In the landscape of higher interest rates, the incidence of distressed businesses is increasingly prominent. This trend is not limited to startups aiming for exponential growth but also encompasses established enterprises navigating through economic downturns. In assessing distressed businesses for sale, the transition from financial health to distress can be swift and unforgiving, making the accurate valuation of such businesses paramount for stakeholders. This guide, presented by Eton Venture Services, explores the nuances of valuing distressed businesses for sale, offering essential insights for investors, executives, and professionals in related fields.

In today’s global commerce landscape, the phenomenon of distressed businesses has become more noticeable, marking a significant trend that spans across startups and established corporations alike. The shift from financial health to distress underscores the critical need for precise business valuation. This guide delves into the intricacies of such valuations, shedding light on recent developments that underscore the urgency and complexity of these assessments.

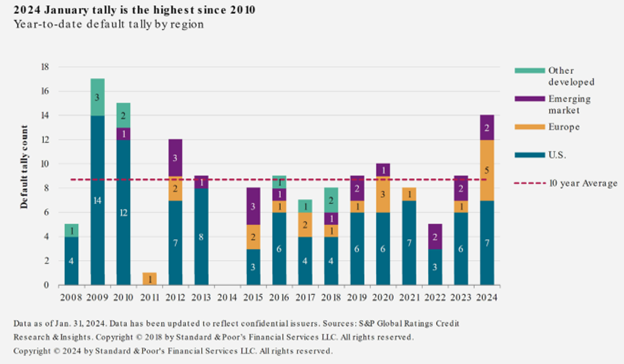

As noted in Pitchbook’s Global Distressed Credit Weekly Wrap February 16, 2024 (the “Global Distressed Credit Report of Feb. 16, 2024”), the beginning of the year saw a notable uptick in business defaults, with the global corporate default count reaching 14 in January, the highest for the month since 2010. This trend is not isolated, with the U.S. leading in corporate defaults, followed closely by Europe and emerging markets. This rise is attributed to several factors, including weak business risk profiles, highly leveraged capital structures, and impending debt maturities.

Particularly affected sectors include Consumer Products and Media & Entertainment, which have shown a higher propensity for defaults. Distressed exchanges contributed significantly to these defaults, highlighting the challenges businesses face with looming debt obligations.

The Global Distressed Credit Report of Feb. 16, 2024 also noted that the S&P expects overall defaults to remain elevated given the high number of downgrades to CCC+ and lower ratings.

Per the Global Distressed Credit Report of Feb. 16, 2024, S&P Global Ratings also noted in a separate report that it projected the U.S. speculative-grade corporate default rate will reach 4.75% by the end of 2024 under a base case scenario, representing 80 defaults. A pessimistic case could result in a 6.75% default rate and 114 defaults, while an optimistic case may yield a 3.25% rate and 55 defaults.

S&P noted the 4.75% year-end rate “may include a peak default rate earlier in the year.” Previously in November 2023, S&P projected the default rate would hit 5% by September 30, 2024, under a base case.

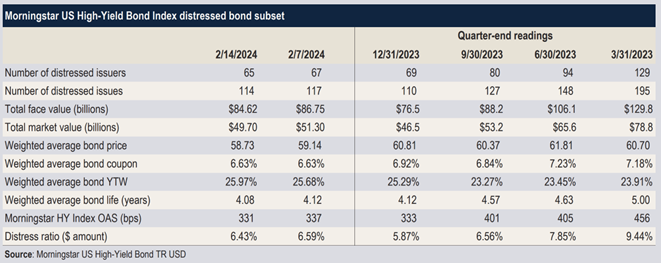

The Morningstar US High-Yield Bond Index Distress Ratio

Further insight into the state of distressed businesses can be gleaned from the Morningstar US High-Yield Bond Index, which saw a reduction in its distress ratio, indicating a slight contraction in the market value of distressed issues, as cited in the Global Distressed Credit Report of Feb. 16, 2024.

This data, reflecting changes in distressed bond prices and yields, provides a nuanced view of the market’s response to distressed businesses, with sectors such as Media, Healthcare, and Telecommunications showing significant numbers of distressed issues.

