Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Valuations are tricky, even more so at the seed stage when startups are pre-revenue or have very little revenue.

Traditional valuation methods like Discounted Cash Flow or Revenue Multiples don’t work as there is no revenue figure to refer to.

Instead, investors look at qualitative factors and the future potential of a startup rather than financial metrics.

At Eton, my startup valuation firm, we’ve valued hundreds of startups alongside VCs, so we know the ins and outs of the process.

In this guide, I’ll take you through three key methods that venture capitalists (VCs) and angel investors use to value startup companies with no revenue.

Key Takeaways

If you’re raising capital or planning an exit, understanding pre-revenue startup valuation methods is essential.

While established companies with steady revenues can rely on traditional metrics like EBITDA multiples, startups face unique challenges. You often lack substantial historical data or comparable assets, making standard approaches less reliable.

The most practical methods for pre-revenue startups include the Comparable Transactions Method, where you analyze recent acquisitions of similar companies to benchmark your value. The Comparable Transactions Method is one of the most popular startup valuation techniques because it’s built on precedent. You’re answering the question, “How much were startups like mine acquired for?”

The Venture Capital Method focuses on your expected exit value, working backward to determine current worth. VCs typically target specific ownership percentages and returns, using your projected exit valuation to calculate today’s price. This method aligns with how investors actually think about deals.

The Berkus Method assigns monetary values to five key factors: sound idea, prototype, quality management team, strategic relationships, and product rollout.

The Berkus Method was created by venture capitalist Dave Berkus to find valuations specifically for pre-revenue startups—businesses not yet selling their products at scale. The idea is to assign dollar amounts to five key success metrics found in early-stage startups. It caps pre-revenue valuations at $2–2.5 million, providing a structured approach when financial projections are uncertain.

For slightly more mature startups, the Scorecard Method compares your company to funded peers across multiple dimensions like team strength, market size, and competitive advantage. You’ll adjust the average valuation in your sector based on how you stack up against these benchmarks.

In the next sections, we’ll show you how to value a pre-revenue startup with each of these methods.

The Comparable Transactions Method or “Comps” involves valuing a startup by comparing it to similar companies in the same industry that have recently been valued or sold.

This method is used when there are enough similar companies to form a reliable comparison base.

VCs favor this method because it provides a market-based reference point.

Here’s a step-by-step to value a startup using Comp method for pre-revenue startups:

Select companies that were recently valued or acquired, with similar business models, technologies, and target markets but are in early stages like yours.

“You research and find out what similar companies to yours have recently been valued at,” says Brett Fox, Startup CEO Coach who has raised over $100 million in Venture Capital & Private Equity Funding.

Use databases like Crunchbase or AngelList to find startups at similar development stages.

Determine the multiples for each of the comparable companies selected.

Commonly, pre-revenue tech startups might look at multiple of the following depending on the nature of the startup:

“Appropriate adjustments need to be made to account for differences between the target company and transaction comparables,” writes Mayank W., Chartered Accountant & Legal Expert guiding startup founders to growth and success.

Make preliminary adjustments to these multiples based on the following factors:

Apply the refined multiples to your startup’s specific metrics to estimate the valuation.

Formula: Valuation = Adjusted Multiple × Your Metric (e.g., $500 per monthly active user × 10,000 users)

Choose a conservative approach by using the lower end of the multiple range to avoid unrealistic expectations.

Step 1: Identify Comparable Companies

Step 2: Gather Data on Financial Metrics and Establish Multiples

Step 3: Calculate the Average Multiple

Step 4: Adjust for Unique Factors

Final Estimated Valuation

There are three key downsides to the Comparables Method, however:

In these cases, VCs use two other methods, which I’ll go into in detail in the next section.

📖 Related read: SaaS Valuation: How to Value Your SaaS Company Like a VC

The Venture Capital valuation method focuses on estimating the future value of the company and working backwards to determine its present value, accounting for the risk and expected returns that venture capitalists anticipate.

“What the Venture Capital Method does is focus into the future, the possibility, the potential,” explains Alejandro Cremades, cofounder at Panthera Advisors and fundraising consultant.

“They’re focusing on the projections, those three or five-year projections, and putting a return or a potential multiple into that.”

Here’s a step-by-step guide to calculate your startup’s value based on the VC method:

Estimate the potential selling price of the startup in the future, typically at the point when the investors exit (usually 5-10 years).

