Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Goodwill impairment occurs when the carrying value of goodwill from a past acquisition exceeds its current fair value, meaning that the goodwill asset has lost value.

This can indicate that the expected benefits from the acquisition, such as synergies or market position, are not as valuable as initially anticipated.

Such situations can be daunting for business owners, investors and financial professionals, as questioning the value of previous acquisitions raises concerns about leadership’s decision making.

This guide is designed to help you navigate the challenges, risks, and testing process for goodwill impairment. We’ll also look five case studies that show the impact of unaddressed goodwill impairment.

Need a reliable valuations & testing partner? Click here to learn about our goodwill impairment services. |

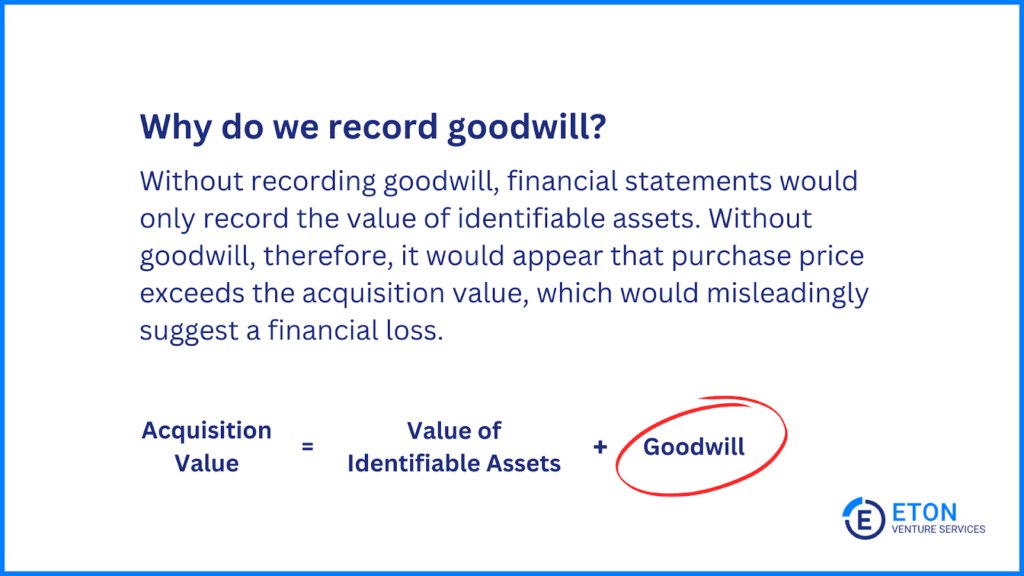

Goodwill is an intangible asset that arises when one company acquires another for a price higher than the fair value of its “identifiable assets”.

Identifiable assets include both tangible assets, like property, equipment, and inventory, as well as certain intangible assets that can be measured independently, such as patents, trademarks, or customer contracts.

Unidentifiable assets include more subjective things like brand reputation, customer loyalty, and employee expertise which can’t separately be measured.

For example, if Company A buys Company B for $5 million, but Company B’s identifiable assets are valued at $3 million, the $2 million excess is recorded as goodwill. This reflects non-identifiable factors like brand reputation, customer relationships, or employee expertise that the buyer expects to generate future economic benefits.

Goodwill is recognized on your balance sheet following Acquisition Accounting Guidelines, under the IFRS and GAAP.

To understand impairment, it’s helpful to know how this process typically works as it sets the foundation for assessing any potential loss in value:

Revaluing assets and liabilities: All existing assets and liabilities in the acquired company’s balance sheet are revalued at fair value. Often, there aren’t significant changes here, but sometimes hidden assets or liabilities are identified.

Recognizing unrecognized assets and liabilities: Intangible assets that may not have been previously recorded—such as self-created brands or customer contracts – are recognized at their fair value.

Calculating goodwill: The difference between the purchase price and the fair value of the acquired net assets is then recorded as goodwill on the acquirer’s balance sheet.

