Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

In this article:

Your valuation date is key for both legal and financial reporting compliance. It’s also fair to employees receiving stock options.

A 409A valuation is used to set the exercise price for employee stock options, ensuring compliance with IRS regulations and avoiding potential tax penalties for the company and the receipients of its stock option grants.

If the exercise price is set below the fair market value, stock optionee could face significant tax liabilities under IRS Section 409A.

It’s important for you and your employees that you choose the right 409A valuation date.

There are also risks to choosing the wrong one:

To illustrate this, imagine this scenario:

You’ve not yet issued stock options to your employees, but you want to. You’re also fast approaching a material event, such as a venture financing round.

You may be tempted to complete your 409A valuation before the financing round because the fair market value is likely to be lower, and thus more advantageous to your employees. The problem with that is, to be tax compliant you’ll need to conduct a second 409A valuation after you close the financing. That’s because the financing round is likely to have changed the fair market value of your company’s common stock.

In scenarios like this, it’s more practical and cost-effective to conduct the 409A valuation after the financing round. This approach ensures tax compliance and reduces the need for multiple valuations in a short period.

Your choice of date can also make the valuation process easier. If you choose a date that aligns with your financial statements (month-end or year-end) then you’ll have the documents required for the valuation. If you don’t line it up with your financial statements then it may be more difficult to get those documents in order.

But that’s not the only scenario you’ll face. Below you can see the considerations I make when assisting an Eton client on determining the optimal 409A valuation date.

Related Read: Find the Right 409A Valuation Consultant For You Here

Tip 1: If you do a 409A valuation before a material event, you’ll just have to do another one right after it to maintain compliance. Careful not to waste money here.

Tip 2: Align your valuation date with your month-end or year-end to make handing over up-to-date financial statements easier for yourself.

Tip 3: If this is your first 409A valuation, choose a date at the end of the month before.

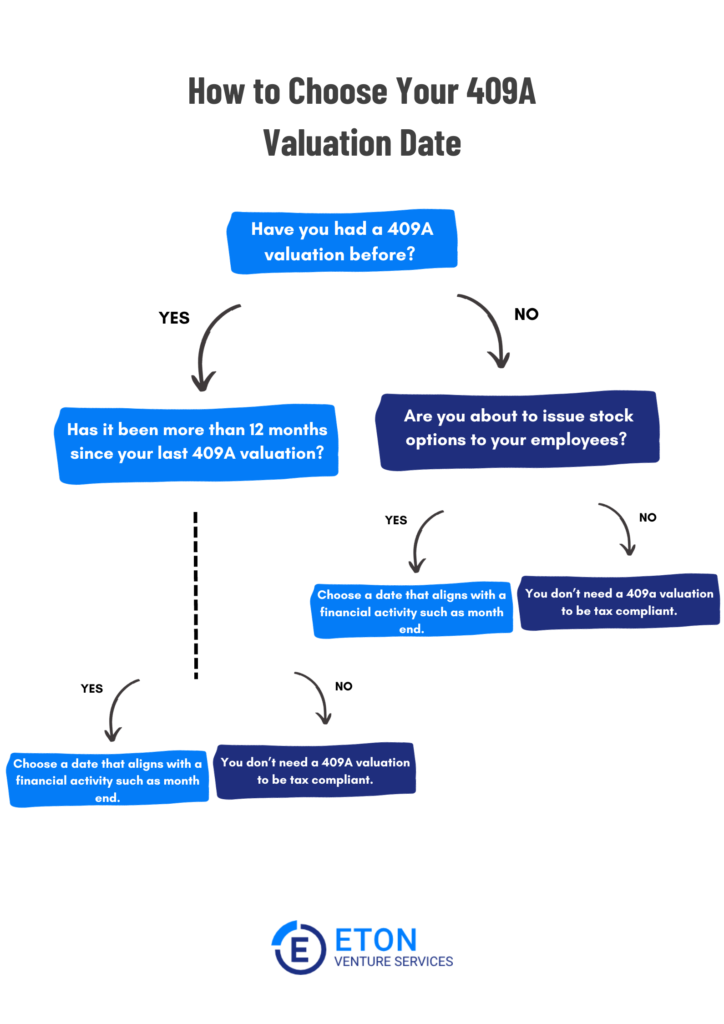

When a client comes to me with this question, the first question I have in return is: “Have you had a 409A valuation previously?”

