Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

There’s no better way to prepare for an upcoming 409A valuation than to see a real 409A valuation report example.

In this article, I’ll break one down section by section, dig into the details, and then look at the 409As of Stripe, Instacart, and Twitter/X.

That way you’re fully prepared for your next 409A and peace of mind through the process.

A 409A Valuation Report is a document that determines the fair market value (FMV) of a private company’s common stock and a full explanation of the methodologies applied and the assumptions utilized to reach that FMV.

As of 2004, the report is an IRS requirement for any company offering common stock options to its employees. Having a 409A valuation conducted by a reputable third-party is the easiest and most secure way to avoid penalization from the IRS.

This is the report we’ll break down section by section below. Please note that we are only reviewing the calculation exhibit pages. Download our free 409A valuation report calculation pages here:

Example 409A Report Sample – ABC, LLC IRC409A VD 6.30.2023 Draft Exhibits (1)

Your Eton 409A valuation report will come in four sections:

Below I’ve outlined what information those sections hold and why each one is important to the overall valuation analysis.

As you make your way through, you’ll see why an independent third party business valuation expert is needed to ensure you’re compliant.

These reports require complex valuation methodologies and research-based judgments to determine an accurate, unbiased fair market value (FMV) of your company and thus the individual stock options you can offer. Most companies don’t have that expertise in-house and are unlikely to be unbiased in their valuation.

We’re happy to walk every client through their 409A valuation report in detail, answer any questions they may have, and make adjustments as necessary—anything to give you peace of mind.

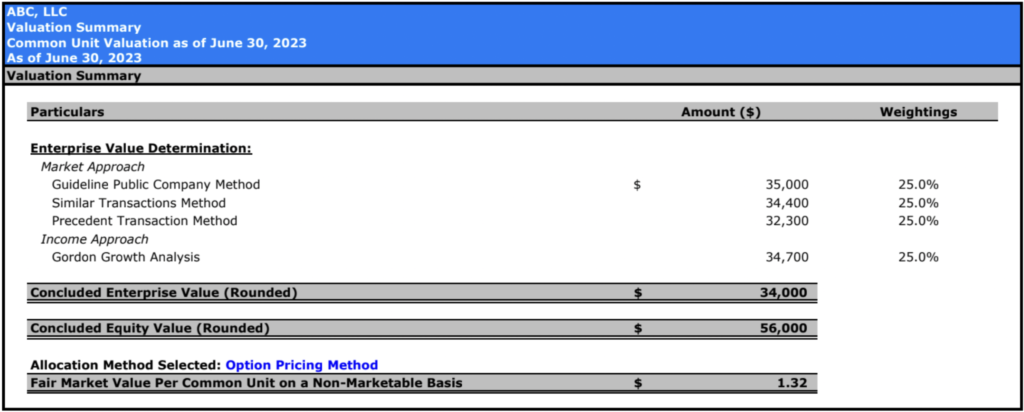

In a nutshell: This section summarizes the fair market value calculation and provides oversight of the the approaches and methodologies used.

Every 409A valuation report we produce begins with a valuation summary.

This summary tells you what methods we took to determine the equity value of your company and then shows the concluded FMV of the common security (here, a “unit” because the sample is from an LLC).

In this example, the “Fair Market Value Per Common Unit on a Non-Marketable Basis” (i.e., post-DLOM) is $1.32.

In a nutshell: The Business Enterprise Valuation Determination shows in detail the value indications (Enterprise and Equity value) based on the methods we utilized to provide a reasonable and rigorous analysis, so that we can make sure that the report fits well within the “Safe Harbor.”

