Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

A healthcare business valuation isn’t just about financials. Reimbursement models, payer mix, referral networks, regulatory exposure, and physician compensation structures all influence value.

If you’re preparing for a transaction, financial reporting requirement, or physician compensation arrangement, the right healthcare valuation firm helps you avoid regulatory exposure, pricing errors, and costly disputes.

In this guide, I’ll outline what separates top healthcare valuation firms from average ones and introduce eight options that consistently deliver compliant, audit-ready results.

Before choosing a healthcare valuation company, look for these key factors:

Delays are common in this industry. We’ve had clients come to us after waiting months for prior firms to deliver. Speed matters, especially when deals or compliance deadlines are involved. However, it also shouldn’t come at the expense of accuracy or defensibility.

At Eton, we can complete a healthcare business valuation in as little as 10 days, and even faster when required, without compromising analytical rigor or regulatory compliance. Book a call with me here to get started.

From my decades of experience in the industry, below are the top 8 healthcare valuation firms I recommend and why I recommend them.

And if you’re specifically searching for medical practice valuation companies, several of these firms stand out for their work with physician groups.

Eton Venture Services is a U.S.-based valuation firm that delivers healthcare business valuations and fair market value (FMV) opinions structured to withstand regulatory scrutiny under Stark Law, the Anti-Kickback Statute, and IRS guidelines.

The firm has completed more than 10,000 valuations with a perfect audit record and is trusted by healthcare operators, private equity firms, legal counsel, and boards making high-stakes compensation and transaction decisions.

Eton at a Glance

Every healthcare valuation is handled directly by senior professionals who analyze the specific regulatory, structural, and operational realities of the engagement; no automated shortcuts that often overlook compliance nuances or deal-specific risks.

Key strengths:

Pricing: Affordable, flat-fee engagements structured by scope and complexity. Contact us for a custom quote based on your transaction type, regulatory exposure, and organizational structure.

Best for: Healthcare providers, physician groups, private equity-backed platforms, and legal teams that require defensible FMV opinions or healthcare business valuations tied to regulatory-sensitive transactions.

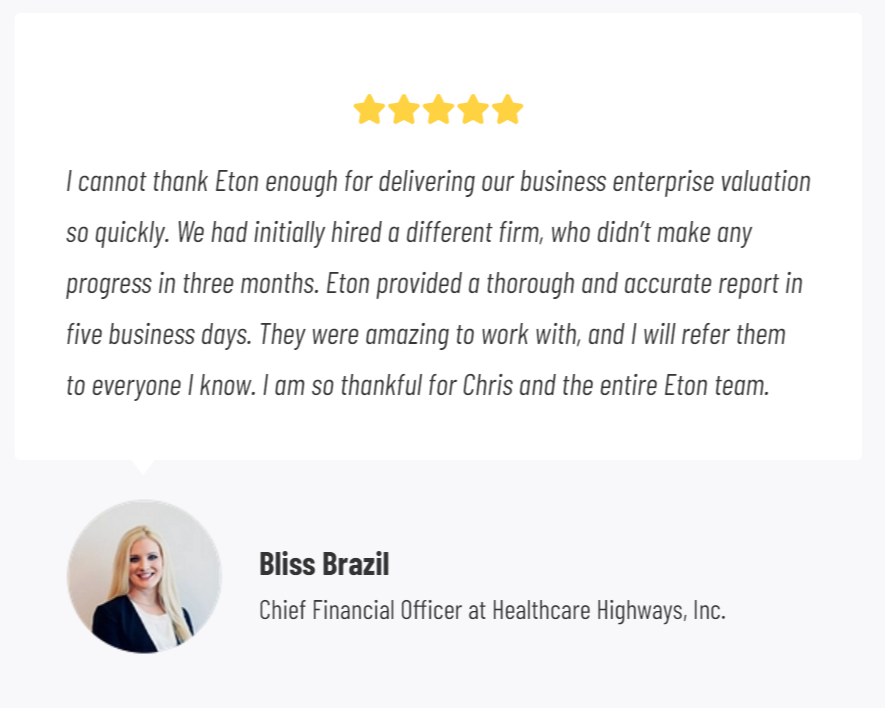

💡 Bliss Brazil, Chief Financial Officer at Healthcare Highways, Inc., shares her experience with us below:

Click here to get a free valuation consultation with Eton Venture Services.

