Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Determining the right valuation price for a business can be complex and confusing for business directors. Yet it’s the most important contributor to healthy financial decision-making during a business sale process.

Inaccurate valuations can erode buyer confidence, lead to undervalued exits, and result in a drawn-out sale process—none of which are attractive prospects when you’ve decided to exit your business.

In this guide, I’ll help you value your business for sale. The guide will cover the challenges you’ll likely encounter, valuation rules of thumb, advanced valuation techniques, and important factors to consider.

Key Takeaways

|

“The SDE method gets to the heart of what matters most, showing potential buyers exactly what they can take home from the business.” – Colton Owens CFA, Director of Valuations at Business Valuation Firm, Eton Venture Services

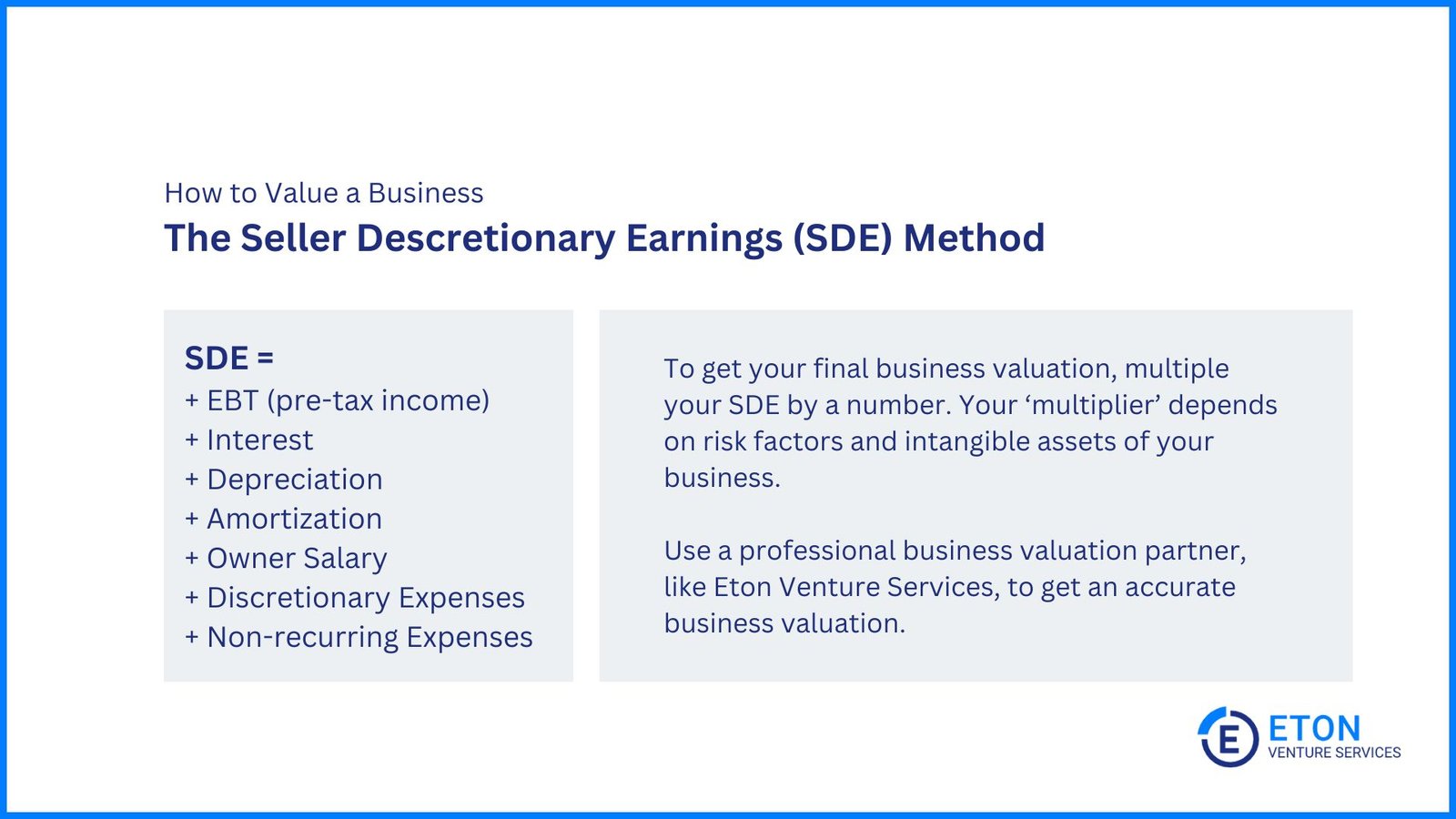

The most common way of valuing a smaller-sized business is the Seller’s Discretionary Earnings (SDE) method.

This method is particularly popular for small businesses because it provides a clear picture of the total financial benefit an owner-operator would receive from the business.

The SDE method calculates the business’s earnings before interest, taxes, depreciation, and amortization (EBITDA), then adds back the owner’s salary and benefits, as well as any non-essential expenses to determine true potential profits.

This total is then multiplied by an industry-specific multiple, usually between 1 and 4, to determine the business’s value.

I find this method most effective and practical because it accounts for the common practice in smaller businesses of owners taking various personal expenses through the business, providing a more accurate representation of the business’s true earning potential for a new owner.

What the SDE valuation method considers:

These considerations make SDE critical for small businesses where personal and business finances are often intertwined.

Here are three steps to pricing your business you can follow right now:

For SMEs, as previously explained, SDE is the most common starting point for valuation, as it reflects the total financial benefits the owner derives from the business.

This adjusted figure gives a snapshot of your business’s profitability and the total value that it provides to the owner in a year.

For businesses that use the SDE in their valuation, the SDE multiplier typically ranges from one to four the SDE, influenced by factors such as market trends, company size, and industry specifics. Your industry multiplier is how we capture future earnings within the SDE approach.

“Nailing down the right industry multiple is key when valuing a business using SDE. It’s the difference between striking a fair deal and potentially leaving cash on the table.” – Chris Walton JD, CEO at Business Valuation Firm, Eton Venture Services

