Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

In 2019, Kraft Heinz took a $15.4 billion goodwill impairment, largely due to aggressive cost-cutting by 3G Capital following the 2015 merger of Kraft Foods Group and H.J. Heinz Company.

This merger combined iconic acquired brands like Kraft, Heinz, and Oscar Mayer, with goodwill reflecting the premium paid for anticipated synergies.

However, instead of reinvesting in brand growth, deep cuts weakened supply chains and strained customer relationships, diminishing brand value.

For companies with goodwill on their balance sheets, this serves as a clear warning: neglecting signs of impairment risks overstated asset values and costly write-downs.

A proactive approach to identifying both internal and external goodwill impairment triggers can help safeguard your company’s financial integrity.

This article walks you through the key events to watch for, shares real-world examples of businesses that have faced these challenges, and offers clear strategies to help you monitor them effectively.

Key Takeaways

|

Need a reliable goodwill valuations & testing partner? Click here to learn about our goodwill impairment services. |

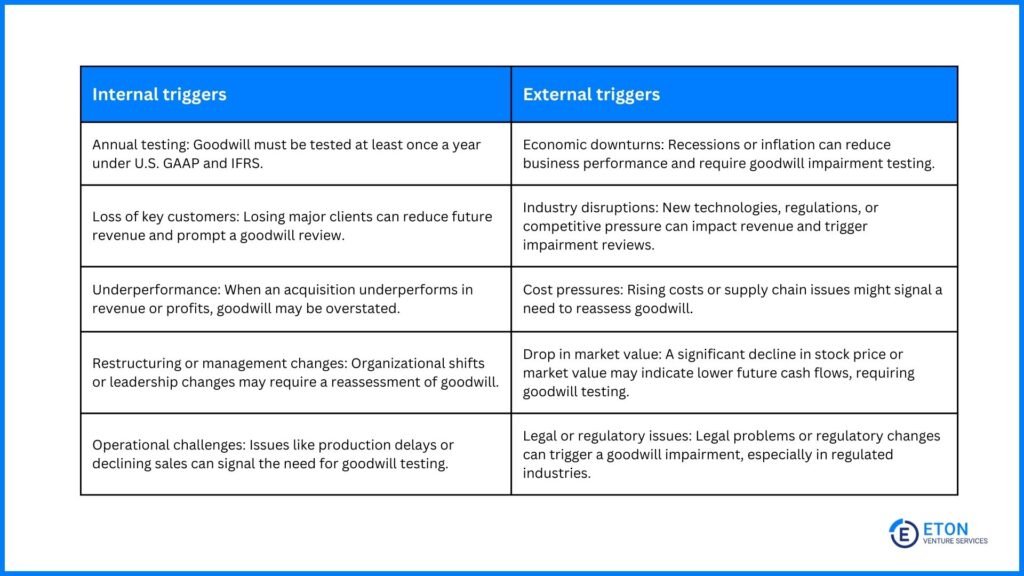

A ‘triggering event’ signals a critical financial checkpoint, indicating that a company’s goodwill may be overvalued and needs to be tested for impairment.

These events fall into two types: internal events – like unexpected drops in performance or major restructuring – and external shifts, such as economic downturns or regulatory updates.

As Eric Croak, CFP, President at Croak Capital, explains: “Too many people think of goodwill impairment as arising only when the company’s performance tanks. Really, goodwill impairment is just as likely to arise when the economy tanks, even if the company finds itself racking up record results.”

That’s why, under U.S. GAAP, goodwill impairment testing isn’t just a yearly check – it’s also required whenever these triggering events arise.

This means comparing the carrying value of goodwill to its fair value. If goodwill is overvalued, the difference is recorded as an impairment loss, which has direct implications for both the balance sheet and income statement.

On the balance sheet, goodwill is reduced by the amount of the impairment loss, lowering the company’s total assets. On the income statement, the impairment loss is reported as an expense, reducing net income for the period.

This ensures that the company’s financial statements accurately reflect its current financial position and that the overvalued goodwill no longer distorts its profitability and asset value.

Without understanding the specific events that trigger goodwill impairment, businesses can struggle to act before financial consequences set in.

Identifying these events early is key to maintaining accurate valuations and avoiding significant write-downs, which can distort companies’ financial position, undermine credibility with stakeholders, and expose them to legal and compliance risks.

Below are key triggering events to watch out for:

Economic downturns, such as recessions or inflationary periods, can significantly impact a company’s financial health.

During these times, consumer spending often decreases, and businesses may struggle to maintain previous revenue levels.

A prime example of this is the COVID-19 pandemic, which disrupted entire industries and forced many businesses to adjust their financial projections downward.

Supply chains were interrupted, demand for certain goods and services plummeted, and companies grappled with decreased cash flow.

In response, many had to reassess the value of their goodwill, as the long-term prospects they had originally anticipated were no longer viable.

Changes in interest rates can have a far-reaching effect on both consumer behavior and business operations.

When interest rates rise, the cost of borrowing increases for both individuals and companies. In turn, consumers may cut back on discretionary spending as loans and credit become more expensive, while businesses may find it more costly to finance their operations and expansions.