The recent developments emphasize the importance of taking a nuanced approach when valuing distressed businesses. Key steps in the complex valuation process include identifying the specific type of distress and understanding broader market trends. With the rise in defaults and changing dynamics of distressed bonds, valuation professionals must incorporate forward-looking assessments and consider sector-specific vulnerabilities to accurately evaluate a distressed business’s worth.

Evaluating a distressed business for sale involves using similar methodologies as those used for healthy companies, with important adaptations to address the unique challenges these companies present. Valuators scrutinize financial data, assess the business and industry context, and gauge the company’s earnings generation capacity. However, the behavior of troubled companies necessitates a modified approach.

Normalization of Operating Results

A primary challenge in distressed business valuation is normalizing operating results. This process, common to all valuations, involves adjusting the company’s financials to exclude nonrecurring or extraordinary items, allowing valuators to project earnings under typical operational conditions. For distressed businesses, this adjustment is critical, as it helps isolate the core operational performance from the noise of financial distress.

Identifying the Reasons Behind Underperformance

Grasping the factors behind a company’s subpar results is essential for a precise valuation. Issues like deficient leadership or onerous debt could present prospects for boosted worth under new control or with access to altered resources. On the other hand, problems like waning demand or outdated technology might signify barriers to profitability restoration that cannot be overcome.

When Valuing Distressed Businesses for Sale, a Forward-Looking Approach is Required

For companies experiencing financial distress, the valuation methodology must take a predominantly forward-looking perspective, unlike the retrospective performance-based approach used for healthy businesses. This process involves determining the underlying causes of the distress, evaluating whether these issues are addressable, and forecasting likely earnings going forward based on planned managerial or operational changes. This method recognizes that the historical performance of distressed enterprises may not reflect their prospective potential, requiring an analytical and predictive valuation technique tailored to their specific circumstances.

The Discounted Cash Flow (DCF) method, adapted for distressed businesses, introduces adjustments for default risk when calculating expected cash flows. Expected cash flows are calculated as the sum of estimated cash flows under each scenario multiplied by the probability of the respective scenario. This nuanced adjustment accounts for the elevated uncertainty in distressed scenarios, significantly impacting future cash flow projections.

To refine the discount rate for distressed companies, the following adjustments are made:

This approach combines traditional DCF analysis with an additional layer for distress valuation. Value of equity is calculated as the DCF value of equity on an ongoing concern basis multiplied by one minus the probability of distress, plus the distress sale value of equity multiplied by the probability of distress. Key steps include conducting the valuation with the going concern assumption, determining the probability of distress, and estimating the distress sale value of equity.

This method is split into two strategies for distressed companies:

These expanded methodologies underscore the complexities of valuing distressed businesses, demanding bespoke adjustments and a forward-looking perspective to accurately capture their value and potential for stakeholders.

Revising future cash flow forecasts for a struggling company requires a thorough analysis of how strategic changes could boost revenue creation and cost efficiency. For instance, a struggling retail chain could potentially see revenue increases through expanding e-commerce or optimizing store locations. Simultaneously, cost cuts could be projected by renegotiating supplier agreements or implementing more effective inventory management systems.

These revisions necessitate a deep comprehension of the business’s operational factors and the market it functions within. Analysts may employ scenario planning to assess various strategic initiatives’ impacts under alternative market situations, providing a range of probable results that mirror the uncertainty inherent in rehabilitating struggling companies.

The Market Valuation Approach values a business based on how comparable companies are valued in the marketplace. This approach can be challenging for distressed businesses due to the lack of direct comparables and the distressed company’s unique circumstances. However, by making nuanced adjustments and carefully selecting comparable companies, this method can provide valuable insights into the market’s perception of value for businesses in similar industries or with similar distress levels.

In selecting and adjusting comparables, identifying comparable companies involves looking at firms within the same industry or facing similar distress levels, adjusting for differences in size, market presence, and financial health. These adjustments may include normalizing earnings before interest, taxes, depreciation, and amortization (EBITDA) for non-recurring expenses or extraordinary items to achieve a more accurate comparison.

Furthermore, the valuation expert must consider the broader market conditions, such as industry trends, regulatory changes, or economic cycles, that could impact the distressed business’s value relative to its comparable companies. This comprehensive approach allows for a valuation that reflects not only the distressed company’s current state but also its potential for recovery in the context of market dynamics.

