Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

In biotech, a drug in development could be worth billions… or nothing. Success usually depends on a long chain of uncertain outcomes: clinical trials, FDA approval, regulatory shifts, and investor patience.

So, unlike most businesses, biotech companies can raise capital or sell at high valuations before generating a dollar of revenue. And that’s where the challenge lies: You’re not just measuring what is, you’re pricing what could be.

Take Legend Biotech, for example. When this cell therapy leader went public in 2020, it raised over $150 million, even without an approved product. Investors backed it because of the speed and promise of its pipeline, including an experimental CAR-T therapy for multiple myeloma.

When investors make calls like this, they’re looking for signals that reduce uncertainty and hint at future success.

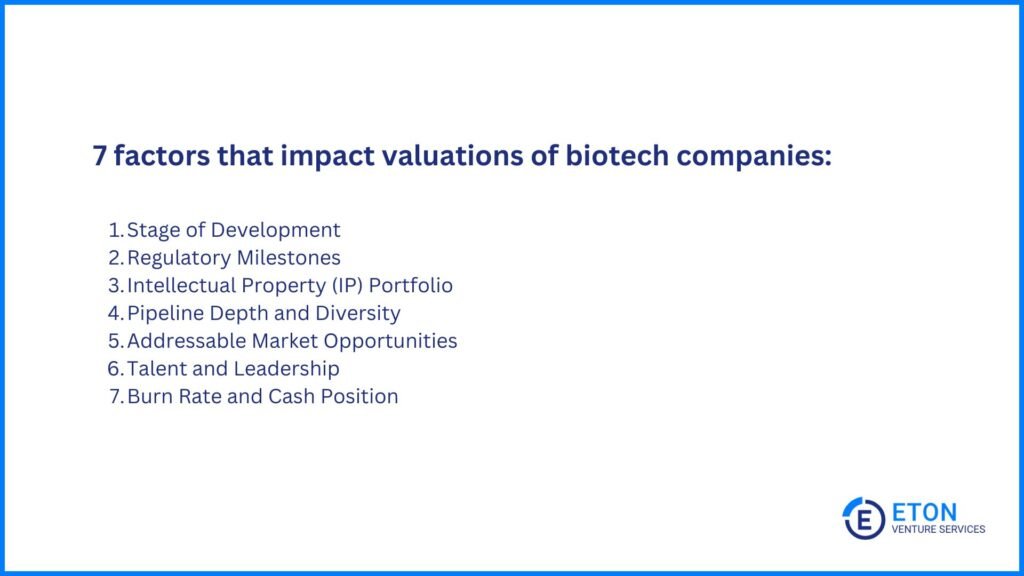

Having valued biotech companies at every stage, from early-stage startups to revenue-generating firms, I focus on these key factors to assess risk, timing, and payoff potential:

These considerations give buyers and investors a clearer picture of where the company stands and what kind of upside or risk they’re taking on. From there, valuation methods help translate these insights into numbers.

The rest of this article explains how these valuation methods work, when to apply each one, and what to consider as you assess a biotech company’s true worth.

Key Takeaways

|

To value a biotech company, we typically use one or a combination of the following valuation methods:

Some methods price the future. Others are based on what the company has already achieved. And since biotech companies vary widely by stage, the right method depends on how much has been proven and how much still rests on potential.

Let’s break down how each method works, when it applies, and what it tells you about a biotech company’s true value.

