Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Gyms may look asset-heavy — equipment, square footage, and buildouts. But in a saturated fitness market, those things are easy to replicate. What isn’t easy to replicate is a loyal membership base, strong community engagement, and a brand that keeps people coming back.

That’s why valuing a gym isn’t just about what it owns, but about how well it stands out.

Over the years, I’ve worked with gym owners, investors, and operators to help translate that competitive edge into a defensible valuation. And I’ve found that the most valuable gyms tend to outperform in a few key areas:

These aren’t just operational wins; they’re the foundation of value. The next step is translating them into numbers using the correct valuation methods.

Here’s how these valuation methods work and when each of them makes the most sense:

Key Takeaways

|

To value a gym business, we typically use one or a combination of the following valuation methods:

The right valuation method depends on your gym’s unique strengths.

Some methods capture future earnings, which are stronger when you have loyal members, high retention, and a solid subscription model.

Others highlight how your gym compares to businesses that have sold recently and share similar strengths, like a strong brand or a great location.

And some focus on what your physical assets, like equipment or real estate, are worth today.

Each method shines a light on a different part of the story. The key is knowing what makes your gym stand out and choosing the approach that captures that value best.

Let’s look at how each approach works in practice and when to apply it:

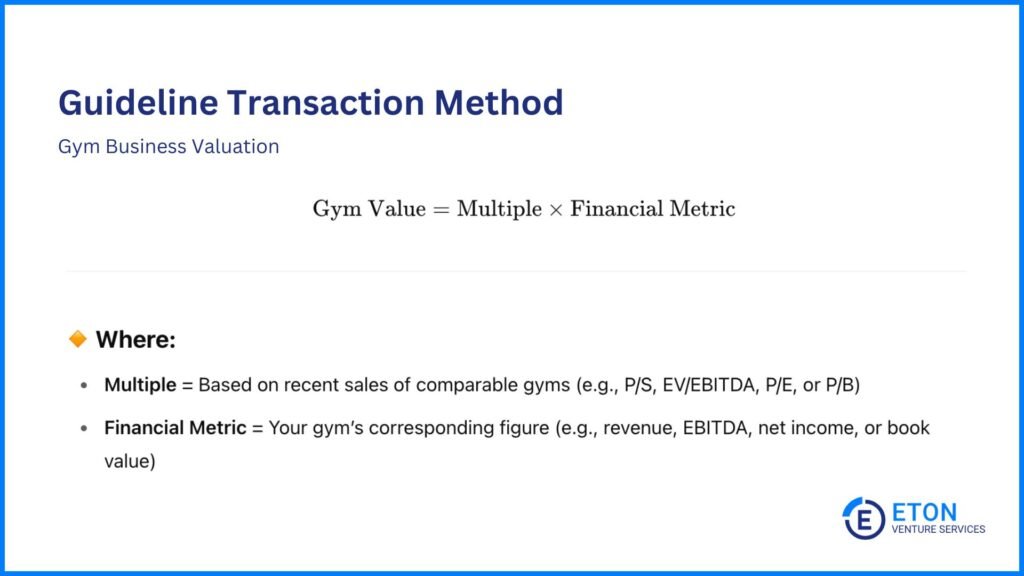

The Guideline Transaction Method values your gym by looking at recent sales of similar fitness businesses. Instead of building a valuation from scratch, it uses real-world data to show what a gym like yours was worth in a sale. That’s why it’s especially useful for owners who want to see what real market activity reveals about their gym’s value.

To apply this method, we first find gyms with similar size, revenue, and business model. Then we look at the valuation multiples from those deals to see how much buyers paid relative to revenue, profit, or asset value.

Those multiples often reflect things that affect how reliable or sustainable the numbers are, like member retention, location, or brand reputation.

However, since those details aren’t always visible in the data, we use professional judgment to figure out what may have influenced the multiple in each deal. Then we consider whether your gym has those same strengths, and adjust the multiple if needed.

For example, say a comparable gym with $1.5 million in annual revenue sold for $3 million. That’s a 2x revenue multiple. If that gym had strong retention and a high-traffic location, we’d consider whether your gym shares those strengths. If it does, that multiple might be appropriate to apply to your own revenue. If not, we’d adjust it to better reflect your specific business.

Different multiples give different insights depending on how your gym creates value. Here are the most relevant ones:

However, no two transactions are exactly the same. And they mostly depend on the buyer’s objectives and the seller’s situation:

That’s why it’s important to look beyond the numbers. Just because a comparable gym sold for a certain multiple doesn’t mean your business should be valued the exact same way.

