Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Over the years, I’ve valued wealth management firms of all sizes, and no matter the firm, certain factors always make a big impact when determining their worth. These include:

These factors provide a deeper understanding of a firm’s financial stability, growth potential, and risk profile. Valuation methods then use this information to quantify the firm’s worth in a structured, measurable way, helping investors and stakeholders make informed decisions.

In this article, we’ll cover how that’s done and explore these factors in more detail.

Key Takeaways

|

To value a wealth management firm, we typically use one or a combination of the following methods:

These methods follow the principles of the two widely accepted valuation approaches: the market-based and the income-based approach.

While there’s a third common valuation approach—the cost-based approach—it is better suited for industries with significant tangible assets, like manufacturing, rather than service-based and human capital-intensive firms such as wealth management.

Now, let’s take a closer look at the key valuation methods under each approach: how they work, when they apply, and what they reveal about a firm’s true value.

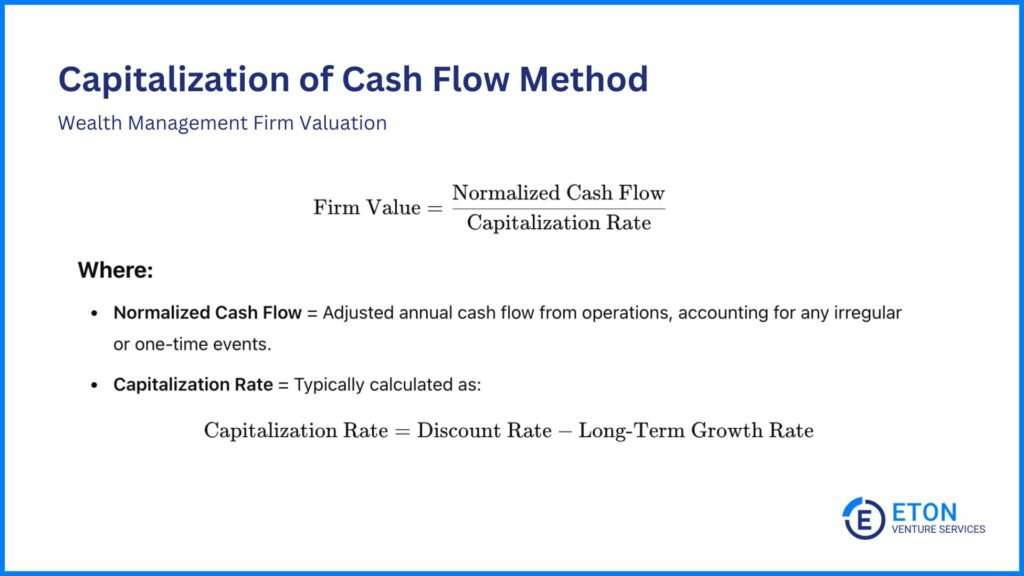

The CapCF method under the income approach is ideal for wealth management firms with stable, predictable income.

It works especially well for firms that have been in business for some time, have long-term clients, and generate consistent revenue, such as those relying on AUM-based fees.

This method estimates the firm’s value by applying a capitalization rate to its stable cash flow, reflecting risk and assumed long-term growth.

It relies on the expectation that the firm’s financial performance will continue at a similar level in the future. This simplifies the valuation process by focusing on the firm’s existing cash flow and doesn’t require long-term projections.

To calculate a wealth management firm’s value using the CapCF method, follow these steps:

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

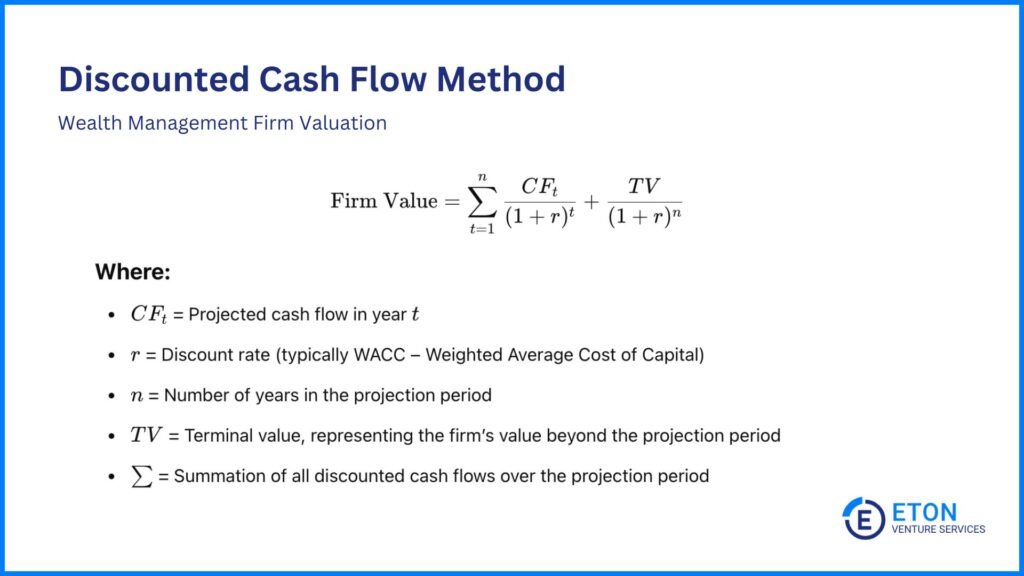

The DCF Method, also under the income approach, is particularly useful for firms that are growing, undergoing strategic changes, or facing shifting market conditions. This is because it focuses on future performance rather than relying solely on historical data.

It works by projecting the firm’s future cash flows and discounting them to their present value using a discount rate. This rate reflects the firm’s risk and the time value of money.

Here are the steps involved in using the DCF method:

For example, if the forecasted cash flow for next year is $1 million and the discount rate is 10%, the present value would be $909,090 ($1 million ÷ (1+0.10)).

Valuators repeat this process for each year in the forecast period, with each future cash flow discounted to its present value. The total present value of all the future cash flows is then summed to estimate the firm’s value.

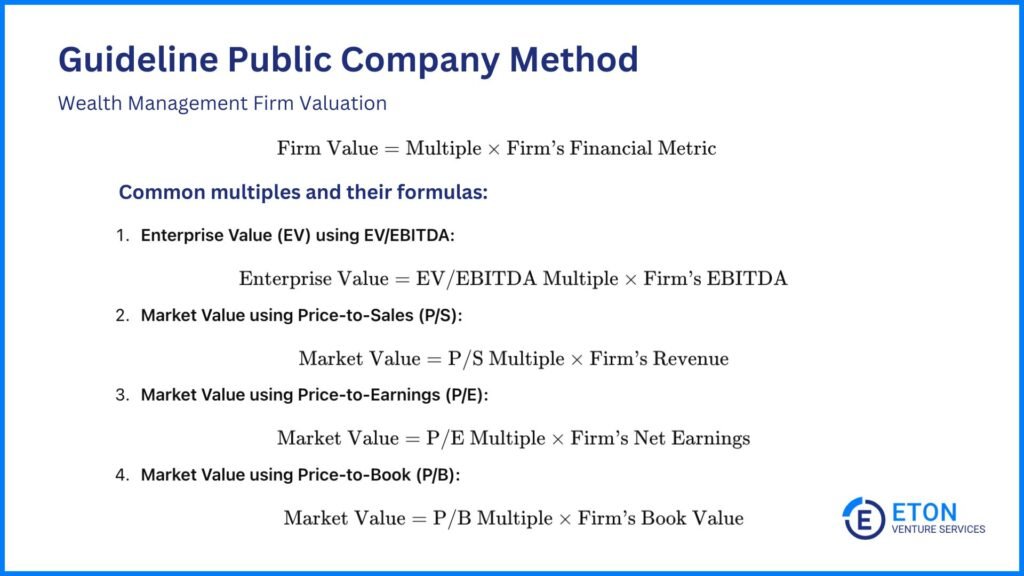

The Guideline Public Company Method is a market-based valuation approach that determines the value of a wealth management firm by comparing it to similar companies that trade on public stock markets.

Analysts select public companies that closely match the subject company in industry, size, and financial characteristics, calculating key multiples like price-to-sales or EV/EBITDA ratios.

Common multiples include:

Valuators then apply these multiples to the relevant financial metrics of the wealth management firm being valued to determine its market value.

For example, if the average EV/EBITDA ratio for similar firms is 8x and the firm’s EBITDA is $5 million, its estimated enterprise value would be $40 million.

Similarly, if the average Price-to-Earnings (P/E) ratio for comparable transactions is 15x and the firm’s annual earnings are $2 million, its estimated market value would be $30 million.

