Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Over the years, I’ve valued medical practices across specialties. While no two are exactly alike, certain factors always play a big role in shaping their worth.

These include:

These factors determine a practice’s stability, profitability, and future prospects, which potential buyers evaluate to assess financial health, growth opportunities, and operational success after acquisition.

The next step is turning that picture into a defensible valuation by applying the right quantitative valuation methods.

In this article, I’ll break down how that’s done and how these key factors affect the final valuation.

Key Takeaways

|

To value a medical practice, we typically use one or a combination of the following methods:

These methods follow the principles of the three widely accepted valuation approaches: market-based, income-based, and asset-based. If you want to learn more about these approaches, we recommend reading our detailed guide on business valuations.

Now, let’s take a closer look at the key valuation methods under each approach: how they work, when they apply, and what they reveal about a medical practice’s true value.

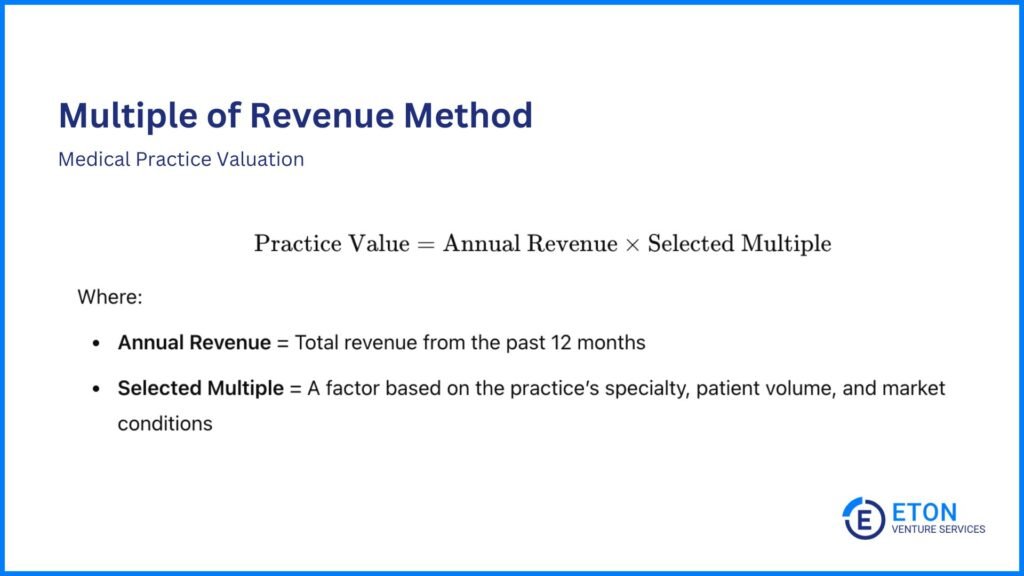

The Multiple of Revenue Method is a market-based approach we often use for small to medium-sized medical practices with consistent revenue streams.

It applies a multiple to the practice’s annual revenue, with general practices typically ranging from 0.5x to 0.7x and specialized practices reaching up to 1.0x.

The reason these multiples are often less than 1.0x is that small to mid-sized medical practices often depend on the owner to keep patients coming back. If a buyer isn’t sure patients will stay after the sale, the practice may be worth less.

Also, while revenue is steady, it doesn’t always mean high profits, which is often the case for small to mid-sized practices. So, if profit margins are low, the multiple will also be lower.

Here’s how to value a medical practice using this method:

For example, if a medical practice generates $1.5 million in annual revenue and the selected multiple is 0.7x, its value would be $1.05 million.

This method is commonly used for initial valuations due to its simplicity and the reliability of revenue figures in medical practices.