The final price will depend on the structure of your deal: What you’re selling, who’s buying, and what each party hopes to gain from the transaction. Based on this, we may need to adjust the multiple upward or downward to separate deal-specific factors from market-based value.

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

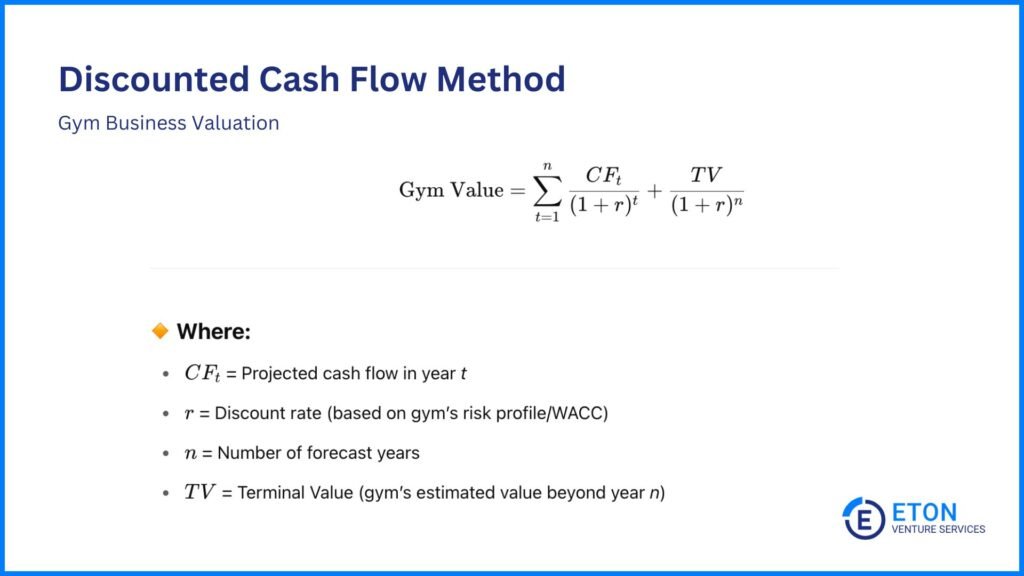

The Discounted Cash Flow Method estimates how much money your gym will likely make in the future and then determines what that income is worth today.

For example, if your gym is expected to generate $750,000 annually for the next five years, we don’t take that future income at face value. It’s adjusted (discounted) to reflect the risk involved and the time value of money.

Unlike the GT Method, which looks at what other gyms sold for in the past, this approach focuses on your gym’s future potential. It’s especially useful for investors who care about profitability and long-term earnings.

But here’s the catch: future earnings only matter if they’re reliable. That’s why this method works best for gyms with strong membership numbers, high retention, and a steady stream of recurring revenue. If people are showing up regularly and staying loyal month after month, your cash flow becomes more predictable. This makes projections easier.

Here’s how to apply this method:

The Asset-Based Approach values your gym by adding up the fair market value of everything the business owns (assets), then subtracting what it owes (liabilities).

This method works best when a gym’s physical assets, like owned real estate, high-end equipment, or custom buildouts, are more valuable than its ability to generate income. That’s often the case when the business isn’t profitable due to things like weak retention, limited brand presence, or inconsistent revenue, or when it’s winding down operations.

In this case, if your gym owns equipment, furnishings, and property worth $2.5 million, and you have $1 million in liabilities, your estimated value using this method would be $1.5 million.

The calculation itself is simple: Fair market value of assets – total liabilities = asset-based value.

But keep in mind: This method only looks at the physical side of the business. It doesn’t reflect intangible strengths like member loyalty, brand reputation, or recurring revenue.

If your gym’s value comes mostly from steady income, strong retention, or market position, the DCF or GT methods will likely give you a more accurate picture.

It’s also possible to combine approaches. There are two ways to do this:

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

This calculator gives you a ballpark estimate of your gym’s value using the Discounted Cash Flow Method. It’s one of the common methods we use to value gym businesses as discussed earlier in the article.

But remember: This is meant to give you a quick starting point, not a final valuation. Valuing a business is more complex. We often combine multiple methods, adjust for context, and consider many moving parts. For a reliable, accurate valuation, talk to our team at Eton Venture Services.