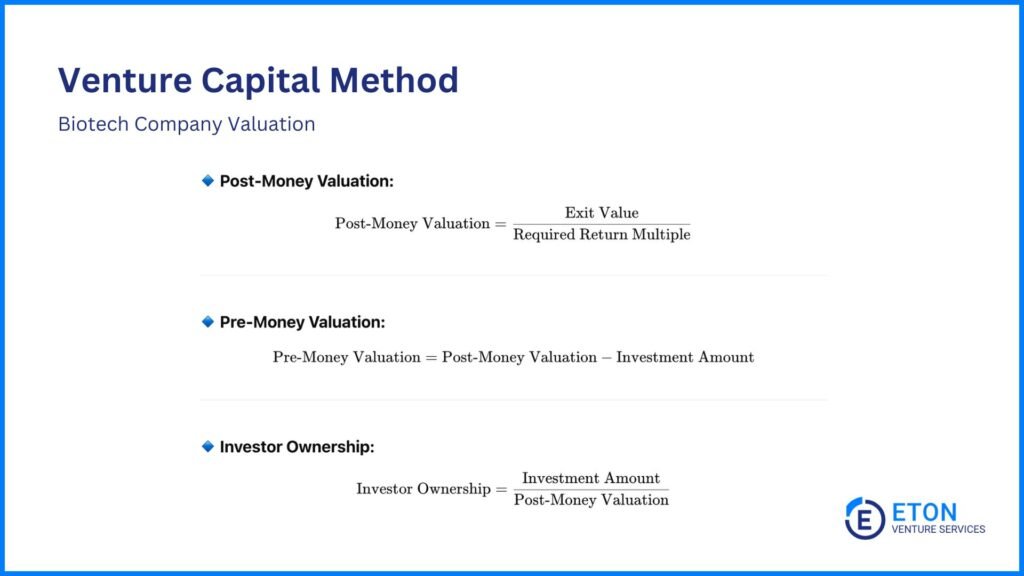

The VC Method works best for early-stage biotech startups, the ones still in research mode. These companies usually don’t have earnings yet. Instead, their value lies in what they could be worth one day after a successful exit.

Since traditional valuation methods need steady cash flow or profits, they don’t work well here. So, we flip the process: we estimate what the company could sell for in the future, then work backward to figure out what it’s worth today.

Here’s how it works, step by step:

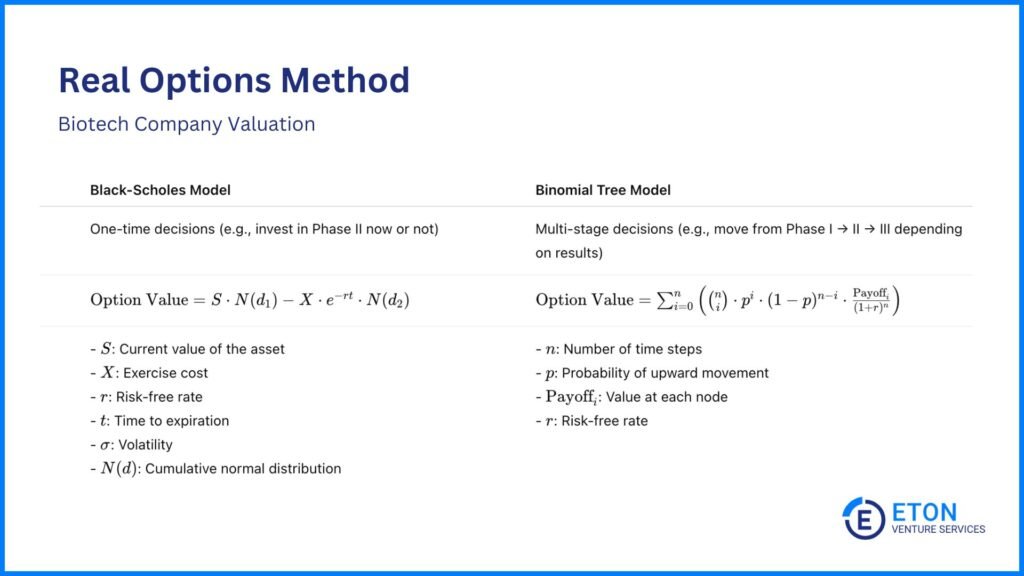

In biotech, many decisions aren’t made all at once. You might wait to invest in a Phase II trial until Phase I results come in. Or pause development on a second drug until the first reaches a regulatory milestone. Real options help capture the value of that flexibility.

A real option is the right, but not the obligation, to move forward with a project later once more information is available.

Let’s say you have a drug that isn’t worth much today because Phase I results haven’t come in yet. But if those results are strong, the company might choose to invest in Phase II trials; a step that could eventually lead to FDA approval and millions in future revenue. The company can choose to invest (or not) based on what the data shows.

That choice has real value. And real options valuation helps you price in that future possibility, instead of writing off the project just because it’s early or uncertain.

That’s why this method fits biotech so well. It’s ideal for R&D-heavy companies facing high-stakes, binary outcomes, like FDA approvals.

It’s also useful when the company holds early-stage drug programs or undeveloped IP that may not generate cash flow yet but might be valuable later.

