Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

If you’re reading this, you’re likely at a crossroads with the business you’ve poured your heart and soul into. Maybe you’re ready for retirement, feeling burnt out, or seeing an opportunity to cash out while the market’s good.

Whatever brought you here, I understand that the question ‘How much can I sell my business for?’ is about much more than just getting a number.

We value thousands of businesses each year, and while it’s tempting to think there’s a simple formula, the reality is both more complex and more nuanced.

Your years of building customer relationships, developing efficient processes, and creating a strong team all factor into your business’s true worth.

While in this article we’ll share our best answer to help you estimate a rough value, it’s important to remember that business valuation is as much an art as it is a science. So, for a truly accurate and defensible figure, professional expertise is indispensable.

That’s why we recommend thinking of this as just the first step toward making informed, confident decisions about your business’s value.

Key Takeaways

|

To determine how much to sell your business for, you must first choose a business valuation method that suits your business size, stage and unique scenario.

All valuation methods fall under three widely recognized approaches:

The following is a quick overview of the methods under each approach. You can use this to skip to the method best suited for your business stage and circumstances:

| Approach | Method(s) | Suitable for |

| Asset-Based | Book Value Method | Early-stage or asset-heavy businesses (e.g., startups, real estate) |

| Market-Based | Revenue Multiple Method | High-growth businesses (e.g., tech startups, subscription models) |

| SDE Multiple Method | Owner-operated small businesses (e.g., restaurants, retail shops) | |

| EBITDA Multiple Method | Medium to large businesses with stable earnings | |

| Income-Based | Discounted Cash Flow (DCF) Method | Larger businesses with predictable cash flows and mature markets |

The book value method is an asset-based valuation method that’s particularly suitable for very early-stage companies with little or no revenue or earnings.

It’s also ideal for asset-heavy businesses that generate the majority of their cash flows from real estate, machinery, equipment, or inventory.

Here’s how to calculate the value of your business using the book value method:

|

It also doesn’t take into account the current market value of assets, which may differ from their book value, particularly in industries undergoing rapid changes.

In these cases, alternative valuation methods like market-based approaches or the discounted cash flow (DCF) analysis, which we’ll cover next, may be more appropriate.

Note that book value isn’t the only asset-based valuation method there is. To explore more methods under this approach suitable for early-stage companies, read our full guide on business valuation methods.

The ‘revenue multiple method’ is a market approach-based method that’s particularly useful for businesses with high growth potential, such as tech startups or subscription-based models, where profitability may not yet reflect the true value.

For these companies, especially those that are unprofitable or only marginally profitable, revenue becomes a more reliable indicator of value.

For example, Databricks, a cloud-based data engineering platform, achieved a $43 billion valuation based on a 28x revenue multiple, despite not yet being profitable. Its $1.5 billion revenue run rate and 50% annual growth were the primary drivers of this impressive valuation.

So, if you’re valuing a high-growth company, here’s what you need to do:

|

Note that this method has its limitations. Since it doesn’t consider profitability, businesses with high sales but thin or negative margins could appear overvalued.

Additionally, it overlooks the costs of generating revenue, making it less accurate for businesses with high operating expenses.

As a result, the revenue multiple method works best as a starting point, complemented by other approaches like the EBITDA or SDE multiple, which we’ll explore next.

For small, owner-operated businesses, the SDE multiple method is often the most appropriate, as it values the business based on the total financial benefit an owner derives from it.

It works particularly well for businesses like restaurants, small retail shops, or service providers, where the owner’s role is integral to daily operations. Whether you’re conducting restaurant valuation or retail business valuation, this method effectively shows what new owners can expect to earn. It’s also appealing to buyers who plan to step into the owner’s position and replicate these earnings.