The Cost Approach provides an estimate of the net realizable value of a distressed company’s assets if sold individually rather than as an ongoing concern. This approach is particularly relevant when a business’s liquidation is more probable than its turnaround. It establishes a floor value for the business by ensuring stakeholders understand the minimum value that could be recovered through a liquidation scenario.

Estimating the net realizable value involves assessing the liquidation potential of each asset, such as inventory, property, equipment, and intangible assets like patents or brand names. This assessment must account for the costs of selling these assets, potential market demand, and the time required to complete the liquidation process.

The Cost Approach underscores the importance of maintaining a thorough inventory and valuation of assets. It offers a pragmatic perspective on a distressed business’s worth. Furthermore, it serves as a critical component of a comprehensive valuation strategy by ensuring all potential exit paths are considered.

Specialized firms can provide deep technical knowledge and expertise in articulating complex financial concepts, which is crucial for creating robust valuation analyzes of distressed businesses and defending those valuations in challenging contexts such as litigation or bankruptcy proceedings.

Specialized firms can help potential buyers and create robust valuation analyzes for distressed businesses in the following ways:

By leveraging the expertise of specialized firms, potential buyers can make more informed decisions about the purchase of distressed businesses and navigate the complexities of valuing these companies more effectively.

Valuation professionals must consider current market trends, with insights from Pitchbook and Morningstar shedding light on sector-specific distress and market dynamics. These insights inform the selection of comparables and adjustments in cash flow projections, shaping valuation strategies.

Thorough due diligence is essential when acquiring a distressed business. A comprehensive examination of financials, assets, liabilities, operations, market position, and legal obligations must be conducted to uncover all risks and issues. Inadequate due diligence may obscure critical details, leading to unfavorable outcomes post-acquisition.

An understanding of industry-specific trends is also important, as sector dynamics significantly influence valuation and recovery potential. Prospective acquirers should incorporate insights from sources like Pitchbook and Morningstar into their evaluations, customizing their approach to nuanced forecasts within the relevant market.

Identifying the true causes of financial distress, such as inefficient operations, market shifts or management issues, is key to developing an effective turnaround strategy. Failure to accurately diagnose the root problems can hinder implementation of recovery measures.

Proper deal structure impacts risk exposure and success. An asset purchase, for example, may limit liabilities while allowing selection of desired assets. Understanding acquisition methods like ordinary transactions, assignments for creditors, Article 9 purchases and bankruptcy is critical to choosing the optimal approach.

A comprehensive, actionable turnaround plan addressing operational, financial and market strategies tailored to the unique situation and goals is also needed. Lack thereof could stall or reverse recovery efforts post-acquisition.

Engaging experienced advisors provides invaluable guidance across due diligence, valuation, structuring, and planning to reduce errors and oversights. Prospective acquirers must recognize challenges unique to distressed situations and the sale process itself. Setting realistic expectations and strategies ensures informed decision-making aligned with objectives and risk tolerance. Careful consideration and strategic planning across these areas can significantly reduce acquisition risks while facilitating a smoother process and enhancing prospects for successful turnaround and value realization.

This guide provides strategic insights for valuing and acquiring distressed companies. A sophisticated grasp of valuation methods, industry trends, and strategic deal structures is crucial for this process. This resource aims to supply investors with the expertise required to navigate the associated complexities. Strong emphasis is placed on expert counsel and thorough planning. A strategic methodology enables investors to find and benefit from opportunities within the distressed market, promoting renewal and expansion. Comprehensive analysis and a well-thought-out approach are paramount for success.

At Eton Venture Services, we are dedicated to providing you with professional business valuation and advisory services that go beyond the ordinary. Don’t settle for software-driven “form” models or inexperienced teams when it comes to the critical financial assessments in business valuation. Rely on Eton’s team of experts to deliver rigorous, in-depth assessments of your target company’s financial performance, enabling you to make better-informed decisions. Join the industry leaders who have already experienced the advantages of Eton’s exceptional client service and businss valuation and advisory expertise. Let us navigate you through the complexities of business valuation. Contact Eton Venture Services today.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.