Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Valuing a customer list often starts with basic numbers: how many customers, how much revenue each one brings, and what that adds up to financially.

But having guided many M&A deals, I know those figures are just the start. To understand its full value, here’s what we look at:

Analyzing these factors gives us a clear view of the list’s current value (how much it contributes today) and its potential to generate future economic benefits (how much value it can produce over time). We then turn these insights into an accurate valuation using valuation methods.

The rest of this article explains how these valuation methods work and when to use each one.

Key Takeaways

|

Because customer lists are intangible assets, they don’t follow the same valuation approach as physical assets like equipment or real estate. Instead, we use specialized methods to value them (you can learn more about intangible asset valuation here). These methods are:

The method that will get the most accurate valuation depends on the information available and the characteristics of your list.

For example, when a customer list’s value hinges on future benefits, like strong retention rates and high profit margins, we turn to income-based methods like Multi-Period Excess Earnings and Relief From Royalty.

But when future cash flows are too unpredictable, we use the Replacement Cost Method. It estimates what it would cost to recreate an equivalent customer list, taking into account the number of active accounts and the marketing and sales expenses required to acquire them.

Let’s break down how to apply each method:

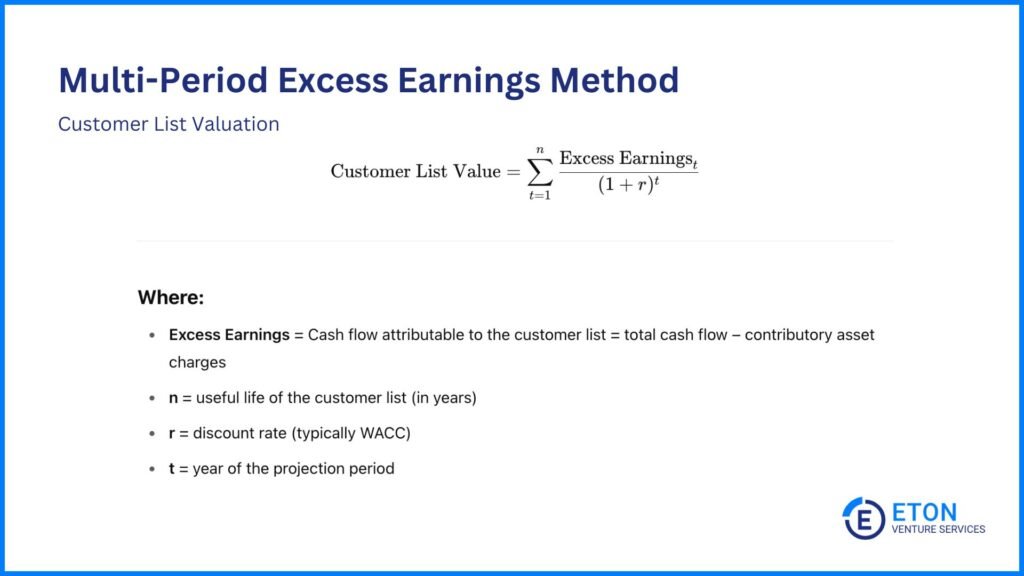

The Multi-Period Excess Earnings Method (MPEEM) is best used when a single intangible like a customer list is the primary earnings driver, because it isolates that asset’s specific contribution to the business’s overall value.

For example, if a company projects $500,000 in total cash flow and $200,000 of that is driven by non-list assets, the remaining $300,000 represents the excess earnings linked to the list.

Here’s a step-by-step guide on how to apply the MPEEM:

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

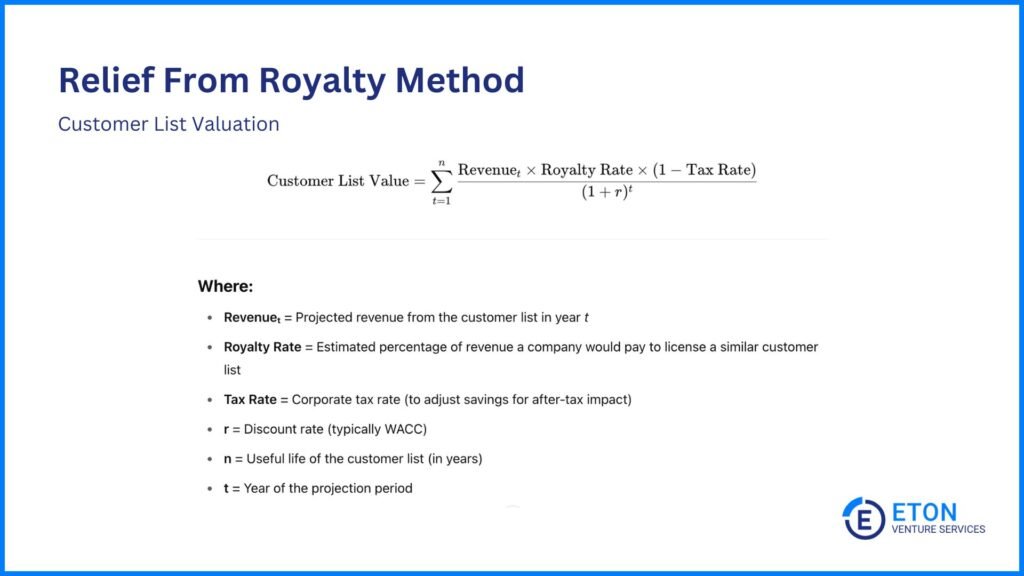

The Relief from Royalty Method (RRM) estimates how much your company saves by owning a customer list instead of paying to license it. The idea is simple: if you didn’t own the list, you’d likely need to rent access to it, and that comes at a cost. By owning the list, you avoid those payments, and those savings help determine its value.

If a company would typically pay 5% of revenue to use a similar customer list, and that list brings in $1 million a year, skipping that royalty saves $50,000 annually. That number helps us estimate the list’s value today.

We apply this method when a customer list would otherwise be licensed, or (like all methods in this article) during purchase price allocations where we need to value each asset separately.

Here’s how it works:

That final number ($132,900) is the value of the customer list using this method. It shows what the company saves by owning the list instead of paying to use it.

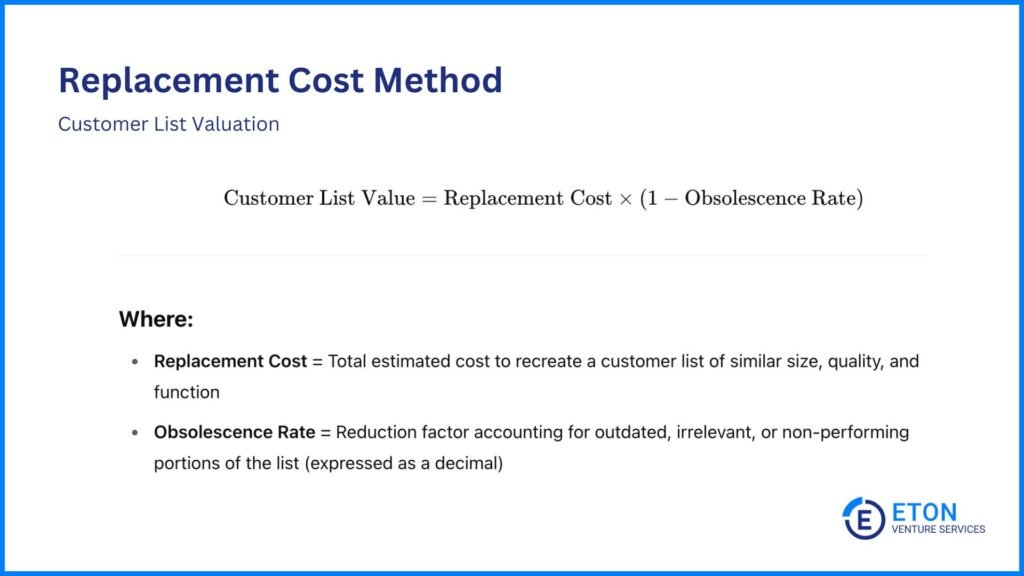

The Replacement Cost Method estimates how much it would cost to recreate a customer list that serves the same purpose as the original, i.e. driving similar sales, covering the same markets, or reaching a similar number of active customers.