Your answer to that question prompts further questions:

Let’s look at why these questions matter and how they’ll help determine your 409A valuation date.

If you haven’t had a 409A valuation previously, then there’s only one primary consideration to choose your date.

That is, are you about to issue stock options to your employees?

If yes, you should select a date corresponding to when you plan to offer those options, while taking into account any prior material events. Assuming on material events, this allows you to get the biggest bang for the buck by having the longest possible shelf life on your 409A valuation.

We typically recommend choosing a date at the end of the month rather than one at the beginning or middle because it lines up with other financial activities. This helps in incorporating the most recent financial data, making the valuation more accurate.

Of course, if you have previously closed a financing, whether a priced preferred round or a unpriced SAFE round, the date that financing closed is probably the best valuation date to select, assuming that you are planning to grant options soon.

If you don’t plan on issuing stock options to your employees then you may be able to hold off on conducting a 409A valuation.

If you have had a 409A valuation before, I’ll ask when it occurred and if a material event has happened since.

Examples of material events:

A material event triggers the need for a new 409a valuation. And in the absence of material events, most law firms recommend a new valuation every 12 months.

So how should you choose your valuation date when there isn’t a material event?

First, we should look at when your last 409A valuation was. If it’s coming up to that 12 month expiration date, then choose a date that fits nicely with your month-end financial statements.

Such a date is commonly referred to as an “Accounts Closing Date”. An accounts closing date will be either the end of the month, end of the quarter, or end of the year.

We typically suggest the date that’s closest to, but never ager, the 12-month 409A valuation expiration date.

Example:

Suppose your startup’s last 409A valuation had an expiration date of March 15, 2022. As you approach the one-year expiration mark, there have been no material events such as funding rounds or major product launches. Accordingly, the your March 15, 2022 409A valuation will expire on March 15, 2023.

Accordingly, you could align your new 409A valuation with your financial statements and choose a date for month’s end near March 15, 2023.

A suitable valuation date for the new 409a valuation could be February 28, 2023. This date is close to your fiscal year-end, allowing for the incorporation of the most recent financial data, and it’s just before the 12-month deadline of your last valuation, ensuring continuous compliance with IRS regulations.

Of course, you could certiainly go March 15, 2023 as the valuation date if you prefer.

Often, companies will need a 409A valuation date earlier than the 12-month expiration date. This is because a material event has occurred.

If the material event is within the last 12 months, the date it “occurred” is likely the best valuation date.

Most often, the material event is venture financing. If that’s the case and there’s more than one closing date within the funding round (all closing date), we typicall recommend going with the initial closing date of the financing.

If the dates are spread out across the year, perhaps a more appropriate valuation date is the most recent closing date.

Example:

Let’s say your high growth technology company recently completed a venture financing round. The funding round had multiple closing dates: the initial closing was on June 5, 2023, and there were subsequent closings on September 15, 2023, and December 10, 2023.

Since these closings are spread out across the year, it would be our view that the most relevant 409A valuation date would be associated with the most recent closing date. In this case, that would be December 10, 2023. This date is chosen because it reflects the company’s most current valuation post-funding, taking into account the latest infusion of capital.

At Eton, we work with start-ups across all industries, delivering audit-defensible 409A valuation services and that guarantee safe harbor from the IRS.

That’s because our valuation experts are Big 4 (Deloitte, Ernst & Young (EY), KPMG, and PwC) trained and our processes are USPAP compliant.

What makes us different from the bigger firms is that we’re dedicated to service, competitive on price, and our valuation process never takes longer than 10 days.

Need a 409A valuation? Get in touch with my team here.

Further Reading:

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.