Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Buying or selling a business can be overwhelming. The list of things to do seems endless.

Each decision feels monumental, and it’s easy to feel overwhelmed by the magnitude of it all.

One key process that you have to go through is purchase price allocation.

This is where you identify and value each asset, both tangible and intangible, as well as liabilities, of the company you’re about to acquire or sell.

If you overlook this or do it incorrectly, you could:

To help you navigate this topic, I put together this guide on purchase price allocation.

I’ll discuss what it is, why it’s important, and how to allocate purchase price for different asset classes.

Key Takeaways:

The allocation of purchase price in asset sale is the process of assigning the total price of a company to assets, such as buildings, trademarks, and loans.

When you acquire a company, you need to allocate the total purchase price across the assets obtained.

This is necessary to properly record the assets on the buyer’s financial statements and to determine the tax consequences of the transaction.

When allocating the purchase price, you need to consider key components such as tangible assets, intangible assets, liabilities, and goodwill.

Let’s look at each of them in detail.

Tangible assets are physical things the company owns, such as:

Allocating the purchase price to tangible assets means figuring out their true market value.

Fair or true market value is found out by considering factors such as age, condition, and market demand.

Intangible assets are non-physical assets that hold value for a company, such as:

The process of allocating intangible assets is more difficult as their value is subjective and based on future earning potential.

To ensure accurate and reliable valuation of intangible assets during the PPA process, I recommend you consider the following best practices:

Liabilities are what the company owes to others, such as:

Allocating the price to liabilities makes sure the buyer takes care of them and shows them correctly on their financial records.

Goodwill is an important part of PPA. It represents things like:

It is considered an indefinite-lived intangible asset and is not amortized but tested for impairment at least annually.

Accounting professionals calculate goodwill as the excess of the purchase price over the fair market value of net identifiable tangible and intangible assets.

Essentially,

Goodwill = Purchase Price – Fair Value of Identifiable Net Assets

Where:

Now that you understand the what, let’s get into the why.

Purchase price allocation is an essential part of a business sale or acquisition because it impacts financial reporting, taxation, and even the decision-making process.

Here’s how:

When a company acquires assets, it needs to accurately reflect their value on its balance sheet.

By allocating the purchase price to the different components of the transaction, the company can provide a clear and transparent representation of its assets’ worth.

For example, Tech Innovations buys another company called Gadget Corp for $1 million.

In financial reporting, Tech Innovations must show the true value of everything it got from Gadget Corp on its balance sheet.

So, it breaks down the $1 million:

Now, Tech Innovations’ balance sheet clearly shows not just a $1 million purchase but exactly what that $1 million bought.

This information is crucial to make sure investors, lenders, and other stakeholders make the right financial decisions.

Taxation is another area where purchase price allocation plays a significant role.

Different components of an asset sale may have different tax implications.

For example:

By properly allocating the purchase price, businesses can figure out the tax liabilities for each asset bought or sold.

Both the buyer and seller must complete IRS Form 8594 during the sale to report the sale and purchase of business assets.

The form helps categorize the business into its different components.

By accurately filling out Form 8594, businesses can correctly determine the tax implications of each component.

This information is crucial for tax planning purposes and ensures compliance with applicable tax laws and regulations.

PPA affects whether buyers and sellers go through with a deal.

Buyers use it to see the real worth of what they’re buying.

This knowledge helps them make informed decisions about the potential return on investment and the overall financial impact of the transaction.

Sellers use purchase price allocation to negotiate a fair price for their assets and maximize their financial gains.

For example, GlobalTech is considering buying InnovateTech for $5 million.

During the PPA process, it finds risks in patents’ validity and customer loyalty, lowering its value.

Despite InnovateTech’s market potential, GlobalTech doubts the deal’s worth.

Now without a price adjustment or resolution, the deal risks falling through.

![How to Allocate Purchase Price in Asset Sale [3 Steps]](https://etonvs.com/wp-content/uploads/2023/11/3-Step-Purchase-Price-Allocation-Process--1024x576.jpg)

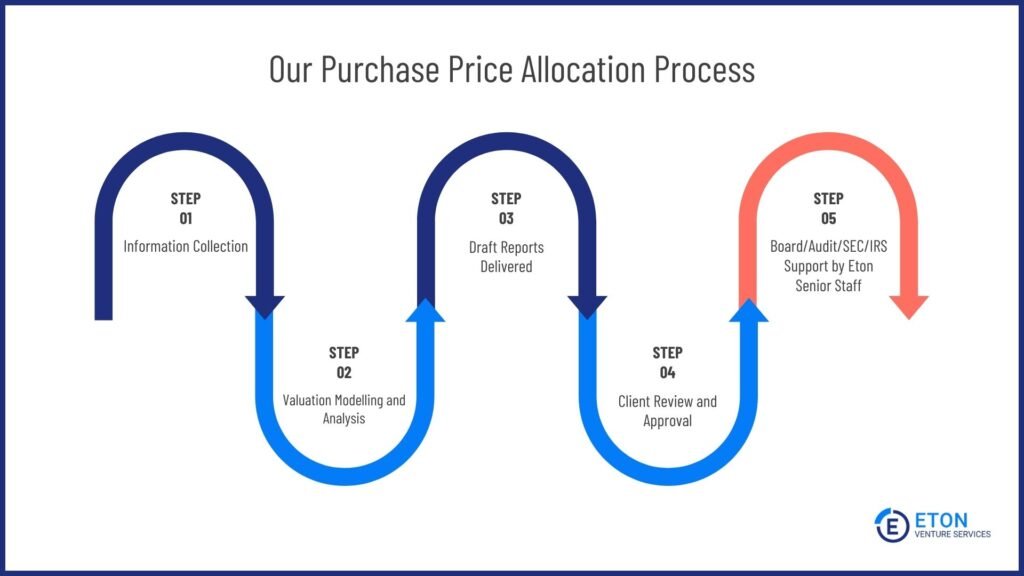

Here is what a typical PPA process looks like in detail:

The first step in the allocation process is to identify the assets and liabilities and how much they’re worth.

