Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Over the past 15 years, I’ve seen how the right business valuation method can shape critical decisions that define a company’s future, whether during a sale, merger, or strategic planning.

The wrong approach, on the other hand, can lead to missed opportunities, undervaluation, or inflated figures that turn away buyers or investors.

The key consideration here is that no two businesses are alike. Each has a unique mix of assets, market position, and growth potential, meaning a one-size-fits-all valuation simply doesn’t work.

To truly capture a business’s worth, the method must align with its specific traits and circumstances.

That’s why in this guide, I’ll break down 9 key valuation methods, explain when and how to use them, and show how to factor in the intangibles that can elevate your business’s worth.

By the end, you’ll have the clarity and confidence to navigate the valuation process and position your business for success.

Key Takeaways

|

Business valuation is both an art and a science, blending financial analysis with a deep understanding of market dynamics, competitive positioning, and growth opportunities to arrive at a fair and objective estimate of your company’s market value.

It’s usually conducted by third-party experts who go beyond just crunching numbers – they assess both the tangible assets, like property and inventory, and the intangible elements, such as brand reputation and intellectual property, that tell your business’s story.

To better understand what this entails, we recommend taking a look at this sample business valuation report.

Business valuations bring confidence and clarity to financial decision-making.

Whether you’re buying or selling, a third-party valuation adds credibility to your negotiation process. Especially when dealing with experienced opposition, it strengthens your position and allows you to advocate for a higher (or lower) sale price with logical reasoning.

However, the world of business valuations extends far beyond the buying and selling of businesses. At Eton, we value businesses and assets for thousands of companies and individuals every year, each with their own goals and reasons in mind.

That said, here are situations where valuation becomes particularly significant:

We’re highlighting these situations because the approach to a valuation can be entirely different depending on why the valuation is needed.

For example, if one of our clients sells their business, we use narrative and comparables to argue for the highest possible sale price.

Whereas, if the valuation is needed for section 409A compliance, we hone in on Fair Market Value – an objective, defensible value that complies with IRS guidelines, ensuring the valuation is neither inflated nor speculative.

Bruno Reich, CEO of Reich Construction LLC, provides further examples of this:

“Merger and acquisition scenarios often benefit from market-based methods to align with industry transaction patterns. Meanwhile, internal planning and strategic decision-making may warrant income-based approaches that capture company-specific value drivers and growth prospects.”

In short, the purpose behind a valuation also shapes how it should be approached. By aligning the method with your specific goals, you ensure the results are both meaningful and practical.

Valuing a business involves different methods, each suited to specific business circumstances and characteristics.

Generally, these methods fall into three main categories: income-based, market-based, and asset-based approaches.

Each approach provides a unique perspective, capturing different aspects of a company’s value, from its earning potential to its market position and the strength of its assets.

Scott Bialek, Co-Founder at Hurst Lending, recommends the following:

“One best practice I always recommend is to carefully consider the specific circumstances and objectives when selecting the appropriate valuation methods. There is no one-size-fits-all approach, as different scenarios call for different methodologies.”

Below, we break down the main approaches and their key valuation methods:

This approach values a company by assessing the cost of its net assets, primarily focusing on the tangible assets it holds.

It’s particularly useful for early-stage companies or those without substantial revenue, where the value of physical assets is more significant than its revenue or profits.

For instance, a newly established manufacturing company with costly machinery but minimal sales could rely on this approach to determine its value.

Common methods under this approach are:

The Book Value method calculates a company’s value based on its balance sheet by subtracting total liabilities from total assets.

This approach provides an estimate of the company’s net worth, or equity, based solely on the value of its tangible assets, such as property, equipment, and inventory.

While it’s a straightforward calculation, Book Value may not fully reflect the company’s market value, especially if there are intangible assets like brand reputation or intellectual property, which aren’t typically recorded on the balance sheet.

Book Value Formula:

Value = Value of Total Assets on Books – Value of Total Liabilities on Books

The Net Asset Value Method calculates a company’s value by determining the difference between its total assets and total liabilities, adjusted to reflect their current market value.

