Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

While many service businesses handle a mix of ongoing client work and one-time projects, Certified Public Accountant (CPA) firms stand out for the significant portion of their revenue that comes from essential, recurring services, like tax filings, audits, and payroll.

This kind of work isn’t optional for clients, and it isn’t easy to switch providers. Once trust is established, relationships often last for years, sometimes even decades. That makes CPA firm revenue unusually stable, which is a major driver of value.

To assess that stability, we look beyond surface-level revenue and earnings to key factors that show how secure and sustainable the business really is. These include:

Each of these factors helps tell the story behind the numbers: Why the revenue exists, how secure it is, and whether it can grow. Valuation methods then turn those insights into a price that stands up in negotiations with buyers.

Here’s a breakdown of how these valuation methods work and when to use them:

Key Takeaways

|

To value a CPA firm, we typically use one or a combination of the following valuation methods:

These valuation methods turn the things that drive your CPA firm’s value into concrete financial figures.

For example, steady income from repeat services and loyal clients means reliable cash flow, which is exactly what the DCF method is designed to capture.

Likewise, a strong brand, niche focus, and a referral network that delivers a steady stream of qualified leads often lead to higher multiples, which the GPC and GT methods use to estimate your firm’s value.

Ultimately, these valuation methods connect the traits that make your CPA firm stable and attractive to buyers to a credible estimate of its worth.

Now, let’s break down how each method works, when to use it, and what it reveals about your CPA firm’s value:

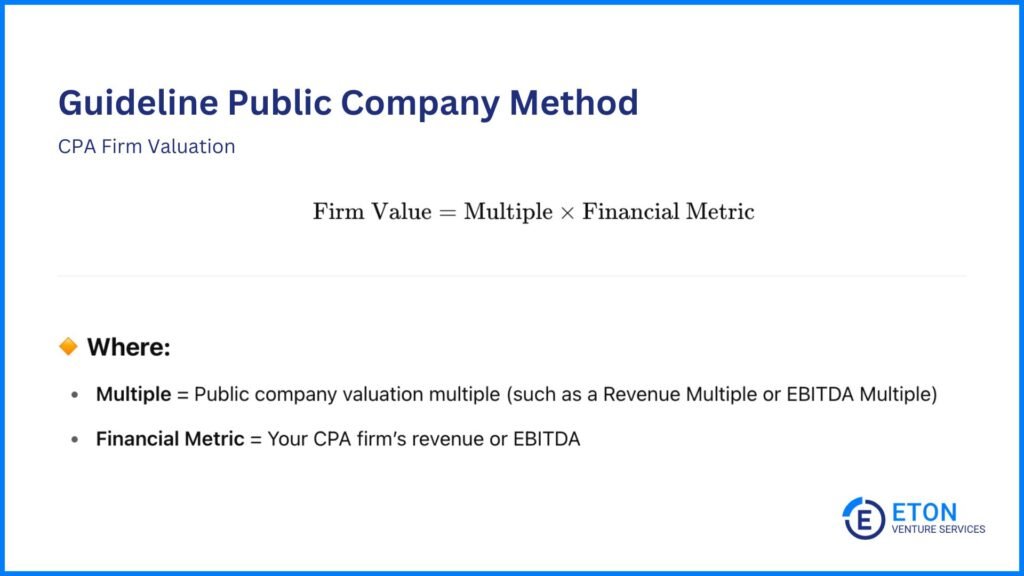

The Guideline Public Company Method compares your CPA firm to publicly traded companies with similar financial and operational traits to estimate its value. That’s why it works best when there are enough comparable public companies and reliable data to support a fair comparison.

Once we find comparable public companies, we examine the valuation multiples at which those companies trade. Those multiples are the financial ratios that show how much investors are willing to pay for your CPA firm relative to metrics like its revenue or earnings.

Tip! You can find these multiples in financial databases, company reports, and online platforms like Bloomberg Terminal that track financial data for public companies.

For CPA firms, the most relevant multiples are:

For example, if comparable firms trade at an EBITDA multiple of 4x and your firm earns $2 million in EBITDA, its value would be $8 million (4 x $2 million).

But why would investors value companies at two, three, or more times their revenue or earnings? The short answer: They’re pricing in the traits behind the numbers.

Strong client retention, recurring revenue, brand strength, and a focused market position all affect how predictable and scalable a company’s performance looks. That makes the revenue look more reliable and less risky to buyers, which usually leads to a higher valuation multiple.