As you can see in the image above, this section first showcases the value indication determined by each methodology applied, their weightings (25% each), the Concluded Equity Value, and the Concluded Enterprise Value.

|

Helpful hint: In a 409A valuation, it’s essential to consider both the Equity Value and the Enterprise Value of the company. The Equity Value reflects the worth of the company’s shares, vital for determining the fair market value (FMV) of common stock for stock option pricing and reporting exercises. On the other hand, the Enterprise Value offers a broader perspective, encompassing not just equity but also debt and other factors, to give a comprehensive view of the company’s total value. Understanding these two values in conjunction provides a more nuanced and accurate assessment of the company’s financial standing, crucial for a reliable 409A valuation. |

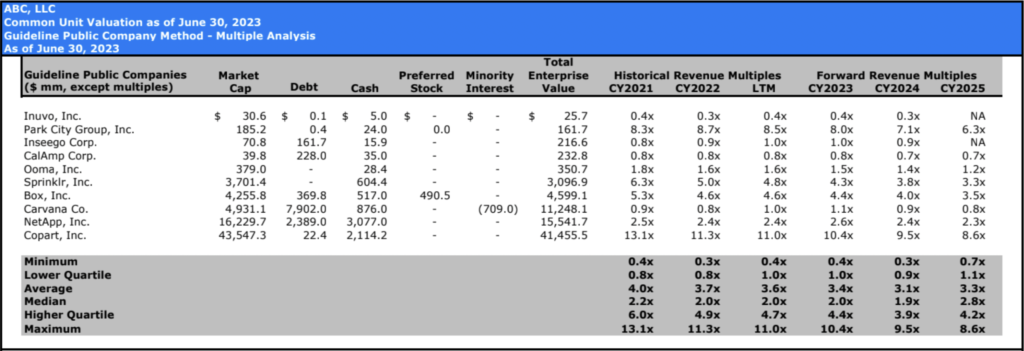

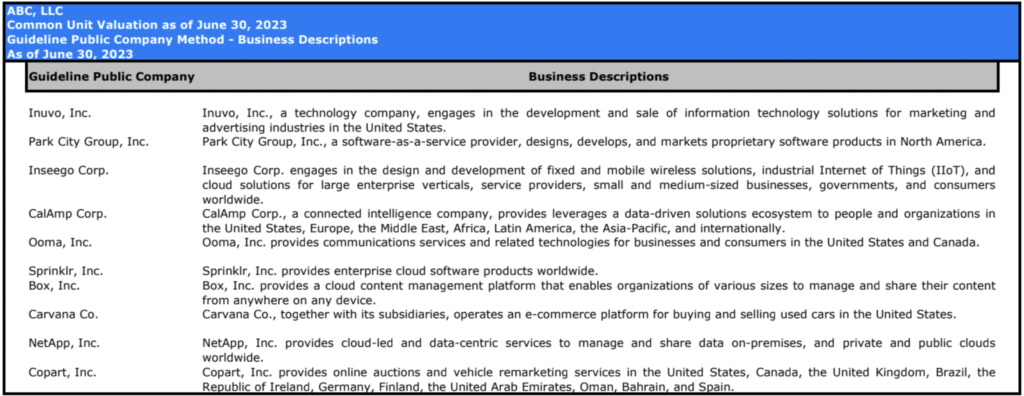

Further down, you’ll be given tables outlining the financial metrics and multiples of the companies used as comparison points in the Guideline Public Company Method (“GPC”) as well as descriptions of the guideline public companies utilized.

In this case, as the Market Approach uses three methods, you’ll find tables pertaining to all three and in the order they were first presented.

