Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

A Quality of Earnings Report for small businesses with less than $10 million in revenue typically costs between $25,000 and $35,000. For larger businesses, prices often start at $60,000 and can reach six figures.

The exact price depends on the following factors:

We’ll cover these in more detail in the next section.

While the expense may seem significant, a quality of earnings analysis is a vital step in the financial due diligence process.

It provides a reliable picture of your target company’s financial health and highlights potential risks, such as revenue misrepresentation, expense manipulation, and unrecorded liabilities.

This level of insight justifies the cost by reducing the chances of post-closing surprises and empowering you to negotiate effectively.

To further understand the value behind these costs, read on as we break down the steps involved in the analysis and the key components of a QoE report.

Key Takeaways

|

When it comes to the cost of a Quality of Earnings report, there’s no one-size-fits-all answer. The price depends on several factors unique to your business and the scope of the analysis.

Because we believe in transparency, here’s a breakdown of the key elements that influence the cost of your QoE analysis:

Larger businesses naturally require more extensive reviews, from analyzing higher transaction volumes to sifting through multiple years of detailed financial data. The bigger the business, the more time and resources are needed to ensure every aspect is thoroughly assessed.

Financial statements that already align well with Generally Accepted Accounting Principles (GAAP) make the analysis more straightforward. However, if adjustments are needed to bring the numbers up to standard, this can add time—and cost—to the process.

“Clean” financials—those that are well-organized and accurate—speed up the process and reduce costs. If your records contain inconsistencies, missing data, or errors, additional time is required to sort through the issues, which can increase the cost.

A straightforward service business is easier (and less costly) to analyze than a company with complex operations, such as those involving inventory, multiple revenue streams, or intricate supply chains. The more layers your business has, the deeper we need to dive to make sure every nuance is accounted for.

If your business includes multiple entities or subsidiaries, the scope of the analysis expands significantly. Each entity’s financials need to be reviewed and consolidated, which increases the workload and, ultimately, the cost.

Certain industries, like technology or healthcare, often have unique accounting challenges or regulatory considerations. These complexities require specialized expertise and additional analysis, which can add to the cost.

Larger firms typically have higher overhead costs, which are reflected in their fees. At Eton, we pride ourselves on offering Big 4-level expertise at boutique firm rates. This ensures you receive top-quality service without the premium pricing.

Understanding these factors can help you set realistic expectations for your QoE report’s cost and make an informed choice when selecting a provider.

The report itself is structured around four key components, each required to reveal the true financial health and sustainability of the business.

