Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Private companies present valuable investment opportunities for venture capitalists, private equity firms, and strategic buyers.

But, unlike public companies whose stock prices reflect market sentiment in real-time, private companies don’t have an obvious price tag.

So, how do investors and buyers determine their true worth?

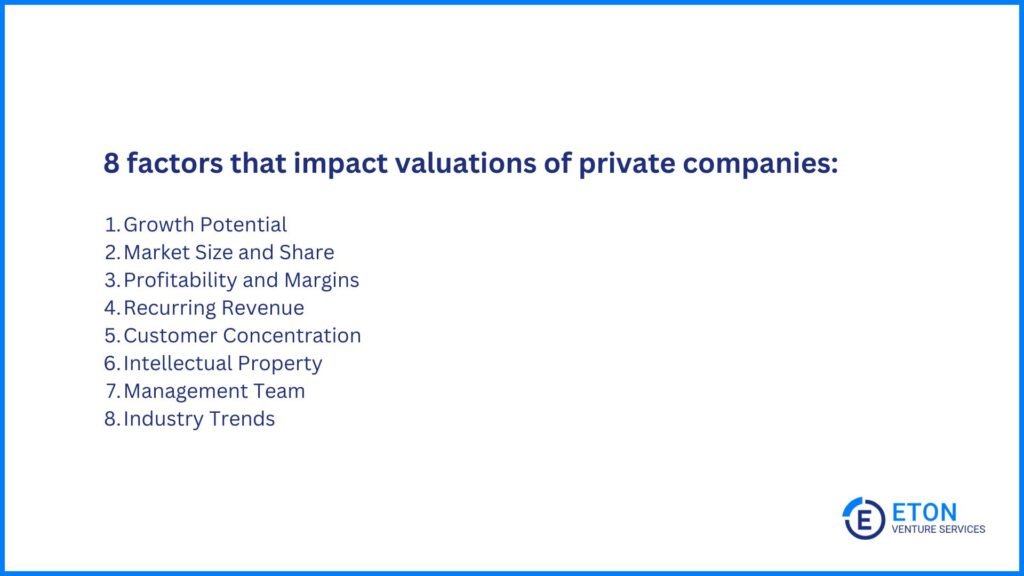

We’ve valued hundreds of private companies, and certain factors come into play time and time again when assessing their worth:

These factors show how resilient, scalable, and appealing a private company is to investors and buyers. Valuation methods then turn these insights into real numbers to provide a reliable way to measure a company’s worth — and support your decisions.

Here’s how these valuation methods work, when to apply them, and what you need to consider in the process:

Key Takeaways

|

To value a private company, we typically use a combination of the following valuation methods:

Each method turns a company’s value drivers, such as growth potential, market size, customer concentration, and intellectual property, into concrete financial figures.

Some compare similar businesses to determine value. Others project future earnings to reflect cash flow stability and expected growth. Investors and buyers use these methods to assess a company’s worth, even without a publicly available price.

Let’s take a closer look at each method: how it works, when it applies, and what it reveals about a private company’s true value.