VMG Health is one of the most established healthcare valuation firms in the market. With over 300 professionals and more than 45,000 completed engagements, they operate at significant scale within the healthcare advisory space.

The firm provides healthcare business valuation, FMV opinions, financial due diligence, and transaction advisory services. They are particularly known for their work in regulatory-compliant fair market value analyses under Stark Law and the Anti-Kickback Statute.

Key strengths:

VMG works with:

Pricing: Not publicly listed. Likely varies based on engagement scope and complexity.

Best for: Larger healthcare organizations, health systems, or PE-backed groups seeking a scaled healthcare valuation company with deep regulatory experience.

HMS Valuation Partners specializes exclusively in healthcare valuation and transaction advisory services.

With over 27 years of experience and more than 15,000 valuations completed across 45 states and Europe, they work with clients ranging from standalone hospitals to large health systems and physician groups.

They are best known for defensible FMV opinions and commercial reasonableness analyses structured to comply with Stark Law and the Anti-Kickback Statute.

Their services span:

Key strengths:

Pricing: Not publicly listed. Likely varies depending on engagement scope and complexity.

Best for: Healthcare organizations that need specialized healthcare appraisers for FMV opinions, commercial reasonableness analyses, and transaction-related healthcare valuations.

FTI Consulting is a global advisory firm offering transaction advisory and valuation services across industries, including healthcare.

Unlike healthcare-exclusive firms, FTI operates as a large multidisciplinary platform focused on complex M&A transactions. Its work spans due diligence, post-deal integration, and valuation support.

The team navigates key legal and regulatory frameworks that impact healthcare valuations, including Stark Law and the Anti-Kickback Statute.

Beyond valuation and transaction advisory, FTI also supports physician compensation arrangements and other healthcare financial matters.

Key strengths:

Pricing: Not publicly listed. Likely higher than boutique healthcare valuation firms like Eton due to size and structure.

Best for: Large healthcare organizations or private equity groups involved in complex transactions that require integrated advisory and valuation support.

Carnahan Group combines healthcare consulting with technology-driven valuation tools, serving urban and rural hospitals, surgical facilities, and physician practices.

Its proprietary platform, FMV-MD®, generates automated fair market value opinions for physician compensation arrangements.The firm also uses proprietary market data and trend analysis to inform its compensation valuations.

While this technology can improve efficiency in standardized compensation scenarios, healthcare transactions often involve regulatory nuance and structural complexity that automated tools may not fully capture.

Organizations should ensure the level of analysis aligns with the complexity and risk profile of the arrangement.

Beyond its technology platform, Carnahan also provides business valuations, compensation analyses, medical equipment appraisals, and strategic advisory services.

Key strengths:

Pricing: Not publicly listed. Likely varies depending on platform usage and scope of engagement.

Best for: Healthcare organizations with more routine physician compensation arrangements seeking efficient, market-informed valuation support.

HealthValue Group (HVG) is a boutique healthcare valuation and transaction advisory firm based in the Denver area, serving clients across 35 states as well as internationally.

The company conducts detailed research and analysis to produce valuations that withstand rigorous scrutiny, and their team works within key healthcare compliance frameworks, including Stark Law and the Anti-Kickback Statute.

In addition to healthcare business valuation, HVG provides capital equipment appraisals, fair market value (FMV) opinions, quality of earnings reports, and litigation support services, including expert witness work.

Key strengths:

Pricing: Not publicly listed. However, like Eton, HVG offers fixed-fee engagements, which provides cost predictability.