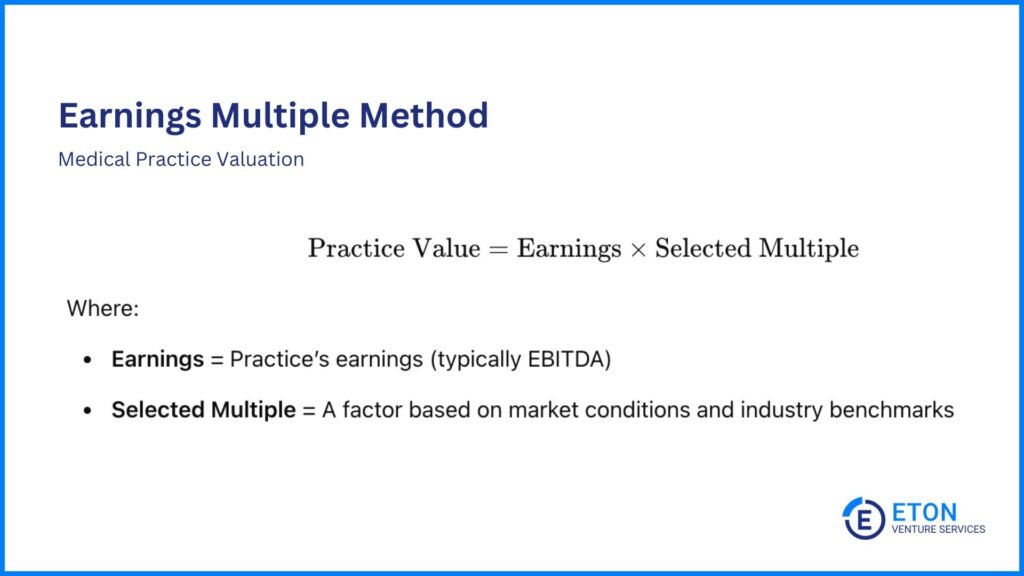

The Earnings Multiple Method is another widely used market-based valuation approach. It’s useful for valuing established medical practices with consistent earnings.

This method applies a multiple, typically ranging from 3x to 6x, to a practice’s earnings before interest, taxes, depreciation, and amortization (EBITDA).

To determine a medical practice’s value using this method:

For example, if similar medical practices in the market trade at an earnings multiple of 4x and a practice has $500,000 in earnings, its estimated value would be $2 million.

This method is widely used because it focuses on profitability and allows for easy comparison across practices.

Need third-party valuation help? Explore our guide to the top healthcare valuation firms and find the right partner for your business.

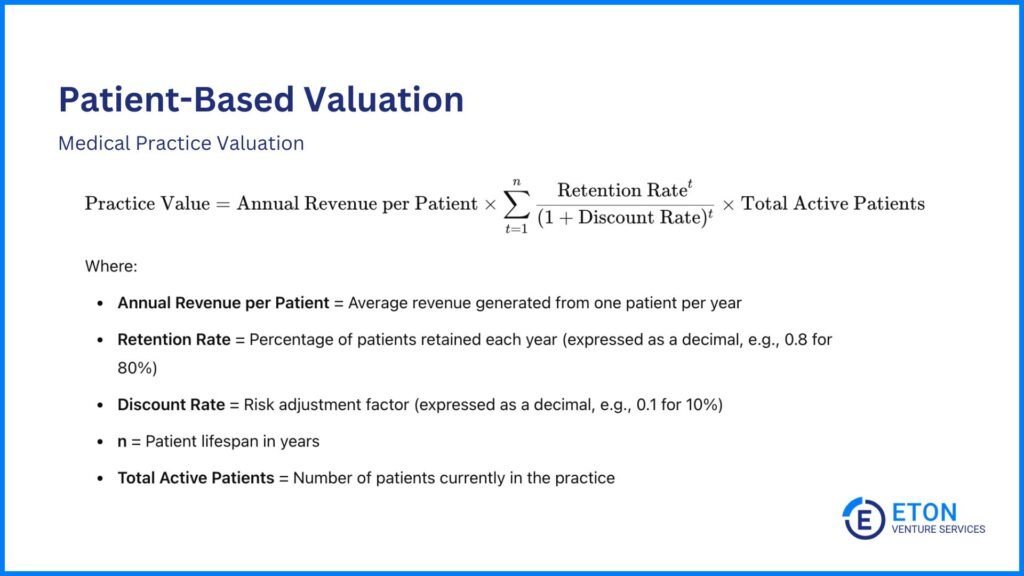

The Patient-Based Valuation method is an income-based approach that recognizes the value of the patient base as a key asset of the practice. That’s why it’s particularly relevant for primary care practices and specialties where patient relationships drive long-term value.

For example, a pediatric practice that has built relationships with families over multiple generations could benefit from this method due to its consistent patient pipeline and high likelihood of referrals.

In contrast, a specialty practice that relies on one-time procedures, such as a surgical center, may not see the same long-term patient value since revenue is driven more by procedure volume than ongoing relationships.

In these cases, the DCF method or the Earnings Multiple method may be more appropriate because they focus on profitability and future cash flow rather than patient retention.

