Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Startup valuation is an incredibly complex and nuanced process.

There are a lot of variables to consider: the nature of your business, your business model, the market potential, your team’s expertise, and more.

But it’s also incredibly important. An inaccurate or skewed valuation can lead to:

At Eton, we’ve helped hundreds of startups with their valuations over the past 15 years, making us highly experienced in the field.

In this article, I’ll give you a complete guide to the startup valuation world, including:

Key Takeaways:

Startup valuation is the process of figuring out how much a startup and its assets are worth at a specific time, also called the fair market value (FMV).

This involves examining various aspects of the startup, including:

FMV is what someone would pay for a business or property if both the buyer and seller are willing, not forced, and both have reasonable knowledge of relevant facts.

When might you need to determine FMV? Let’s look at key scenarios and why it’s important to get this value right.

In tech and software fields, 409A valuations are essential for companies issuing stock options as part of employee compensation.

These valuations determine the fair market value (FMV) of your company’s common stock, ensuring that stock options granted to employees comply with IRS regulations.

Accurate 409A valuations prevent penalties and provide a defensible FMV, protecting both your company and your employees from unfavorable tax consequences.

Compliance with these regulations builds trust and transparency within your company and with the IRS.

When you’re raising venture capital, accurate valuations determine ownership percentages for new and existing investors.

Known as “Venture Capital Valuations,” they assess your company’s worth before (“pre-money”) and after (“post-money”) new capital injections.

This helps you negotiate fair investment terms and attract investors by providing transparency and confidence in your startup’s growth potential.

Accurate valuations ensure you retain appropriate equity and control, aligning all stakeholders’ interests.

Valuations play a critical role in mergers and acquisitions by helping founders, investors, and potential buyers understand the value of the company.

Exit valuations, similar to M&A valuations, offer a clear picture of your company’s worth during an acquisition or sale.

These valuations facilitate negotiations and decision-making by providing realistic expectations about the potential return on investment.

Accurate valuations ensure that all parties have a solid basis for aligning interests and finalizing deals.

Accurate valuations are vital for financial reporting purposes.

They ensure regulatory compliance with accounting standards and provide stakeholders with a true picture of the company’s financial health.

Reliable valuations build trust among investors, creditors, and other stakeholders by demonstrating transparency and integrity in the company’s financial statements.

This transparency is crucial for maintaining strong relationships with financial backers and regulatory bodies.

Valuations are crucial for determining the correct amount of taxes your startup owes.

Accurate valuations help you avoid overpayment or underpayment of taxes, preventing fines and penalties.

Compliance with tax laws maintains your financial stability and reputation with tax authorities.

Accurate tax valuations also prevent potential disputes with tax authorities, saving you time and resources.

Valuations are key when planning exit strategies, such as selling your company or going public.

Exit valuations estimate your company’s value in the context of an acquisition or sale.

Accurate valuations maximize returns for you and your investors by providing a clear basis for negotiating exit terms and structure.

They help determine the best exit timing and ensure fair compensation for all parties, leading to a successful and profitable exit.

So, what are the key factors that influence the accuracy of your valuation?

There is no one-size-fits-all when it comes to valuing startups. It’s highly subjective and depends on a lot of different factors like:

The maturity of a startup, from seed stage to more developed stages, impacts its risk profile and the amount of data available for valuation.

Early-stage startups come with higher risks and less data, whereas more mature startups have more operational history and possibly consistent revenue streams.

The potential market size is crucial because it indicates the upper limit of what the startup could eventually earn.

Larger markets often allow for higher valuations due to the greater potential for revenue and growth.

The stage of the product (idea, prototype, fully developed, etc.) affects risk level.

The further along a product is in development, the lower the risk and the higher the valuation, as there is more proof of concept and potentially early traction.

A strong, experienced management team can significantly enhance a startup’s valuation.

This is because their experience typically reduces the risk of failure and increases the likelihood of successful execution.

A startup’s historical growth and future growth potential are critical.

