Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

When it comes to Section 409A, compliance isn’t something you leave to chance.

Not when you know what’s at risk:

Want to avoid those consequences and the many others that could come from a lack of 409A compliance?

Dive into our 409A compliance checklist below.

409A compliance means following the rules of Section 409A of the IRS code, which deals with how nonqualified deferred compensation is handled. In simple terms, it ensures employees pay the right amount of taxes on the real value of their stock options.

Failing to comply can result in hefty penalties for both the company and the employees. On the flip side, being compliant helps businesses avoid risks and gives employees confidence in the fairness of their compensation.

To ensure you stay compliant, here’s our 9-point compliance checklist.

Section 409A compliance starts with this easy-to-follow 9-step checklist.

Use it as your reference point when you offer deferred compensation or common stock to your employees and revisit it anytime your 409A is up for renewal.

With that said, we also recommend consulting your lawyer and relying on a reputable 409A valuation provider to navigate these requirements effectively.

Click to expand each one and learn more:

If your company doesn’t offer stock options or other types of delayed compensation, you probably don’t need a 409A valuation.

A 409A valuation is required when a private company gives employees stock options. If that applies to your business, you’ll need to start the process of getting one.

The Legal Part: IRC 409A primarily addresses “nonqualified deferred compensation plans.” The need for a 409A valuation arises when such plans include stock options or stock appreciation rights, as their valuation affects taxation timing and compliance.

One of the easiest ways to guarantee 409A compliance is to secure a safe harbor status.

There are a few paths to safe harbor status the IRS recognizes. However, the most secure and accessible one is achieved through hiring an independent third-party 409A provider.

Need help finding a reputable independent third party? We have a list of the top 409A valuations consultants for hire.

The Legal Part: Treasury Regulations §1.409A-1(b)(5)(iv)(B) discusses valuation methods that are presumed to be reasonable. And this includes: Valuation determined by an independent appraisal within 12 months of the stock option grant (Treasury Regulations §1.409A-1(b)(5)(iv)(B)(1)).

To be compliant, your 409A valuation must be determined by reasonable methods.

So when you choose your independent third-party provider, ask them about their 409A valuation process and the methods they use in determining the value of your common stock.

Reasonable methods include:

The Legal Part: The specific valuation methods are outlined in Treasury Regulations §1.409A-1(b)(5)(iv)(B), which mentions the use of reasonable valuation measures, including the consideration of “the value of tangible and intangible assets,” “the present value of future cash-flows,” and “market value of stock in comparable businesses.”

Read our guide to learn about all the 409A requirements to be aware of.

To help your 409A valuation provider apply reasonable methods to your valuation, you’ll need to hand over certain company documents. These will provide the basis for which methodologies are used and the context for how the valuation is calculated.

These documents include:

For a longer list of required documents, check out our piece on 409A valuation requirements. The exact document list required will depend upon the provider you choose.

The Legal Part: The documentation requirement is part of ensuring your valuation is based on “reasonable application of a reasonable valuation method” as per Treasury Regulations §1.409A-1(b)(5)(iv)(B)(2).