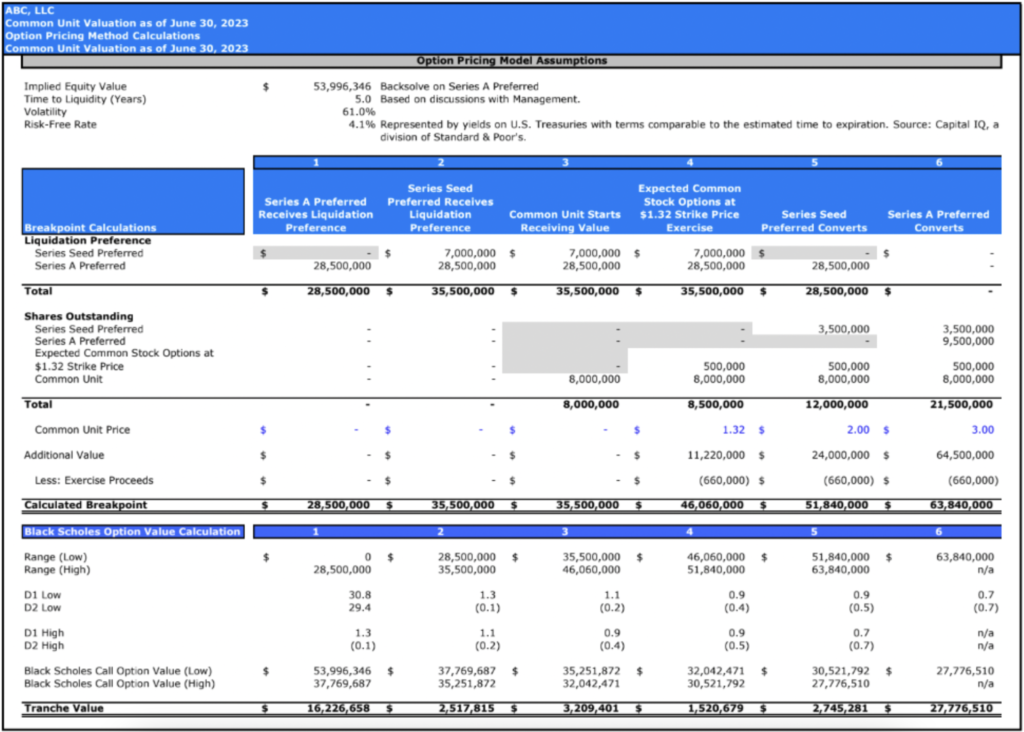

The Precedent Transaction Method (PTM) is a nuanced valuation approach. It begins by examining a company’s recent securities transaction, such as the sale of Series A Preferred equity, to deduce an overall value for the company and its entire capital structure.

This method involves using the Options Pricing Model, informed by the Black-Scholes framework, to incorporate various elements like the rights and preferences of all securities, the total number of outstanding securities, and the recent transaction’s per-share price.

Specifically, it ‘backsolves’ for the implied equity value that aligns the Series A Preferred’s issue price with its fair market value. This approach is based on the rationale that the recent Series A transaction, being an arms-length deal, accurately reflects the fair market value, assuming that investors neither overpaid nor underpaid. The chart below provides the setup of the method, including its assumptions.

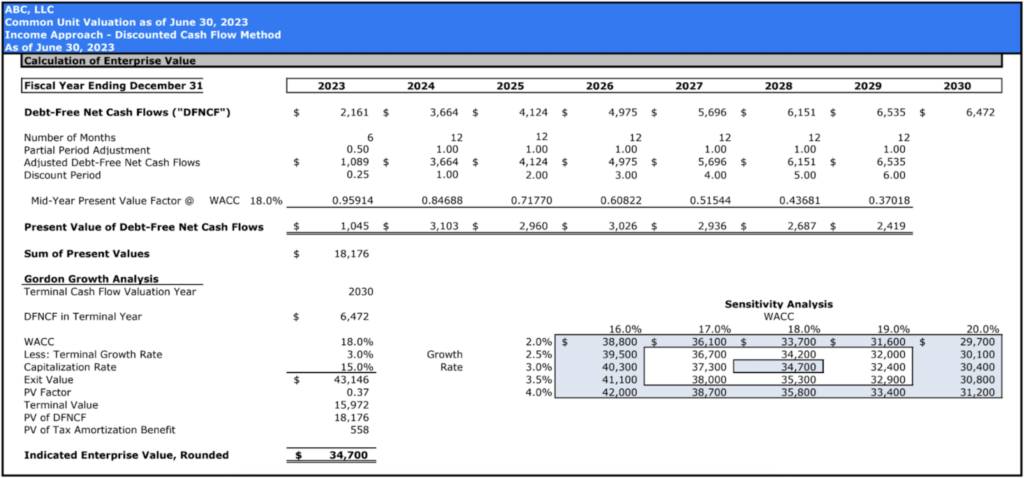

Before showing the application and calculations of the Discounted Cash Flow (DCF) Method under the Income Approach:

This section is long and can look overwhelming at first glance. But it’s important that the reasonable methodologies used, and assumptions made, are clearly shown.

