Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Over the years, I’ve valued a wide range of restaurants, and one thing is clear: The restaurant industry is notoriously volatile. Profit margins are thin, failure rates are high, and unpredictability is the norm.

Given these challenges, a good valuation approach must balance risk with opportunity. That’s the only way to ensure your restaurant’s final number value objectively reflects its true financial potential.

To do this, pay attention to certain value drivers including:

These factors help paint a full picture of your restaurant’s financial health and future potential. They highlight what makes your restaurant appealing to buyers and where the risks may lie.

But to turn that picture into a concrete number, you need a valuation method.

There are different valuation methods you can use, each of which takes a different approach: Some rely heavily on sales or earnings, others focus on assets or projected cash flow.

The right method depends on the type of restaurant, how it earns revenue, and how stable or scalable it is. So, let’s look at how these methods work, when they apply, and what you need to consider in the process.

Key Takeaways

|

To value a restaurant, we typically use one or a combination of the following valuation methods:

These valuation methods translate a restaurant’s key value drivers into solid financial figures.

A prime location with high foot traffic can drive higher sales, for example, and that reflects in stronger sales multiples. Similarly, consistent sales trends and diversified revenue streams contribute to cash flow stability and growth potential, which shape DCF projections.

This is how we bridge the gap between what makes a restaurant unique and how much it’s worth in financial terms.

Now, let’s take a closer look at these valuation methods: how they work, when they apply, and what they reveal about a restaurant’s true value.

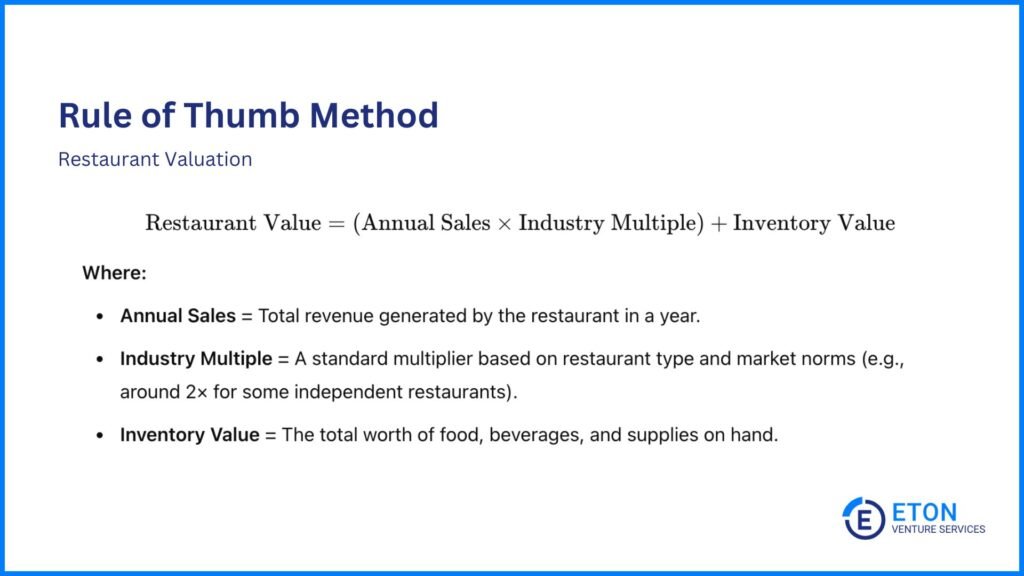

The Rule of Thumb Method is commonly used for quick estimates, particularly with small, independent restaurants.

Even though it’s not the most precise approach, brokers often use this method in early discussions because it’s a quick way to estimate value without diving into detailed financials

That said, it can overlook important factors like location or brand strength — factors that play a big role in a restaurant’s market value. So it’s best not to use it as a final valuation.

Instead, combine it with more detailed approaches, like market-based or income-based methods. There are two ways to do this:

We use the Multiple of Sales Method for valuing quick-service restaurants, franchises, and established eateries with consistent sales.

This method applies a multiple to your restaurant’s annual sales to determine its value. The multiple typically ranges from 0.3x to 1.0x based on various factors such as location, market conditions, and the brand’s reputation.

If you’re wondering why multiples are often lower than one, it’s because restaurants operate with tight profit margins, high overhead costs, and fluctuating demand. This makes a full dollar-for-dollar valuation of sales less common.

Independent diners or small quick-service restaurants in competitive areas may see lower multiples. On the other hand, well-known franchises with strong brand recognition and steady cash flow may trade at the higher end of the range.