For companies that rely heavily on borrowing, this can severely impact cash flow and future earnings projections.

As a result, the company’s assets, including goodwill, may no longer hold the same value they once did, prompting a need for impairment testing.

Geopolitical events – such as trade wars, sanctions, or political instability – can cause major disruptions in the global market.

When a country is affected by these external factors, businesses operating in or heavily reliant on that region may suffer.

For instance, sanctions imposed on a country can block access to essential markets or suppliers, leading to decreased sales and higher operating costs.

Similarly, political upheaval can cause uncertainty and disrupt normal business operations, from production delays to consumer demand shifts.

In such situations, a company’s revenue projections may no longer be realistic, and the goodwill recorded on the balance sheet may no longer reflect the true value of the business.

Companies impacted by these forces often need to reassess their goodwill to ensure it aligns with their current market position.

Rapid technological changes can quickly make once-valuable products obsolete, impacting companies that struggle to keep pace.

A clear example is Microsoft’s 2014 acquisition of Nokia’s smartphone division. Microsoft aimed to expand in the smartphone market but soon found Windows Phone struggling against dominant systems like iOS and Android.

The anticipated value didn’t materialize, leading Microsoft to take a $7.6 billion impairment charge in 2015 – nearly the full amount paid for Nokia’s assets.

This write-off reflected how technological shifts had diminished Nokia’s market value, forcing Microsoft to reassess its goodwill.

Changes in laws or regulations can alter the competitive landscape for businesses, often in ways that significantly impact their future earnings.

For example, stricter environmental regulations may force companies to invest heavily in new technologies or face penalties, increasing operational costs and reducing profitability.

Industry-specific rules, such as those affecting financial institutions or healthcare providers, can have similar effects.

Thus, when regulations shift, companies may need to revise their financial projections and review their goodwill to account for increased costs and reduced profitability.

The competitive landscape of any industry can change overnight, often due to new entrants, shifts in consumer preferences, or the emergence of substitute products.

These shifts often challenge traditional business models, making it harder for companies to keep their market position or profits.

For example, the rise of streaming services disrupted the cable and media industries, forcing many companies to rethink their assets and growth strategies.

AT&T’s acquisition of DirecTV in 2015, intended to expand its television services, faced these challenges as consumer preferences shifted to streaming platforms.

By 2021, AT&T recorded a $15.5 billion impairment charge on DirecTV, recognizing that the future benefits they had anticipated were no longer viable.

In such cases, goodwill may need to be reassessed, as the benefits once expected from acquisitions may no longer match the company’s current situation.

Environmental disasters – such as hurricanes, wildfires, earthquakes, or floods – can severely impact a company’s assets and financial outlook.

When facilities are damaged, production is delayed, or operating costs rise due to these disruptions, the future cash flows that justified goodwill may fall short. This can trigger a need for an impairment test to adjust goodwill on the balance sheet.

If the disaster significantly affects long-term profitability or market position, a goodwill impairment may be required to reflect the company’s new financial reality.

A company that experiences a sustained decline in revenue, profit, or cash flow is likely overvaluing its goodwill. Walgreens, a major retail pharmacy chain, provides a clear example of this with its investment in VillageMD, a healthcare provider focused on primary care services.

Despite VillageMD’s underperformance, Walgreens delayed acknowledging the decline, which led to an eventual $5.8 billion goodwill impairment.

This situation not only showcases the impact of underperformance as a triggering event but also emphasizes the importance of businesses acting promptly when financial results fall short of expectations.

Waiting too long to reassess goodwill can lead to significant financial write-downs that could have been managed more effectively if addressed earlier.

A sharp decline in a company’s stock price can be a red flag that signals deeper financial challenges, such as reduced profitability or future growth concerns.

This drop may reflect market perceptions that the company’s earnings potential has weakened, often due to internal issues or external market pressures.

When this happens, the company must reassess its goodwill, as the previously recorded value may no longer be supported by the company’s current or future performance.

Losing major customers or contracts can drastically reduce a company’s revenue and profits. If a business depends heavily on a few key clients, the loss of even one can trigger the need for impairment testing.

Without these customers, a company’s future earnings may fall well short of its original projections, calling into question the value of its goodwill.

That’s why it’s necessary for companies to regularly assess customer relationships and the potential financial impact of losing them.

Mergers and acquisitions often change a company’s structure, making it necessary to reassess the value of its goodwill. The AOL-Time Warner merger in 2000 is a notable example of how internal restructuring can go wrong.

After the merger, the two companies struggled with cultural differences, misaligned strategies, and unmet performance goals. By 2002, these issues culminated in a massive $54 billion goodwill impairment.

This case shows how poor integration following a merger or acquisition can lead to a rapid decline in value, making it essential for businesses to carefully manage their goodwill during times of restructuring.

When a company sells off key assets or business units, the remaining operations may not support the same level of goodwill.

In such cases, a company must reassess whether the value of its remaining business justifies the goodwill recorded on the balance sheet. Failure to do so can result in overvaluation and the need for a later write-down.