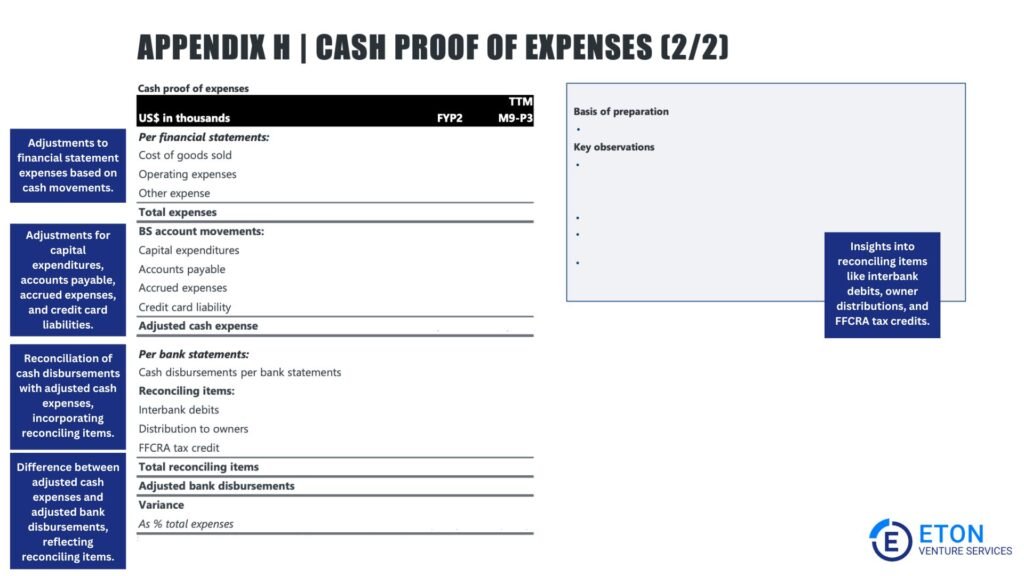

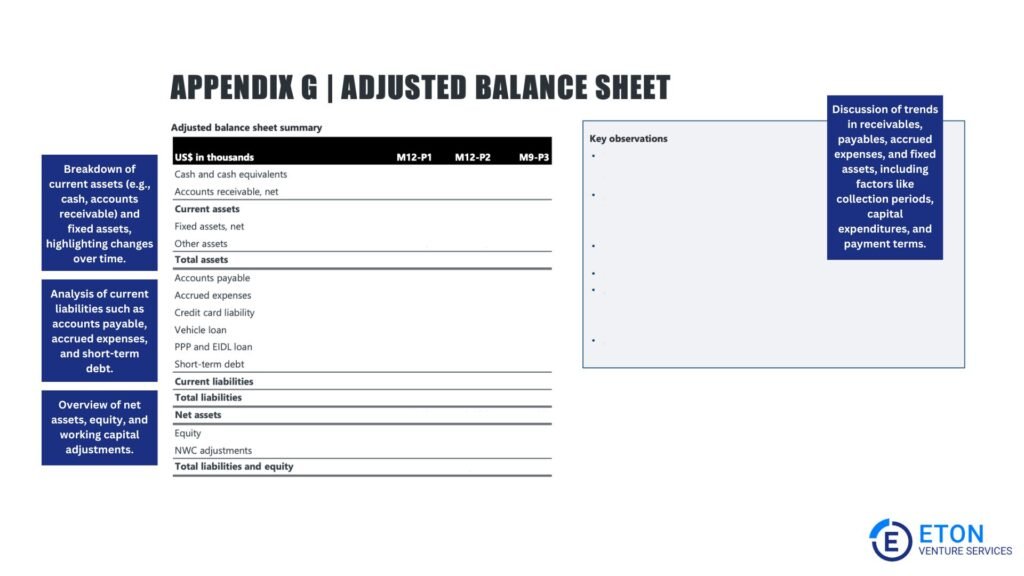

Please note that the images are provided as examples and do not reflect the full report.