However, those underlying traits aren’t always disclosed in full detail. So when we apply this method, we use professional judgment and reasonable assumptions to interpret what likely drove the multiple and then assess how closely your firm aligns.

If your company shares the same traits, applying a similar multiple may be appropriate. If not, we adjust accordingly to reflect the differences.

We also consider the fact that public companies benefit from greater marketability and liquidity. This means their shares are easy to buy and sell, and their pricing is transparent.

Since private firms don’t offer that same flexibility, we often apply discounts (such as Discount for Lack of Marketability) to the final valuation. This means the final price may be lower than simply multiplying your firm’s metrics by the public company multiple.

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

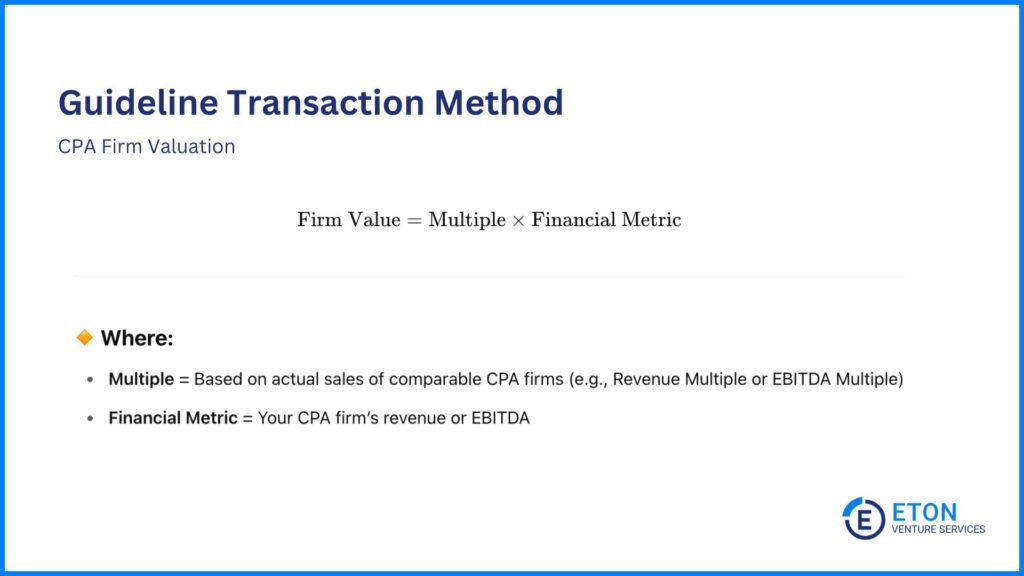

While the GPC Method compares your CPA firm to companies that trade on public stock markets, the Guideline Transaction Method looks at actual sales of similar firms.

It’s especially useful for small to mid-sized CPA firms, particularly when public comparables are limited and there’s a strong set of transactions involving similar firms in the same market.

For example, if comparable firms sold at a multiple of 1.3x revenue and your firm brings in $5 million annually, the value would be $6.5 million (1.3 x $5 million).

But those numbers alone don’t tell the full story; each deal has its own context.

So, even if the comparable firm is mostly similar, you’ll need to adjust the multiple if the premium or discount in that deal doesn’t reflect your firm’s situation. The goal here is to separate one-time deal dynamics from your firm’s underlying market value.