Here’s how this method works:

For example, if your restaurant has $1.2 million in annual sales and the multiple is 0.5x, its value would be $600,000 (0.5 x $1.2 million).

This method is popular because it’s simple and reliable—in the restaurant industry, sales figures are often more consistent than reported profits.

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

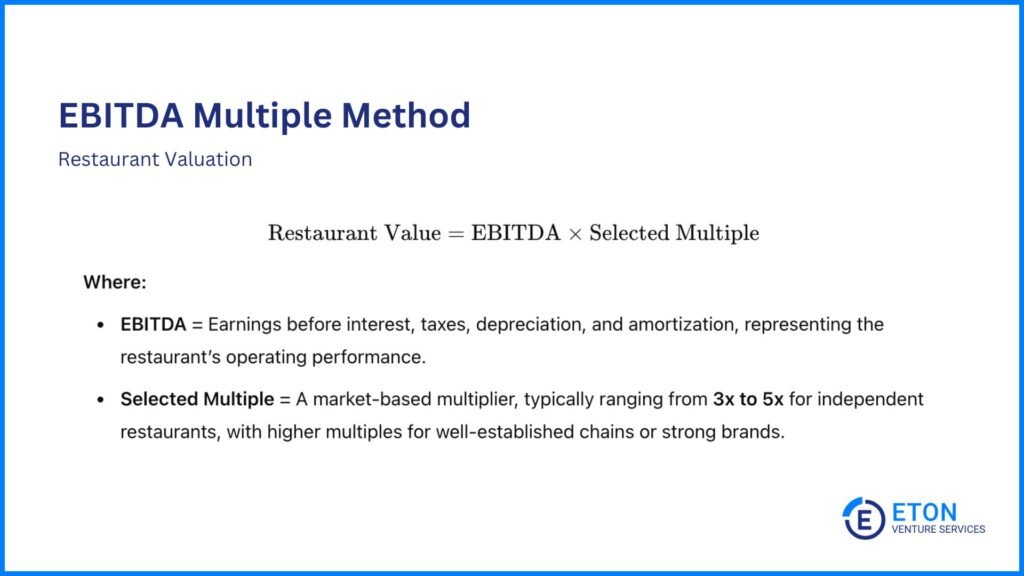

If you own a full-service restaurant, high-end establishment, or restaurant group, the EBITDA Multiple Method is a common way to determine its value.

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It reflects a restaurant’s operating profitability before accounting for financing, tax structures, and non-cash expenses. And since the types of restaurants I mentioned usually have steady earnings, EBITDA is a reliable way to measure their financial performance and value.

To apply this method, you’ll first need to calculate your restaurant’s EBITDA. Then, multiply it by an industry-based multiple. For independent restaurants, this typically ranges from 3x to 5x.

Here’s a step-by-step guide for clarity:

For example, if your restaurant has an EBITDA of $2 million and the applicable multiple is 4x, its value would be $8 million.

Note that EBITDA multiples can be higher for well-established chains or restaurants with strong brand value.