A significant variable affecting this multiplier is the owner risk. If the business’s success heavily depends on the owner, potential buyers may perceive higher risk, impacting the overall valuation.

The final valuation can be expressed using the formula:

Business Value = SDE×Multiplier

For example, if your SDE is $250,000 and the multiplier is 3, your business value would be $750,000. This step translates the calculated SDE into a tangible value for the business.

While the SDE approach covered above offers a valuable lens into the owner’s actual earnings, relying on a single valuation method can sometimes overstate or understate a business’s value. Each method has its limitations, so combining different approaches is often the best strategy.

To explore these methods in more depth, we recommend reading our comprehensive guide on business valuation methods.

By blending various methodologies, business owners can mitigate these limitations and achieve a more credible and accurate assessment of their business’s true worth.

The income-based valuation method focuses on the likely future earnings of the business.

This approach is best suited for businesses with stable and predictable cash flows, as it estimates future cash flows and discounts them back to their present value using an appropriate discount rate.

For instance, if a business expects to generate $100,000 annually for the next five years and uses a discount rate of 10%, the present value of these future cash flows can be calculated using the Discounted Cash Flow formula. This involves discounting each year’s cash flow back to its present value and summing these amounts to determine the total value of the business.

In this approach, you can use SDE to serve as the basis for cash flow estimates, ensuring that projections reflect the actual economic benefit the owner derives from the business.

This makes the income-based method particularly relevant for small businesses that rely on accurate income projections.

The market-based valuation approach derives value from comparing the business to similar entities within the market.

By researching the sales of similar businesses and applying a market multiple – such as revenue or earnings multiples – business owners can estimate their company’s value. If you’re a startup and don’t have revenue yet, read this guide.

This method is applicable when there is sufficient data on comparable businesses that have recently been sold. That makes it restricting—how do you know the authenticity of data used for multiples or if the industry or peer group selected for multiples represents the exact comparable? How would you really choose the right multiple?

Let’s assume you do feel confident in finding the right multiple. If comparable businesses sell for two times their annual SDE and your business has an SDE of $200,000, your estimated market value would be $400,000.

