Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

If valuing a hotel was just about real estate, all hotels in the same city would be worth the same. But they’re not.

A luxury resort and a budget motel can sit on the same street, yet one could be worth millions more than the other. Why? Because a hotel’s value isn’t just in its property; it’s in how well it operates, the brand behind it, and the revenue it generates.

After working on hotel valuations across different markets, I’ve seen certain factors consistently impact their worth:

These factors shape a hotel’s earning power. To then turn these insights into numbers, we rely on valuation methods. These methods are how we determine the hotel’s value. Some methods focus more on the real estate, while others weigh the business side more heavily.

Here’s how these valuation methods work, when to apply them, and what to consider in the process:

Key Takeaways

|

To value a hotel, we typically use one or a combination of the following valuation methods:

Some methods lean more heavily on a hotel’s real estate value, especially when cash flow is difficult to assess or the property itself is worth more than its operations.

This is the case with:

Other methods weigh the business side more heavily. They consider factors like occupancy rates, RevPAR, location, and brand strength —elements that can make two hotels on the same street worth vastly different amounts.

The best method depends on the hotel’s financial health, market conditions, and availability of reliable data. Let’s break down how each works, when to use it, and what it reveals about a hotel’s value.

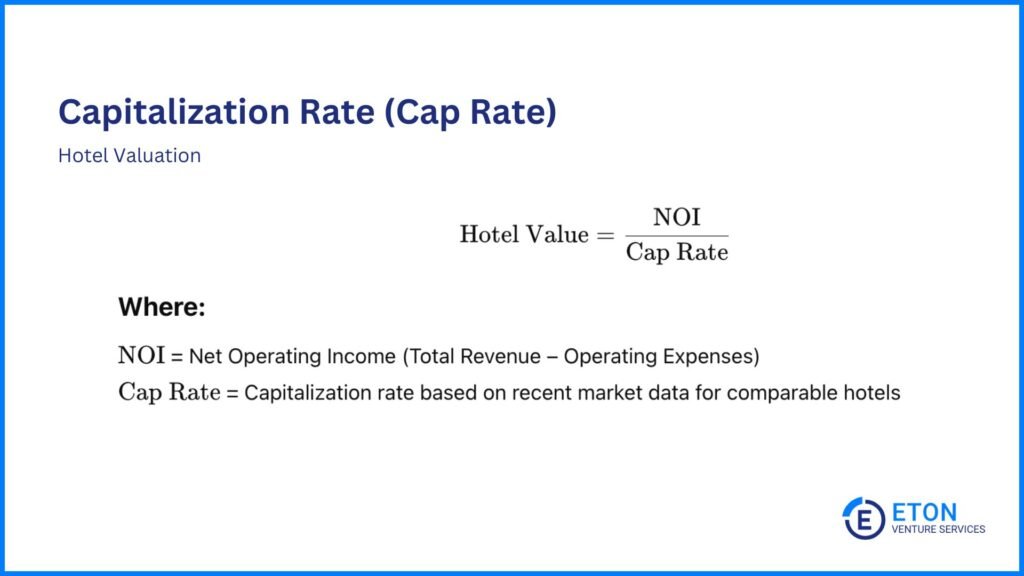

The capitalization rate method determines a hotel’s value using its net operating income (NOI) and a market-based cap rate.

For example, if a hotel has an NOI of $1 million and similar hotels sell at an 8% cap rate, its value would be $12.5 million ($1 million ÷ 0.08).

The cap rate reflects the expected return on investment for hotels in the same market.

Here are the steps to calculate a hotel’s value using the cap rate method:

This method generally works best for established hotels with steady cash flow, such as chain hotels, business hotels, and budget hotels. These hotels generate consistent revenue, so it’s easier to estimate their value based on income.

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

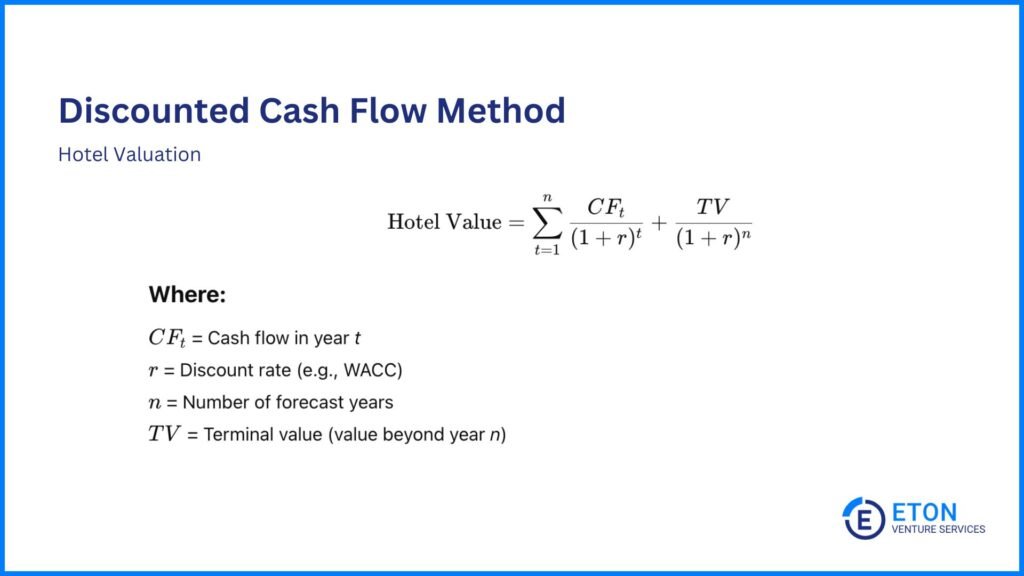

The Discounted Cash Flow (DCF) method predicts how much cash a hotel will make in the future and adjusts for risk and the time value of money.