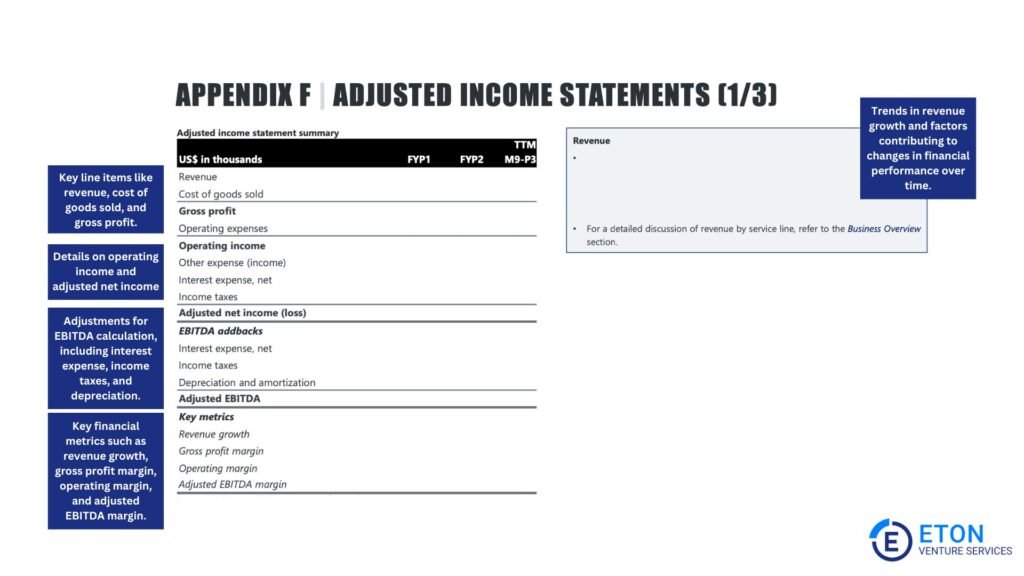

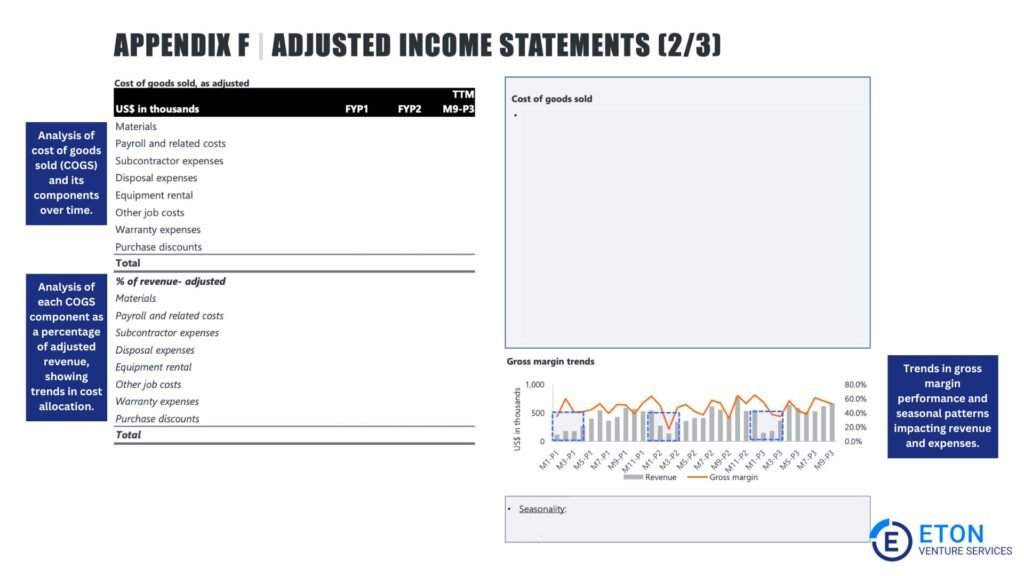

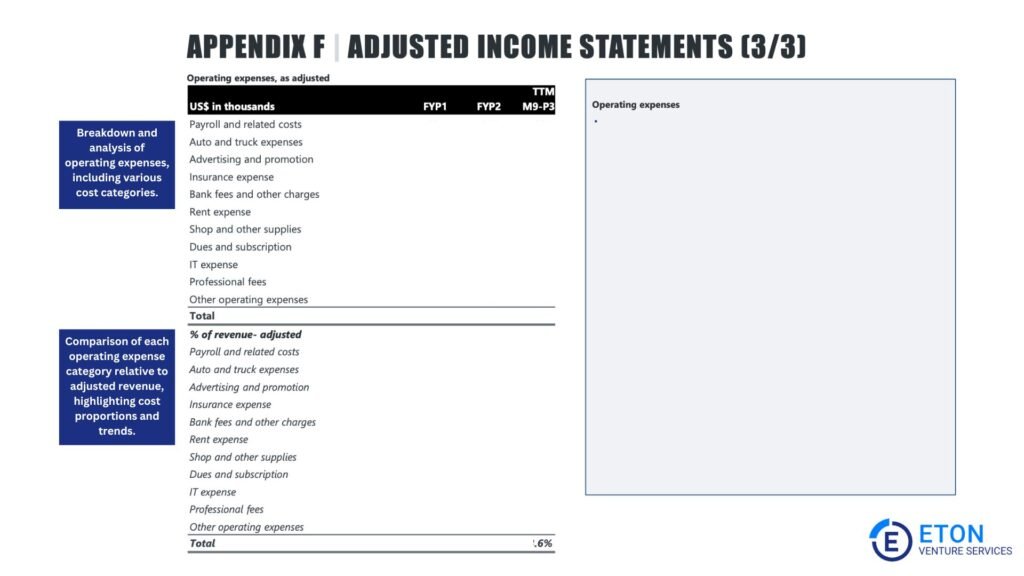

This dives into revenue, expenses, and profitability to make sure they accurately reflect core operations. It includes:

