Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

You started your company with a vision to build something that lasts, whether that means disrupting an industry, scaling a proven model, or taking your next big step toward IPO.

You’ve been heads down building the product, hiring a strong team, and raising capital from investors who share your vision.

Now, issuing stock options has become an important part of that growth, rewarding the people building alongside you and aligning everyone for what’s ahead.

But it also comes with IRS rules you need to follow, including obtaining an independent 409A valuation report to establish the fair market value of your common stock, known as the 409A price.

In this guide, we’ll break down everything you need to know about 409A valuations: what they are, when you need one, how they’re performed, their cost, how they differ from other types of valuations, and how to ensure your report meets IRS standards.

Whether you’re an early-stage startup or a later-stage company managing multiple rounds, understanding these fundamentals will help you make informed decisions and stay compliant.

A 409A valuation is an assessment of the fair market value (FMV) of a private company’s common stock, essentially the price a willing buyer and a willing seller would agree on for those shares under normal market conditions.

This value is then used to set the 409A strike price for stock options, which give employees the right to buy common stock in the future.

The IRS requires a 409A valuation to make sure those stock options aren’t issued below fair market value. Setting the strike price below FMV could trigger heavy tax penalties for employees, so a 409A helps keep both the company and its team compliant.

To determine FMV, the valuation considers the company’s financials, market conditions, capital structure, and growth prospects (but cautiously and only if they’re well supported).

Most companies hire a third-party 409A appraiser to perform this analysis using accepted methods such as discounted cash flow, market comparables, or asset approach. We cover these in more detail later in the article.

A 409A valuation remains valid for 12 months or until a material event occurs, such as a new funding round.

To put the 409A valuation in context, here’s how it compares to the other types of valuation terms you’ll encounter as your company grows:

| Type of Valuation | Purpose | Subject | Methodology | Typical Outcome |

|---|

A VC valuation reflects what investors are willing to pay for preferred shares, which include special rights like liquidation preferences and anti-dilution protection.

It’s usually much higher than a 409A valuation, because it’s based on where the company is going, not where it is today. Investors factor in growth potential, not just current numbers.

A 409A valuation, by contrast, only focuses on the fair market value of common stock as it stands today, without future projections or negotiation.

Some of the factors that may lead to differences in the two valuations include:

While a VC valuation sets investor pricing and guides funding terms, a 409A valuation keeps option pricing aligned with IRS standards, each serving a distinct purpose. However, both play an important role in the startup ecosystem.

📚 You might also like: How to Value a Startup Company with No Revenue in 3 Ways

A 409A valuation reflects the fair market value of common stock for compliance purposes and assumes the company will remain private in the near term, which means applying discounts for illiquidity since the shares cannot be easily sold.

An IPO price is set when the company goes public and is influenced by investor demand, market conditions, and future growth expectations.

Unlike 409A valuations, it is not limited by tax or compliance requirements and often reflects a much more optimistic view of the company’s potential.

For instance, a private company could have a 409A valuation of $50 per share, only to see those same shares debut at $150 once public.

The gap between the two reflects their purpose. The private company 409A valuation is for compliance and employee option pricing. The IPO price is driven by public market sentiment.

A 409A valuation reflects what your common stock is worth today. A post-money valuation reflects what investors pay for preferred shares after funding, based on expected growth and added rights.

Post-money valuation can be calculated by dividing the investment amount by the percentage of ownership the investor receives. It sets the paper value of the company and is based on the preferred stock price agreed during the deal.

Preferred shares carry protections like liquidation preferences and anti-dilution protection, which don’t apply to common stock. This makes preferred shares more valuable.

So, if a company raises $10 million at a $40 million pre-money valuation, the post-money is $50 million. But the 409A valuation of common stock might fall between $10 and $15 million. This isn’t a mismatch but is instead a result of the different goals behind each valuation.

Preferred price is what investors pay for preferred shares during a funding round.

Preferred shares typically come with added rights and protections. These can include liquidation preferences, anti-dilution clauses, board seats, and priority in payout if the company is acquired. Because of these advantages, preferred stock is more valuable than common stock and commands a higher price.

The preferred price is set through negotiation between the company and its investors. It reflects the perceived upside of the company and is often based on future growth expectations, not just current performance. This price becomes the basis for the company’s post-money valuation, but it does not apply to common shares.