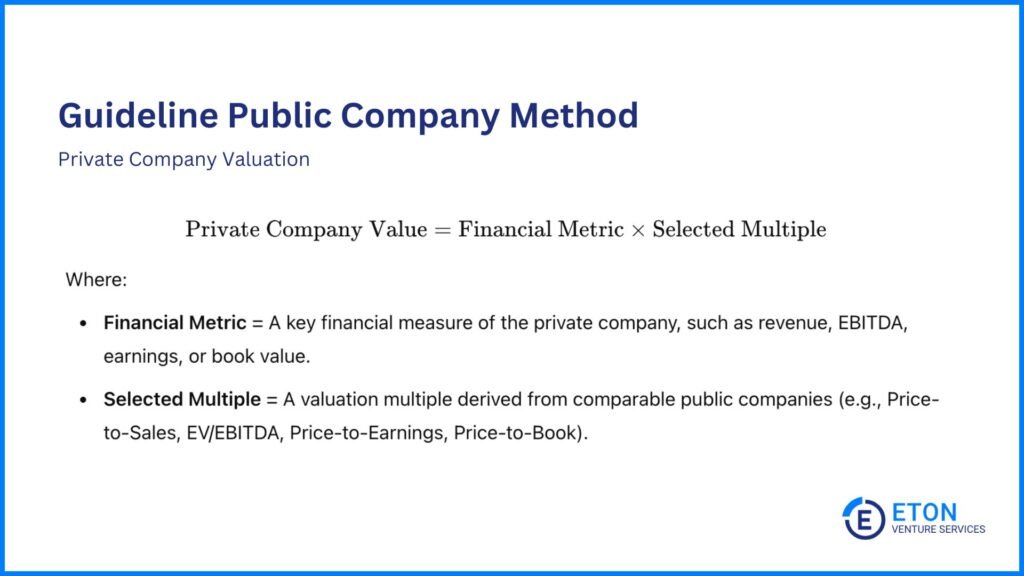

The Guideline Public Company Method values your private company by comparing it to similar companies that trade on public stock markets. That’s why it works best if your business is in an industry with plenty of public peers, like retail or software.

To apply this method, select public companies that closely match your company in industry, size, and growth profile. Then, calculate multiples like price-to-sales or EV/EBITDA ratios.

These multiples compare a company’s value relative to its financial metrics, like revenue or earnings. They give insight into how the market values similar businesses, which enables you to estimate a fair price for your private company.

Common multiples include:

We then apply these multiples to the relevant financial metrics of your private company to determine its market value.

For example, if the average EV/EBITDA ratio for similar firms is 5x and your firm’s EBITDA is $10 million, its enterprise value would be $50 million.

We often use the GPC method in conjunction with other methods, like Discounted Cash Flow.

Market multiples show how investors price similar companies and what likely drives those valuations. But public filings don’t always reveal things like retention, concentration risk, or competitive edge, so we often infer what’s behind the numbers. We then use professional judgement to adjust the multiple and account for how your company compares.

Still, because some traits aren’t visible or measurable, these comparisons may miss unique risks or growth plans. That’s where other methods help round out the full picture.

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

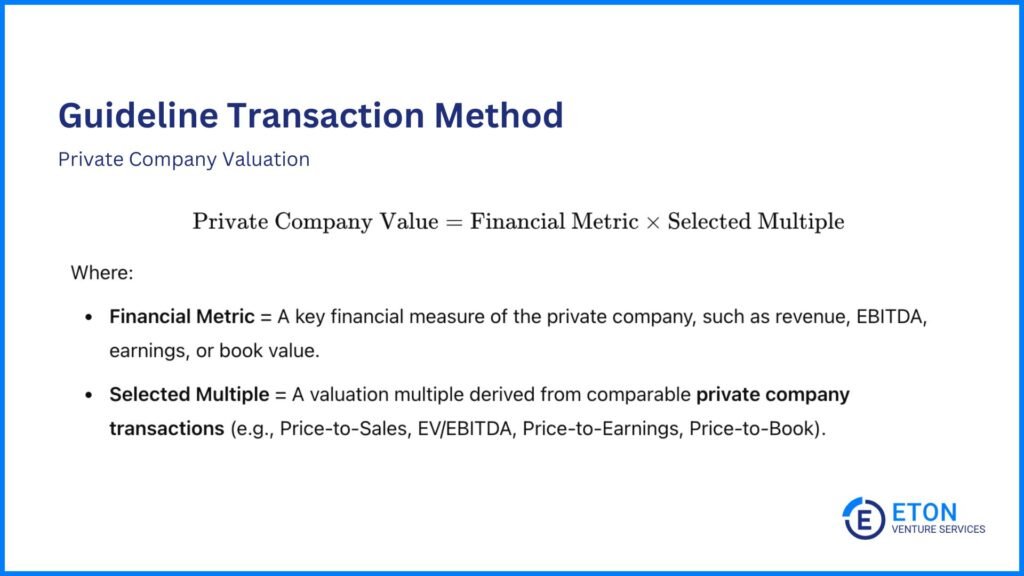

The Guideline Transaction Method analyzes pricing multiples from reported sales or acquisitions of similar firms to determine the value of your private company. That’s why it works well for companies in industries with frequent M&A activity.