Goodwill impairment happens when the value of a company’s goodwill drops below what was originally recorded.

This happens for any number of “trigger” reasons, like when a business acquisition does not perform as expected or when external conditions change.

The impairment of goodwill is then recorded as an expense, directly decreasing the carrying amount of goodwill on the balance sheet.

For example, if you acquire a business for $5 million, recording $2 million of goodwill, but subsequent events suggest that the acquired business can no longer generate $1 million of anticipated returns, a goodwill impairment loss of $1 million might be recognized, reducing the goodwill value on the books.

In most cases, goodwill impairment is not good news. It signals that the value of the acquisition has dropped, reflecting a shift from the original plan.

It’s worth noting that, although investors and external stakeholders often see an impairment of goodwill as a signal of poor financial decision-making, these shifts aren’t always within management’s control. Sometimes, they result from forces beyond the company’s reach, such as economic recessions, competitive disruptions, and regulatory changes.

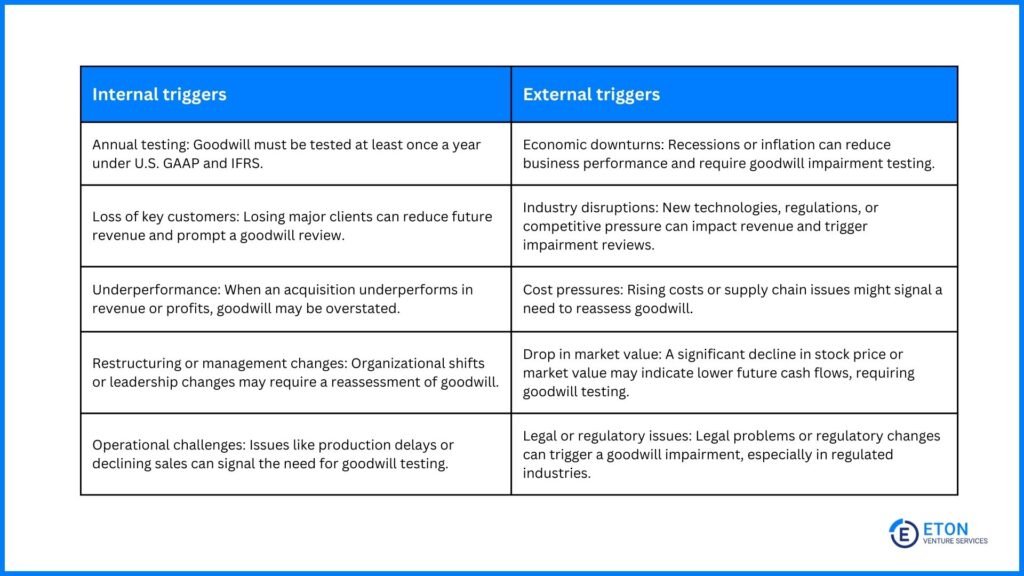

Triggering events are like warning lights for a finance team; they signal when it’s time to start goodwill impairment testing.

Goodwill impairment triggering events can be categorized into internal and external factors. Below, we’ve detailed the most important ones—read our full list of 30+ goodwill impairment triggering events here.

Goodwill impairment can be a tough reality, but it’s not inevitable. Fortunately, proactive measures can help reduce the risk and safeguard your financial health.

Here are key strategies you can implement throughout the acquisition process and beyond to protect your goodwill from unnecessary write-downs:

By building these strategies into your routine, you’ll also be better equipped to handle goodwill impairment testing with confidence.

Once you’ve determined that goodwill impairment testing is needed due to a trigger event like a market downturn or changes in performance, the next step is calculating the impairment loss.

If your company is based in the U.S., you’ll use GAAP. For companies outside the U.S. or those doing international business, IFRS is the appropriate standard.

Understanding which framework to follow is important, as the calculations and requirements may vary between GAAP and IFRS.

For first-time acquirers in particular, this can seem overwhelming, but it’s necessary for keeping your financials accurate and compliant with these accounting standards.