A shift in leadership or changes in a company’s strategic direction can alter future cash flow expectations, triggering the need for goodwill impairment testing.

For instance, General Electric’s acquisition of Alstom’s power business was based on optimistic projections for traditional power generation.

However, the market for natural gas and coal declined as renewable energy gained momentum, resulting in a $22 billion goodwill impairment.

This example shows how misjudging future market conditions, particularly when linked to major strategic shifts, can lead to a significant decline in a company’s value.

Inadequate due diligence during an acquisition can result in overpaying for a business and, eventually, a significant goodwill write-down.

HP’s 2011 acquisition of Autonomy is a classic example of this. HP missed accounting irregularities at Autonomy, which later resulted in an $8.8 billion goodwill write-down.

This highlights the importance of thorough investigation and accurate valuation when acquiring new businesses.

A failure to properly assess risks during the acquisition process can result in substantial financial losses down the line.

When your business experiences a decline in goodwill, it can feel like your reputation and customer trust are slipping away. Ignoring the issue often leads to further financial damage, including lost revenue and a weakened brand.

If left unresolved, the erosion of goodwill can continue to hurt customer loyalty and public perception, leading to financial struggles and long-term reputational harm.

So, how should you respond? Here are some strategies to follow:

Start by determining the specific triggering event behind the goodwill decline. Whether it’s an external factor like an economic downturn or an internal issue such as restructuring, identifying the cause allows you to address the impact directly.

Use customer feedback, financial data, and market analysis to understand the underlying problem. Having a clear understanding of the root cause will guide you in taking effective action.

Once you’ve identified the issue, it’s necessary to address it openly with your customers and stakeholders. Be transparent about the problem and the steps you’re taking to resolve it.

Whether through public statements or direct communication with key clients, transparency builds trust. Clear, honest communication helps control the narrative and reassures stakeholders that you are committed to resolving the issue.

Words alone are not enough to regain trust. You need to take concrete actions, like improving customer service, updating messaging to reflect core values, or launching initiatives that directly address the issues at hand to re-engage your audience.

“For a client who faced backlash over insensitive marketing, we updated their messaging to align with company values and emphasize diversity and social responsibility. We hosted educational webinars and rebuilt trust through transparency. Referrals rose 43% in 9 months.” – Julie Ginn, Vice President Global Revenue Marketing, Aprimo

Demonstrating that you are actively working to improve shows customers that you value their trust and are committed to making things right.

A strong brand and well-aligned employees are key to rebuilding goodwill.

Invest in employee training to ensure they reflect your company’s values in every customer interaction. At the same time, run positive brand campaigns, highlight customer success stories, and engage in public relations efforts that reinforce your company’s image.

Strengthening internal and external perceptions of your brand helps repair goodwill and solidify your reputation.

Don’t leave your recovery efforts unchecked. Monitor progress closely using key performance indicators, customer feedback, and sentiment analysis. Stay flexible and adjust your strategies as needed to ensure that goodwill continues to improve.

Continuous tracking and adaptation will help ensure long-term success as you work to regain trust and restore your company’s reputation.

In conclusion, by taking quick, targeted action, you can not only repair the damage but also strengthen relationships with customers, stakeholders, and investors, rebuilding trust and loyalty across the board.

Goodwill impairment testing is not a one-time event. Companies need to implement proactive monitoring practices to identify potential triggering events promptly. Below are some best practices for maintaining vigilance:

Engaging valuation specialists and auditors isn’t just a good idea – it’s often necessary for ensuring the accuracy of your goodwill impairment testing.

At Eton, our experts bring a level of expertise and objectivity that can be crucial in validating assumptions, performing precise valuations, and ensuring full compliance with ASC 350.

Their insights help safeguard against costly errors and provide confidence that your financial reporting reflects the true value of your business.

After identifying a triggering event, a company should immediately conduct a goodwill impairment test to reassess the fair value of its goodwill. If the carrying value exceeds the fair value, the company must record an impairment loss. Regularly monitoring financial performance and market conditions can help companies identify triggering events early.

When goodwill is impaired, the company records an impairment loss on the income statement, lowering net income. On the balance sheet, the value of goodwill is reduced, which decreases total assets. This adjustment ensures the financial statements show the company’s assets at their fair value.

Not testing for impairment after triggering events can result in overstated assets and inflated earnings. This can damage investor trust, create legal risks, and lead to larger financial write-downs later. On the other hand, acting promptly ensures transparency and helps avoid more significant financial issues down the road.

Goodwill impairments are non-reversible; once an impairment loss is recognized, it permanently reduces the carrying value of goodwill. However, by addressing the root causes, such as improving business performance or adapting to industry changes, companies can rebuild financial health and restore stakeholder confidence.

Businesses can minimize the risk of goodwill impairment by regularly monitoring key performance indicators, maintaining strong customer relationships, staying updated on industry trends, and engaging in due diligence during mergers and acquisitions. Proactively identifying potential risks and responding early can prevent severe financial impacts.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.