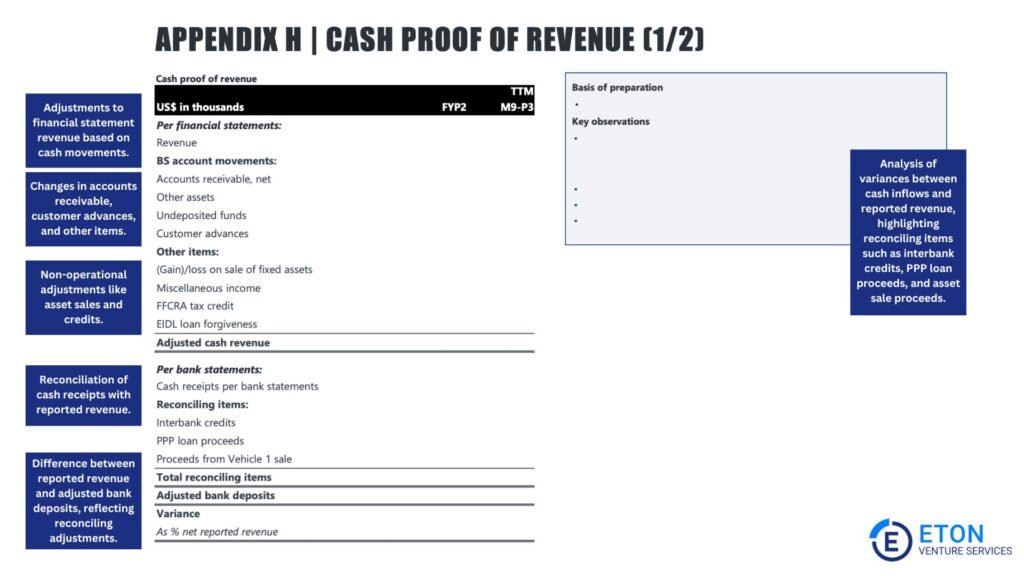

Cash flow is the lifeblood of any business, and this section examines whether the reported figures are accurate and sustainable. It includes:

This ensures that income and cash flow align with the company’s financial position, identifying any risks hidden in the details. It includes:

Numbers alone don’t tell the full story. This section examines the business’s operational strengths and challenges, including:

For a more in-depth explanation of how a quality of earnings analysis process works and what the report includes, we recommend reading our full article on this here.

Choosing the right provider for your Quality of Earnings analysis requires striking a balance between quality, affordability, timeliness.

A good provider will deliver actionable insights while making sure the process remains efficient and cost-effective.

Specifically, here’s what to look for:

On the other hand, here’s what to avoid:

At Eton, we combine the expertise of a team trained at Big 4 firms like Deloitte, EY, KPMG, and PwC, with the cost efficiency of a boutique firm.

This means you’ll receive the same quality and precision you’d expect from top industry leaders—without the high overhead costs that typically come with them.

Our buy-side QoE process goes beyond financial data to truly understand your target business, providing you with a reliable picture of the key factors that drive its performance.

And we’re not just here to deliver a report—we’re here to be your partner.

We’ll explain every finding, answer your questions, and guide you through the process to help you close your deal with confidence.

In short, when you choose Eton, you’re choosing accuracy, transparency, and a steadfast commitment to your success.

Ready to move forward? Reach out today to find out exactly how much a QoE report will cost, based on the size, industry, and complexity of your target business.

A typical engagement on a quality of earnings analysis lasts four to eight weeks.

The exact timeline can vary depending on the complexity of the business, the scope of the analysis, and the availability of financial records.

If the report identifies major issues, such as inconsistent revenue reporting, unrecorded liabilities, or other financial risks, these should be addressed promptly.

These findings may lead to renegotiations on deal terms, adjustments to the purchase price, or, in some cases, a decision to walk away from the transaction.

A good provider will help you interpret these red flags and assess the best course of action moving forward.

Absolutely. The best QoE reports are tailored to address the unique risks and priorities of the buyer or deal.

Whether you’re concerned about customer concentration, revenue trends, or specific liabilities, you can work with your provider to focus on the areas that matter most to your transaction.

At Eton, we customize every report to align with your goals, ensuring no detail is overlooked.

Yes, you do. An audit ensures accurate financial statements for regulatory or financing needs, but it doesn’t address deal-specific concerns like normalized earnings, customer dependencies, or revenue sustainability.

A QoE report focuses on these areas and provides forward-looking analysis to help you understand how the target’s financials translate into future performance—something an audit alone can’t provide.

Smaller businesses definitely benefit from a QoE report, just as much as larger companies do.

In fact, for small businesses, a QoE report can be especially valuable because it helps clarify the true financial performance, which is often closely tied to the owner’s decisions.

For buyers, it provides confidence that they’re not overpaying, while for sellers, it can help demonstrate the true value of the business.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.