Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Before you acquire a company, you want to know exactly what you’re committing to.

Beneath the reported numbers and projections, there can be (and our experience, always is) overlooked liabilities, inflated earnings, or operational inefficiencies that could change your perspective. That’s where your M&A due diligence is essential.

In this article, we’ll share how we approach Quality of Earnings in the M&A due diligence process for our clients.

This specific focus on financial due diligence will help you thoroughly assess your target company’s true financial health. However, we’ll also highlight other important parts of a complete due diligence checklist.

Key Takeaways

|

Due diligence is an investigation conducted during a merger or acquisition to evaluate the target company’s financial, operational, legal, and strategic standing. This helps identify potential risks and confirm alignment with the buyer’s objectives.

For buyers, this is a powerful and important process. It helps spotlight any hidden risks, liabilities, or inconsistencies that could derail the deal.

For sellers, it’s an opportunity to showcase value, build trust, and address any weaknesses before they become sticking points in negotiations. If done right, it can even boost the company’s perceived worth.

Ultimately, due diligence in M&A gives both parties the clarity and confidence they need to make informed decisions, laying the foundation for a smooth and successful transaction.

My team has supported private equity firms and in-house teams with 1,000s of M&A due diligence reports.

The stage where we consistently uncover the most valuable insights is during the Quality of Earnings (QoE) analysis—arguably the cornerstone of thorough financial due diligence.

While we’ll cover other types of due diligence later in the article, this stage reveals whether the business generates sufficient cash flow to sustain its operations and justify the investment.

The purpose of a QoE analysis is to ensure that profits come from ongoing, repeatable business activities rather than one-time events, accounting manipulations, or temporary boosts.

QoE analysis identifies two types of earnings:

Distinguishing these two types of earnings while preparing a QoE report offers several advantages:

For both parties, thorough financial due diligence reports strengthen trust, offer an independent perspective, and minimize post-closing disputes—ultimately increasing the likelihood of a successful deal.

QoE analysis helps peel back the layers of a company’s financials, revealing what’s really driving its profitability.

Here are 11 elements assessed in this part of the M&A due diligence process:

The report evaluates the quality and consistency of the company’s internal controls and recent changes in its accounting policies.

The purpose is to understand their impact on accounting records or stated earnings before interest, taxes, depreciation, and amortization (EBITDA).

It also identifies unusual trends in past financial statement preparation, atypical policies, and adjustments to procedures over time, highlighting their effect on earnings.

Additionally, it ensures compliance with accounting standards like GAAP or IFRS. This is to confirm that the financial statements are accurate, transparent, and follow recognized frameworks.

Proof of cash compares the company’s cash inflows and outflows with its financial statements.

By matching bank statements to recorded revenues and expenses, this analysis helps identify discrepancies and confirms that reported earnings align with actual cash activity.

It also provides a clearer view of the company’s cash collection cycles and overall financial health.

This component examines whether the company’s revenue is derived from stable, recurring activities or influenced by temporary factors, such as one-time contracts or seasonal spikes.

It also involves evaluating customer concentration risk. If a large portion of revenue depends on a handful of clients, this could pose a risk if those clients reduce orders or switch to competitors.

EBITDA is a key metric used to evaluate a company’s operating profitability by excluding factors unrelated to its core operations.

EBITDA normalization goes a step further by adjusting this figure to remove non-recurring or non-operating items, such as gains from asset sales or restructuring costs.

These adjustments help isolate the company’s true operational earnings, providing a clearer picture of its sustainable profitability.

Pro forma adjustments may also be applied to reflect expected post-transaction changes, such as cost efficiencies or operational synergies.

For example, these adjustments might account for shared services eliminating redundant costs. This helps buyers evaluate the company’s future earning potential.

EBITDA is often used to evaluate profitability, but it doesn’t account for taxes, capital expenditures, or working capital needs.

Thus, a free cash flow analysis provides a clearer measure of cash available for operations, debt repayment, or investor returns, offering a realistic view of financial flexibility.

Analyzing gross margins by product line or service provides insights into the company’s profitability trends.

A QoE analysis assesses whether margin changes are sustainable or driven by temporary factors like one-time cost reductions.

Accurate expense management ensures that all costs are properly recorded, classified, and matched with the corresponding revenue in the correct periods.

This way, the company’s financial statements show an honest picture of its performance, without errors or manipulations that could inflate profits.