Here’s how it works:

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

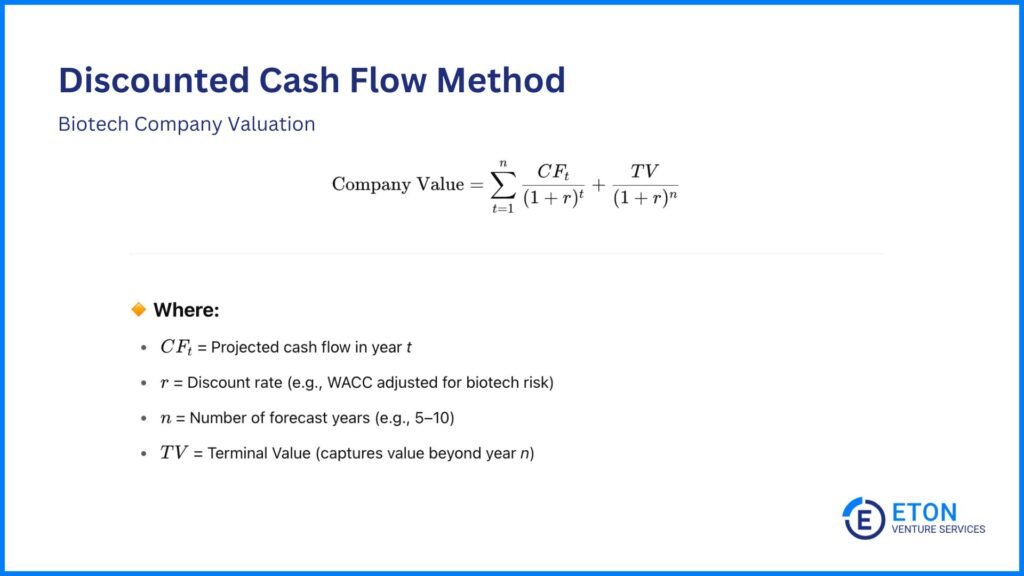

The Discounted Cash Flow Method values a company based on how much cash it’s expected to generate in the future, then discounts those amounts to reflect what they’re worth today.

For example, if a biotech company is expected to generate $10 million per year over the next five years, we don’t just add up that $50 million and call it a day. Instead, we apply a discount rate to adjust for risk and the time value of money. So the actual valuation might land closer to $35-40 million.

Because this method relies on cash flow projections, it works best for later stage biotech companies that are already generating revenue or those approaching commercialization. For these companies, cash flow is more predictable, and there’s enough data to make solid forecasts.

Here’s how to apply it:

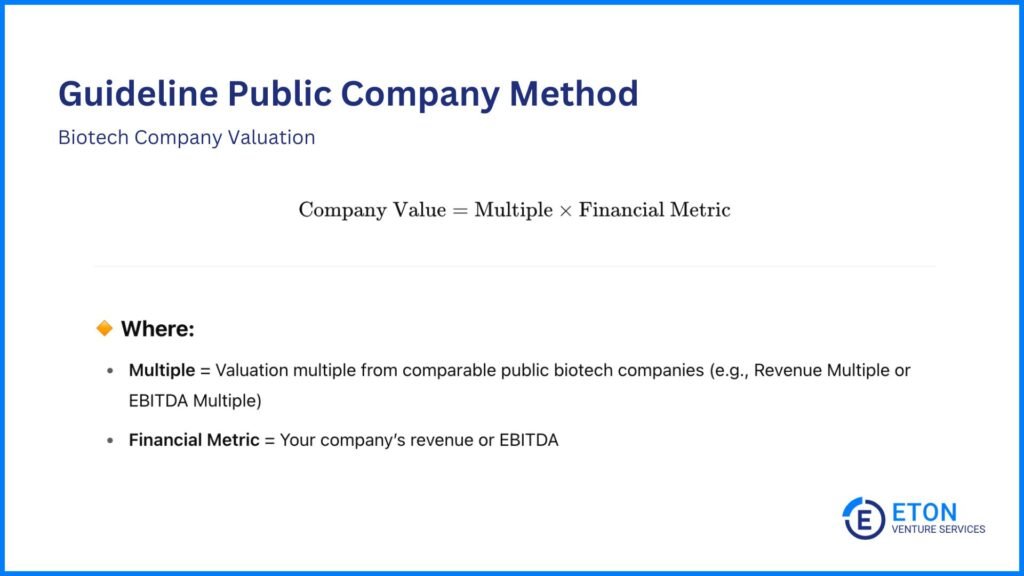

The Guideline Public Company Method values a biotech company by comparing it to publicly traded companies with similar traits.

We don’t typically use it for early-stage, pre-revenue biotech startups because they lack the financial data needed for reliable comparisons.

Instead, it works best for companies that are already generating revenue or have reached profitability, where we can compare real-world performance, not just potential.