Best for: Healthcare organizations, legal teams, and private equity firms seeking a boutique firm with deep regulatory expertise across transactions, compliance, and litigation matters.

BuckheadFMV is a national healthcare valuation firm known for delivering defensible reports tailored to complex transactions and compensation arrangements.

The firm provides business and asset valuations for mergers, buy-ins and buy-outs, joint ventures, shareholder transactions, and financial reporting.

They also issue FMV and commercial reasonableness opinions for physician compensation, hospital management agreements, and other regulatory-sensitive arrangements.

Their work is structured to align with Stark Law, the Anti-Kickback Statute, and IRS guidelines.

Key strengths:

Pricing: Not publicly listed. Likely varies based on transaction scope and regulatory complexity.

Best for: Hospitals, physician groups, and healthcare entities requiring defensible healthcare valuations tied to compensation arrangements or regulatory compliance.

At Eton, we don’t treat healthcare company valuation like a generic industry engagement. We account for reimbursement risk, physician compensation structures, referral exposure, and transaction design from the outset.

Our team has completed over 10,000 valuations with a perfect audit record. Every healthcare business valuation and FMV opinion is prepared and reviewed by experienced professionals with backgrounds in Big 4 consulting and top law firms.

With Eton, you get:

We’re able to deliver healthcare business valuations in 10 days or less because, as a boutique healthcare valuation firm, we stay hands-on with every client and have refined our process across thousands of engagements without adding unnecessary layers or bureaucracy.

If you’re evaluating top healthcare valuation firms and need a fast, defensible healthcare business valuation, reach out to our team to schedule a free consultation.

A healthcare valuation determines the fair market value (FMV) of a healthcare business, asset, or compensation arrangement.

FMV is the price or compensation that independent parties would agree to in an arm’s-length transaction, without factoring in referral volume or other regulatory considerations.

This may involve a healthcare business valuation for a hospital or physician practice, a healthcare asset appraisal, or an FMV opinion tied to physician contracts.

In regulated settings, healthcare valuation firms structure reports to support compliance under Stark Law and the Anti-Kickback Statute.

For internal planning purposes, yes.

But for regulatory-sensitive matters, such as physician compensation arrangements, hospital transactions, or compliance-related valuations, an independent third-party opinion is strongly recommended and, in practice, expected by boards, auditors, and regulators.

Internal valuations are difficult to defend when compliance exposure is involved.

Some healthcare appraisers hold credentials such as ASA (Accredited Senior Appraiser), CVA (Certified Valuation Analyst), or ABV (Accredited in Business Valuation). But credentials alone don’t tell the full story.

What matters most is the depth of legal and financial expertise behind the work. The most important things to look for are:

The best healthcare valuation firms combine technical training with hands-on healthcare experience and analytical depth grounded in backgrounds such as Big 4 consulting, law, and accounting; the kind that holds up under regulatory and auditor scrutiny.

Watch for:

If a healthcare valuation company cannot clearly explain how they support regulatory defensibility, that’s a concern.

Large firms offer brand recognition, scale, and integrated transaction services. That can be helpful in highly complex, multi-entity transactions.

However, many boutique healthcare valuation firms handle the same hospital business valuations, physician compensation analyses, and regulatory-sensitive engagements, often with more direct senior involvement and fewer internal layers.

Top boutique healthcare valuation firms typically provide:

For many healthcare valuations, a specialized boutique firm, such as Eton Venture Services, can deliver the same rigor as a large platform, with a more responsive and tailored experience.

Automation can support standardized compensation analyses. However, physician contracts and specialty hospital valuation work often involve regulatory nuance and fact-specific judgment.

Healthcare valuations tied to Stark or Anti-Kickback compliance usually require deeper analysis and documentation than automated outputs can provide.

For low-risk, routine arrangements, structured tools may assist. For regulatory-sensitive matters, experienced human healthcare appraisers provide the judgment, context, and documentation that automated systems cannot replicate.

Schedule a free consultation meeting to discuss your M&A or valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.