Rapid growth not only in revenues but also in user base or market share can lead to higher valuations.

As you can see, valuing startups is a nuanced and subjective process that requires a level of expertise many individuals might not possess.

This is why I advise folks to work with a trusted startup valuation expert to avoid legal penalties and financial losses.

At Eton, our boutique team of Stanford Law lawyers and Ex-Big 4 Consultants provide compliant, independent, and audit-defensible startup valuations leveraging our 15 years of experience.

However, if you’re considering undertaking the valuation on your own, below are the criteria to determine if you are prepared to conduct your own startup valuation.

If you can check everything in the above list, you might be qualified to value your startup. In the next section, I’ll share all the key valuation methods that you can consider.

If not, our team is one call away. Please get in touch with me here.

You can also check out our roundup of the best valuation service providers.

One key thing to take note of when choosing a valuation method is that startups are very different in nature from publicly traded companies.

Traditional valuation methods like Discounted Cash Flow (DCF) and Comparables don’t work for startups (or they can lead to skewed results) as startups usually don’t have substantial historical financial data or comparable assets. But if you do have these, the traditional methods are suitable.

Most valuators consider alternative approaches when they’re working with startups.

Below, I’ll share 10 different valuation methods, divided into 3 categories:

These methods depend more on judgment and estimation, such as evaluating the team’s expertise, market potential, and innovative business models, rather than relying solely on hard numbers like financial history, which many new companies lack.

Startups often face uncertain futures and rely heavily on these factors, making qualitative assessments crucial.

Here are the three qualitative startup valuation methods:

The Berkus Method assigns a monetary value to key qualitative aspects of a startup, like its operations and risks.

Berkus is used to value early-stage startups, where financial data is scarce or non-existent.

However, it can only be used for startups which are expected to reach at least $20m in revenues in the next five years.

1. Assign a value of up to $500,000 to each of the five key elements:

2. Add the assigned values to get the total pre-money valuation of the startup.

Let’s assume a startup with the following characteristics:

Total Berkus Valuation: 300,000+400,000+450,000+350,000+250,000=1,750,000

The Scorecard Valuation Method helps angel investors value pre-revenue startups (in the valuation range of $1m and $2.5m) by adjusting average pre-money valuations using weighted factors.

It is best used for pre-revenue startups that have some initial market traction but do not have long-term financial data.

It’s especially useful where many similar startups exist by development stage, sector, and location.

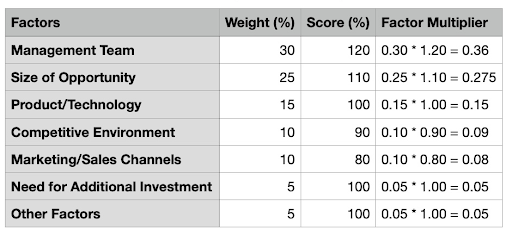

Assign a score (%) to each factor based on performance relative to the average.

Scores can exceed 100% if the startup is above average.

1. Average Pre-Money Valuation: $2 million

2. Weights, Scores, and Factor Multipliers:

3. Total Adjustment Factor: 0.36 + 0.275 + 0.15 + 0.09 + 0.08 + 0.05 + 0.05 = 1.0554

4. Adjusted Valuation: $2 million * 1.055 = $2.11 million

The Risk Factor Summation Method adjusts valuation by adding or subtracting value based on perceived business risks.

This method is useful for pre-revenue startups or those with minimal operational history.

1. Identify similar startups (industry, stage, location) and compute their median pre-money valuation.

2. Identify relevant risk factors, such as:

3. Score each risk from -2 to +2 based on its impact relative to typical startups.

4. Adjust the median valuation by $250k per +1 score and $500k per +2 score. Subtract equivalent amounts for negative scores.

Adjusted Pre-Money Valuation = Median Pre-Money Valuation + Total Adjustment

Assume the median pre-money valuation of comparable startups is $5 million.