In contrast, a 409A valuation applies discounts to reflect the lack of these rights, lower liquidity, and higher risk associated with common stock. That’s why the common stock price in a 409A valuation is usually significantly lower than the preferred price, even at the same point in time.

⚠️ Note: In public markets, a “strike price” is the fixed price at which options can be exercised, to buy (calls) or sell (puts) a stock.

In startups, it refers to the price employees pay to purchase common stock under their equity grants.

A 409A valuation sets the minimum legal strike price by determining fair market value on the grant date.

By law, the strike price must be at or above the FMV on the grant date. Setting it lower without proper documentation can expose employees to IRS penalties.

Most startups complete a 409A valuation to establish a compliant strike price that still leaves room for employee upside. A lower 409A means a lower strike price, which creates greater potential gain for employees when the company’s value increases.

So while the strike price is the number written into an option grant, the 409A valuation is what makes that number valid.

409A compliance protects you and your employees from major tax consequences when issuing stock options or RSUs.

Proper valuations also:

Luckily, there’s a system in place that makes these benefits easy to obtain. It’s called a “safe harbor”.

409A safe harbor is a set of IRS rules that, when met, give your 409A valuation a presumption of reasonableness. In practice, that means the IRS has to prove your 409A value is grossly unreasonable before it can challenge your stock option pricing.

There are three routes to 409A safe harbor status:

The simplest way to secure a 409A safe harbor for most businesses is the first route: A 409A Independent Appraisal Presumption. It involves hiring a reputable, independent third-party valuation firm who will complete the valuation on your behalf.

These experts ensure your 409A valuation satisfies the IRS criteria to be considered safe harbor-compliant. The following section details those legal requirements.

To qualify for the 409A valuation “safe harbor”, you must adhere to the following requirements:

The valuation must be documented in a written report. A verbal estimate or internal spreadsheet does not satisfy IRS requirements.

Valuations expire after 12 months, or sooner if new information arises that materially affects the company’s value, such as a funding round, merger, acquisition, or major business change.

Failing to update your 409A on time can lead to significant IRS penalties, including immediate taxation on deferred compensation and a 20% additional penalty.

While we’ve mentioned earlier that there are other routes to safe harbor (such as the Illiquid Start-Up and Formula Presumptions), these apply only in limited circumstances and are subject to greater IRS scrutiny.

For most companies, the IRS expects a qualified, independent appraiser or firm to perform the valuation.

An independent appraisal ensures objectivity, credibility, and compliance with IRS standards, giving your company the strongest presumption of reasonableness if reviewed.

Your valuation provider must apply accepted methods, typically the Market Approach, Income Approach, or Asset Approach, and follow USPAP (Uniform Standards of Professional Appraisal Practice).

Using reasonable, standardized methodologies ensures your valuation is credible and defensible in the event of an IRS review.

Your appraiser must account for all factors that could influence value, including financial data, market trends, capitalization structure, and growth prospects.

In addition, a compliant valuation must include thorough documentation of the data, assumptions, and methods used.

If any of these requirements are not met, your valuation may fail to qualify for safe harbor protection, which can trigger significant IRS penalties and severe consequences. These can include:

To avoid these risks, you want to work with a 409A valuation provider whose reports consistently qualify for IRS safe harbor.

A safe harbor-compliant valuation is presumed valid unless the IRS can prove it’s “grossly unreasonable”. If it doesn’t qualify, the burden of proof falls on you.

At Eton, every valuation we deliver meets safe harbor standards. We offer two tailored 409A valuation packages designed to match your company’s stage and structure:

We often see companies make these mistakes (and get penalized for it):

You’re required to complete a startup 409A valuation the first time you plan to grant stock options to employees, then every 12 months as an early-stage company.

Late-stage companies often shift to semi-annual or quarterly schedules to support continuous grants and meet audit requirements.

Both early-stage and late-stage startups are also required to obtain a new 409A valuation after a material event.

A material event is any development that significantly affect your company’s value, such as:

If a material event occurs, you’ll need to update your valuation before granting any new stock options. The 12-month cycle resets from that new valuation date.

For example, if you conduct your first 409A valuation in March and later close a Series A in September, you’ll need to complete a new 409A valuation after the raise. Your next one would then be due the following September, assuming no further material events occur before then

If you’re wondering how to do a 409A valuation or what the process looks like and how long it takes, we’ve outlined it all below, using our approach and timelines here at Eton as a reference.

Time taken: You can choose a provider in as little as 1-2 days.