This approach provides an up-to-date reflection of the company’s net worth by accounting for market conditions. It includes adjustments for both tangible assets, like property and equipment, and intangible assets, such as intellectual property, if their value can be reliably measured.

However, the method may still miss certain intangible factors, like brand equity or competitive advantage, which are harder to quantify but can significantly impact overall market value.

While more precise than purely historical calculations, NAV relies on accurate market value estimates, which can introduce some subjectivity.

Net Asset Value Formula:

Value = Fair Value Total Assets – Fair Value Total Liabilities

Liquidation Value estimates the amount of cash that could be realized if the company’s assets were sold off immediately, and its liabilities were paid in full.

This method calculates a worst-case scenario for valuation, often applying lower values to assets since they might be sold quickly, potentially at a discount.

It’s commonly used for companies facing bankruptcy or financial distress, as it provides insight into what stakeholders might recover if the business ceases operations.

Liquidation Value Formula:

Value = Sum of Value of Assets at Discount – Liabilities

The Cost to Replace Method estimates the current cost of acquiring a substitute with similar functionality, making it a practical approach for both tangible and intangible items.

It is often applied to purchased intangibles like software or licenses, but it can also be used for physical items such as equipment or buildings.

When the substitute differs in factors like technology or functionality, adjustments are made to ensure an accurate estimate.

However, this method may overlook broader intangible factors, such as brand reputation or customer relationships, that influence overall value.

The Reproduction Cost Method estimates the cost to recreate a replica of an asset, whether tangible or intangible, as it was when acquired.

It includes all direct costs, such as labor and materials, and indirect costs, like lost income during reproduction.

This method is often applied to in-house-developed intangible assets, such as custom software or proprietary systems, as well as tangible assets like specialized machinery or unique infrastructure.

Unlike the Cost to Replace Method, which values a comparable substitute, this method focuses on duplicating the original asset exactly.

The market-based approach values a company by comparing it to similar businesses in the market, providing a real-time benchmark based on comparable companies.

It’s most useful for companies with established revenue and financial history, as these allow for meaningful market comparisons.

For example, a private software company with $10 million in revenue could apply a 5x price-to-sales multiple from comparable public companies to estimate its value at $50 million, adjusting for differences in growth or risk.

The following methods are commonly applied under this approach:

This method values a private company by analyzing valuation multiples from comparable publicly traded companies.

Analysts select public companies that closely match the subject company in industry, size, and financial characteristics, calculating key multiples like price-to-sales or EV/EBITDA ratios.

The GPC Method is most reliable when the private company has a stable revenue history with multiple years of financial data.

To enhance accuracy, adjustments are made to account for differences in size, risk, and other relevant factors between the public companies and the subject company.

Guideline Public Company (GPC) Method Formula:

Value = Comparable Company Multiple × Subject Company Metric

The Guideline Transaction Method derives a private company’s value from multiples based on recent M&A transactions involving similar companies.

Analysts identify comparable transactions that reflect similar financial and operational characteristics to the subject company.

Unlike the GPC method, which uses trading values from public companies, this approach relies on pricing multiples from actual sale prices in reported transactions.

Like the GPC method, however, it is most effective when the private company has established revenue, allowing for accurate application of transaction multiples.

Adjustments ensure that factors like transaction terms, market timing, and specific financial conditions are considered, enhancing the valuation’s accuracy and relevance.

Guideline Transaction Method Formula:

Value = Comparable Transaction Multiple × Subject Company Metric

Subject Company Transaction Method, also known as Precedent Transaction Method, is a valuation approach that derives a company’s value from its own recent financing activities, such as equity sales or capital raises.

By analyzing the terms and valuations of these transactions, one can infer the company’s current worth.

This method is particularly useful when the company has a history of recent transactions that reflect its market value.

Subject Company Transaction Method Formula:

Value = Price per Share (from recent transaction by the company) × Total Shares Outstanding

This approach values a company based on its ability to generate future cash flows, discounting them to present value.

It’s ideal for companies in later stages with stable, predictable earnings and reliable financial forecasts, focusing on long-term value.