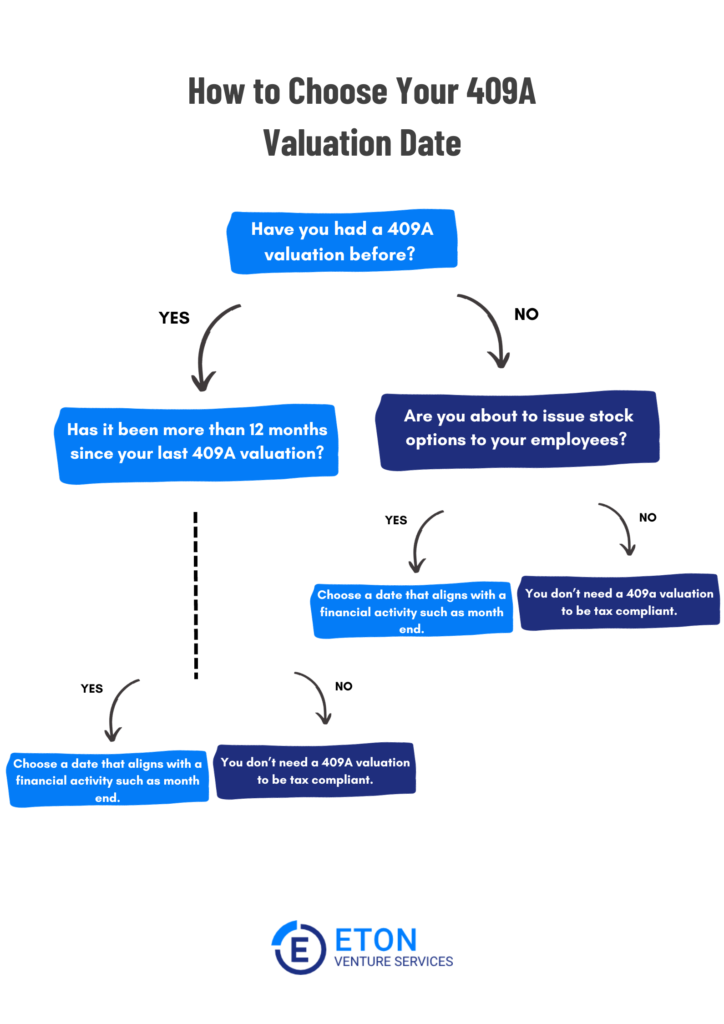

Your valuation date is an important part of 409A compliance.

If you choose a date that doesn’t align with when you’re legally required to complete a 409A valuation then you’re at risk of undervaluing your common stock.

The IRS doesn’t want you to backdate your 409A valuation in an effort to have a lower Fair Market Value (FMV) which is why they created regulations on how and when your valuation must be completed.

For clear guidance on how to choose a valuation date, read our guide: 409A Valuation Date | How Do I Choose a Date?

The Legal Part: The Treasury Regulations under Section 409A of the Internal Revenue Code (§1.409A-1(b)(5)(iv)(B)) require that stock options be granted at or above the fair market value (FMV) of the stock as of the grant date, necessitating an accurate and recent valuation date to ensure the exercise price reflects the current FMV and complies with 409A regulations.

This accurate valuation date is key to preventing backdating and ensuring the validity of the valuation for up to 12 months, barring significant company changes.

Your 409A valuation must exist in a written format. This way it can be checked by the IRS should they audit your business.

Without a thorough written 409A valuation report, you can’t prove that the determined valuation is compliant with Section 409A.

Your written report should include detailed methodologies, assumptions, and conclusions.

We have a sample report available for download. Access it here and read our guide so that you can understand what to look for.

The Legal Part: Treasury Regulations §1.409A-1(b)(5)(iv)(B)(2) implies maintaining written documentation is a standard business practice for substantiating the valuation’s reasonableness.

An unsigned 409A valuation report is a dangerous thing. Without a signature, there’s no one certifying its accuracy and compliance.

It should be signed by the valuator overseeing it. In most cases that’s the firm you hired to complete the valuation but if you’ve chosen another route to safe harbor it may be someone internal.

Not every 409A service provider adheres to this requirement so be on the lookout for those that don’t. Notably, cap table providers who double as 409A valuation providers automate the 409A process and do not sign their reports.

If an IRS auditor saw that you had an unsigned report, it could be enough to forfeit safe harbor status.

The Legal Part: While not explicitly stated in IRC 409A, this practice is part of ensuring that the valuation process is formally documented and validated, which is a best practice in financial and tax compliance.

409A valuations are never a one-and-done practice. Compliance means updating the FMV of your common stock whenever a material event occurs and in the absence of a material event, every 12 months.

A material event is a significant company development, such as a funding round, major client acquisition, or substantial change in financial outlook, that could materially affect the company’s valuation.

The Legal Bit: Treasury Regulations §1.409A-1(b)(5)(iv)(B)(1) indicates that valuations should reflect “all information available” up to the date of grant. This suggests the need for revaluation if significant changes occur (aka when a material event occurs). The same section implies a periodic reevaluation is prudent, especially as the standard for private companies is a rebuttable presumption that valuations are valid for 12 months.

Each time a new valuation is conducted, go through the checklist again to ensure ongoing compliance.

With Eton as your 409A valuation provider, you’ll never have to wonder if your 409A valuation is compliant—you’ll know it is.

In fact, our team of experienced valuators (all Big 4 trained) have completed over 10,000+ audit-defensible 409A valuations with each and every one meeting IRS requirements and qualifying for safe harbor.

The best part is compliance doesn’t come at exorbitant costs (see how much an Eton 409A valuation costs).

If you want a 409A valuation that’s compliant and cost-effective, get in touch with me here.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.