For example, if comparable private transactions show an average Price-to-Sales ratio of 4x, and your firm has $10 million in annual revenue, its market value would be $40 million.

However, unlike public market methods (like GPC), where stock prices constantly change in response to investor demand, private company valuations don’t follow a set market price. Instead, each deal depends on its unique details, including buyer motivations and negotiation terms.

Some buyers pay more if a company offers something valuable, like strong customer relationships or strategic market positioning. Others negotiate lower prices if the seller needs to exit quickly or if the business doesn’t fully align with their goals.

That’s why simply applying a multiple from past deals isn’t enough. You need to adjust for factors that influenced those transactions:

The key is to separate deal-specific influences from the company’s underlying value. That way, you ensure a fair and realistic valuation that reflects what makes your business unique.

The Discounted Cash Flow Method best suits private companies with predictable cash flows and growth rates.

That’s because it works by projecting the firm’s future cash flows and discounting them to their present value using a discount rate. This rate reflects the company’s risk and the time value of money.

Here are the steps involved in using the DCF method:

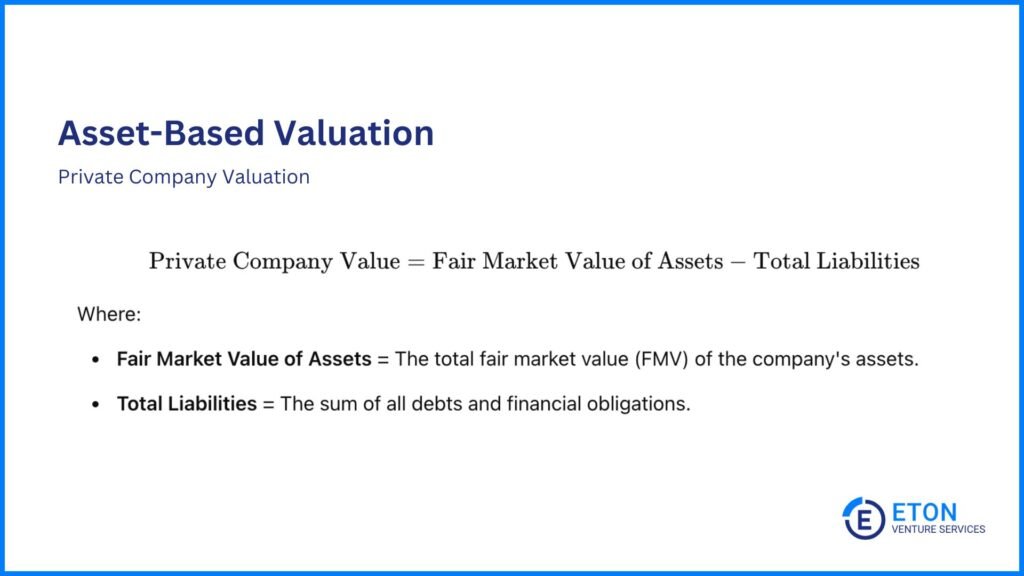

The Asset-Based Approach is best suited for capital-intensive industries, such as manufacturing firm valuation scenarios or transportation. It’s applicable when tangible assets significantly influence the company’s operations. It’s also useful for valuing a company at an early stage that has little to no revenue.

For example, if a manufacturing company has machinery, equipment, inventory, and property with a fair market value of $12 million, and total liabilities, including loans and accounts payable, amount to $5 million, its net asset value would be $7 million.

This approach estimates a company’s net worth, or equity, based solely on the value of its tangible assets.