For instance, a renewable energy firm with predictable cash flows from long-term power purchase agreements could use this method to estimate its value.

Below is the key method within this approach:

This method estimates a company’s value by projecting its future cash flows and discounting them to present value with a rate that reflects the business’s risk profile and the time value of money.

By assessing if anticipated future earnings justify the current investment, DCF offers a thorough look at the company’s potential.

It’s particularly useful for companies with predictable cash flows, though it requires accurate assumptions about future revenue, expenses, and growth rates to produce a reliable valuation.

The DCF approach accounts for expected changes over time, providing flexibility for various financial scenarios.

Discounted Cash Flow (DCF) Formula:

Value = (CF1 ÷ (1 + r)^1) + (CF2 ÷ (1 + r)^2) + … + (CFn ÷ (1 + r)^n)

Where:

Generally, while each valuation method offers valuable insights, relying on just one can give an incomplete picture of a company’s worth. That’s why we often use a combination of methods to help balance out the limitations of each approach and provide a more well-rounded view.

For instance, where an asset-based approach highlights tangible assets, market-based or income-based methods can capture the value of intangibles like growth potential or brand reputation.

Using multiple methods also allows for cross-checking results, helping to identify any gaps or inconsistencies. If notable differences arise between approaches, it’s often a sign to dig deeper into the assumptions or inputs behind each method.

This process doesn’t just make the valuation more accurate – it makes it more credible, offering both buyers and sellers a realistic range to work with and ensuring decisions are based on a fuller understanding of the business’s value.

While the methods discussed above provide a solid framework for valuing different types of businesses, small business owners often need a tailored approach that considers personal finances, owner involvement, and variable cash flows.

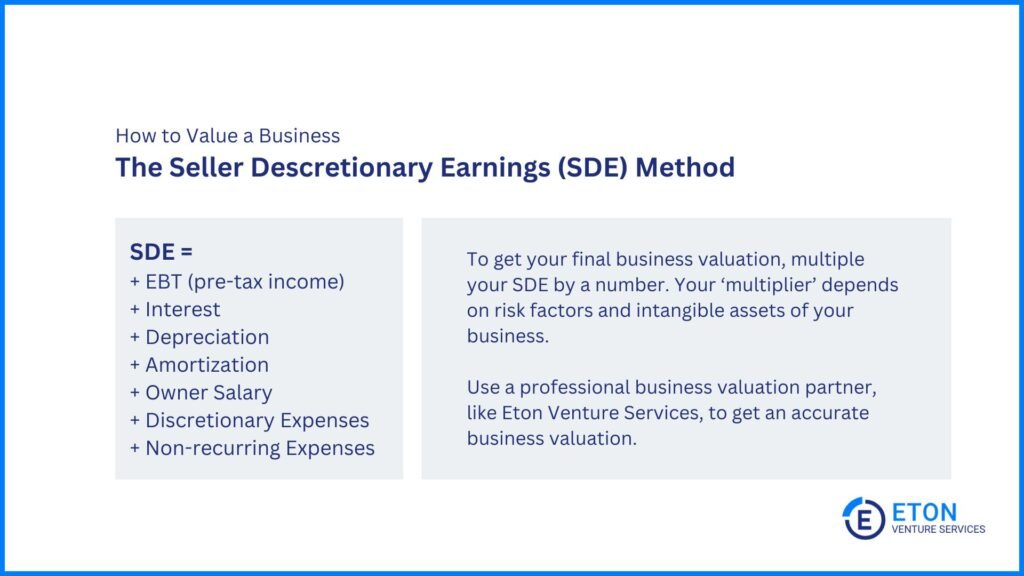

This is where the Seller’s Discretionary Earnings (SDE) method stands out as an effective option.

The SDE method calculates a business’s earnings by starting with EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and adding back the owner’s salary, personal benefits, and non-essential or one-time expenses.

This adjustment provides a clear picture of the business’s true financial performance from the owner’s perspective.

To arrive at a valuation, the calculated SDE is multiplied by an industry-specific multiple, typically ranging from 1 to 4, depending on factors like market conditions and the business’s perceived risk.