Utilizing SDE in this method enhances the accuracy of comparisons, as it reflects the actual financial benefits derived from the business. This facilitates a more meaningful alignment with the multiples applied to similar businesses.

The asset-based valuation method calculates the business’s value based on the value of its tangible assets and its intangible assets.

This approach is particularly useful for asset-heavy businesses, such as those in manufacturing or real estate, or for businesses that are winding down or being liquidated.

To conduct an asset-based valuation, one must assess the total value of the business’s assets and subtract any liabilities to find the net asset value.

For instance, if a business possesses $500,000 in assets and has $100,000 in liabilities, the asset-based valuation would amount to $400,000.

However, this method has limitations. As Paul Herman, CEO at Bluebox Corporate Finance notes, “the [asset-based valuation approach] often generates a great valuation for those with a very strong asset backing, but for businesses with lots of growth, it’s not always the most appropriate route to take.”

Later in this article, we’ll look deeper at the best valuation approaches for companies with strong growth potential. We’ll also show you how to actually calculate your business sale price using a combination of these methods.

Financials matter, but they’re just one part of a strong valuation.

To get the valuation you deserve in an M&A deal, you also need to tell a compelling story about those aspects of the business that you know make it even more valuable than its current revenue figures suggest.

In many cases, these goodwill and intangible asset factors mean the difference between an average sale price and high sale price:

These factors show that business valuation isn’t just about numbers; it’s about understanding the story behind your business.

This allows you to better make the argument for higher multiples when it’s time to sell or attract investors and can make all the difference in achieving the best possible outcome for your hard work.

Valuing a business in uncertain markets necessitates digging deeper into what truly drives value, as external economic pressures can distort perceptions.

Here are several factors to consider:

In uncertain markets, businesses that show flexibility and can pivot quickly tend to hold more value. Agility in both operations and revenue streams demonstrates resilience, especially when market disruptions occur.

Conversely, businesses heavily reliant on one revenue source or a small customer base pose higher risks. A sudden shift, like losing a major client, could destabilize such companies and drastically reduce their value.

“When a business relies too heavily on a single customer or a small group of clients for the bulk of its revenue, that kind of dependency can be risky, especially in uncertain times. If one of those clients decides to pull out or reduce their business, it can really destabilize the company. It’s a big warning sign that the business might not be as resilient as it appears on the surface.” – Eric Croak, CFP, President, Croak Capital

A business’s operational efficiency isn’t just about rapid growth; it’s about sustaining profit margins and reducing costs without compromising quality.

This is particularly important in volatile markets and relies on effective systems and processes that enable businesses to adapt during downturns.

Companies that successfully demonstrate strong operational management are more likely to achieve long-term growth potential. This ability signals to investors that the business is prepared to tackle future challenges.

Customer retention is also an important factor to consider. High churn rates can indicate weaknesses in a company’s value proposition, which may lower its overall worth.

In tough economic times, businesses that struggle to keep their customers face significant challenges since acquiring new ones often costs more than the revenue gained.

If a company relies heavily on new customer acquisition without retaining existing ones, it could reveal deeper issues. Long-term customer retention is a stronger sign of stability and growth than a temporary surge in new customers.

Being able to respond quickly to changing market conditions – such as supply chain disruptions or shifts in the economy – plays a huge role in a business’s success, especially in unstable markets.

Companies that can swiftly adjust their operations or product offerings are better positioned to succeed. On the other hand, those with limited supply chain transparency may encounter significant risks.

Albert Brenner, Co-Owner of Altraco, emphasizes this point:

“Companies that see change as an opportunity and design operations to pivot quickly will succeed regardless of market ups and downs. Those unable to adapt due to rigid mindsets or inefficient operations will be left behind. Vision and strong supplier relationships have allowed my company to steer through pricing changes, disasters, and help customers do the same”.

Examining a business’s past performance in conjunction with its future potential helps clarify possible outcomes and enables adjustments to the valuation in light of associated risks.