Working capital, the difference between current assets (like cash and receivables) and liabilities (such as payables and short-term debts), is a measure of short-term liquidity.

A QoE analysis examines whether the company has enough liquidity to cover short-term obligations and continue operations without financial strain.

Additionally, it reviews debt and debt-like items, such as loans, leases, or contingent liabilities, to uncover obligations that could burden the business post-transaction.

A thorough QoE analysis reviews federal, state, and local tax returns to ensure compliance and assess deferred tax liabilities or credits that may impact post-transaction cash flow.

It also identifies aggressive tax strategies, underreported income, or pending liabilities, providing a clear view of the company’s tax position and potential risks.

Related-party analysis evaluates transactions between the company and closely tied entities, such as affiliated businesses or family-owned suppliers.

The focus is on ensuring these dealings occur at market rates—“arm’s length”—to prevent any distortion of the company’s financials.

It also identifies risks tied to these relationships, such as dependencies on key customers or suppliers that could be disrupted by a change in ownership.

Operational quality in a QoE analysis examines how well a company’s operations support sustainable earnings.

It involves assessing physical assets, intangible assets like intellectual property, supply chain stability, and the effectiveness of management and financial controls.

While this may seem similar to operational due diligence (which we’ll cover later in the article), the key distinction is that QoE emphasizes how operations drive earnings. On the other hand, operational due diligence examines broader operational risks and efficiency.

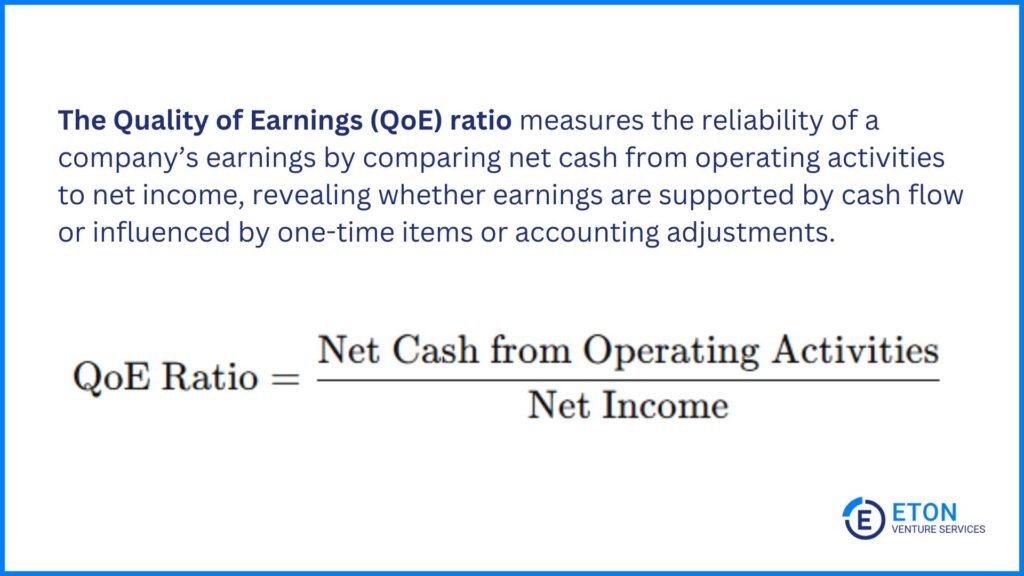

The QoE ratio quantifies a company’s earning “quality.” It’s calculated during M&A due diligence to make it easy to interpret the sustainability and reliability of earnings. To learn about this in more depth, we recommend reading our full guide here.

To calculate the ratio, divide the net cash from operating activities (found on the cash flow statement) by the net income (reported on the income statement).

Interpreting the QoE Ratio:

For instance, if a company reports $1.5 million in net cash from operating activities and $2 million in net income, the QoE ratio would be 0.75.

This indicates that the company’s net income isn’t fully backed by cash flow, which could raise concerns about the quality of the earnings.

A QoE analysis does more than just verify numbers—it sheds light on the risks that shape a company’s valuation.

Understanding these risks highlights key areas that demand further investigation or negotiation during the M&A process.

Here are some common risks to be aware of:

It’s important to note that these risks don’t always indicate fraudulent activity or deal-breakers, but they still require careful consideration because they can influence the final price.