Think back to when you took math exams at school and had to show your work. It’s essentially the same thing. By showing your work, you’re communicating that you know how to get to the answer, and that you haven’t taken any unreas0nable steps to get there (i.e., you have “reasonably applied” the valuation method). This is important for the Safe Harbor.

Where possible, we use a combination of methodologies to come to the FMV indication. That’s why this 409A report example shows two approaches applied: the Market Approach (three separate methods under the market approach!) and the Income Approach, which utilizes the discounted cash flow analysis.

The Similar Transaction Method (also sometimes called Guideline Transaction Method or (confusingly) Precedent Transaction Method) under the Market Approach is when we estimate FMV by comparing your business to similar businesses that have been sold.

The DCF (DCF) Method, a key component of the Income Approach, determines a company’s Fair Market Value (FMV) by projecting its future earnings and discounting them to present value, thereby assessing the Company’s income-generating potential.

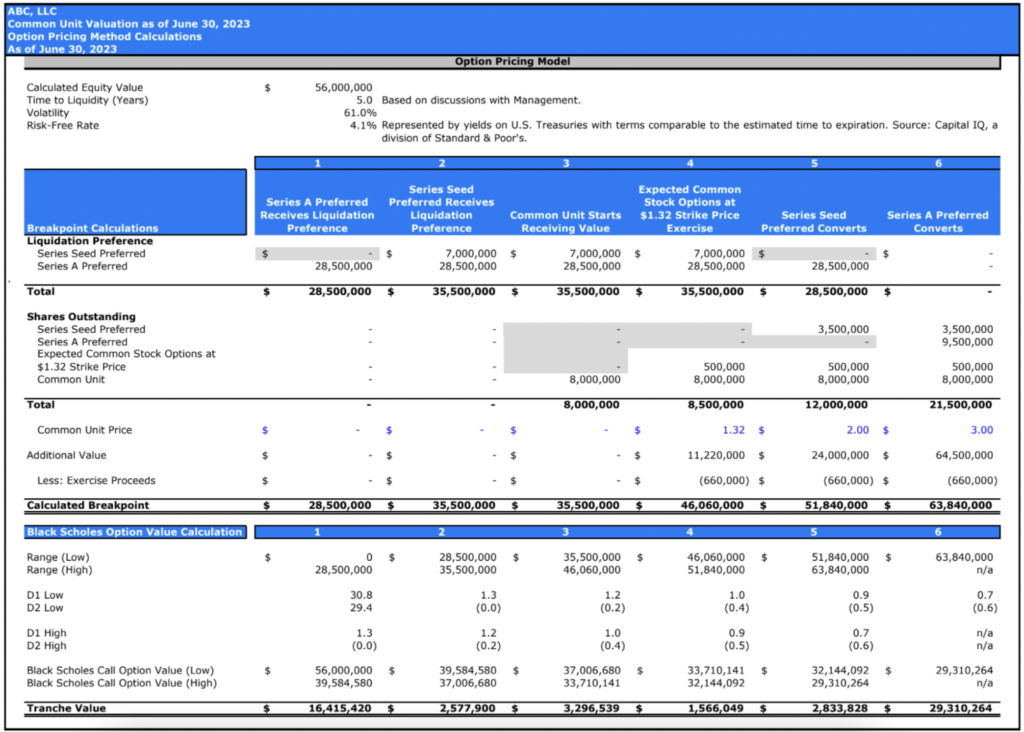

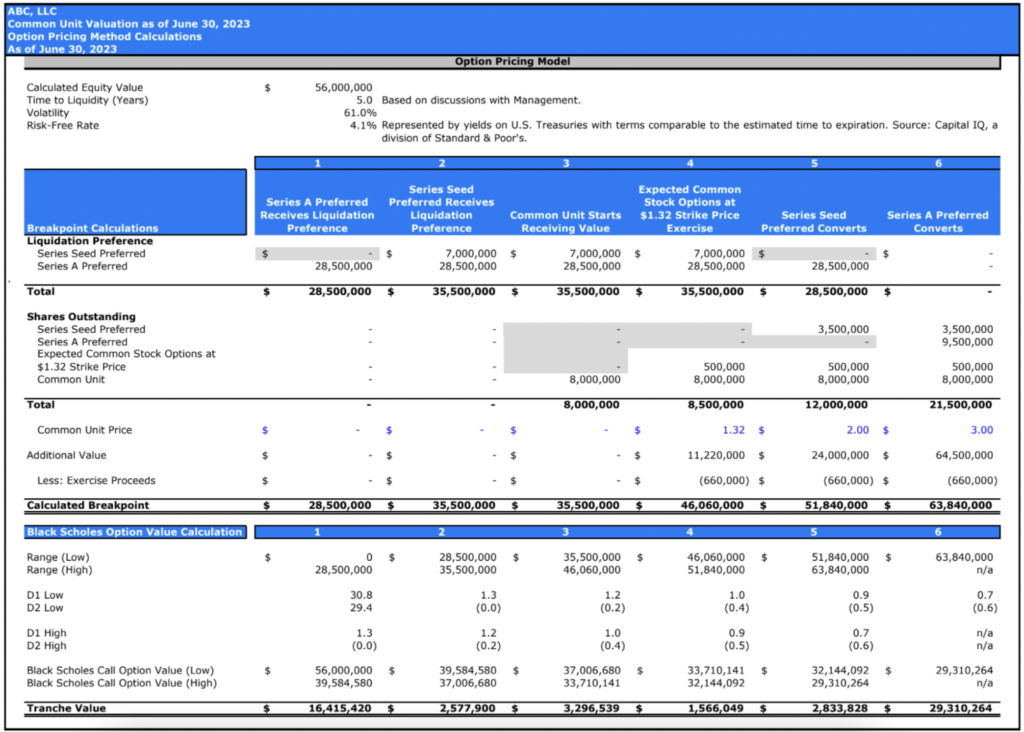

In a nutshell: This section provides a concise overview of the calculations applied in the Option Pricing allocation method, illustrating how the company’s total value – $56 million in our case – is distributed among various equity types, including Series Seed Preferred, Series A Preferred, upcoming Common Stock Options, and Common Units.

The allocation method considers specific factors such as liquidation preferences, dividend rights, and conversion privileges, alongside risk factors like volatility and opportunity cost (using US Treasury securities as the risk-free rate), and the element of time. Below is the model’s first page from our example report:

The next section of the model expands on the capitalization table, detailing it for each valuation breakpoint. This section highlights that not all classes of securities are affected equally in the valuation waterfall. Particularly, “preferred” securities are given this name due to their “preferences” over “common” in the distribution hierarchy.

|

Helpful Tip: A “breakpoint” in a company’s equity “waterfall” marks where the division of equity value shifts among different securities, such as preferred and common stock. Triggered by contractual terms (like liquidation preferences and exercise prices), these breakpoints affect each security type’s value uniquely. They signify where equity distribution rules change, crucial in complex structures with various securities. |

The accompanying chart details how each equity class is impacted at distinct valuation levels, with precise breakpoint calculations illustrating the varied effects on these classes at each threshold or “tranche” (i.e., Tranche 1, Tranche 2, etc.).

Additionally, the model calculates the Black-Scholes option values for each tranche, offering vital insights into the complex financial dynamics at play across the company’s valuation spectrum. This analysis is key to getting a handle on how equity is distributed among stakeholders under varying valuation scenarios.