As Chris Percival, Founder & Managing Director of CJPI, states:

“One red flag evaluators should be aware of is an over-reliance on past performance. While historical data is valuable, it doesn’t necessarily predict future results – particularly if key management is exiting as a result of the transaction.”

That’s why evaluators should consider factors like scenario analysis, growth drivers, market conditions, competitive advantage, and the management team – going beyond just a discounted cash flow approach.

For instance, in evaluating a target company’s growth potential, an acquirer may construct multiple cases – best, worst, and baseline – all based on assumptions about market conditions, competitive pressures, or operational efficiencies.

Analyzing market trends and strategic plans shows how well a company navigates challenges and seizes opportunities.

Companies in fast-growing sectors with strong scaling strategies tend to attract more buyers, while factors like product pipelines and market share provide insights into future success.

“One red flag evaluators should watch for is a lack of a clear strategic plan or vision for future growth. If a business does not have a well-defined roadmap for scaling or adapting to market changes, it may struggle to achieve its growth potential, which could impact its sale price.” – Gary Hemming, Commercial Lending Director, ABC Finance Limited

Valuing family-owned businesses can be tricky due to emotional connections and complicated ownership. Here are some important points to consider:

Businesses in rapidly growing markets face unique challenges in valuation due to quick changes in demand and competition. Here are key points to consider:

Businesses with seasonal revenue patterns require different strategies for valuation:

Valuing a small business might seem simple, but it’s often more complicated than it appears.

While you can estimate your business’s value through various methods, such as analyzing earnings or using Seller’s Discretionary Earnings (SDE), there’s so much more to consider, such as market conditions and risks.

“Valuing a small business is as much an art as it is a science. The SDE method provides the canvas, but experience paints the full picture.”—Chris Walton JD, CEO at Business Valuation Firm, Eton Venture Services

That said, the main reason for involving a valuation expert lies in their ability to highlight hidden value, like intangible assets, and provide an unbiased, credible assessment that strongly backs up their valuation arguments.

They’ll also use the right methods based on industry standards and your business’s unique situation, helping you get the best price.

So, while some small business owners may try to handle their own valuations, it’s important to carefully weigh the pros and cons before diving in.

Pros | Cons |

Cost savings: Conducting a valuation on your own can save on fees associated with hiring an expert. | Lack of expertise: Business valuation requires specialized knowledge and experience to account for all relevant factors. |

Familiarity with the business: Owners have in-depth knowledge of their operations, which can aid in understanding financial metrics. | Time-consuming: Gathering data, analyzing market conditions, and applying appropriate valuation methods can take considerable time. |

Control over the process: Managing the valuation process allows owners to focus on specific elements they deem important. | Risk of missing intangible assets and goodwill: Owners may overlook unique factors – such as brand reputation or customer loyalty – that could enhance value. |

Empowerment: Completing a valuation independently can provide valuable insights into business performance. | Potential for inaccuracy: Errors in calculation or methodology can lead to undervaluation, resulting in lost opportunities during a sale. |

In conclusion, while there are benefits to valuing a business independently, the complexities of the process often make it advisable to seek professional assistance.

This not only saves time but also helps avoid costly mistakes, ultimately leading to a more accurate and potentially higher valuation.

If you’re approaching a business valuation, we highly recommend grabbing our free Business Valuation Cheatsheet. It’s a quick, reliable reference for the key approaches and methods whenever you need it.

Understanding the key concepts in business valuation is crucial for small business owners. Here are some of the most important concepts to know:

When to Use Fair Market Value (FMV) | When to Use Market Value (MV) |

Legal purposes (e.g., estate planning, divorce settlements) | Selling the business in the open market |

Tax valuations (e.g., gift tax or charitable donations) | Finding comparables to justify a higher price |

Situations requiring a well-established valuation standard | Quick sales or capitalizing on market trends |

Most business owners should prioritize Market Value, as it represents the price that buyers are willing to pay in the current market.

However, understanding the concept of Fair Market Value offers a useful benchmark and perspective on what the business could be worth in neutral conditions.

By considering both values, you can make informed pricing decisions that take into account your personal situation and the market dynamics.

Schedule an initial call today to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.