Financial due diligence is just one (albeit important) lens through which to analyze a company.

A thorough M&A due diligence process takes a more holistic look at the company’s tax, legal, IT, human resource, and commercial standing.

Findings in these areas can either confirm or challenge the assumptions underlying a company’s valuation, potentially strengthening or weakening its appeal.

Let’s take a look at these one by one:

Tax due diligence focuses on reviewing the target company’s tax records and obligations to ensure compliance with tax laws and identify any potential tax risks.

This includes analyzing historical tax filings and outstanding audits, and evaluating how the merger or acquisition will impact the tax situation of the newly formed entity.

The goal is to identify any existing or future tax liabilities and ensure the structure of the deal is tax-efficient.

Legal due diligence examines the target company’s legal standing, including its corporate structure, contracts, and potential legal risks.

This involves reviewing agreements with customers, suppliers, and employees, as well as intellectual property rights.

It also includes checking for any ongoing or potential legal disputes, regulatory compliance issues, and risks related to the target’s industry, labor laws, and environmental regulations.

Interested in finding law firms to conduct legal due diligence for your startup? Read our article on the best 20 law firms here.

Operational due diligence looks into the target company’s day-to-day operations to identify areas where efficiencies or improvements can be made.

This includes assessing the company’s processes, supply chain, production systems, and organizational structure.

The analysis uncovers operational risks, bottlenecks, or redundancies that could impact the company’s performance post-acquisition.

IT due diligence focuses on the target company’s technology infrastructure and systems to ensure they are robust, secure, and capable of supporting future growth.

This includes reviewing the company’s IT systems, cybersecurity measures, and data management practices.

The goal is to identify any vulnerabilities, outdated technologies, or integration challenges that may arise after the acquisition.

Commercial due diligence evaluates the target company’s market position, customer base, and competitive landscape.

This type of due diligence seeks to understand the target’s commercial viability by analyzing market trends, customer demand, growth potential, and potential market risks.

It involves a deep dive into the company’s product or service offerings, market segmentation, pricing strategy, and customer relationships.

This helps assess whether the target has a sustainable competitive advantage and if it aligns with the acquirer’s strategic objectives, ensuring that the business has the potential for future growth and profitability.

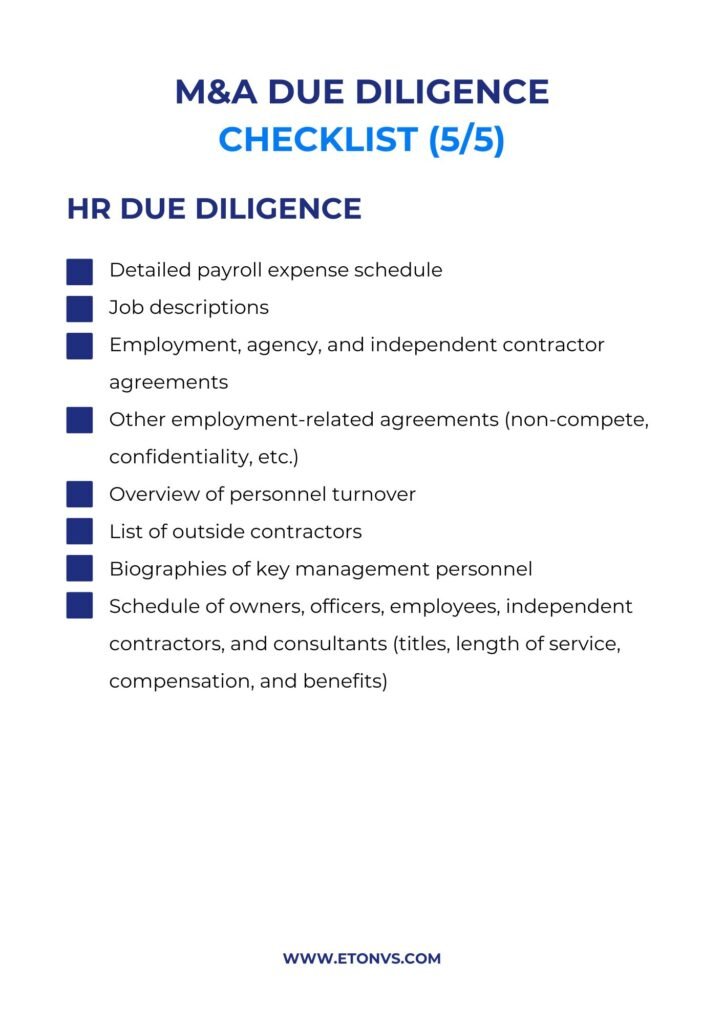

HR due diligence evaluates the target company’s people, policies, and workplace culture to ensure a smooth transition and retain key talent after the deal.