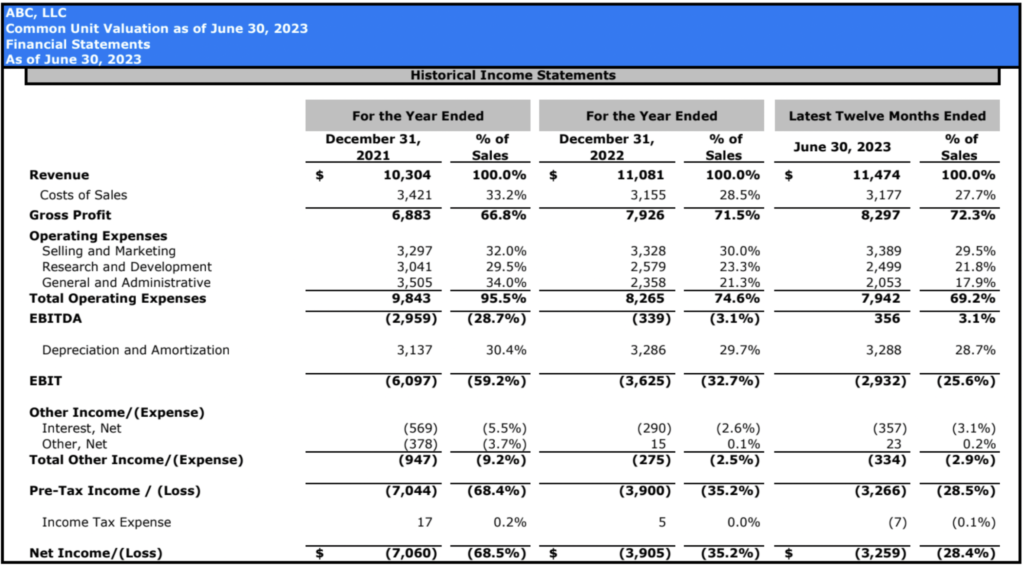

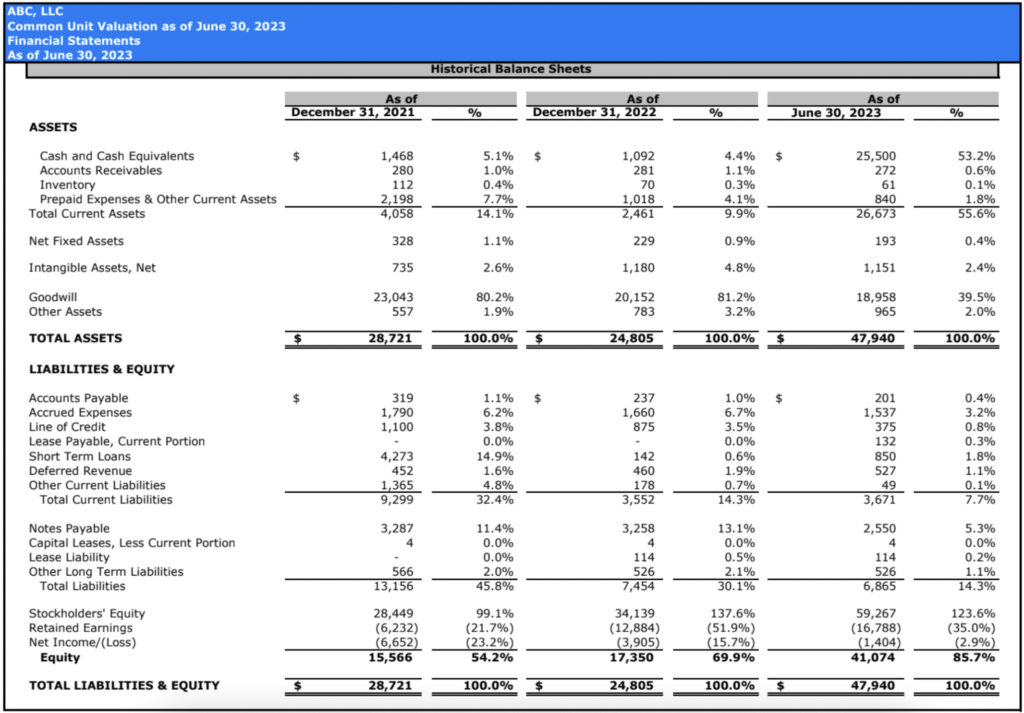

In a nutshell: In this section, you’ll find all of the secondary information used to inform the valuation (such as your company financials).