An evaluator assigned the following scores to the risk factors:

Total Adjustment = +$250k + $0 – $250k + $500k – $250k + $0 – $500k + $250k + $0 – $500k + $250k – $250k = -$500k

So, Adjusted Pre-Money Valuation = Median Pre-Money Valuation + Total Adjustment

Adjusted Pre-Money Valuation = $5,000,000 – $500,000 = $4,500,000

Quantitative valuation methods use numerical data and calculations for startups that have enough financial data to make such an analysis.

Hence it is particularly useful for startups beyond the seed stage entering growth phases.

These are the 3 methods:

Also called “Pre-Money” and “Post-Money” valuations, it is used during fundraising to determine the value of a company before and after new capital is injected.

These help in determining the ownership percentages for new and existing investors.

It estimates the future exit value of a startup and discounts it back to the present using the expected rate of return.

For startups that anticipate significant growth and plan to exit via sale or IPO within a foreseeable timeframe.

1. Estimate a terminal value of the startup at the time of exit.

It is found using relative valuation multiples in the year of exit.

It requires an estimate of either revenue or earnings in the year of exit.

2. Discount the terminal value using a proper discount rate.

The investor’s expected ROI is used as a discount factor.

3. Formula:

Post-money valuation = Exit value / Expected ROI

Pre-money valuation = Post-money valuation – Investment amount

Calculation:

Post-money valuation = $100M / 10 = $10M

Pre-money valuation = $10M – $5M = $5M

The First Chicago Method estimates startup value by considering multiple future financial scenarios:

Ideal for post-seed startups with some operational data but facing:

where

Expected value = (10M * 0.3) + (5M * 0.5) + (1M * 0.2) = $3M + $2.5M + $0.2M = $5.7M.

The Cost-to-Duplicate Method values a startup based on the cost of replicating its assets and technologies.

It is a very objective method, as it allows investors to look at real expense records.

Use for early-stage startups with significant investment in development but no revenue yet.

Valuation = Total R&D Costs + Technology Development Costs + Physical Asset Costs + Prototype/Initial Production Costs

Assuming:

Total Cost-to-Duplicate = $1M + $2M + $3M + $0.5M = $6.5M.

If you’re a late-stage startup, have substantial historical financial data, or comparable assets in the industry, then these traditional valuation methods will be suitable for you.

These methods are applied to businesses in general, not just startups.

These are the 4 traditional valuation methods:

Discounted Cash Flow (DCF) estimates the value of an investment based on its expected future cash flows.

These cash flows are discounted back to their present value using a discount rate that reflects the investment’s risk and the cost of capital.

For businesses with predictable, stable cash flows and a record of historical financial data.

The general formula for DCF is:

Where:

CFt is the cash flow in year t, and r is the discount rate.

Here are the general steps to start the valuation process:

Assume $100,000 annual cash flows for 5 years at a 10% discount rate.

Present Value = $90,909 + $82,645 + $75,132 + $68,302 + $62,093 = $379,081.

The Market Comparables method values a company by comparing it to similar companies with publicly available financial data.

This approach utilizes financial ratios such as the ones below to gauge a company’s market value relative to its peers.

It’s effective in industries with many public companies, providing robust data for comparison.

Value=Metric×Average Industry Multiple

Assume:

So Value = $4M x 25 = $100M

The Precedent Transaction method values a company by analyzing the prices paid for similar companies in past acquisition deals.

It takes into account the premium that buyers have historically been willing to pay for companies within the same industry.

This method is particularly effective in industries where acquisitions are common and there is a sufficient record of past sales.

Commonly used multiples include:

Suppose

So Value = $10M x 4 = $40M

Real Options Valuation (ROV) values the flexibility to change strategies in response to future events.

It treats investments as options, measuring the value added by management’s ability to adapt, like expanding, delaying, or abandoning a project.

Use Real Options in highly volatile industries with uncertain future conditions.

It is used for projects or companies with significant investment in innovative technologies, real estate development, or natural resources where investment decisions impact future cash flows.