We recommend looking for these three characteristics:

For more detail, read our guide to the best 409A valuation consultants for hire.

Time taken: 1-2 days (client side)

The first step in working with a consultant will be documentation collection.

This is often a bottleneck, as it takes your team time to collect and prepare information.

At Eton, we request:

Upon receipt of these documents, our side of the process starts. The first thing we’ll do is check we have everything we need. If we don’t we’ll get in touch immediately and make additional requests.

But from here on out your input and effort are minimal. Your consultant will begin their valuation methodology and get back to you within a few days.

Time taken: 1 day (client and valuation firm)

It’s part of our process to understand what prompted your 409A valuation and what stage you’re at as a start-up.

These details will inform the methodologies we choose and determine if we need to fast-track the process to meet deadlines.

We’ll ask you at this point to choose a valuation date. The valuation date is the date on which the fair market value of your company’s stock will be determined.

If you’re not sure what date to choose, we’ll make some suggestions to assist with this choice.

There are a few things we’ll take into consideration when choosing the date, such as if you’re approaching or have just passed a major corporate event, you’re close to the end of the fiscal year, and when you want to issue stock options to employees.

Your 409A is valid for a year from the date of valuation or until a ‘material event’. Material events include financing rounds, term sheets for financing rounds and acquisitions.

To explore this subject further, read our full guide to choosing your 409A valuation date here.

Time taken: Anywhere from 1-7 days (depending on specified turnaround time)

Once we have your valuation date and we’ve received your documents, the 409A analysis begins.

This is where advanced methodologies are used to determine your startup’s valuation.

There are three 409A valuation methodologies we use:

Each one adheres to the AICPA (American Institute of Certified Public Accountants) published guidance on 409A valuations.

Which one gets applied depends on the developmental stage of your business. For example, a series-a 409A valuation might use a different methodology than a seed-stage valuation.

Generally speaking, early-stage startups that have raised funding but aren’t yet profitable will rely on the market approach. Those who haven’t generated revenue and who haven’t raised funds will likely use an asset approach. In both instances, because of the early stage, the company is unable to reliably forecast financials.

The income approach is often applied to businesses that are bringing in revenue with a positive cash flow. They will be able to forecast financials.

We always look to see if one (or all three) approaches fit your situation and will continue to consider them as options throughout the valuation process.

Delivered on: day 7 (by valuation expert)

Your dedicated analyst will prepare the draft valuation calculations which include the methods chosen, assumptions made, data pulled, and the draft fair market value conclusion.

We’ll let you know when you can expect to receive this draft. That way you can reserve time in your schedule to review it.

As soon as it’s completed, we’ll send them to you.

Related Read: Check out this Real 409A Valuation Report Sample

Received on: day 10 (client to review and raise any concerns and questions)

Time taken to finalize: 1-2 days

With your draft report now in your possession, you have the opportunity to review it. Check that you understand the assumptions made and are comfortable with the valuation numbers.

If anything is unclear or you have concerns, you can schedule a call with us and we’ll discuss any issues in detail.

When you’re happy with the valuation, we’ll both sign off on the draft calculation pages.

Then you’ll authorize us to prepare the final report. That final report will be delivered to you within 1-2 days.

Related Deep Dive: How long does a 409a valuation take?

For a detailed look at what the final deliverable looks like, we’ve created a full breakdown of an actual 409A valuation report. It walks you through each section so you know what to expect.

You can also download the full report here: Example 409A Report Sample

The cost of a 409A valuation depends on your company’s size, complexity, and stage, but most 409A appraisals for startups fall within the $2,500-$4,000 range.

At Eton, both our 409A valuation packages, early-stage and late-stage, are priced fairly for the level of detail, audit readiness, and personal guidance they include.

For an exact quote tailored to your company’s needs, contact us directly. We’ll respond quickly and walk you through what to expect.

Interested in a full breakdown of 409A valuation costs?

Read our article: How Much Does a 409A Valuation Cost? Prices in 2025

There are a few common misconceptions about 409A valuations that can lead to compliance issues, unexpected tax exposure, or delays when companies start granting equity.

Here are four myths we see most often and the facts you should rely on instead:

A common myth is that only large or mature companies need 409A valuations. In reality, any company granting stock options needs a 409A valuation to ensure compliance.

Some believe that the valuation determined in a funding round can be used for 409A purposes.