Here are the main steps to guide you through this process:

Often called “Step Zero”, U.S. GAAP permits companies to begin with a qualitative evaluation of external and internal factors to gauge whether it’s more likely than not that a reporting unit’s fair value is below its carrying amount (i.e. goodwill has been impaired). If the likelihood is below 50%, the costly quantitative test can be skipped.

In contrast, IFRS mandates impairment testing whenever there are clear indicators of impairment, without an option for a qualitative step.

Next, it’s important to determine which reporting units (under U.S. GAAP) or cash-generating units (under IFRS) will be subject to the goodwill impairment test.

These units are the basis for evaluating potential impairment, as they represent the smallest identifiable business divisions that generate largely independent financial data or cash flows.

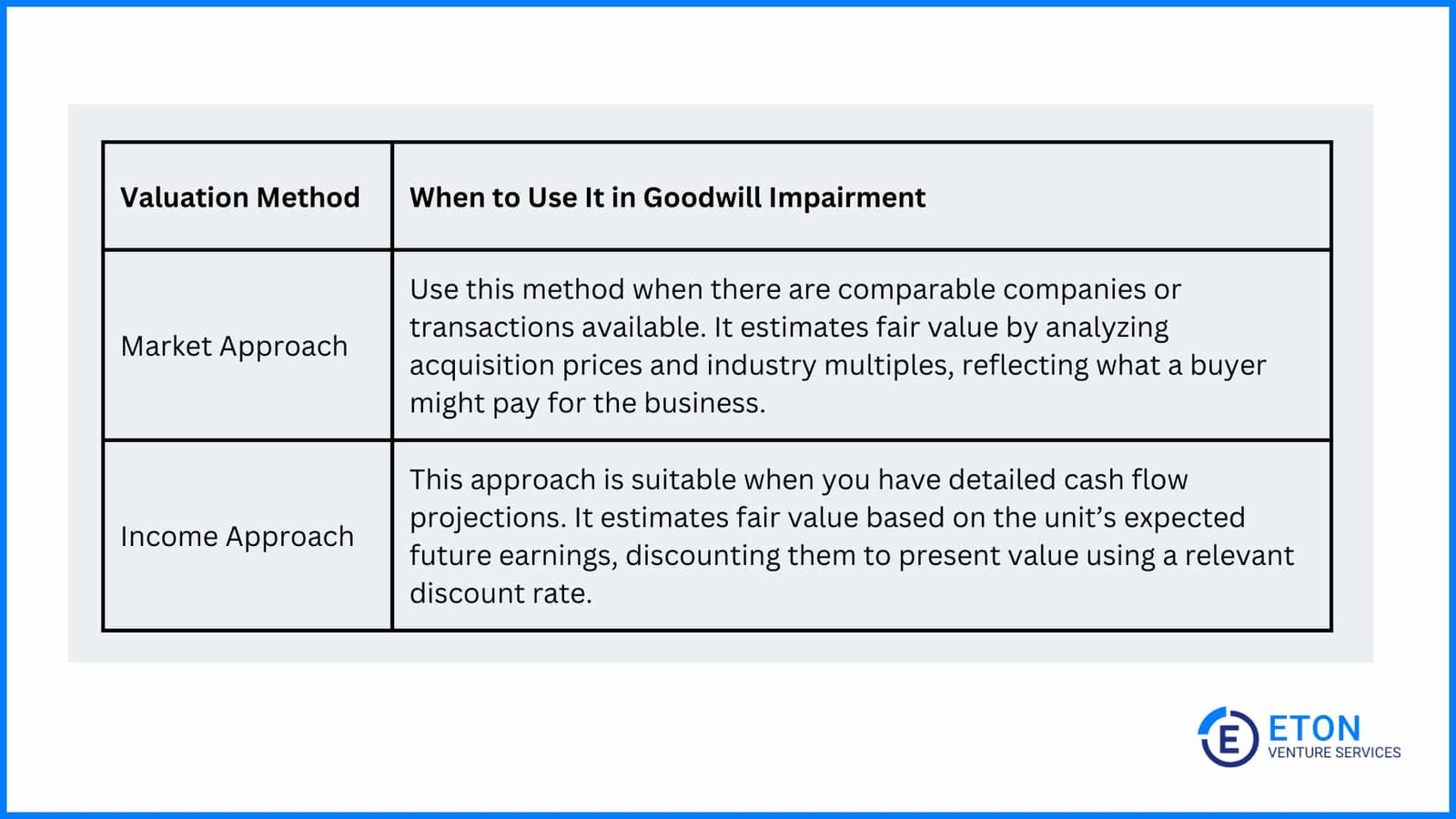

If the qualitative assessment suggests potential impairment, or if IFRS standards apply, the company must perform a quantitative test to determine the fair value of the reporting units (U.S. GAAP) or CGUs (IFRS).

This involves using recognized valuation methods, such as the market approach and income approach, either individually or in combination, depending on the business’s specific circumstances.

The selection of these methods is done on a case-by-case basis to ensure the most accurate valuation. Here are some factors to consider:

Need expert support? We’ve done 1,000s of valuations for goodwill impairment testing. Contact us here.

After running the quantitative test, it’s important to check that your fair value estimates aren’t too dependent on just one set of assumptions.

Sensitivity analysis helps by testing how changes in key factors, like discount rates, growth forecasts, or market conditions, affect the fair value of your reporting units or CGUs.

By looking at different scenarios, from best case to worst case, you can see how much the results might change and understand the risks involved.

Under ASC 350, companies compare the fair value of the reporting unit, including goodwill, with its carrying amount. If the carrying amount exceeds the fair value, it suggests potential impairment.

Similarly, IFRS requires comparing the CGU’s carrying amount to its recoverable amount (the higher of fair value less costs of disposal, or value in use). If the carrying amount exceeds the recoverable amount, impairment is indicated.