This involves assessing each component’s fair market value and considering factors such as the asset’s condition, market demand, and future earning potential.

Additionally, parties may enlist the expertise of valuation professionals to ensure accurate assessments.

Valuation professionals use different methods, such as:

Which of the three approaches fits your business well depends on your business stage:

Generally speaking, early-stage start-ups that have raised funding but aren’t yet profitable will rely on the market approach.

It is because it’s hard to guess future earning potential at this stage.

If the company has neither funding nor revenue, use the cost approach.

It’s because at this stage, the company is unable to reliably forecast financials.

The income approach is often applied to businesses that are bringing in revenue with a positive cash flow.

They will be able to forecast financials.

At Eton, our s look to see if one (or all three) approaches fit your situation and will continue to consider them as options throughout the valuation process.

Other than the business stage, we also look at the following factors when doing PPA:

Every PPA is unique, and the emphasis on these factors can vary depending on the specific circumstances and characteristics of the company being valued.

Your company might have considerations that another wouldn’t.

→ During the valuation analysis, it’s also important to consider any intangible assets that may be present, such as patents, trademarks, or customer relationships.

These assets can have significant value and should be properly identified and valued.

Once the analysis is complete, the next step is to determine the fair market value of each asset or liability.

This is crucial as it serves as the basis for allocating the purchase price.

Simply put, fair market value is the price that the buyer is willing to pay and the seller is willing to accept for an asset or liability—provided that both parties know the important details and neither is being forced to buy or sell.

It’s generally determined through a combination of methodologies, such as income approach, market approach, and cost approach.

In some cases, the fair market value may be determined by using observable market prices.

For example, if the asset being valued is a publicly traded stock, the fair market value can be determined by looking at the current market price.

The final step in the process involves allocating the purchase price among the identified components. This is typically done based on their relative fair market values.

The allocation should be well-documented and supported by credible evidence to ensure compliance with relevant accounting and tax regulations.

It’s important to note here that the allocation of purchase price can have significant financial and tax implications for both the buyer and the seller.

It can also have a huge impact on future financial reporting, as it affects the values assigned to the acquired assets and liabilities.

This is why it’s best to work with a qualified professional who can provide an accurate, reliable, and court-defensible allocation.

This way the PPA gets safe harbor status from the IRS, meaning the onus is on them to prove that the PPA is inaccurate if audited.

The PPA process is complex, and requires a deep understanding of financial modeling, tax laws, and market analysis.

At Eton, our main goal is to help you navigate through this, while providing you with the most accurate PPA valuation in as short as 10 days.

Our Big-4 trained experts understand the complexity of purchase price allocation, and have proven track record in helping clients gain confidence in their fair value reporting.

We’ve fine-tuned the PPA valuation process to be as smooth as possible for you.

This is how it will look like if you work with us:

Book a call with me today to discuss your PPA needs.

If you are conducting the purchase price allocation on your own, I recommend you to follow these best practices to get the most accurate valuation:

When allocating the purchase price of a business, you must value each asset class separately.

Then, distribute the total sale price across the asset classes based on their relative fair market values.

The asset classes typically include tangible assets like inventory, equipment, and real estate as well as intangible assets such as intellectual property, customer relationships, and goodwill.

The valuation methodology selected depends on the nature of the asset.

For tangible assets, methods like replacement cost or market comparison are often used.

Intangible assets require more complex methods, such as the income approach or cost approach.

The valuation methodology must be well-documented to substantiate the allocation.

The purchase price allocation has significant tax consequences for both the buyer and seller.

Assets are depreciated or amortized over time for tax purposes, so their classification and valuation impacts the deductibility of expenses.

The allocation also determines whether the sale is taxed as an asset sale or stock sale for the seller, which can impact the tax rate.

I advise you to consult tax professionals to get this squared away.

Any amount of the total purchase price remaining after allocating values to the identifiable assets is allocated to goodwill.

Goodwill represents intangible assets like reputation, brand, and competitive position.

While goodwill is not depreciable for tax purposes, it must be valued to determine the appropriate allocation of the purchase price.

If you need a fast, accurate, and reliable purchase price allocation support, please get in touch with me here.

Have more questions about purchase price allocation? I answered them below:

The main asset classes are:

This includes tangible assets used in the business like machinery, equipment, furniture, fixtures, and vehicles. These long-lived assets are valued at their fair market value, establishing the equipment value based on the price that would be received in an orderly transaction between market participants.

Due diligence is a crucial aspect of the purchase price allocation process during mergers and acquisitions (“M&A”) and business combinations.

Thorough due diligence helps ensure that the PPA is accurate, compliant with accounting standards, and optimized for tax purposes.

We wrote an extensive guide on due diligence here.

At Eton, we can deliver a purchase price allocation report in 10 days. We can even turn it around in as short as 1 day for an extra fee.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.