Suppose a company built its customer list through paid advertising, events, and outreach. If recreating a list with similar scale,engagement and that supports comparable sales results would cost $200,000, that becomes the starting point for its valuation.

This method is useful when you know what it costs to build the list, but you can’t reliably predict its future performance, which makes methods like MPEEM or RRM harder to apply. This is often the case for early-stage businesses or when the list is no longer performing consistently.

Here’s how to apply it:

A customer list’s value goes beyond the number of names on it. It’s about what those customers bring to the business now and over time. Things like profit margins, retention rates, and list quality all influence how much that list is truly worth.

And in the context of M&A, during the subsequent purchase-price allocations or even when you’re licensing a list, understanding these factors is what turns raw data into a defensible valuation.

Valuation experts play a key role in this process. We analyze these factors, assess their impact, and build a clear case for how they shape the list’s value.

Here’s what we look at:

A customer who spends more isn’t always more valuable. What also matters is how much profit they bring in. Two customers might generate the same revenue, but if one buys high-margin services and the other sticks to low-margin products, their value to the business isn’t the same.

For example, a company with 1,000 high-margin customers may be worth more than one with 5,000 lower-margin buyers, especially if those 5,000 also take more effort to support.

How long customers stick around has a big impact on future earnings. High retention means predictable income while high churn means more money spent to replace what’s lost.

If a company retains 85% of its customers year after year, buyers will likely see the list as a strong asset. But if 40% drop off every few months, the value drops with them.

Segmenting the list by behavior, purchase history, or demographics helps reveal which customers matter most.

If one group consistently buys premium products or renews every year, that segment may have a much higher lifetime value than others. This alone could make your list worth more, even if other segments are less active or consistent.

When you can point to segments that drive strong, repeatable income, it supports a higher valuation because the earnings tied to those customers feel more predictable and defensible.

A five-year-old list full of bounced emails or inactive numbers won’t hold much value.

On the other hand, a well-maintained list with current contact info and details about recent activity signals quality. It’s easier to monetize because you can use it to reach out, promote new offerings, or re-engage past customers. This often leads to a higher valuation.

If the overall market is shrinking or full of competitors offering cheaper or more convenient alternatives, it puts pressure on the value of your list.

Shifts in buyer behavior like moving to digital channels, preferring subscriptions over one-time purchases, or expecting faster service can also make it harder to retain or grow those customer relationships if your company doesn’t adapt quickly.

Additionally, new regulations or economic downturns may affect how the list performs. The more challenging the environment, the more likely buyers are to discount the list’s potential and value.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re working through a purchase price allocation, evaluating licensing potential, or preparing for a broader transaction.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your customer list. We ensure that all key factors that influence your list’s value, such margins, retention, segmentation, quality, and broader market conditions are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that support your next move.

It becomes harder to predict how the list will perform in the future. That limits your ability to use income-based methods like MPEEM or Relief from Royalty because those rely on reliable forecasts.

In these cases, valuation often shifts to the Replacement Cost Method. Instead of looking at future income, we estimate how much it would cost to build a similar list from scratch today. It’s a more practical option when data is limited.

Yes, and sometimes it’s the best way forward. Using more than one method can help cross-check the results and give you a more well-rounded view of value.

For example, you might use MPEEM to estimate future earnings and Replacement Cost to see what it would take to rebuild the list. If both numbers are close, it helps support a stronger conclusion. If they’re far apart, you can dig deeper into why.

Yes, but it depends on the list’s condition and how easy it would be to start using it again. If the contact information is still accurate and the customers are still relevant, the list may still support future sales or marketing.

But if the list is outdated, with lots of inactive names or missing data, its value drops. In some cases, it may only be worth what it would cost to replace.

Yes, it can. If most customers only deal with one person, and that person leaves, there’s a risk those relationships won’t last. Buyers see that as a weakness, and it can lower the list’s value.

To reduce that risk, it helps if the business has more structure around customer management, like keeping detailed notes in a CRM, tracking communication history, and making sure more than one person knows each account. That way, the business keeps the relationship even if someone leaves, and the list holds more value.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.