Once impairment has been identified, the impairment loss is calculated based on the difference between the carrying amount and the appropriate fair value (ASC 350) or recoverable amount (IFRS).

The impairment loss is then recorded as an expense on the income statement, reducing net income for the period, and the carrying amount of goodwill on the balance sheet is reduced accordingly.

Finally, companies must disclose details about the impairment, including the financial impact and reasons behind it, to ensure transparency with stakeholders.

As you move through the steps of goodwill impairment testing, staying proactive is key to avoiding costly surprises.

Regularly monitoring both market conditions and internal performance can help you identify potential impairment triggers early.

By conducting periodic reviews and keeping your financial data up to date, you can address issues before they escalate, ensuring your business remains compliant and avoiding significant last-minute write-downs.

Now, you might be wondering how goodwill impairment plays out in real-world scenarios. Below are some real-world goodwill impairment examples that illustrate how various businesses have experienced goodwill impairment due to different triggering events:

The merger between AOL and Time Warner, once seen as a groundbreaking deal in 2000, quickly became an example of a business move gone wrong.

After the merger, the combined company struggled with internal issues like clashing corporate cultures and poor strategic decisions. They also faced a rapidly changing digital environment that they couldn’t keep up with.

By 2002, the company’s market value had dropped significantly below what was expected. This loss in value led to a large reduction in the company’s goodwill.

The downfall of AOL-Time Warner shows how challenging it can be to merge companies, especially when expectations aren’t met and market conditions change.

In 2014, Microsoft acquired Nokia’s smartphone division for $7.9 billion to gain a foothold in the mobile market.

However, it soon faced strong competition from Apple and Android, and consumer interest in Microsoft’s Windows Phone remained low.

By 2015, Microsoft took a $7.6 billion goodwill impairment, nearly the entire acquisition cost, reflecting Nokia’s diminished value in a fast-evolving market.

This serves as a reminder of how quickly technological shifts can disrupt industries and diminish the expected value of an acquisition.