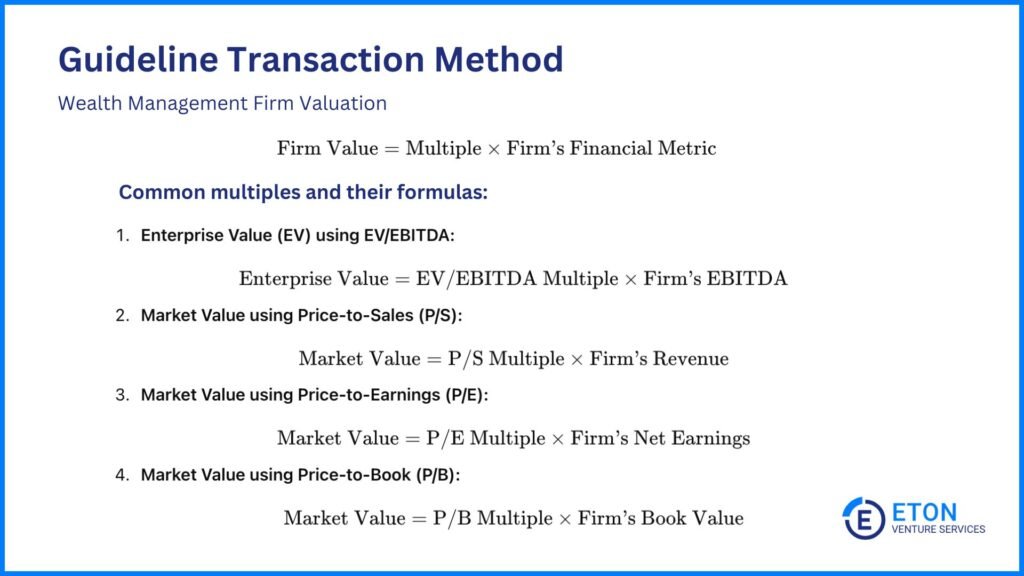

The Guideline Transaction Method is another market-based valuation approach. It determines the value of a wealth management firm by analyzing pricing multiples derived from reported sales or acquisitions of similar firms.

Valuators then apply multiples such as Price-to-Sales, EV/EBITDA, Price-to-Earnings, and Price-to-Book to the relevant financial metrics of the private company being valued.

For example, if comparable private transactions show an average Price-to-Sales ratio of 2x, and the firm being valued has $10 million in annual revenue, its estimated market value would be $20 million.

Unlike public market methods, where value is determined by the trading activity of many buyers and sellers in a liquid, transparent market, this approach focuses on pricing seen in private, negotiated transactions.

These deals reflect agreements shaped by specific buyer and seller motivations, strategic considerations, and deal terms unique to the private market.

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

Valuing a wealth management firm involves considering multiple factors that influence its market worth. Key elements such as revenue stability, client base diversity, profitability, and compliance history can significantly affect the final valuation.

Valuation experts play a huge role here. We analyze these factors, highlight their impact, and make a credible argument on your behalf that they increase the business’s overall value.

Here are the main factors that play a role in determining a wealth management firm’s value:

Wealth management firms generate revenue through several models, each contributing differently to their valuation based on stability and growth potential:

Firms with steady, recurring revenue streams—such as those relying heavily on AUM or fixed fees—receive higher valuations due to their reliability and reduced risk.

In contrast, firms with revenue dependent on commissions or one-time fees face greater variability, which can impact their appeal to buyers.

Assets Under Management (AUM), the total value of investments managed by the firm, is a key metric for assessing revenue potential.

Firms with growing AUM demonstrate strong client relationships and consistent revenue generation, signaling stability and scalability.

Declining AUM, on the other hand, can indicate client attrition, poor performance, or inefficiencies, which negatively affect valuation.

The diversity and composition of a firm’s client base play a major role in valuation. A broad, growing client base helps reduce risks and offers more revenue opportunities.

In contrast, firms with a few clients controlling most of their AUM face greater risk, as this can make the firm more vulnerable to income fluctuations, potentially lowering its valuation.

Additionally, the type of clients matters—firms with a younger, growth-oriented client base are often valued higher than those with a majority of clients in retirement.

Client turnover is another important factor; steadier, more predictable business typically leads to more profitable operations and sustainable cash flow, enhancing the firm’s overall value.