We also commonly use it as a “floor” valuation in distressed situations, where asset liquidation may be the primary option for recovering value.

However, while it’s a straightforward calculation, it may not fully reflect the company’s market value, especially if intangible assets like brand reputation or intellectual property exist.

In turn, for businesses with significant intangible assets, like technology firms or service-based companies, this method may undervalue the company’s true worth. In these cases, it’s best to use income-based or market-based approaches to determine a private company’s value.

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

For investors and buyers, valuing a private company is about assessing risk and opportunity. Things like market size, intellectual property, and customer concentration help determine how stable a company is and how much room it has to grow. This ultimately influences its price tag.

Valuation experts play a huge role here. We analyze these factors, highlight their impact, and make a credible argument on your behalf that they increase the business’s overall value.

Here are the main factors we consider:

We often value private companies with clear growth opportunities higher — whether they’re expanding into new markets, introducing new products, or adopting new technologies. That’s because they show strong potential for future success.

Additionally, businesses that can scale effectively and increase revenue without a proportional rise in costs are more attractive. If you’ve got a clear plan to keep scaling and bringing in more revenue, that tells investors you’re set up for long-term success and that you can stay profitable and valuable as you grow.

If your business operates in a large, expanding market, it has more chances to grow and gain market share. This makes it more appealing to investors.

Likewise, companies that dominate their market or carve out a strong niche often hold more value. A well-established brand helps keep demand high, allows for better pricing, and makes it easier to stay ahead of the competition.

High margins mean your business can generate reliable cash flow, which makes it less risky for investors. Cash flow is especially important in mature industries, where staying profitable keeps a company competitive.

On the other hand, businesses with falling or unpredictable profits may have trouble attracting buyers. This can lead to a lower valuation.

We often value companies with steady income from long-term contracts or subscriptions higher because they carry less risk.

A reliable revenue stream, supported by high customer retention, keeps finances strong and makes future planning easier, which appeals to investors.

A strong and diverse customer base keeps a company’s revenue steady. This makes it more stable and better positioned for growth.

Businesses that rely too heavily on a few clients risk major losses if those clients leave. On the other hand, having a mix of customers from different markets or industries makes a company more resilient and less dependent on any one source of income, which increases its valuation.

Strong intellectual property rights make it harder for competitors to copy your key products or services. In turn, this helps your business maintain its pricing power and market position.

Companies with valuable IP, especially in technology, biotech, and specialized industries, often attract higher valuations because their innovations support long-term growth and profitability.

Investors seek businesses with strong management teams that have successfully executed growth strategies, navigated industry challenges, and maintained financial stability.

Effective leadership translates into better decision-making, adaptability, and long-term vision, all contributing to business resilience and expansion.

Additionally, a skilled and stable workforce supports operational efficiency and innovation, which also contributes to a higher valuation.

Businesses in fast-growing fields like renewable energy or artificial intelligence often receive higher valuations because investors see strong growth potential.

Conversely, companies in slow-growing or declining industries may have lower valuations due to fewer opportunities for innovation and less market interest.

This is also why a company’s ability to adapt to industry changes, such as new technology, shifting consumer preferences, or updated regulations, can significantly affect its perceived value.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re planning for growth, preparing for a transaction, or structuring a transition.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your private company. We ensure that all key factors – such as customer concentration, market share, recurring revenue, and intellectual property – are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that support your next move.

Private company valuations differ from public company valuations in important respects.

Public companies trade on stock exchanges, so their market prices are updated daily, reflecting investor sentiment, liquidity, and transparent financial data.

In contrast, private companies lack a public market, which means valuers must rely on internal financials, industry comparables, and forecasts.

This often necessitates additional adjustments – such as discounts for lack of marketability and liquidity – to account for the increased uncertainty and lower trading frequency.

Private companies can improve their valuation by concentrating on a few key areas:

The frequency depends on market conditions and significant business changes. Many companies opt for annual or biennial valuations, or revaluation whenever there is a major operational or market shift that could affect its value.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.