Here’s how Patient-Based Valuation works:

For example, if a practice generates $500 in annual revenue per patient, with an average retention rate of 80% per year and a patient lifespan of 10 years, the total projected revenue for one patient would be:

Total Patient Value = $500 × (0.8 / 1 + 0.8² / 1 + 0.8³ / 1 + 0.8⁴ / 1 + 0.8⁵ / 1 + 0.8⁶ / 1 + 0.8⁷ / 1 + 0.8⁸ / 1 + 0.8⁹ / 1 + 0.8¹⁰ / 1) = $1,785.25

Applying a discount rate further refines the present value of these future cash flows. For example, if the discount rate is 10%, the adjusted total patient value would be:

Present Value of Patient = $500 × (0.8 / 1.1 + 0.8² / 1.1² + 0.8³ / 1.1³ + 0.8⁴ / 1.1⁴ + 0.8⁵ / 1.1⁵ + 0.8⁶ / 1.1⁶ + 0.8⁷ / 1.1⁷ + 0.8⁸ / 1.1⁸ + 0.8⁹ / 1.1⁹ + 0.8¹⁰ / 1.1¹⁰) = $1,370.19

This adjustment accounts for both patient retention and the time value of money, providing a more accurate estimate of the present-day worth of a patient relationship.

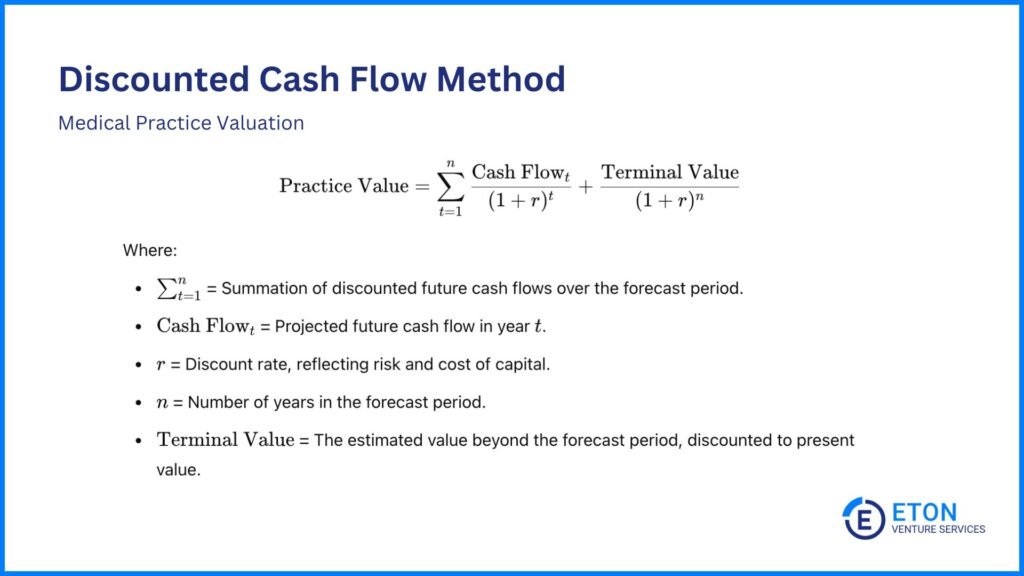

The Discounted Cash Flow (DCF) Method, also an income-based approach, suits larger medical practices with stable cash flows and growth potential.

It’s especially useful for practices with long-term patient relationships or recurring revenue, as it captures the present value of future earnings.

Here are the steps involved in using the DCF method:

For example, if a medical practice is expected to generate $800,000 in cash flow next year and the discount rate is 12%, the present value would be $714,286 ($800,000 ÷ (1 + 0.12)).

Repeat this process for each year in the forecast period, with each future cash flow discounted to its present value.

If the business has a terminal value of $5,000,000 beyond the forecast period, discount it using the same discount rate.

For instance, if the forecast period is five years, the present value of the terminal value would be approximately $2,836,241 (calculated as $5,000,000 ÷ (1.12)⁵).

Finally, add the present value of all future cash flows—including this discounted terminal value—to determine the company’s value.