For instance, a business with an SDE of $250,000 and a multiple of 2.5 would have an estimated value of $625,000.

While SDE is highly effective, combining it with other valuation methods – like income-based or market-based approaches – can provide a more complete view of the business’s overall worth.

To learn more about this, we recommend reading our article on how to value a business for sale.

It’s easy to assume that business valuation is just about tangibles, like assets and revenue, when in reality, it’s also about the intangible factors that set your business apart.

These factors tell the full story of your business and give buyers and investors the confidence to pay a premium, recognizing the future potential your business offers.

Expert valuation professionals account for these elements when applying frameworks like income-based, market-based, or asset-based approaches.

For example, brand reputation or synergies may directly impact projected cash flows in a Discounted Cash Flow (DCF) analysis, while geographical location or market conditions can influence comparable company valuations in a market-based approach.

Similarly, while the asset-based approach primarily focuses on tangible assets like property or equipment, it can also account for intangible assets such as intellectual property or goodwill if their value is explicitly quantified.

Understanding these factors and how they influence valuation can help you better position your business for sale or investment.

Below are 9 key factors to consider when assessing your business’s value:

A strong brand and a loyal customer base can significantly enhance your business’s value. These intangible assets signal trust, long-term stability, and future earning potential, making your company more appealing to buyers and justifying a higher valuation.

Location also plays an important role in determining a business’s value. Operating in a high-demand or strategic area can increase your business’s attractiveness, while a less favorable location may limit your valuation due to regional challenges.

The context of a sale or investment plays a big role in the final valuation. A sale under favorable conditions often leads to better outcomes, while a forced sale or liquidation tends to focus on realizable assets, resulting in a lower valuation.

The age of a business can affect its perceived value. Newer companies may lack a track record but offer high growth potential, while established businesses often bring stability and reliability, often justifying a premium.

External factors like market trends, economic stability, and competition heavily influence valuation. Strong market conditions and economic growth can raise your business’s value, while uncertainty or high competition may have the opposite effect.

In the context of mergers, the potential for synergies – such as cost savings or revenue growth from combined operations – can significantly raise the valuation. Buyers are often willing to pay a premium if they see opportunities for added value beyond standalone operations.

A skilled, visionary management team is a key factor in valuation. Strong leadership inspires confidence in a company’s future, making it more attractive to buyers and often justifying a higher valuation.

High barriers to entry – such as proprietary technology, exclusive relationships, or significant capital requirements – make your business harder to replicate. These competitive advantages enhance your valuation by increasing buyer interest and justifying a premium.

When buyers aim to acquire a controlling stake, they may offer a control premium for the added authority over the business. This reflects the value of having full decision-making power over strategy, operations, and cash flow.

Understandably, capturing the true value of intangible factors isn’t always straightforward – it requires a strategic approach that highlights what makes your business unique.

For companies with significant intangible assets, working with experts ensures these elements are accurately understood and fairly reflected, giving you the best chance to achieve a valuation that represents your business’s true worth.

Valuing a business isn’t always straightforward. Below are a few challenges that can make the process tricky and impact accuracy:

When a company doesn’t have detailed or consistent financial records, it can be hard to get an accurate picture of its value. Sometimes, it’s also challenging to find good data on similar companies to use as comparisons.

This underscores why one method often isn’t enough to capture the full picture – combining approaches tailored to the business’s specific context often yields more accurate results.

Runbo Li, CEO of Magic Hour, emphasizes this point:

“If financial records and future cash flows are solid, DCF can give accurate insights. But in industries where data on comparable sales is more accessible, the Market Approach might be faster and more relatable. Ultimately, combining approaches is sometimes the most reliable way to cross-verify results, especially when the stakes are high.”

Goodwill represents the additional value a buyer pays for a business beyond its tangible assets and liabilities, often linked to factors like reputation, customer relationships, and brand strength.

Intangible assets, such as intellectual property and brand equity, also play a significant role in enhancing a business’s overall value.

Traditional methods like book value often fail to capture these elements, making tailored approaches like income-based or market-based valuation more effective.