However, investor valuations reflect what VCs pay for preferred stock, which includes protective rights and preferences that make it more valuable than common stock.

Additionally, investor valuations are forward-looking and based on growth potential, while 409A valuations must determine the current FMV of common stock as it stands today.

Because of these fundamental differences, investor valuations cannot be used for 409A compliance.

Some think that a 409A valuation is a one-time need. However, it’s an ongoing requirement as long as the company continues to grant stock options.

While stock options are the most common use case, 409A valuations also apply to restricted stock units (RSUs), stock appreciation rights (SARs), and other forms of equity-based compensation that require fair market value determinations.

At Eton, we make it simple to get a valuation you can rely on.

You get the same technical rigor and audit-ready reporting you’d expect from a Big 4 firm (because many of our consultants were trained there), combined with the speed, accessibility, and personalized service of a boutique team.

Most 409A valuations are completed in ten days, and for startups on tight deadlines, we also offer a one-day expedited option.

Our work is 100% human, never automated. Every report is signed by qualified appraisers, fully USPAP-compliant, and safe harbor-eligible. That level of diligence is why our clients’ reports have consistently passed auditor and IRS reviews without issue.

We also tailor every engagement to your company’s stage.

Each package is priced fairly, aligned to your needs, and delivers the same level of accuracy and defensibility to satisfy investors, auditors, and the IRS.