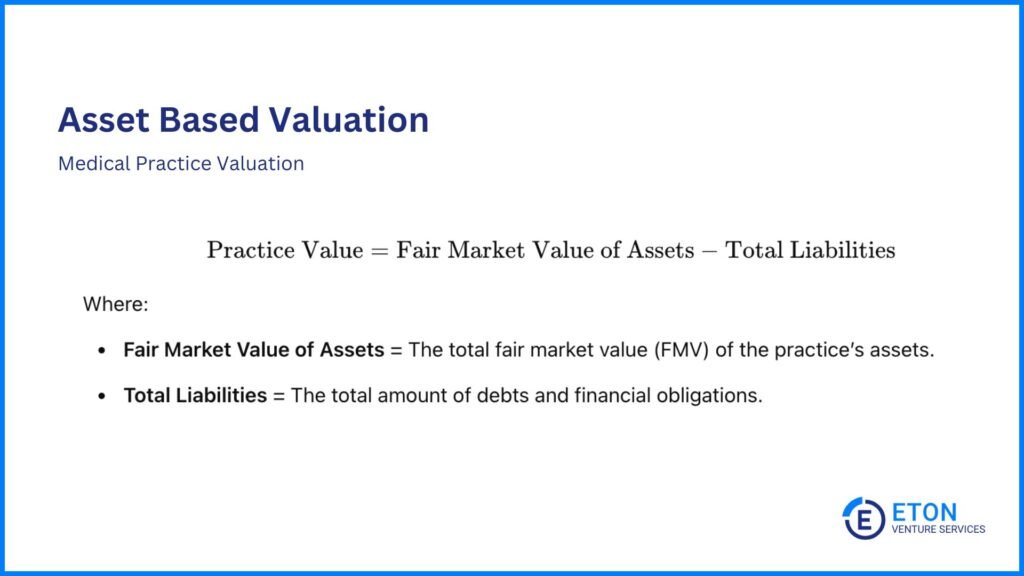

The Asset-Based Approach works best for medical practices with substantial tangible assets, such as high-value medical equipment or real estate. It’s particularly relevant when a practice is being liquidated or needs a baseline valuation.

For example, if a practice owns medical equipment, office space, and other assets worth $3 million, and its total liabilities, including loans and outstanding expenses, amount to $1 million, its net asset value would be $2 million.

This method provides a clear estimate of a practice’s net worth based on its tangible assets. However, it may not fully reflect the market value, as it doesn’t account for intangible factors like patient relationships, brand reputation, or recurring revenue.

For practices where intangible assets play a key role—such as those with strong patient loyalty or specialized services—income-based or market-based valuation methods may offer a more accurate picture of value.

We also often combine approaches to get a clearer picture of a medical practice’s value, especially when both earnings and assets matter.

Let’s take an example: a dental clinic makes $1.5 million per year and owns equipment and a building worth $1 million. An income-based method (such as DCF) may value it at $3 million, while an asset-based valuation may value it at $1 million.

If the clinic’s ability to generate consistent cash flow is the primary value driver, we place more emphasis on the income-based valuation while incorporating the asset-based method to account for real estate and equipment.

So, using a 75% weight on income and 25% on assets, for example, the final valuation would be $2.5 million ($3 million × 75% + $1 million × 25% = $2.5 million).

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

Valuing a medical practice involves considering multiple factors that influence its market worth beyond just revenue figures. Key elements such as patient base, specialty, technology integration, and physician productivity can also significantly affect the final valuation.

That’s also where valuation experts play a huge role — we analyze these factors, highlight their impact, and make the case for why they contribute to the business’s overall value.

Here are the main factors we consider:

A large, diverse, and loyal patient base supports consistent revenue and long-term financial stability. Additionally, strong referral networks and high retention reduce reliance on new patient acquisition, lowering investment risk.

Because these factors translate into predictable cash flows and reduced marketing costs, they make a practice more attractive to buyers, leading to a higher valuation.

Practices offering specialized treatments, surgical procedures, or advanced services often generate higher revenue and attract more patients.

Subspecialties within cardiology, dermatology, orthopedics, or other high-reimbursement areas can be particularly valuable.

Additionally, practices that offer ancillary services, such as in-house diagnostics, physical therapy practices, or cosmetic procedures, can create additional revenue streams, which enhances their overall value.

For example, a dermatology practice with a strong cosmetic component may command a higher valuation than one focused solely on medical dermatology.

Higher reimbursement rates—the amount insurers pay for medical services—directly impact a practice’s revenue and profitability.

Practices that secure strong insurance contracts and maintain efficient billing processes generate steady cash flow, making revenue more predictable. This stability can lead to higher valuations.

Modern medical technology and the efficient use of electronic health records (EHR) can make a medical practice more valuable by improving workflow, patient care, and financial performance.

Additionally, practices that invest in telemedicine, AI-assisted diagnostics, and automated billing systems often run more efficiently. This reduces administrative work and improves patient satisfaction, both of which enhance their valuation.