In these cases, it’s also important to engage valuation experts to ensure goodwill and intangible assets are properly accounted for, providing a more accurate representation of the business’s true worth.

Market ups and downs can make valuation challenging, especially for businesses in industries sensitive to economic shifts.

Sudden changes in the economy can significantly impact current value and future earning potential, making reliance on historical data risky because it can be inaccurate.

While past performance provides valuable context, it often overlooks the dynamic nature of markets and emerging risks.

As Chris Percival, Founder & Managing Director of CJPI, states,

“One red flag evaluators should be aware of is an over-reliance on past performance. While historical data is valuable, it doesn’t necessarily predict future results.”

To mitigate these risks, combining historical insights with forward-looking projections ensures a more balanced and accurate valuation.

Valuation requires assessing a business’s growth potential, risk profile, and market dynamics, which often involve making assumptions about future performance.

This includes analyzing factors such as revenue trends, cost structures, competitive pressures, and broader economic conditions.

However, these variables can be unpredictable, and relying on outdated or overly optimistic assumptions can distort the results.

To ensure a thorough and accurate valuation, it’s important to revisit these assumptions periodically, incorporate the latest market data, and adjust for any changes in the business’s unique circumstances or external environment.

Valuing a business is no small task – it’s a process that balances numbers, market realities, and unique business traits. While you might feel equipped to handle it yourself, there’s often more at play than meets the eye.

In this case, a valuation expert not only provides the expertise needed to assess all aspects of your business, including hidden value like brand reputation or customer loyalty, but also brings the credibility necessary to support your valuation in negotiations.

This added credibility can make the difference between a buyer trusting your numbers or challenging your price, potentially leaving money on the table.

While some business owners may opt for a DIY approach, it’s important to weigh the benefits and drawbacks carefully:

|

Pros of a DIY business valuation |

Cons of a DIY business valuation |

|

Cost savings: Conducting a valuation on your own can save on fees associated with hiring an expert. |

Lack of expertise: Business valuation requires specialized knowledge and experience to account for all relevant factors. |

|

Familiarity with the business: Owners have in-depth knowledge of their operations, which can aid in understanding financial metrics. |

Time-consuming: Gathering data, analyzing market conditions, and applying appropriate valuation methods can take considerable time. |

|

Control over the process: Managing the valuation process allows owners to focus on specific elements they deem important. |

Risk of missing intangible assets and goodwill: Owners may overlook unique factors – such as brand reputation or customer loyalty – that could enhance value. |

|

Empowerment: Completing a valuation independently can provide valuable insights into business performance. |

Potential for inaccuracy: Errors in calculation or methodology can lead to undervaluation, resulting in lost opportunities during a sale. |

Ultimately, while a DIY approach can provide insight and save costs, engaging a professional ensures a thorough and reliable valuation that enables confident and effective negotiations.

At Eton, we help you with this by uncovering the full value of your business, ensuring no opportunities are missed.

Our experts provide valuations using methodologies tailored to your business’s circumstances, giving you a stronger foundation for negotiations and maximizing your sale price.

With our support, you can confidently present a valuation that truly captures your company’s worth.

The value of a business is typically 1 to 4 times its annual profit for most small businesses. However, this multiple can vary based on factors like industry, growth potential, and market conditions.

High-growth industries, such as technology or SaaS, may see multiples as high as 3 to 5 times profit or more, while businesses in declining industries may be worth less than 1-time profit due to higher risks and reduced demand.

A private company’s valuation is calculated using a combination of methods depending on its characteristics and the valuation’s purpose.

Common approaches include:

These methods can also be tailored to factors like industry, size, and growth stage. Often, using a mix of approaches ensures a more accurate and balanced valuation.

For a business valuation, key documents include financial statements (profit and loss, balance sheets, and cash flow) and tax returns from the past 3-5 years.

Other essentials are reports on receivables and payables, inventory valuations, legal documents, lease agreements, intellectual property records, business plans, financial forecasts, payroll data, loan details, asset listings, insurance policies, and key contracts.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.