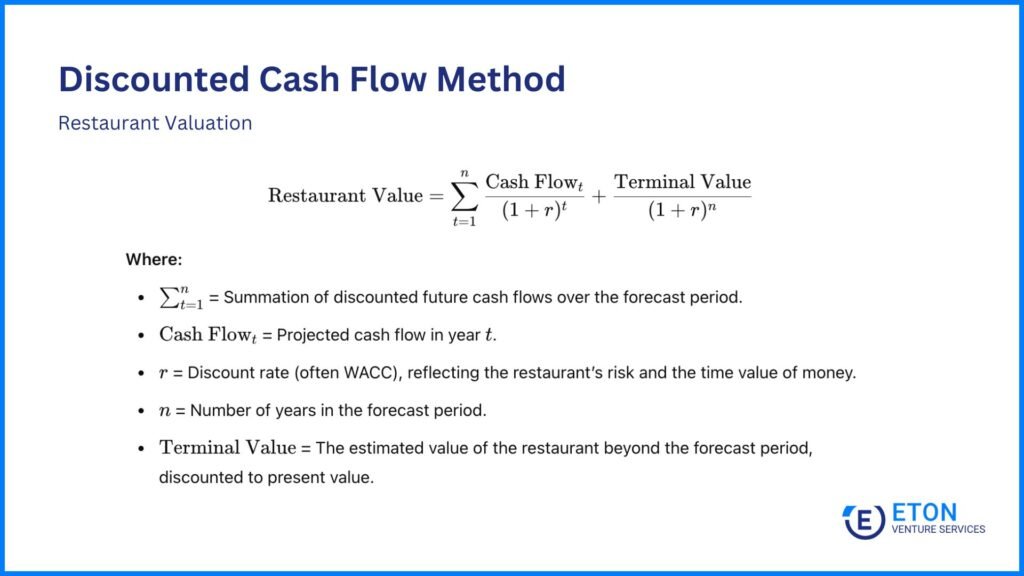

The Discounted Cash Flow Method is best suited for restaurants with predictable cash flows or expanding chains.

It works by projecting the restaurant’s future cash flows and discounting them to their present value using a discount rate. This rate reflects the restaurant’s risk and the time value of money.

Here are the steps involved in using the DCF method:

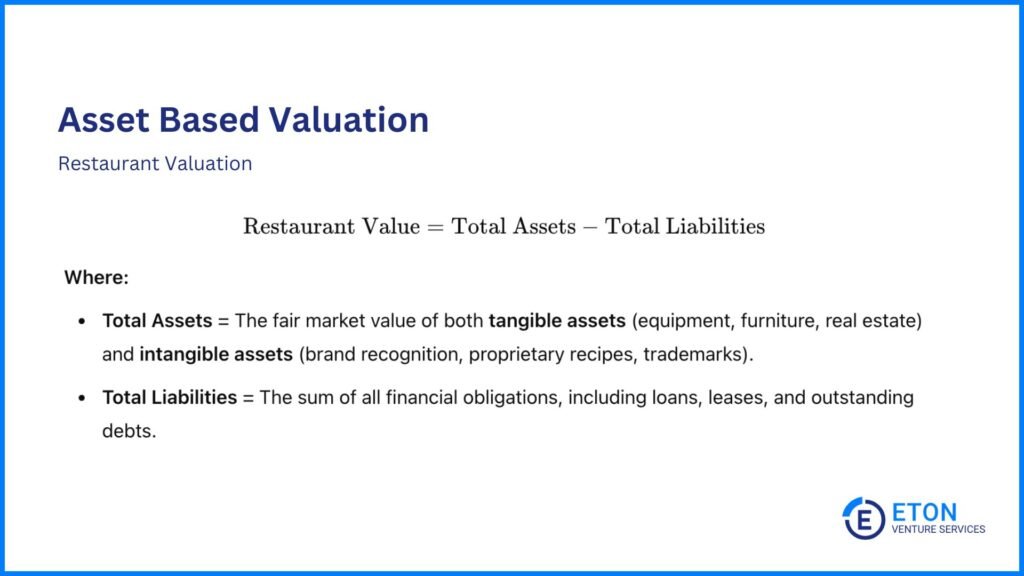

Asset-based valuation determines your restaurant’s value by assessing both its tangible and intangible assets. It’s most useful if your restaurant has significant physical assets or sits in a prime location.

That said, this method is usually a starting point or a fallback for underperforming restaurants. Since it focuses on assets rather than earnings, it provides a baseline value rather than a true market-driven estimate.

Here’s how it works:

For example, if your restaurant’s assets are valued at $1.5 million and its liabilities total $500,000, its value would be $1 million.

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

Valuing a restaurant is about assessing both risk and opportunity from a buyer’s perspective. A prime location and strong brand can signal growth potential. Meanwhile, inconsistent sales or a reliance on a single revenue stream may pose risks.

That’s why valuation experts play a huge role here. We analyze these elements, highlight their impact, and make the case for how they shape the restaurant’s overall value.

Here are the main factors we consider:

A prime location can significantly increase a restaurant’s value, particularly when it’s located in a high-traffic area with good visibility and easy accessibility.

The neighborhood should also match the restaurant’s concept. Busy areas are great for quick-service restaurants, for example. On the other hand, quieter locations may be better for casual or family-style dining.

Additionally, factors like proximity to competitors, the area’s demographic appeal, and available parking can all affect foot traffic. This affects the restaurant’s ability to maintain steady revenue and, thus, its valuation.

When buyers assess a restaurant’s potential, they look closely at historical sales trends. Consistent or growing sales signal effective management, a menu that resonates with customers, and strong brand loyalty.

Declining or unpredictable sales trends, however, might cause potential buyers to question the restaurant’s ability to maintain performance. This could lead to a lower valuation.