Valuing a gym is about understanding what drives performance and what signals risk.

From a buyer’s perspective, things like member retention, recurring revenue, and brand strength speak to long-term potential. On the other hand, high turnover, unpredictable cash flow, or poor facility upkeep can raise red flags.

These factors shape the story behind your gym’s numbers and help explain why one business is worth more than another.

Valuation experts play a key role in this process — we analyze these drivers, highlight their impact, and make the case for how they shape your gym’s overall value.

Here’s what we look at:

A growing membership base is a good sign, but only if members are sticking around. High retention leads to more predictable revenue and lower costs to replace lost members.

For example, a gym that keeps 80% of its members year after year will likely have stronger cash flow than one constantly cycling through new signups.

Buyers look at both: how many people join, and how long they stay.

How your gym earns revenue matters just as much as how much it earns.

Subscription models (like monthly memberships) create recurring income that’s easier to forecast and typically valued higher. In contrast, pay-per-visit models can lead to unpredictable revenue swings, especially during slow seasons.

Investors and buyers prefer gyms with steady, repeatable income because it gives them more confidence in future performance.

A gym in a busy urban area near office buildings or public transit has a built-in advantage over one tucked away in a low-traffic zone. Convenience, visibility, and proximity to your audience all matter. They support higher pricing, attract more walk-ins, and lower marketing costs.

Lease matters too, because even the best location loses value if rent is unpredictable or the gym can’t stay long-term.

When the location and the lease work together, it adds real staying power to the business.

People don’t just join a gym. They judge it. Outdated machines, worn flooring, or poorly maintained locker rooms can turn potential members away.

On the other hand, a clean, modern space with well-maintained equipment signals professionalism and justifies higher membership fees.

Buyers notice that too. A quality facility can mean fewer capital upgrades down the road in addition to stronger member retention today.

A well-known, trusted gym brand carries real weight in the market. And it’s not just about a flashy logo; it’s about community presence, member experience, and word-of-mouth.

For instance, a boutique fitness studio with a loyal local following and glowing online reviews may command a higher valuation than a lesser-known competitor, even with similar revenue.

Reputation also depends on the people delivering the experience. Skilled, long-tenured trainers add stability and trust. If members stick around for the trainers as much as the space, their retention becomes a key part of the gym’s value.

If they’re staying post-sale, that continuity can support a higher valuation. If they’re likely to leave, buyers may lower their offer to account for the risk of losing members with them.

Most gyms see seasonal shifts, but how you manage those swings matters. If your gym runs year-round programs, promotes off-peak specials, or offers flexible memberships, you’re more likely to smooth out revenue dips.

And buyers pay attention to that consistency. A gym with stable cash flow across the calendar is usually worth more than one that relies on short-lived surges.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re planning for growth, preparing for a transaction, or structuring a transition.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your gym. We ensure that all key factors, such as membership numbers and models, location, facility quality, brand reputation, and seasonality are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that support your next move.

Owning your gym space can boost value, especially if it’s in a great location. You’re not just selling a business, you’re also selling real estate. That gives buyers more security and cuts out rent costs, which can make your gym more attractive.

But that doesn’t mean owning is always better.

Leasing can work just as well if the lease is long-term, the rent is fair, and the location is strong. In fact, some buyers prefer leases because they don’t want to manage real estate. They’d rather focus on growing the gym.

What really matters is stability. Whether you own or lease, buyers want to know the gym can stay where it is without surprise rent hikes or the risk of having to move.

On the other hand, short leases, high rent, or unclear terms can be red flags. If buyers feel the lease puts the gym’s future at risk, they may lower their offer to account for that uncertainty.

In short, while owning can add value, a solid lease can still support a strong valuation as long as it protects the business’s long-term future.

Absolutely. A gym that serves a specific niche like powerlifting, group fitness, or women-only training can stand out from competitors.

If that niche attracts loyal members and leads steady revenue, it can actually increase your gym’s value. But if it’s too narrow or seasonal, it might limit future growth, which can lead to a lower valuation.

The key is whether your niche helps your gym stay profitable and in demand over time.

It’s a good idea to revisit your gym’s valuation at least once a year.

Market conditions, membership trends, and your financial performance can all change quickly, especially if you’re expanding, improving profitability, or reacting to competition.

Hence, annual check-ins help you stay informed, set smarter goals, and be ready if an opportunity or buyer comes your way.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.