This section includes:

Think of the supporting exhibits as an appendix to the valuation calculation pages. This section contains all of the information that helped inform which methodologies we chose and the application of those methodologies as it relates to the company being valued.

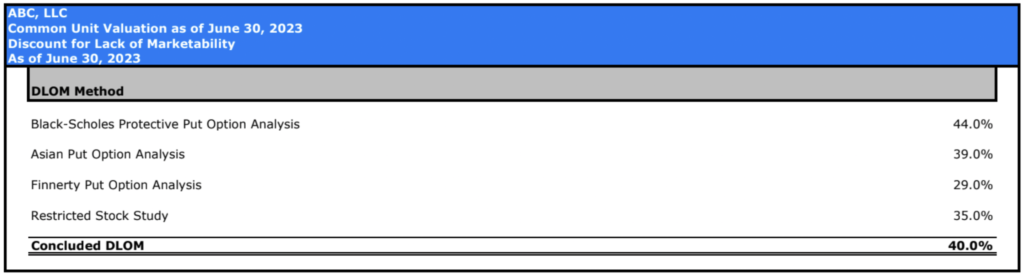

This section also includes the vital calculation of the Discount for Lack of Marketability (DLOM). The DLOM is applied to account for the reduced liquidity associated with private company securities, which are not as readily marketable as public company stocks.

This discount reflects the relative difficulty and uncertainty in selling such securities and the longer time frames often required to find a buyer. Calculating the DLOM involves assessing factors like the company’s size, the rights and restrictions associated with the securities, the holding period, and the general market conditions.

Including the DLOM in our valuation model helps ensure a more accurate and realistic assessment of the company’s common equity, recognizing the inherent challenges in liquidating private securities.

|

Helpful hint: Ensure your 409A valuation report is signed by the provider, as an unsigned report may lack validity and safe harbor protection. This necessity is underscored by the Tax Court’s ruling in Estate of Hoensheid v. Comm’r (In re Estate of Hoensheid), T.C. Memo 2023-34, which stipulates that a “qualified appraisal” must be signed and dated by a qualified appraiser. Unsigned reports risk non-compliance with tax regulations, potentially jeopardizing the safe harbor status of any related grants. |

Every now and again, a company’s valuation makes headlines—either because it’s high or faltering. When that happens it allows us to look at what’s happened and why.

Three recent company valuations that landed on TechCrunch are Stripe, Instacart, and X (formerly Twitter). Let’s look at each one in turn to see what occurred and why.

Founded in 2010 and boasting 12 million in revenue as of 2021, Stripe is a Fintech automating financial processes for businesses.

Following a 409A valuation in 2022, Stripe’s valuation was slashed by 28%. The 409A valuation was brought on by the 2022 stock market decline which was categorized as a “Material Event” for the business.

Many businesses would have lost value as a result of the economic decline so Stripe’s valuation isn’t surprising.

Instacart faced a similar devaluation off the back of a 409A in 2021. It dropped 38.5%, taking the company’s valuation from $39 billion to $24 billion.

This devaluation was an objective reflection of how market changes had impacted the grocery delivery platform. The company cited “market turbulence” and the need to attract talent as key reasons for reassessing its valuation. This adjustment also reflected a steep drop in the sales growth rate since the start of the pandemic, a period when demand for grocery delivery had surged. Additionally, the changing landscape of deliveries in the food and other sectors, and the challenges associated with the gig economy’s infrastructure for full-time vehicle drivers, contributed to this reassessment. Other companies in similar sectors, like advertising and delivery, also experienced declines in stock value around this time

This devaluation, while indicative of market shifts impacting Instacart’s business, has a silver lining: it potentially reduces the tax obligations for employees exercising their stock options, as 409A valuations directly influence the taxation of an exercise. A lower 409A FMV could also enable management to offer enticing retention grants or even recruit more talent with a lower, more attractive, exercise price on their stock options.