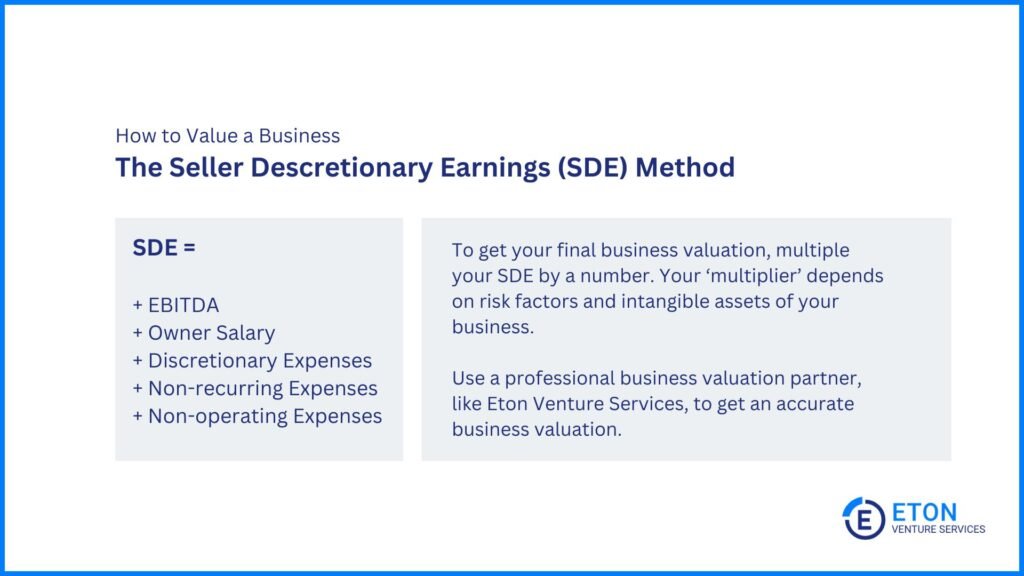

SDE uses EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) as a starting point and adds adjustments for owner-specific benefits, discretionary expenses, and one-time costs.

Here are the exact steps to calculate SDE:

|

It’s important to note that calculating SDE can involve subjective judgments, especially when adjusting for discretionary or one-time expenses.

Professional guidance is needed here to ensure the adjustments are accurate and defensible during negotiations or due diligence.

The EBITDA multiple method is a market-based valuation approach often used for medium to large businesses with stable earnings and growth potential.

It is particularly suited for companies with competitive profit margins and consistent cash flows, especially in mature industries where they align with similar businesses in the market.

This method calculates value based on EBITDA, which measures operating profit before factoring in costs like interest, taxes, depreciation, and amortization.

It’s also often favored during acquisitions where buyers prioritize profitability and positive cash flows, either to service debt or reinvest in the business.

To calculate your business’ value using the EBITDA multiple method, follow these steps:

|

Unlike the SDE method, which adjusts for the owner’s involvement and discretionary expenses, the EBITDA multiple method focuses solely on the company’s operating efficiency and scalability.

This makes it ideal for valuing businesses that can sustain and grow their performance without relying on the owner’s direct participation.

The Discounted Cash Flow (DCF) method is a detailed valuation approach ideal for larger businesses with steady cash flows and established market positions.

It calculates a business’s present value by forecasting future cash flows and discounting them to account for time value and investment risks. This makes it suitable for companies in mature markets with stable operations.

Here’s the step-by-step guide to valuation using DCF:

|

The main limitation of the Discounted Cash Flow (DCF) method is its reliance on assumptions about future cash flows and the discount rate.

While mature markets reduce some uncertainties, factors like economic shifts or unexpected disruptions can still impact accuracy.

That’s why it’s best to use DCF alongside other valuation methods, such as comparable company analysis and precedent transactions.

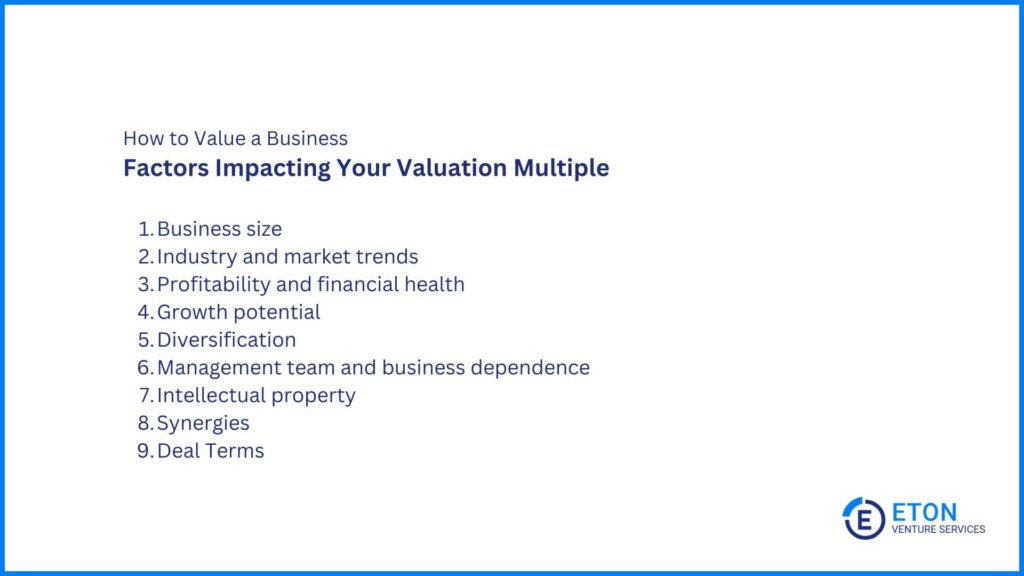

Larger businesses typically command higher multiples due to their stability, market share, and established management teams.