This includes reviewing employee contracts, benefits, compensation plans, and labor law compliance. It also examines leadership, team dynamics, and potential challenges like high turnover or management conflicts.

Addressing these issues early helps prevent talent loss, reduce integration risks, and support future growth.

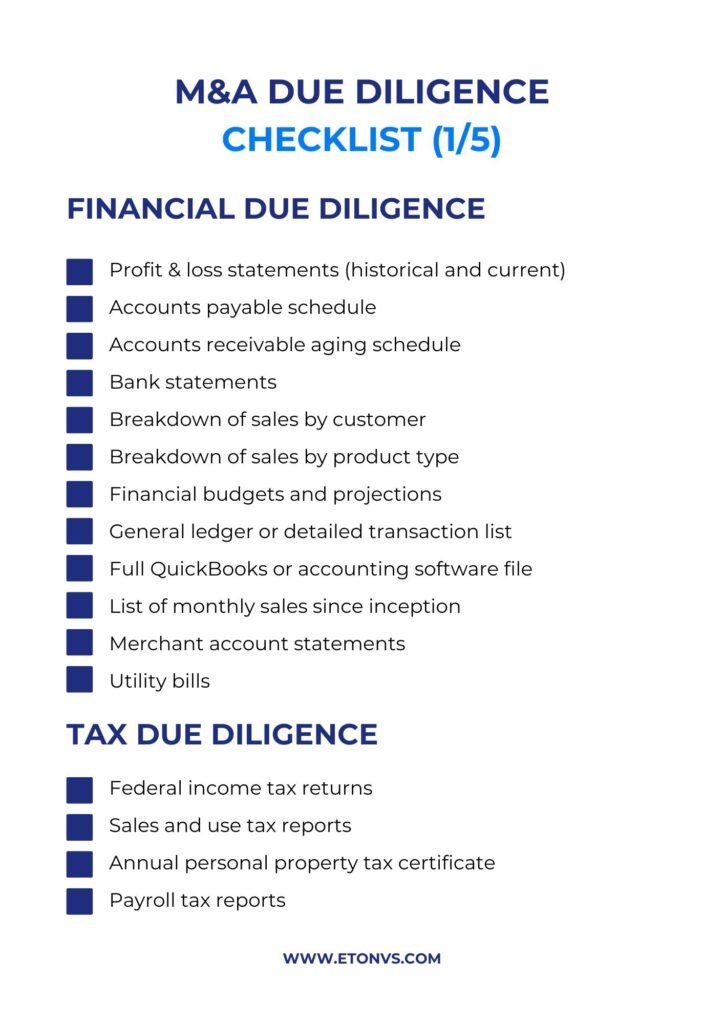

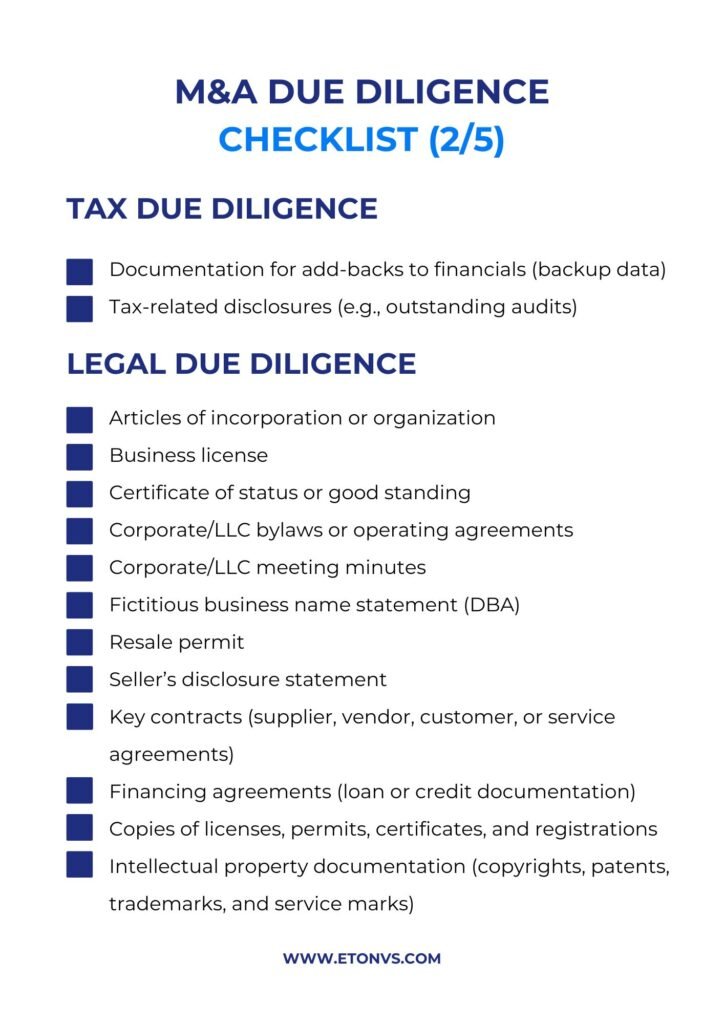

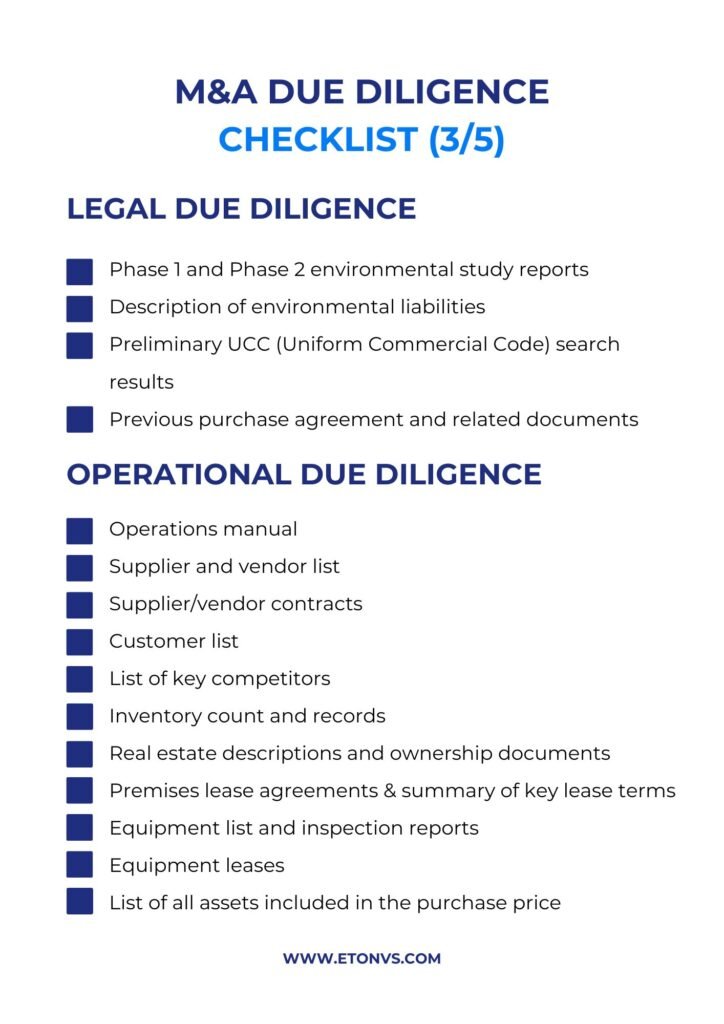

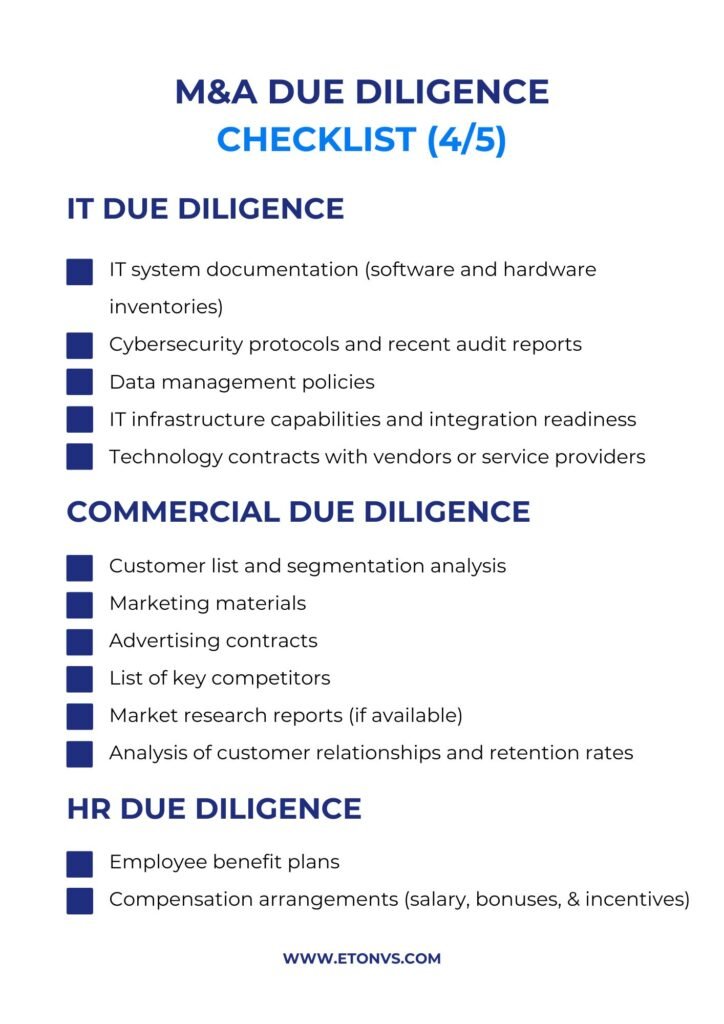

To wrap things up, here’s a checklist with the key documents needed for a thorough M&A due diligence process:

At Eton Venture Services, our commitment to excellence ensures that you receive the highest quality due diligence and purchase price allocation services during your mergers and acquisitions process.

Don’t settle for anything less than the best when it comes to your company’s financial reporting compliance and tax optimization.

Trust our team of experts to provide you with accurate, compliant, and independent valuations that protect your interests and ensure compliance while optimizing tax benefits.

Skipping M&A due diligence can lead to hidden liabilities such as undisclosed debts, legal disputes, or tax obligations, resulting in unforeseen costs. Buyers may also overvalue the target due to overstated financials or unsustainable earnings.