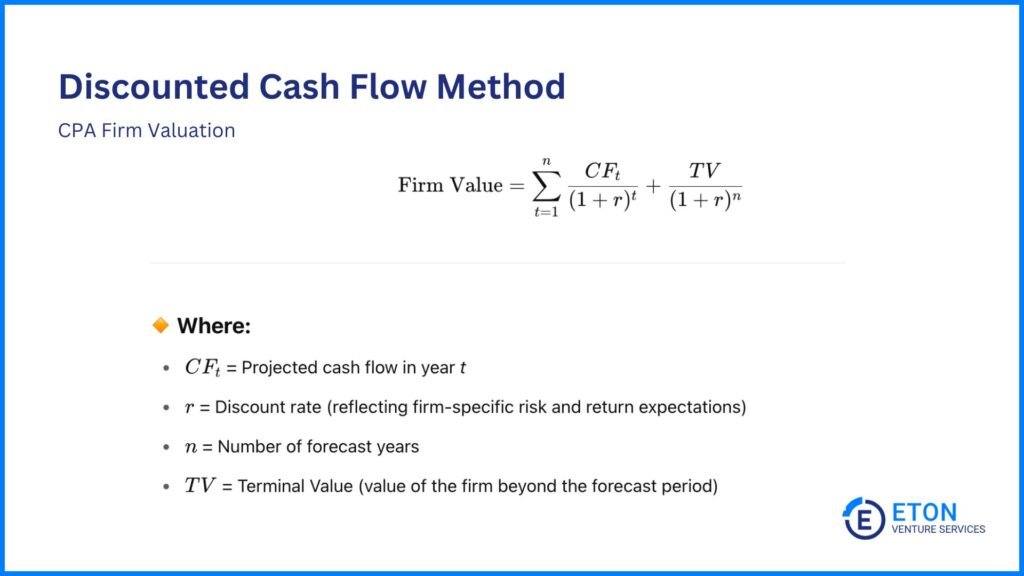

Unlike the GT Method, which looks at what similar firms sold for in the past, the Discounted Cash Flow Method takes a more forward-looking approach.

It estimates what your CPA firm is worth today based on how much cash it is expected to generate in the future and adjusts for risk and the time value of money.

For example, if your firm expects to generate $2 million in cash flow each year for the next five years, we don’t simply add up those future earnings. Instead, we discount them to reflect today’s value, factoring in risks like client turnover, rising costs, or even potential regulatory shifts that could affect demand for your services or increase your overhead..

So even though the total projected cash flow might be $10 million, the present value could be closer to $7.5 million once we account for those risks and time.

This method is especially useful for CPA firms with a history of steady cash flow and strong profitability. So, if your firm has recurring revenue, loyal clients, and consistent margins, DCF can provide a defensible valuation based on those fundamentals.

Here’s how it works:

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

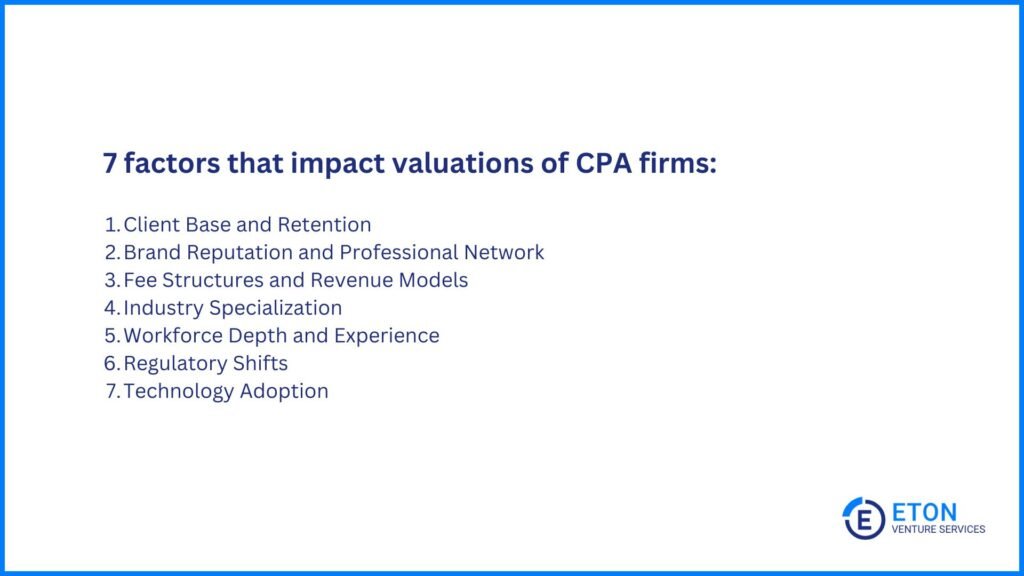

Valuing a CPA firm goes beyond measuring current revenue. It’s about understanding how secure and sustainable that revenue is in the long term.

From a buyer’s perspective, strong financials are important, but they want to see what’s behind the numbers: trusted client relationships, predictable income streams, and the ability to adapt.

That’s why we look beyond surface-level earnings to the underlying factors that show whether a firm’s success can last.

Valuation experts play a huge role here — we analyze these factors, highlight their impact, and make a credible argument on your behalf that they increase the business’s overall value.

Here’s what we look at:

A firm with a strong, diverse client list across industries and revenue sizes is usually more attractive than one that leans too heavily on just a few accounts. That’s because heavy client concentration creates risk. If one or two clients make up a big chunk of revenue, losing them could seriously impact the firm’s future earnings.