Keeping technology up to date also reduces the need for major upgrades from a buyer, making ownership transfer easier. On the other hand, outdated systems may require expensive fixes, which can lower a practice’s value.

It’s also worth noting that digital therapeutics and other innovations are reshaping healthcare. Practices that adopt these tools open up new revenue opportunities and strengthen their market position, which can lead to a higher market value.

Practices in desirable locations—such as urban centers, affluent neighborhoods, or areas with growing populations—tend to receive higher valuations. Proximity to hospitals, medical hubs, and large employer networks can also increase patient flow and, in turn, the practice’s value.

Market demographics also play a role; areas with an aging population or a high demand for specialized care can create steady, long-term revenue opportunities.

Conversely, practices in areas with declining populations or limited access to insured patients may face valuation challenges.

A practice’s value is closely tied on to how productive its physicians are. This includes the number of patients they see, how efficiently they work, and how much revenue they bring in.

High-performing physicians who build strong patient relationships and manage their time effectively help keep cash flow steady.

Their expertise and skills are also very important, as they can improve patient care, make daily operations smoother, and strengthen referral networks, all of which make the practice more appealing to buyers.

Buyers also consider whether key physicians plan to stay post-sale, as continuity helps retain patients and stabilize revenue. If a practice is highly reliant on one or two physicians with no transition plan in place, it may be seen as riskier, potentially affecting its valuation.

A highly profitable practice stands out as a strong investment. Keeping overhead, like salaries, lease payments, and supplies, in check while growing revenue is key here. It attracts buyers because it signals lower financial risk and greater long-term value.

A strong reputation among patients and within the medical community has a big impact on a practice’s value. Practices with respected affiliations, high patient satisfaction, strong referral networks, and positive online reviews are more likely to keep a steady flow of revenue.

On the other hand, a damaged reputation can make it harder to find investors and reduce the practice’s appeal in the market.

Buyers look at whether a practice meets industry requirements for patient care, safety, and operations. Practices that consistently achieve high patient satisfaction scores, low malpractice claims, and strong adherence to regulatory requirements are seen as lower-risk investments.

Conversely, poor compliance history, billing issues, or legal concerns can negatively affect valuation and limit buyer interest.

Medical practices that adjust quickly to changes in the industry and patient needs are often stronger and more valuable.

The COVID-19 pandemic highlighted this even more: Practices that implemented telemedicine, remote patient monitoring, and flexible care models were able to keep their revenue and stay connected with patients despite challenges.

In short, being able to adapt shows buyers that the practice can handle obstacles, seize new opportunities, and continue growing over time, which positively impacts valuation.

Buyers look for practices with clear opportunities for growth, such as hiring additional providers, extending office hours, or expanding into telehealth.

Practices that also have the capacity to add new treatment options, open additional locations, or improve marketing efforts can command higher valuations.

In short, a clear growth strategy shows long-term viability and makes the practice a more valuable investment.

The valuation methods and the key factors affecting valuation we’ve discussed in this article can help you estimate a ballpark figure for your medical practice.

However, note that the valuation of medical practices is often complicated by factors such as changing healthcare regulations, reimbursement models, and technological advancements.

Additionally, alternative payment models, such as value-based care, are becoming more common and may impact traditional valuation methods based solely on fee-for-service revenue.

Because of this, it’s important to engage experts in the process to ensure your valuation accurately reflects the true worth of your practice.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making from initial assessment to final transaction.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your medical practice, ensuring that all key factors—such as technology integration, reimbursement rates, market demographics, and physician productivity—are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that help you navigate every step of your transaction with confidence.

It’s a good idea to update your valuation regularly — typically once a year or whenever there are significant changes in operations, financial performance, or market conditions. This helps you track growth and make informed decisions.

Valuing a medical practice can be complex due to factors like quantifying intangible assets (such as patient relationships and intellectual capital), evolving reimbursement models, and regulatory changes.

Hence, a thorough and professional approach is necessary to accurately assess these nuances and provide a reliable valuation.

While the core valuation approaches remain consistent (income-based, market-based, and asset-based), specialty practices often benefit from higher revenue multiples due to niche services and increased demand. General practices may be valued more conservatively.

Tailoring the valuation process to the specific market dynamics of the practice’s specialty can yield a more accurate estimate.

Essential documentation typically includes financial statements, tax returns, patient volume and revenue reports, equipment and asset inventories, and records of insurance contracts.

Additionally, having up-to-date compliance and regulatory documentation can streamline the valuation process.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.