Employees are key to the value of wealth management firms, as their expertise and client relationships directly impact the firm’s performance.

A strong, experienced team helps maintain continuity and consistency in client service, both of which are important for stable revenue.

On the other hand, firms that rely on a few key individuals or experience high turnover risk disrupting these relationships, which could result in a lower valuation.

Clear succession plans result in a smooth transition of client relationships and leadership during ownership changes, reducing the risk of disruptions to operations or client retention.

Firms with well-defined strategies for handing over accounts and management roles are more attractive to buyers, as they provide confidence in the firm’s long-term stability. This continuity directly supports predictable revenue streams and safeguards the firm’s value.

Firms offering a wide range of value-added services, such as financial planning, tax preparation, and estate management, tend to have higher valuations. These services diversify revenue streams and strengthen client relationships by addressing broader financial needs.

Additionally, wealth management firms often include different service lines—such as Separately Managed Accounts (SMAs), Mutual Fund Strategies, and ETF Strategies—each with its own fee structures, margins, costs, and risks.

These variations can impact the overall valuation of the firm, as each service line carries different financial characteristics that influence profitability and risk.

Moreover, a firm’s ability to offer a diverse set of investment strategies can appeal to a wider range of clients and help mitigate the risks associated with reliance on one service or strategy.

A strong digital presence and a well-established referral network further support a firm’s ability to attract and retain clients, thus enhancing its overall business model and valuation.

Firms with strong profit margins and effective cost management generate stable, recurring income, which appeals to buyers and enhances the firm’s overall valuation.

This consistent cash flow demonstrates financial health and signals the ability to reinvest in growth opportunities.

Buyers are also particularly drawn to firms with clear strategies for sustaining profitability, as these strategies suggest long-term stability and growth potential.

As a result, such firms typically receive higher valuations, with these strengths contributing positively to the multiples applied during valuation.

A clean compliance record plays an important role in determining a wealth management firm’s valuation.

Firms with past violations, fines, or unresolved client complaints can expose themselves to legal risks, which can erode buyer confidence and drive down their market value.

In contrast, firms with robust compliance systems that consistently adhere to industry regulations are viewed as lower-risk investments.

This enhances their reputation and signals stability and reliability, making them more attractive to potential buyers who prioritize long-term security.

Firms that are located near their clients, or those offering robust virtual services, are generally valued higher due to greater client convenience and retention.

Proximity allows for stronger relationships through regular, in-person meetings, while virtual accessibility extends the firm’s reach to a broader, tech-savvy audience.

Buyers view location and accessibility as important factors for maintaining and growing the client base, which can directly impact AUM and overall valuation.

The structure of the transaction, such as whether it’s an all-cash deal or involves deferred payments, directly influences the final valuation.

Buyers typically prefer deferred payment structures with earnouts to mitigate risk, while sellers may prefer higher upfront payments.

Additionally, tax implications, such as whether proceeds are taxed as capital gains or ordinary income, can significantly affect the valuation.

These terms can alter the perceived value of the firm and impact how attractive the deal is to both buyers and sellers.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making from initial assessment to final transaction.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your wealth management firm, ensuring that all key factors—such as AUM, client base diversity, profitability, human capital, and compliance history—are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that help you navigate every step of your transaction with confidence.

Firms can improve their valuation by increasing AUM, enhancing client retention, and diversifying service offerings.

Maintaining strong compliance records, streamlining operations for better profitability, and implementing a clear succession plan can also significantly boost perceived value.

These steps demonstrate growth potential, stability, and long-term success, making the firm more attractive to potential buyers.

Key challenges include assessing the value of intangible assets like client relationships and employee expertise, predicting future revenue streams, and accounting for client retention risks.

Additionally, finding comparable firms for market-based valuations can be difficult, especially for firms with unique characteristics or niche markets. Changes in industry trends and economic conditions also add complexity to the valuation process.

Yes, smaller wealth management firms can achieve high valuations, especially if they have strong client relationships, stable revenue streams, and a solid reputation in their market.

Factors such as consistent growth in AUM, client retention, a diversified service offering, and a well-managed business model can contribute to a higher valuation.

Additionally, firms with unique niches or specialized expertise may attract buyers willing to pay a premium.

Valuation is not solely based on size but also on the firm’s ability to demonstrate long-term profitability, stability, and growth potential.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.