Their size conveys resilience and dependability, which appeal to buyers and often result in a premium valuation.

On the other hand, smaller and mid-sized businesses usually see lower multiples due to their limited assets and tighter profit margins.

Industries with strong growth potential and innovation, such as technology or healthcare, often command higher multiples due to their scalability and future prospects.

When combined with favorable market conditions—like low interest rates, economic growth, or rising demand for businesses in your sector—these factors can significantly boost valuations. This makes timing a critical aspect of achieving a premium multiple.

Businesses with high profit margins and solid financial health usually secure higher multiples.

High profit margins reflect strong cash flow and dependable returns, making the business more attractive to buyers.

Similarly, a healthy financial position—marked by low debt, steady revenues, and efficient operations—reassures buyers of the business’s stability and long-term potential.

A business with a strong track record of growth and clear potential for future expansion typically commands higher multiples.

Buyers are drawn to companies with steady, upward momentum, as it suggests long-term profitability and market appeal.

Filip Dimitrijevski, Business Development Manager at CLICKVISION BPO, highlights this point:

“I also like to look at the company’s growth prospects. If you can see clear signs of growth, like an increase in demand or expanding services, that should be factored in-growth potential can make a big difference in how you value a business.”

In short, valuations often go beyond current performance to account for how well the business is positioned to grow in the future.

A diverse and loyal customer base, along with a well-balanced supplier network, adds significant value to a business.

Companies that avoid over-reliance on a single customer, product, or supplier are less vulnerable to disruptions and economic shifts.

This stability reduces risk and supports higher valuation multiples by ensuring more predictable earnings.

A strong and experienced management team can make a business more attractive to buyers, often leading to a higher multiple.

However, if the business relies too heavily on its owner or a few key individuals, its valuation may suffer. Buyers prefer businesses that can operate independently, with systems and teams in place to ensure smooth operations and long-term growth without being tied to specific people.

Valuable intellectual property (IP), such as patents, trademarks, or proprietary technology, can increase a business’s multiple.

It creates barriers to entry and offers the potential for steady, long-term earnings. This provides a competitive edge that makes the business more appealing to buyers.

When buyers see opportunities to combine operations and reduce costs or increase revenue, they are often willing to offer a higher multiple.

For instance, a business with complementary products or a wider geographic presence can provide additional strategic benefits, making it more valuable to the buyer.

As Jamar Cobb-Dennard, Business Broker & Attorney at Indiana Business Advisors, explains:

“The final consideration for choosing the right valuation multiple is whether strategic or financial buyers can create redundancies (tech, HR, etc.), which can increase the value. This is due to the decrease in COGS and operating expenses, which increases profit, which in-turn increases value.”

The structure of the payment in a deal also influences the multiple. If the buyer pays mostly in cash upfront, the risk is higher for them, leading to a lower multiple.

But if the deal includes payments spread out over time or linked to future performance (like meeting revenue targets), the risk is reduced, allowing for a higher multiple.

Reading this article, you might be tempted to calculate a ballpark figure using the methods we’ve discussed.

But when it comes to accurately answering your question, “How much should I sell my business for?”, applying these methods on your own can fall short.

This is because it may not fully account for the nuances of your hard-earned enterprise—its unique strengths, risks, and market position.

That’s where a professional valuation dives deeper, analyzing these factors to give you a credible number that can stand up to scrutiny.

By having a professionally determined value:

At Eton, we help you with this by applying the right methods and accounting for all the unique factors that impact your business’s value.

Our approach goes beyond simple calculations, ensuring that every aspect of your business is thoroughly considered.

With our expertise, you’ll have a solid foundation for negotiations, enabling you to maximize your sale price with a valuation that accurately reflects your company’s true worth.

To know if a buyer’s offer is fair, it’s important to get a professional valuation. A professional can assess your business’s financial health, market trends, and growth potential.

This gives you a clear idea of whether the offer matches your business’s true worth and helps ensure you’re getting a fair deal.

The best time to sell is when your business is performing well, with solid financials, consistent revenue growth, and strong market positioning.

Market conditions also play a role—consider selling during favorable economic conditions, low interest rates, and industry growth to maximize value.

If you’re happy with your valuation, go to market with that figure confidently and don’t settle for less. Alternatively, you can wait for offers but still ensure they meet or exceed the fair value established in your professional appraisal.

The tax implications of selling your business depend largely on how the sale is structured (asset sale vs. stock/share sale).

In an asset sale, individual assets are taxed at ordinary income rates, which are typically higher, while in a stock sale, capital gains tax applies, which is generally lower.

You should also consider any potential state or local taxes, and how the sale will impact your personal taxes, especially if you’re selling a business you’ve owned for a long time.

Consulting with a tax advisor to understand the full tax impact of different sale structures is crucial for determining the most advantageous pricing strategy.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.