High profit margins indicate that the restaurant is managing its costs well, including food, labor, and overhead – all while generating substantial revenue.

Thus, restaurants with profit margins above the industry average are more attractive investments. They promise strong returns.

On the other hand, restaurants with lower margins may face financial challenges, which can lower their perceived value.

A restaurant with a loyal following, media recognition, or industry awards will likely command a higher valuation. A well-known brand signals differentiation and customer trust; two things that can set a restaurant apart in a crowded market.

Conversely, a weak brand or a history of bad reviews can drive customers away and hurt a restaurant’s market value.

Restaurants that don’t rely on just one income source tend to hold their value better. Dine-in, takeout, catering, and delivery all provide different ways to bring in revenue and make the business more resilient.

The COVID-19 pandemic made this even more apparent: Restaurants with strong delivery and outdoor dining options performed much better.

In short, the more a restaurant can tap into various revenue sources, the more attractive it becomes to buyers. They see it as a less risky investment with more growth opportunities.

A restaurant is only as good as its team. Strong management keeps operations smooth, costs under control, and growth strategies on track. Similarly, a well-trained staff ensures high-quality service, repeat business, and positive customer experiences.

As a result, a restaurant with a capable team is more likely to sustain or even improve its financial performance over time. This increases its market value.

The condition of a restaurant’s kitchen and dining space says a lot about its long-term viability.

Well-maintained, up-to-date equipment keeps operations running smoothly, reduces downtime, and helps control costs. It also minimizes the risk of costly repairs for buyers.

On the front end, an inviting, well-designed dining area improves the customer experience. This encourages repeat business. Conversely, if the space feels outdated or in need of major renovations, it could lead to a lower valuation.

Can the restaurant’s concept be replicated? Whether through franchising, additional locations, or streamlined operations, scalability signals strong growth potential. Buyers looking for long-term returns are more likely to invest in a restaurant that has room to expand.

Many restaurants deal with seasonal fluctuations, especially those in tourist-heavy areas or locations affected by weather. These seasonal patterns are also seen in hotel valuations. The key is how well they manage off-peak months.

Restaurants that offer off-season promotions, diversify their revenue streams, or find ways to attract steady traffic year-round tend to be valued higher.

In contrast, restaurants that struggle during off-peak months are seen as more volatile. Thus, they’re less valuable.

Unique recipes, proprietary cooking techniques, and distinctive restaurant concepts make a restaurant more appealing. This is especially true for niche or specialty establishments. That’s because these elements create a competitive edge and a strong market position that competitors can’t easily copy.

In turn, buyers often pay more for a restaurant with valuable intellectual property, as it supports long-term growth and brand differentiation.

A restaurant’s compliance with health, safety, and other regulatory requirements directly impacts its valuation. A clean record of adherence to regulations reduces risk and reassures buyers about the restaurant’s long-term viability.

On the other hand, a history of violations or non-compliance may raise red flags. This could reduce the restaurant’s appeal and lower its value.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re planning for growth, preparing for a transaction, or structuring a transition.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your restaurant. We ensure that all key factors—such as location, management and staff, regulatory compliance, and seasonality—are thoroughly considered to show all the opportunities your restaurant promises.

Trust our experts to deliver insightful, tailored valuations that support your next move.

Independent restaurants often use simpler methods, like the Rule of Thumb or Asset-Based Valuation. This is because their financial performance tends to be more variable and unpredictable due to seasonal fluctuations and local market conditions, coupled with their smaller scale.

In contrast, larger chains benefit from income-based approaches, such as EBITDA multiples or DCF). These are better suited to capture the stability and scalability of their operations.

The valuation of restaurants presents several challenges. For example, the industry’s inherent volatility, thin profit margins, and seasonal fluctuations make revenue forecasts unpredictable.

Additionally, intangible factors like brand strength and customer loyalty are a part of a restaurant’s success. However, they are hard to quantify.

To address these issues, we often blend simple methods (such as asset-based or rule-of-thumb approaches) with income-based models (like EBITDA multiples or DCF). We also use sensitivity analyses and expert insights to capture the restaurant’s full economic potential.

A restaurant valuation offers a clear snapshot of a business’s current financial health and growth potential.

When a valuation shows strong revenue, profitability, and a loyal customer base, it indicates that the restaurant’s business model is solid and scalable – key traits for successful expansion or franchising.

Additionally, the process can reveal areas for improvement, such as operational efficiencies or enhanced brand strength. You can then address these to further support growth.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.