For example, if we expect a hotel to generate $2 million per year for five years, we determine its value today by applying a discount rate. This rate accounts for risks like market fluctuations and that future money is worth less than money today.

Here’s how to apply it in practice:

This method is especially useful for hotels with steady earnings because it takes into account expected occupancy rates, room pricing, and operating costs to estimate future income.

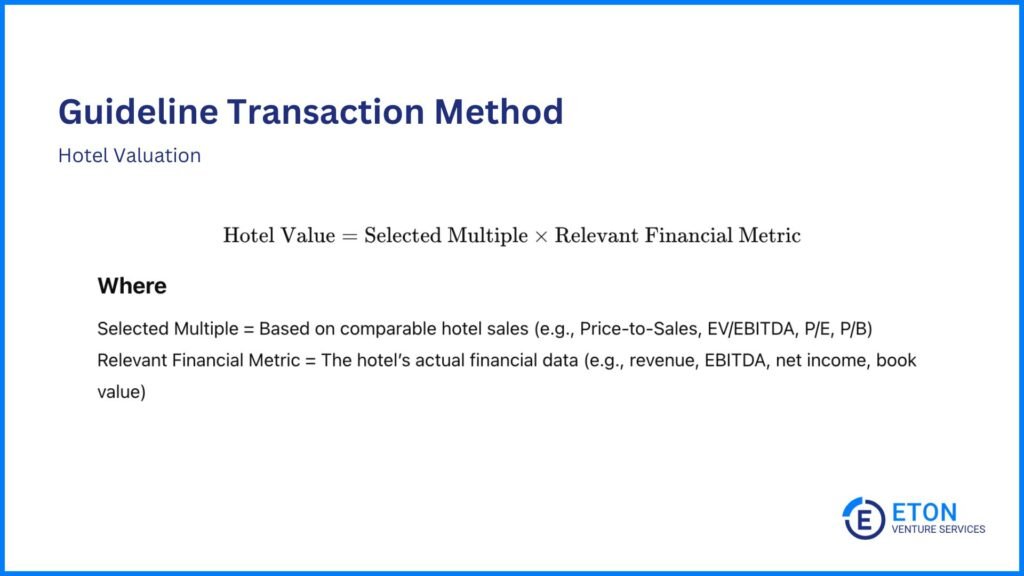

The Guideline Transaction Method values a hotel by looking at recent sales of similar properties in the same market. If enough comparable transactions exist, this method provides a real-world benchmark for what buyers are willing to pay.

But even when hotels seem similar on the surface, their financial performance can be very different, and that has a big impact on value. One hotel might have stronger margins, steadier revenue, or lower operating costs than another, even if they share the same brand or market.

That’s why we don’t rely on past sale prices. Instead, we look at multiples to see how similar hotels were priced relative to their revenue, earnings, or assets. Then, we apply these multiples to our hotel’s numbers and adjust them as needed to account for what makes our property unique. This gives us a much better estimate of what it’s really worth.

For example, if similar hotels sell for 2.5 times annual revenue, and a hotel generates $2 million per year, it might be valued at $5 million.

Here are the most common multiples we use, what they compare, and when they apply:

The Replacement Cost Method estimates a hotel’s value based on how much it would cost to build a similar property today. This includes land, construction, materials, labor, and permits.

So, instead of focusing on income or market sales, this approach looks at the hotel’s physical assets to determine its worth.

For example, if a newly developed hotel in a similar location would cost $15 million to build, including land and construction, then a comparable hotel would be valued at $15 million, with adjustments for depreciation or property condition.

To apply the Replacement Cost Method:

Unlike methods that highlight a hotel’s earning potential, this approach weighs real estate value more heavily. This makes it particularly relevant when cash flow data is unreliable. It applies to:

However, this method also has its limitations. It doesn’t consider a hotel’s ability to generate revenue, which is a key factor in what buyers are actually willing to pay.

So, while a hotel may cost $25 million to rebuild, its market value could still be much lower if it struggles with low occupancy or weak demand.

Additionally, construction costs can fluctuate based on labor, materials, and regulations. This can make estimates less precise.

Because of this, we often use the Replacement Cost Method alongside other valuation methods to get a more complete picture of a hotel’s true worth. There are two ways to do this:

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

This calculator gives you a ballpark estimate of your hotel’s value using the Discounted Cash Flow Method. It’s one of the common methods we use to value hotels as discussed earlier in the article.