Additionally, operational misalignments and compliance issues can disrupt integration, reduce ROI, and damage the buyer’s reputation, potentially leading to deal failure.

A QoE analysis is typically conducted after the letter of intent (LOI) is signed and is a key part of financial due diligence.

It evaluates the reliability and sustainability of the target’s earnings by distinguishing recurring income from one-time gains or accounting adjustments.

This analysis helps confirm whether the company’s reported profits align with its actual financial health and identifies red flags like unstable revenue streams or aggressive accounting practices, ensuring a more accurate valuation before finalizing the deal.

The duration of M&A due diligence varies based on the deal’s complexity and size. On average, it takes a team of 10 around 6 weeks. In more complex deals, due diligence can extend to 90 days or longer.

Factors influencing the timeline include the thoroughness of the review, the responsiveness of both parties and the quality of the target company’s records.

M&A due diligence reports can cost anywhere from $5,000 for a basic report for a small business to over $100,000 for a detailed report on a mid-sized company.

The cost depends on factors like the size and complexity of the business, the clarity of its financial statements, how closely they follow GAAP, the industry, and the number of entities involved.

Larger businesses often need reports from reputable firms, which can raise the price.

Valuation is the cornerstone of M&A due diligence, offering a lens through which buyers assess a target’s true worth.

Beyond determining fair market value, it evaluates the sustainability of earnings, cash flows, and synergies that may justify the deal’s price.

A robust valuation framework also identifies risks, such as overvalued assets or hidden liabilities, that could undermine the transaction’s rationale.

This process works closely with due diligence to ensure a comprehensive analysis.

Valuation provides a critical reference point, while due diligence tests and validates the assumptions behind it, such as revenue projections or cost synergies.

Without valuation, due diligence lacks direction; without due diligence, valuation risks being based on flawed or incomplete data.

Post-deal, valuation insights also guide purchase price allocation and regulatory compliance, ensuring the transaction withstands scrutiny while delivering the expected returns.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.