gains would be $250,000. Only this amount would be taxed as a capital gain.

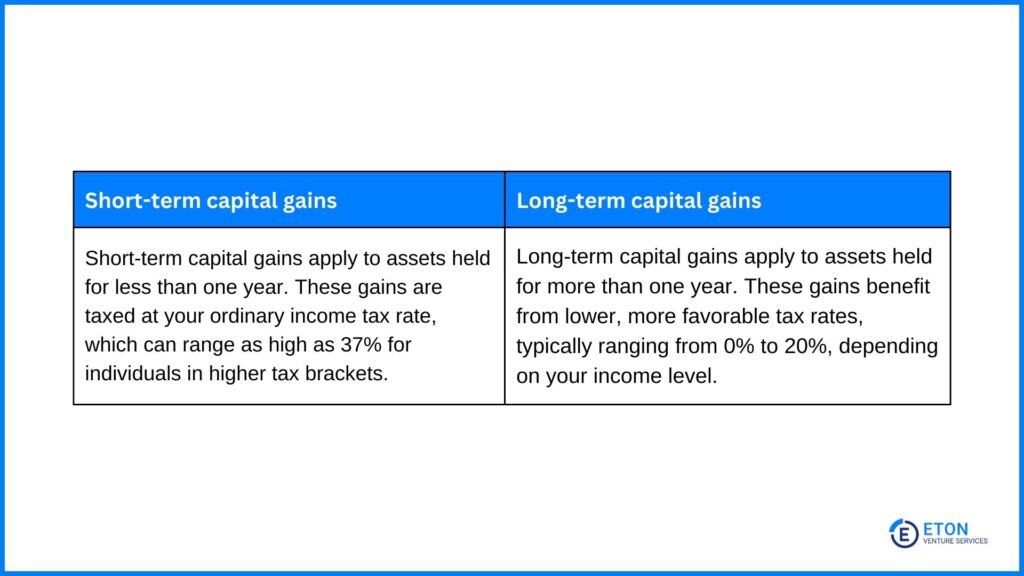

When calculating your taxable capital gains, consider how long you held the asset before selling it. The ownership timeline determines whether your gains are classified as short-term or long-term, which then affects the tax rate applied.

For the tax year 2025, the IRS outlines the following long-term capital gains tax rates:

You may also be required to pay state income tax and a federal 3.8% Net Investment Income Tax (NIIT) on capital gains.

In short, the tax liability from a business sale can take a significant bite out of your hard-earned money. To minimize the impact and ensure you’re fully compliant, we recommend consulting with experts who specialize in business transactions.

At Eton, we offer expert valuation and advisory services, backed by Big 4-level experience, to help you structure your sale effectively, maximize value, and minimize tax liability.

While capital gains tax can feel like a significant obstacle, there are several strategies you can use to defer, reduce, or even eliminate the tax burden. Here are 11 effective ways to do this and protect the profits from the sale of your business:

Assets held for over one year are taxed at the more favorable long-term capital gains rates. On the other hand, those sold within a year are taxed as short-term gains at higher ordinary income tax rates.

This strategy, also known as tax-loss harvesting, involves selling investments that have lost value to offset your taxable gains.

For example:

Careful planning and selling underperforming assets in the same year you make significant gains can maximize the tax-saving potential of this strategy.

An installment sale allows you to spread your capital gains tax liability over several years.

This approach doesn’t eliminate capital gains tax but distributes the tax burden over time, potentially lowering your annual tax liability.

Note: One common type of installment sale is seller financing, where the seller acts as a lender and allows the buyer to pay over time, often with interest.

Seller financing provides tax benefits and makes it easier for buyers—such as employees or family members—to afford the purchase without requiring upfront capital.

Qualified Small Business Stock (QSBS) is a type of stock issued by eligible small businesses that offers significant tax benefits to investors.

This program is designed to encourage investments in innovative small businesses. In turn, it offers investors the opportunity to reduce their tax liability while supporting growing companies.

Note: To qualify, the business must be a domestic C-corporation with gross assets of $50 million or less when the stock is issued. Additionally, at least 80% of its assets must be actively used in its operations.

At Eton, our team can provide expert guidance and valuation services to maximize your QSBS tax benefits.

A 1031 exchange, named after Section 1031 of the IRS, allows you to defer capital gains tax by reinvesting the proceeds from your business sale into a similar, like-kind asset.