To apply it, we start by choosing public companies with similar financial and operational profiles. That includes things like:

Once we’ve found the closest matches, we look at their valuation multiples. Multiples are ratios that show how much the market is willing to pay for a business relative to numbers like revenue or earnings. The most common multiples we use in biotech are:

Tip! You can find these multiples in financial databases, company reports, and online platforms like Bloomberg Terminal that track financial data for public companies.

Once we know the multiple, we apply it to your firm’s own financial metrics. For example, if similar public companies trade at a 6x EBITDA multiple and your company earns $15 million in EBITDA, its value would be: $15,000,000 × 6 = $90,000,000.

However, there are a few important adjustments to consider.

First, no two companies are exactly alike. Even if your biotech company is similar to the public comps, there will be differences. So, we use professional judgment to interpret what likely drove the multiples in those public companies and then assess how your company compares.

If your company shows stronger growth or a more advanced pipeline, for example, it may justify a higher multiple. But if it has a higher burn rate, depends on one drug, or lags in regulatory progress, the multiple may need to come down.

Second, we apply a discount to account for private market realities. Public companies benefit from liquidity (their shares are easy to buy and sell) and transparency (their financials are widely available). Private companies don’t offer that same flexibility or openness, which makes them less attractive to some investors, hence, the discount.

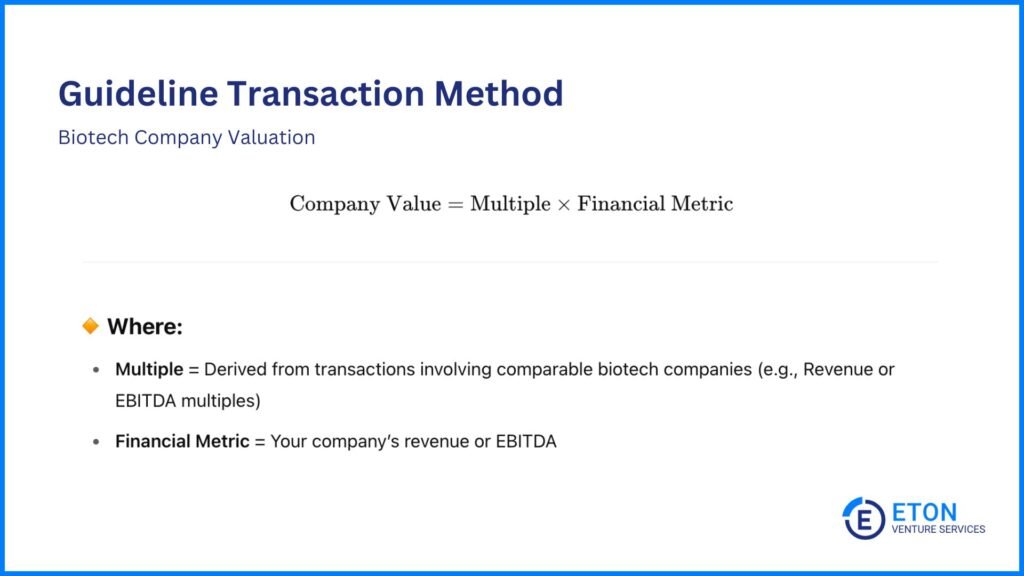

The Guideline Transaction Method values a biotech company by looking at the sale prices of other biotech firms. Instead of relying on public market data and sentiment like the GPC method, it uses actual transactions as a benchmark.

This method is most useful when there’s enough data from recent deals involving similar biotech companies. Since it reflects what buyers have actually paid in real transactions, we often use it when valuing a company for an exit, M&A deal, or investment round.

For example, if companies in similar deals sold for 5x revenue, and your company brings in $20 million, the value would be: $20,000,000 x 5 = $100,000,000.

But we don’t stop there. Every deal has context, and that context affects the price:

So once we find the right multiple, we ask: Was that price high because of a unique buyer incentive or low because of a one-off problem? And does that situation apply to your business?

If it doesn’t apply, we adjust the multiple to reflect this. The goal is to strip out deal-specific noise and focus on what your company would be worth under normal, steady conditions, not just what someone paid in one particular case.

Additionally, as in the GPC method, we adjust the multiple to reflect any differences between the comparables, even if they’re otherwise similar.

For example, say the acquired company had global distribution, while your company is only selling in one region. Even if everything else is aligned, we may adjust the multiple down to reflect that limited reach.

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

This calculator gives you a ballpark estimate of your biotech company’s value using the VC Method and the DCF Method, depending on your company’s stage. These are common methods we use for biotech valuation as discussed earlier in the article.