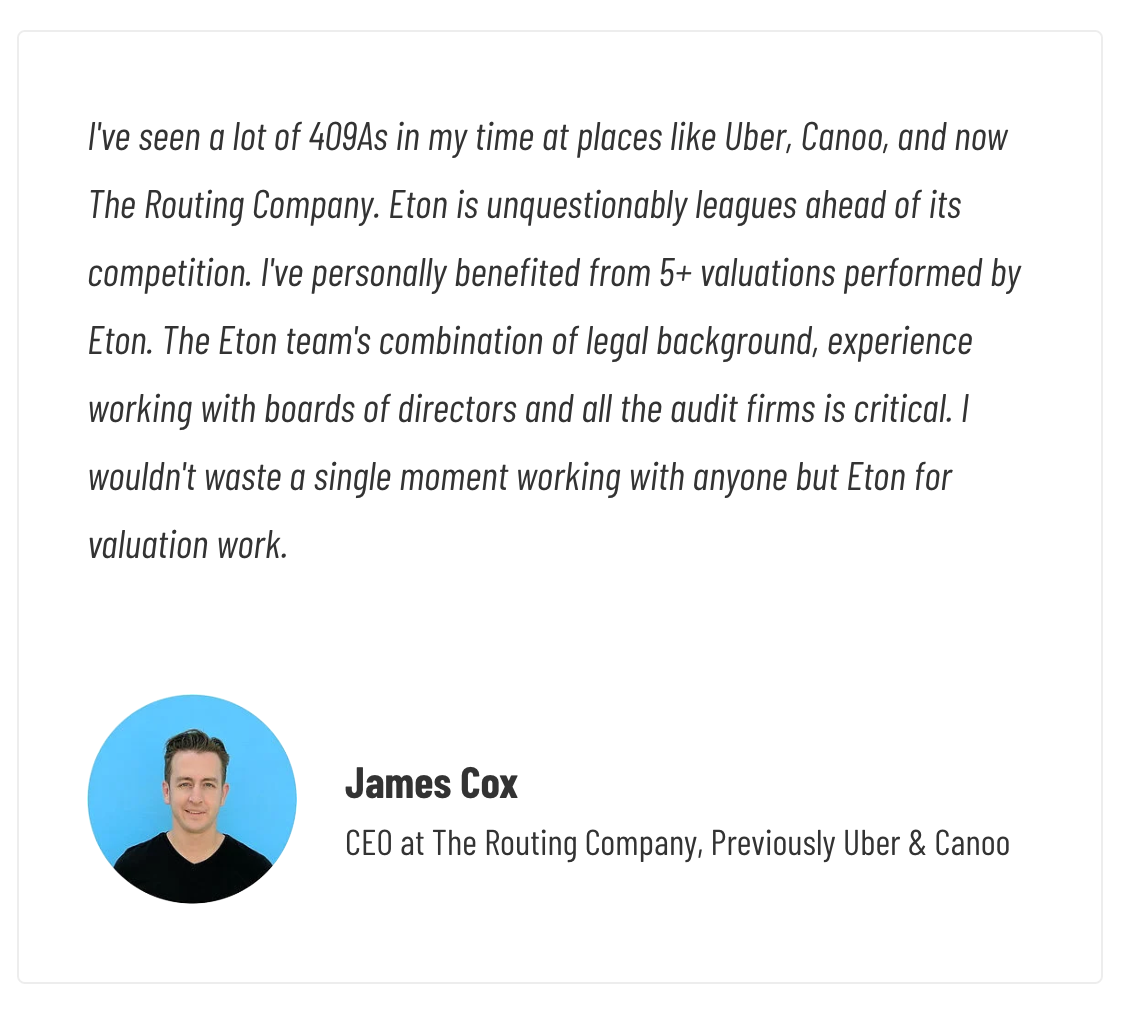

Here’s what one of our clients had to say:

With Eton, you’ll have peace of mind knowing your valuation is done right, delivered on time, and built to meet IRS 409A valuation requirements, all without the Big 4 price tag.

Ready to get started with a trusted, compliant provider?

A defensible 409A valuation is calculated using accepted methodologies under IRS guidance, typically the Market Approach, Income Approach, or Asset Approach.

Analysts consider financials, cap table, preferred pricing, market data, and risk factors to determine common-stock FMV.

At Eton, every calculation is fully documented and USPAP-compliant, giving you the assurance that your valuation is well-supported and will stand up to auditor or IRS review.

It isn’t recommended to perform your own 409A valuation because self-prepared valuations don’t qualify for IRS safe harbor.

Without safe harbor, your strike prices can be challenged, leading to tax penalties for employees and compliance risk for your company.

To meet 409A safe harbor, your valuation must satisfy several IRS requirements that collectively create a presumption of reasonableness.

In practice, that means the IRS can’t challenge your FMV unless they can prove it’s grossly unreasonable.

To qualify, your 409A valuation must:

Meeting all of these criteria ensures your 409A valuation qualifies for safe harbor protection.

Eton structures every 409A appraisal around these exact requirements: each report is written, fully documented, independent, USPAP-compliant, and signed by qualified appraisers. We have a proven track record of delivering valuations that always pass auditor and IRS review.

Most startup 409A valuations cost $2,500-$4,000, depending on stage, complexity, and the level of expertise involved.

At Eton, we offer two packages, one for early-stage and one for late-stage startups, both priced fairly to ensure you get a defensible, IRS-compliant valuation without the high fees of larger firms.

To complete a 409A valuation, most startups need to provide:

Eton streamlines this process and requests only what’s necessary, keeping the lift on your team as light as possible.

Yes. A pre-revenue startup still needs a 409A valuation before issuing stock options. Even without revenue, the company must establish the fair market value of its common stock to set a compliant strike price and qualify for IRS safe harbor.

For early-stage companies with limited financial history, appraisers rely on methods such as the backsolve, option-pricing model, or asset approach, along with factors like recent funding terms, market conditions, and risk profile.

A 409A valuation is valid for 12 months or until a material event occurs, such as a new funding round, acquisition discussions, major revenue shifts, or secondary sales. After that, you must refresh your report before issuing new options.

You should refresh your 409A valuation immediately following a new priced round, as it’s a material event that typically increases your company’s fair market value. Grants issued after a round must use the updated FMV to stay compliant.

A 409A valuation that’s too low can trigger immediate tax penalties for employees if the IRS determines options were granted below FMV.

A valuation that’s too high makes stock options less attractive to employees due to higher strike prices.

An accurate valuation (not artificially inflated or deflated) ensures compliance and preserves the effectiveness of your equity compensation.

A 409A valuation sets the legal minimum strike price for employee stock options.

Regardless of whether the FMV is high or low, it must be accurate and defensible, because options granted below true fair market value trigger IRS penalties for employees.

Yes. SAFE notes, convertible debt, and multiple share classes all impact your 409A valuation because they add complexity to your capital structure.

Valuators must account for these instruments when determining how enterprise value is allocated to common stock.

As a company nears IPO, the 409A FMV usually rises because liquidity risk (the difficulty of selling private shares) decreases as a public listing becomes imminent.

Analysts shift to using public market comparables, pre-IPO pricing indicators, and more sophisticated valuation models that reflect the company’s path to becoming publicly traded.

Once you receive your 409A report, review it for accuracy, obtain board approval of the FMV, retain the report in your records for compliance purposes, and use the updated strike price for all option grants going forward.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.