The valuation typically involves complex financial modeling, often using techniques from options pricing.

The basic formula inspired by the Black-Scholes model might look like this:

A startup has the option to expand its operations in one year.

Calculation:

🤔Want tailored advice for your startup valuation? 🤔

This article is great for general guidance on the startup valuation process but unfortunately, it can’t be tailored to your unique circumstances. And when it comes to valuation, circumstance determines everything.

If you want personalized advice to help you navigate your startup valuation, get in touch with us here. We can provide advice specific to you over a call.

Otherwise, please read on for case studies and best practices.

Now that you know the top 10 methods, let’s look at 2 case studies to understand startup valuations better in context.

Business stage: Series A

Reason for Valuation: Capital raising

Valuation Approach:

The valuation was based on the company’s rapid user growth and profitability since its platform launch.

Since 2019, MoonPay:

Ivan Soto-Wright, the CEO, compared Moonpay to PayPal for cryptocurrency, emphasizing its “crypto-as-a-service” model and highlighting a 35x transaction volume increase in two years.

Outcomes of the Valuation:

MoonPay raised $555 million, valuing the company at $3.4 billion.

This is the largest and highest valued Series A for any bootstrapped crypto company globally.

This substantial valuation was supported by investments from major firms like Tiger Global and Coatue.

Business Stage: Extended Series A

Reason for Valuation: Capital Raising

Valuation Approach:

The valuation considered Griffin’s innovative “banking-as-a-service” (BaaS) model, which allows other fintechs to develop banking services without extensive in-house resources.

This approach, combined with the achievement of obtaining a banking license, significantly bolstered Griffin’s appeal to investors.

Outcomes of the Valuation:

Griffin raised $24 million from investors like MassMutual Ventures and Nordic Ninja.

Most founders overestimate their company’s worth because they are emotionally attached, leading to unrealistic expectations.

Conversely, undervaluing your company can dilute ownership more than necessary and reduce future fundraising capabilities.

To ensure a balanced valuation, here are my best tips based on my years of experience in startup valuation:

Most founders overestimate their company’s worth due to emotional attachment, leading to unrealistic expectations.

Conversely, undervaluing your company can dilute ownership more than necessary and reduce future fundraising capabilities.

To ensure a balanced valuation, use multiple methods to value your business, selecting those that best fit your data and business stage.

Combining approaches like the discounted cash flow (DCF) method, comparable company analysis, and the venture capital method provides a comprehensive view of your startup’s worth.

This multi-faceted approach helps mitigate biases and gives a fuller, more accurate picture of your company’s value.

Analyze similar companies and industry trends to get a sense of the competitive landscape.

This involves looking at recent funding rounds, valuations, and exits of comparable startups.

Understanding market dynamics helps you set a competitive yet realistic valuation. It also demonstrates to investors that you are aware of your market position and the factors influencing your industry.

Staying informed about market conditions ensures your valuation reflects current realities and future potential.

Comprehensive documentation is key to a credible valuation.

Ensure you have clear, well-organized financial records, detailed business plans, and robust projections ready.

This preparation includes up-to-date profit and loss statements, balance sheets, cash flow statements, and any other relevant financial documents.

Thorough preparation shows your professionalism and readiness for scrutiny, building trust with investors and stakeholders.

Well-prepared documents also make it easier for valuation experts to assess your business accurately, leading to a more precise valuation.

Consulting valuation experts is essential for an objective view and guidance through complex valuation frameworks.

Professionals bring experience and expertise that can identify nuances you might miss. They can help you navigate different valuation methods, interpret market data, and understand regulatory implications.

Working with experts, like Eton, ensures your valuation is compliant, defensible, and based on sound financial principles.

Their objective perspective can balance your emotional attachment to the company, leading to a more realistic and credible valuation.

Since 2010, Eton has delivered thousands of audit-defensible startup and 409A valuations.