But remember: This is meant to give you a quick starting point, not a final valuation. Valuing a business is more complex. We often combine multiple methods, adjust for context, and consider many moving parts. For a reliable, accurate valuation, talk to our team at Eton Venture Services.

Tell us where your biotech company stands today to guide the valuation.

Help us understand your current financial outlook to apply the right valuation method.

$0

$0

Valuing a biotech company is often about pricing potential, not just measuring current results. That potential rests on a handful of factors that help reduce uncertainty and clarify what the future might hold.

Things like clinical progress, IP protection, market size, and cash runway give investors a clearer sense of the company’s risk, timing, and upside.

Valuation experts play a huge role here. We analyze these factors, weigh their impact, and build a credible case for how they shape the company’s overall value.

Here’s what we look at:

The earlier a company is in its journey, the harder it is to predict outcomes. But that doesn’t always mean it’s worth less.

While companies that are already commercial or close to it tend to be valued higher, early-stage companies can still be highly valuable if they have strong intellectual property, promising trial data, or target a major unmet need.

For example, a biotech firm working on a breakthrough therapy in oncology might attract significant investor interest, even before generating a dollar of revenue.

The idea is to understand where the company stands today and then to look at how that stage shapes both its risk and potential reward. That’s what we build into the valuation.

Biotech companies move through a long process to launch products: IND filings, clinical trials, and FDA approvals. Each milestone reached reduces risk and boosts valuation.

That’s why a company that just completed successful Phase II trials might attract more interest than one still preparing to file its IND.

The further along the company is in this regulatory path, the more value the market tends to assign to it.

In biotech, it’s not just the science that drives value. It’s who owns it, how well it’s protected, and how hard it is to replicate.

Patents are especially important here. These intangible assets safeguard discoveries, create negotiating power, open licensing opportunities, and help defend future revenue.

For example, a company with granted patents on its lead therapy is in a stronger position than one still waiting on approvals or sorting out ownership rights.

This patent protection gives buyers and investors confidence that competitors can’t easily catch up and that future profits won’t be eroded before they even begin.

A company with only one drug candidate carries more risk. If that single program fails, everything’s at stake.

But a broader pipeline, with drugs in different stages or targeting different conditions, spreads the risk and shows long-term potential.

A deep, diverse pipeline can mean more chances for success, future partnerships, or follow-on products down the line. This usually leads to a stronger valuation.

One of the biggest questions in biotech valuation is how large the potential market is and how well the company can compete in it.

A drug that treats a rare disease may face less competition but has a smaller market. Meanwhile, a treatment for a widespread condition, like diabetes or cancer, might reach millions but may also face more competition.

We take all of this into account when we value the company. A larger market can mean higher revenue potential, but only if the company is in a strong position to reach it. If it’s not, the value might be much lower than what the market size alone would imply.

A smaller market doesn’t always mean lower value either. If the company is well-positioned or able to charge a premium, it can still be highly valuable.

A great idea means little without the right people to execute it. That’s why investors look for teams with the experience to move things forward.

They want to see a team that understands the science and the market—one that can manage clinical trials, raise capital, navigate partnerships, and guide a product to market.

When the right expertise is in place, key roles are filled, and the team is aligned around a clear strategy, it signals capability and long-term value, all of which lead to a higher valuation.

Between trials, manufacturing, and staffing, biotech costs add up quickly. That’s why burn rate (how fast the company is spending cash) and the current cash position matter so much.

If the company has enough funding to reach its next major milestone without raising more capital, that’s a positive signal. But if it’s running low and still early in development, that creates uncertainty and can lower valuation.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re planning for growth, preparing for a transaction, or structuring a transition.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your biotech company. We ensure that all key factors, such as stage of development, regulatory milestones, intellectual property, burn rate and more are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that support your next move.

Yes. While completed trials provide more certainty, we can still value early-stage biotech companies based on factors like intellectual property, scientific promise, market opportunity, and development strategy.

Methods like the Venture Capital Method and Real Options Valuation are specifically designed for these scenarios.

It depends on how central the failed program was to the company’s value. If it was the lead asset, the drop in valuation can be steep. But if the company has a diversified pipeline or strong IP elsewhere, the impact may be more limited. Investors will look at how well the company is positioned to pivot and recover.

Partnerships and licensing deals often raise valuation because they bring in upfront payments, milestone-based payouts, and sometimes royalties. Just as important, they show that a larger company sees real promise in the science. That kind of external validation reduces perceived risk and gives the biotech company more room to grow without raising extra capital right away.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.