Elon Musk’s acquisition of Twitter in late 2022 for about $44 billion was followed by a notable drop in its valuation to $19 billion a year later, as per a 409A valuation. This stark reduction led to speculation about Musk’s leadership impact. Unlike companies like Instacart and Stripe, whose valuations seemingly were affected by broader market changes, social media platforms, in general, had not faced similar valuation declines.

The devaluation in Twitter’s valuation following its acquisition by Elon Musk might carry a silver lining, especially for employees with stock options. Just as in the scenarios above, a lower 409A Fair Market Value (FMV) could reduce their tax obligations when exercising options, as 409A valuations directly affect such taxes when an option is exercised. Additionally, this situation might enable the company to offer more appealing retention grants and attract new talent with attractively priced stock options.

Looking ahead, it will be intriguing to see how Twitter’s valuation adjusts in its next 409A assessment and the strategic responses to address the past year’s challenges,

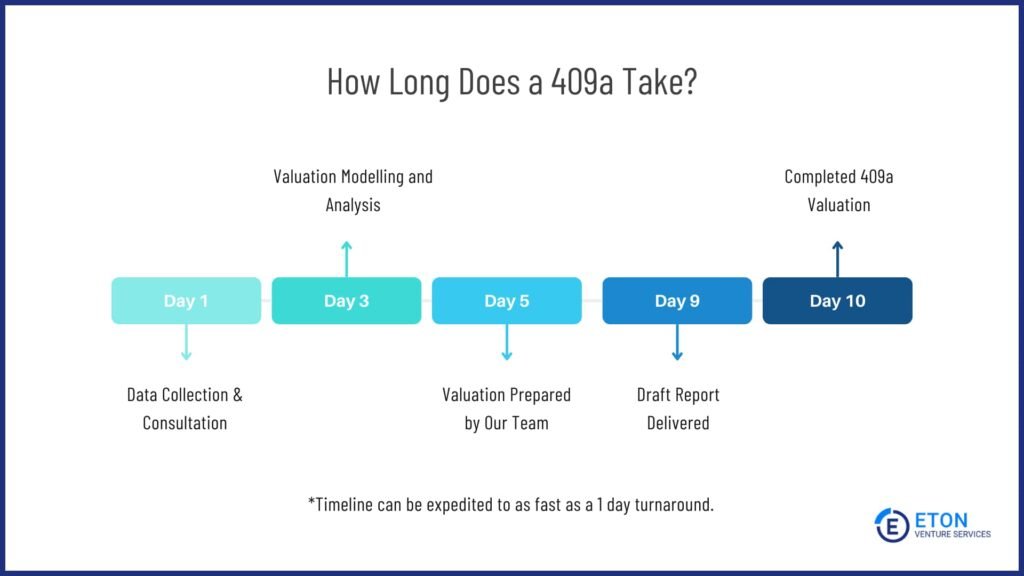

At Eton, 409A valuations never take longer than 10 days from the receipt of all requested documents and information.

If you need a valuation sorted faster, we can accommodate that for an additional fee.

Those 10 days (or less) include a consultation, a thorough analysis of your company and the market, preparation of the valuation draft, a review process, and a final, signed narrative 409A valuation report with calculation pages.

For a full breakdown of how long 409A valuations can take and the factors that influence different timelines, read our article: How Long Does a 409A Valuation Take?

Hiring an independent valuation consultant is the number one way to ensure you’re compliant with IRS Section 409A. Doing so, gives your equity grants the sheild of the “safe harbor” from the IRS.

But you only get the safe harbor if your consultant meets certain criteria (meaning you can’t pick just anyone).

To ensure compliance, here’s what I recommend you look for when hiring your 409A valuation consultant.

A 409A valuation is initially triggered by a company planning to issue common stock options to its employees.

Once that triggering occurrence passed, the company will need to have additional 409A valuations every time a material event occurs. In the absence of material events, the 409A valuation will need to be rerun every 12 months from the prior recent valuation.

Common material events include:

For a 409A valuation, you’ll need to provide several documents, including:

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.