We’re a boutique team of Stanford Law lawyers and Ex-Big 4 Consultants who obsess over great service at affordable prices.

Our valuations are built on robust methodologies that stand up to scrutiny, so you avoid unnecessary costs and complications.

If necessary, we also defend our valuations in court.

I’ve said it before and I’ll say it again—startup valuations are incredibly nuanced and complicated.

You need a valuation partner who’s not only good at what they do, but is also willing to answer all your questions and give you guidance throughout the journey.

That’s what Eton offers.

With Eton, you’ll get the accuracy and reliability of a Big-4 firm, plus a personalized and attentive approach of a boutique firm.

If you work with us, we’ll assign you a senior startup valuation expert, and you’ll have direct access to me, the CEO.

Whether you have a question or a concern, I’m always one call or email away.

But don’t take it from me—hear what our previous startup clients had to say about us.

You can find more testimonials here. (Pro tip: CTRL+F for “startup”.)

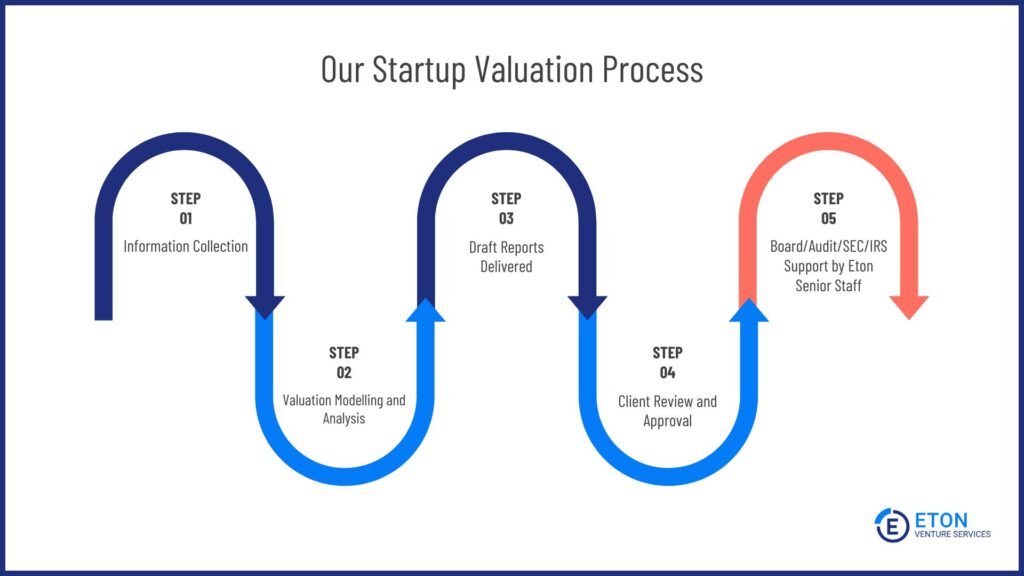

At Eton, we can deliver a startup valuation in 10 days or less.

Provided we have all the necessary documents, we can even complete it in as short as a day for an extra fee.

Here’s how our startup valuation process looks like typically:

If you’re ready to partner with us for your startup valuation, or if you’d like more information, please get in touch with me here.

Have more questions about startup valuation? I answered them below:

In this article, I discussed 10 key valuation methods. Among them, these three methods are most suitable for startups:

Berkus Method: values a startup based on qualitative factors, assigning a monetary value to five key elements (sound idea, prototype, quality management team, strategic relationships, product rollout or sales) to determine its worth.

Scorecard Method: evaluates a startup by comparing it to other funded startups, adjusting the average valuation of similar startups based on factors such as:

Risk Factor Summation Method: estimates a startup’s value by identifying and assessing 12 risk factors, such as:

You adjust the average valuation by adding or subtracting based on these risks.

Startups should typically be valued at key stages such as before raising a new round of funding, during mergers and acquisitions, for 409A compliance, and whenever there are significant changes in the business model or market conditions.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.