Retention matters just as much. Long-standing relationships show stability, loyalty, and steady income — all things buyers love to see. High client turnover, on the other hand, raises questions about service quality, satisfaction, or pricing pressure.

The best-positioned firms have a healthy mix: a broad client base with strong retention rates and no single client making up too large a share of revenue.

That kind of setup makes revenue more predictable and gives buyers confidence that the business will keep performing after a transition. That usually leads to a higher valuation.

For CPA firms, goodwill is everything. A well-regarded firm with strong name recognition and a trusted referral network attracts better clients and more stable opportunities.

If attorneys, financial advisors, or business bankers frequently recommend your firm, that trust leads to steady, high-quality work and, in turn, a higher valuation.

Buyers also often look closely at whether the reputation belongs to the firm as a whole or mainly to the founder. If everything depends on a single person’s name or relationships, that creates risk once they step back. This could ultimately lower the valuation.

How a firm charges for its services directly affects how predictable and profitable its revenue is, and that plays a major role in how we value the business.

In addition to billing type, the revenue model also matters. Most CPA firms already earn a large portion of their income from recurring services like bookkeeping, tax prep, payroll, or compliance work. But how that recurring work is structured and billed still makes a difference.

Firms that package it into ongoing engagements, like monthly retainers or bundled fixed-fee agreements with predictable billing, generate more reliable income over time.

That predictability reduces pricing risk, which means the firm is less likely to lose clients over unclear fees or face income swings due to inconsistent billing.

And from a valuation standpoint, predictable, recurring income is typically worth more because buyers can trust it to continue after the transition.

A firm that serves everyone may be flexible, but a firm with deep expertise in a specific industry still often commands a higher valuation.

Buyers tend to value firms that operate in complex, high-value sectors, such as healthcare, real estate, or nonprofits. In these industries, accounting needs are more technical, regulations are strict, and clients are less price-sensitive. This leads to more stable revenue because clients are more likely to stay long-term and pay premium rates for expertise.

Specialization also reduces competition and can help a firm stand out in a crowded market — two things buyers and investors appreciate.

Suppose the business depends heavily on one or two partners. In that case, that’s a concern for buyers, especially if those individuals manage most client relationships or drive the bulk of the firm’s revenue.

But a CPA firm with an experienced team, clearly defined roles, and strong junior staff is seen as more sustainable. It shows the firm can deliver consistent service, retain clients, and operate smoothly even if key leaders transition out.

That kind of depth is a major advantage during succession planning or when the owner is ready to step back because it reduces disruption and preserves the firm’s value. As a result, it leads to a higher valuation.

Accounting is closely tied to rules and compliance. And when those rules change, so does the work. For example, a new tax law might create more demand for advisory services. Similarly, updated audit standards could require new systems or training.

Firms that stay ahead of these changes and adapt quickly may face additional costs, but they are better positioned to absorb them. They may even turn those shifts into new service opportunities.

On the other hand, firms that lag often face higher long-term costs, greater disruption, and a drop in client confidence — all of which can lead to lower profitability and valuation.

Technology plays a significant role in how smoothly a CPA firm runs, from automation to collaboration to client experience.

Modern accounting software, cloud systems, and secure client portals help reduce manual work, prevent errors, and make it easier to stay on top of deadlines.

For example, during tax season, many firms spend hours emailing back and forth with clients to collect documents like receipts, spreadsheets, and bank statements.

But a firm that uses a secure client portal can request files, receive uploads in real time, and track what’s still missing all in one place. That speeds up reviews, prevents missed deadlines, and saves time for both the firm and the client.

To buyers, that shows a well-run, scalable firm and one that’s already using systems they can build on, not overhaul. That kind of setup makes CPAs far more attractive and boosts their valuation.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re planning for growth, preparing for a transaction, or structuring a transition.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your CPA firm. We ensure that all key factors, such as reputation, specialization, fee structures, revenue models, and technology adoption are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that support your next move.

It depends on how well the firm manages compliance and risk. These sectors can offer high margins and strong demand, which boost value. But if the legal or regulatory landscape is unstable, some buyers may factor in added risk and lower the valuation.

Yes. Virtual or hybrid CPA firms can be seen as flexible, scalable, and cost-efficient. But buyers will also look closely at systems, culture, and client communication to assess long-term viability. A fully remote model isn’t a negative, but it must be well-managed.

They can. Professional credentials, memberships, or quality-control reviews (like a successful peer review) show buyers that the firm meets industry standards and stays current. These signals can build trust and strengthen valuation.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.