In 2018, General Electric (GE) recorded a $22 billion goodwill impairment, primarily related to its 2015 acquisition of Alstom’s power business.

GE anticipated substantial growth in traditional power generation, especially from natural gas and coal. However, as renewable energy gained traction, demand for fossil-fuel-based power declined.

This miscalculation led to a sharp drop in GE’s expected cash flows from the division, and the resulting impairment left its power business with no remaining goodwill.

This example highlights the risks of overpaying for acquisitions without fully considering shifting market trends, as well as the financial consequences that can follow.

In 2019, Kraft Heinz took a $15.4 billion goodwill impairment, largely due to the declining value of its Kraft and Oscar Mayer brands.

This massive write-down was caused by aggressive cost-cutting measures from 3G Capital, which reduced spending on research, development, and quality control.

These cuts hurt the company’s long-term brand strength and damaged customer relationships, forcing Kraft Heinz to reassess the value of its brands.

The impairment highlighted the risks of overestimating brand value and not adapting to changing market trends.

These case studies clearly show how factors such as market shifts, technological advancements, and strategic miscalculations can lead to significant goodwill impairments across industries.

They’re a good reminder for businesses to stay aware of potential risks and proactively manage their intangible assets to maintain value and protect their balance sheets.

Managing Goodwill Impairment to Protect Your Business

Goodwill impairment is more than a technical accounting adjustment. It reflects how real-world challenges, from market shifts to industry disruptions, can impact a company’s most valuable assets.

As highlighted in the examples above, businesses across industries have faced significant write-downs, underscoring the importance of proactive management of goodwill.

To accurately assess goodwill and avoid major financial impacts, it’s important to seek professional guidance. Experts help companies identify potential risks early, maintain compliance with financial standards, and provide clear and accurate valuations.

This support is necessary for avoiding misstatements, protecting financial health, and ensuring that a company’s balance sheet reflects its true value.

Goodwill is important in mergers and acquisitions because it represents the premium paid for intangible assets that can’t be separately identified, such as brand reputation, customer loyalty, and market position.

These elements, although not recorded as individual assets, contribute to the overall value that the acquiring company expects to gain from the purchase.

By accounting for these intangible benefits, goodwill helps justify the price paid for an acquisition that exceeds the fair value of the identifiable net assets, reflecting the long-term potential the buyer sees in the acquired business.

Goodwill is recognized on the balance sheet when a company acquires another business, and the purchase price exceeds the fair value of the acquired company’s net identifiable assets and liabilities. The difference, known as goodwill, is recorded as an intangible asset.

During the acquisition process, the company revalues the acquired assets (both tangible and intangible) and liabilities to fair value, and any excess of the purchase price over this valuation is attributed to goodwill.

Goodwill impairment is triggered by events such as declining cash flows, market downturns, changes in consumer behavior, or internal restructuring. Companies must then determine whether goodwill impairment has occurred through an impairment test, which evaluates whether the carrying value of goodwill on the balance sheet exceeds its recoverable amount, often measured by the fair value of the business unit.

If the business unit’s fair value falls below its carrying value, the impairment is recorded as an expense, reducing the value of goodwill on the balance sheet.

Goodwill must be tested for impairment at least annually. Additional tests are required if triggering events occur, such as significant declines in cash flows, market disruptions, loss of key customers, or economic downturns, which indicate potential impairment.

Goodwill impairment offers investors a clearer understanding of a company’s true financial condition by recognizing that certain intangible assets may no longer provide expected future benefits.

While it improves transparency, a significant goodwill impairment can indicate deeper operational or market issues within the company, potentially leading to a drop in stock prices and reduced investor confidence.

As a result, large impairments are often seen as warning signals of underlying business challenges.

The tax implications of goodwill impairment can vary based on the country’s tax laws and the company’s specific situation. Here are the main tax impacts:

In short, goodwill impairment can reduce a company’s taxes through deductions, but the specifics depend on local tax laws and how the impairment is treated for tax and accounting purposes.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.