But remember: This is meant to give you a quick starting point, not a final valuation. Valuing a business is more complex. We often combine multiple methods, adjust for context, and consider many moving parts. For a reliable, accurate valuation, talk to our team at Eton Venture Services.

This calculator uses the Discounted Cash Flow Method to determine your hotel's value. But in practice, we often combine multiple methods and consider many moving parts to give you a defensible number. Contact our team at Eton Venture Services for precise valuations.

Valuing a hotel goes beyond just the real estate it sits on, it’s about assessing both risk and opportunity. To do this, buyers and investors look at key factors like occupancy rates, brand strength, and seasonality to determine how stable a hotel is and how much potential it has to grow. These factors ultimately shape how much a hotel is worth.

Valuation experts play a key role in this process. We analyze these factors, highlight their impact, and build a strong case for why they drive a hotel’s overall value.

Here are the main factors we consider:

A hotel’s worth depends heavily on how many rooms are filled (occupancy rate) and how much guests are paying per night (ADR). A hotel that keeps rooms full at a strong rate consistently generates revenue. This makes it more valuable.

Let’s say two hotels in the same city both have 100 rooms. One hotel charges $300 per night but only fills 50% of its rooms, while the other charges $200 per night but fills 80%.

Even though the first hotel has a higher price per room, the second one earns more revenue overall, which makes it potentially more attractive to investors.

Hotels with high occupancy and strong pricing power are valued higher because they offer predictable cash flow and steady demand, both of which are crucial for buyers and investors.

RevPAR is a key industry metric that combines both occupancy rates and ADR into a single number. It tells investors not just how many rooms are being filled, but whether the hotel is maximizing its revenue potential.

For example, if a hotel’s ADR is $250, but it only fills 60% of its rooms, its RevPAR is $150 ($250 × 0.60). Compare that to a hotel with an ADR of $200 but 80% occupancy, which has a RevPAR of $160 ($200 × 0.80). Even though the second hotel charges less per night, it generates more revenue per available room, which makes it the stronger performer.

RevPAR is often used to compare hotels in the same market. A well-managed hotel with a high RevPAR is seen as more efficient and better at converting demand into revenue, which translates to a higher valuation.

Hotels in high-demand areas, like city centers, near airports, or close to stadiums, convention centers, and major attractions, attract a steady flow of guests. This drives up their value.

In general, locations with year-round demand offer more predictable revenue, which makes them more appealing to investors. In contrast, hotels that rely on seasonal events may face big swings in occupancy and income. This could lower their valuation.

Accessibility matters too. Properties near public transit or major highways are easier to reach, which can give them an edge over more remote locations.

Hotels under trusted brands like Hilton, Marriott, or Hyatt tend to command higher valuations because they benefit from strong customer loyalty, global marketing, and standardized quality expectations. A traveler choosing between a locally owned independent hotel and a Hilton Garden Inn is often willing to pay more for the brand they trust.

But branding isn’t everything; strong management can be just as valuable. An independent hotel with great leadership, excellent guest reviews, and an efficient cost structure can outperform a poorly run chain hotel. So, investors don’t just look at the name on the sign. They also look at how well the hotel is operated.

Some hotels are busy year-round, while others fluctuate heavily between peak and off-seasons. Seasonality affects valuation because investors prefer consistent, predictable revenue over extreme highs and lows.

A ski resort, for example, might sell out all winter but struggle to fill rooms in the summer. On the other hand, a hotel in a major business district might have steady bookings year-round, which makes it a safer bet for investors.

However, hotels in seasonal markets can still be highly valuable, but their worth depends on how well they manage off-season revenue.

Resorts that diversify – offering summer activities, conferences, or wedding packages – often secure higher valuations because they’re less vulnerable to seasonal slowdowns.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re planning for growth, preparing for a transaction, or structuring a transition.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your hotel. We ensure that all key factors, such as occupancy rates, RevPAR, location, brand, and seasonality, are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that support your next move.

Yes. Even if two hotels have the same number of rooms, for example, and sit on the same street, their value can be very different. That’s because valuation reflects more than just the building – it’s about how well the business performs.

Hence, a hotel with higher occupancy, stronger pricing, better management, or a more recognized brand can generate more revenue and profit, making it more valuable than a similar-looking competitor nearby.

Not always, but there are differences in what drives their value. Franchise hotels often benefit from brand recognition, loyalty programs, and centralized marketing, which can lead to more consistent bookings. That stability is attractive to buyers and can increase value.

Independent hotels may not have the same brand power, but if they’re well-managed with strong reviews, local appeal, and good profit margins, they can be just as valuable – or even more so in some cases.

Renovations can increase a hotel’s value, especially if they help raise room rates or improve occupancy. Upgrades to guest rooms, common areas, or amenities can attract more travelers and support premium pricing.

However, not all renovations add equal value – buyers look at whether the upgrades lead to stronger financial performance. Cosmetic updates might help a little, but improvements that boost revenue or reduce future maintenance costs tend to have the biggest impact on valuation.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.