To take advantage of this strategy:

This strategy is commonly associated with real estate but can also apply to certain business assets, as long as they are used in trade or business operations.

By deferring taxes through a 1031 exchange, you can preserve cash flow and reinvest the full value of your sale into your next venture, giving you more flexibility to grow your investments.

The capital gains tax is deferred until you sell the replacement asset— unless you complete another 1031 exchange at that time.

Opportunity Zones, designated under the Tax Cuts and Jobs Act, are economically distressed areas identified based on specific criteria to qualify for investment incentives. You can defer and potentially reduce your capital gains tax by reinvesting your capital gains into these zones.

Here’s what you need to do:

This strategy not only provides significant tax advantages but also contributes to revitalizing underserved communities, making it a win-win for your finances and social impact.

Selling your business to your employees through an Employee Stock Ownership Plan (ESOP) not only offers tax advantages but also helps secure your company’s future.

Here’s how it works:

If your business is a C-Corporation, the proceeds from an ESOP sale can often be rolled into certain investment plans, allowing you to defer capital gains tax and gain financial flexibility.

This is a practical solution for business owners seeking a smooth transition that benefits both their finances and their team.

A Charitable Remainder Trust (CRT) is an irrevocable, tax-exempt trust that allows you to sell your business in a tax-efficient way while supporting a charity. Here’s how it works:

While you could sell your business and reinvest the proceeds yourself, you’d likely pay more taxes and receive less income.

That’s why it’s a great option to preserve more of your hard-earned money, secure a steady income stream, and leave a lasting gift to a cause you care about.

Rollover equity allows you to defer paying capital gains tax. To achieve this:

This means you only pay taxes on the cash portion of the sale now, while the taxes on the equity portion are deferred until the buyer eventually sells the new company.

This strategy not only postpones your tax liability but also gives you a chance to benefit from the future growth of the new business.

A non-grantor trust is a type of trust where the trust itself—not the person who created it—is responsible for paying taxes. Any income or capital gains from the trust’s assets get taxed to the trust or its beneficiaries, not the creator. To apply this strategy:

This strategy is particularly effective for families looking to manage the tax burden on large capital gains while passing wealth to the next generation.

The IRS allows you to give each recipient a specific amount of assets or property every year without triggering a gift tax.

For 2025, the annual gift tax exclusion is $19,000 per person, meaning you can give up to $19,000 worth of shares to as many individuals as you like, tax-free.

If the value of the gift exceeds the annual limit, the excess is applied against your lifetime gift tax exemption, which is $13.99 million for 2025.

For example:

This strategy not only helps minimize capital gains tax but also enables you to pass wealth to your family in a structured and tax-friendly way.

With extensive experience in diverse scenarios, our team at Eton provides estate and gift tax valuations that follow IRS rules and support your family’s generational wealth strategies.

At Eton, our tailored valuation and advisory services are designed to help you structure your sale, minimize tax liabilities, and ensure full compliance with financial and tax regulations.

We also specialize in:

Because we understand how important it is to keep more of your hard-earned money, we’re here to provide the expertise and support you need to navigate complex tax challenges and maximize the value of your business sale.

No, only capital assets are subject to capital gains tax. These assets are typically held for investment purposes and are not used in the regular operations of a business. Examples include stocks, bonds, and goodwill.

On the other hand, assets used in the course of business operations (also known as ordinary income assets), such as inventory or accounts receivable, are taxed at ordinary income tax rates, not capital gains rates.

Yes, you can combine multiple strategies to reduce capital gains tax.

For example, you might use tax-loss harvesting to offset gains while structuring part of the sale as an installment sale to spread out the tax burden.

Other strategies, like combining a 1031 exchange with gifting shares under the annual gift tax exclusion, can also work together.

Consulting with a tax advisor is key to maximizing your savings while avoiding potential conflicts between strategies.

You typically pay capital gains tax when you file your annual income tax return for the year the sale occurred. For most taxpayers, this means the tax is due by the following year’s tax deadline, usually April 15.

However, if the sale results in a significant gain, you may need to make estimated tax payments throughout the year to avoid underpayment penalties. It’s advisable to consult a tax advisor to ensure you meet any payment requirements and deadlines.

Strategies like a 1031 exchange or rollover equity allow you to defer capital gains tax as long as the replacement asset is held. However, taxes are eventually due when the asset is sold unless further deferral strategies are used.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.