“The most important task for an investor is to project the likely value for a company at the time at which the company may generate liquidity,” writes venture capitalist Alex Wilmerding in his book Term Sheets & Valuations.

This is often based on the expected revenues at that time and applying an industry-appropriate multiple.

However, experts say that “the size of an exit like an IPO or acquisition is impossible to predict”, but investors can still make some estimates.

Determine the expected return on investment that the VC desires.

For example, Fox shares the typical expected ROI as:

Investment Stage | Typical Expected ROI |

Seed Stage | 30X |

Series A | 10-30X |

This reflects the high risk associated with investing in startups, particularly those without revenue.

Using the desired ROI, calculate the post-money valuation by discounting the future exit value back to the present.

The formula used is:

Post-money valuation = Future Exit Value / Expected ROI

To find the pre-money valuation, subtract the amount of capital the VCs are investing now from the post-money valuation.

If the VC is investing $5 million, and the post-money valuation is calculated at $20 million, the pre-money valuation is:

Pre-money Valuation = Post-money Valuation − Investment Amount

Pre-money Valuation = $20M − $5M = $15M

The Berkus Method is a straightforward (and relatively easy) way to estimate the value of early-stage startups, especially those without any revenue yet.

It focuses on the key factors that can drive a startup’s future success, rather than relying on current financial projections.

When investors use this method, they essentially assign a value to key aspects of your startup. Then, they give a value to each of these factors. Here’s how it breaks down:

After assigning values to each factor, the total valuation gives a rough estimate of what your startup could be worth.

For example, let’s say your startup is evaluated like this:

Then, the total valuation will be:

Total Valuation = Value of the Idea + Value of the Prototype + Value of the Team + Value of Strategic Relationships + Value of Product Rollout

Total Valuation = $400,000 + $300,000 + $500,000 + $200,000 + $400,000 = $1,800,000

This means your startup would be valued at $1.8 million.

With the Berkus Method, investors can assess the potential of your startup in a structured way, even when there are no financial metrics to rely on.

💡Good to know. Investors typically use a combination of these three methods to come to the most accurate valuation.

I’ve explained the three key methods investors use to value startup companies without revenue, and how to calculate each.

But valuations are tricky and depend on many moving factors, such as market conditions, the competitive landscape, the strength of your team, and future growth potential.

Rather than attempting the valuation yourself and risking inaccuracies, or not having it done when you need it, my firm, Eton, can provide you with accurate, reliable, and audit-defensible valuations in 10 days or less at reasonable prices.

Understanding how VCs actually value startups reveals a stark contrast to formal valuation methods. VCs often rely on market conditions, ownership targets, and expected returns rather than rigid formulas.

VCs often rely on simplified models and judgment calls that differ from traditional valuation frameworks.

This market-driven approach focuses heavily on ownership targets and expected returns rather than intrinsic value calculations.

VCs typically work backward from their desired ownership percentage. If a fund needs to own 20% of your company and you’re raising $2 million, that implies a $10 million post-money valuation. This ownership-focused approach means valuations often reflect investor requirements more than company fundamentals.

The relationship between VC valuations and 409A valuations illustrates this disconnect.

Growth projections:

Discount rates:

Multi-stage firms entering earlier rounds have intensified competition at seed and Series A.

Everyone moved to earlier stage—part of the decline in late-stage investing is the “baggage” of companies that previously raised money at inflated valuations that they would struggle to justify in today’s market.

For that and other reasons (like cash preservation), VCs moved to focus more on earlier stage, and many funds that typically invest in A started deploying more into seed rounds.

In fact, VCs often do not trust a 409A valuation firm to tell them the true value of a company. The VCs feel that valuing a company is a core competency, and the implications of valuation decisions have massive impacts on their business.

This underscores why founders need to understand both valuation frameworks when negotiating with investors.

The median seed valuation climbed to $14.8 million in Q3 2024, surpassing the previous high of $14.6 million from Q2 2022, according to Carta’s Q3 2024 report. The median Series A valuation also rose to $45 million in Q3 2024, reflecting a continued rebound after the 2022 market correction (Carta, 2024).

Valuations had peaked during the 2021 funding boom, fueled by record capital inflows. For example, Series A companies saw median valuations reach the high $40M range in Q4 2021 and Q1 2022, according to PitchBook. However, the market corrected sharply by mid-2022, triggered by tightening monetary policy and a decline in tech multiples.

Series B valuations were hit hardest. They peaked at $160 million in Q1 2022 and plunged to $80 million by early 2023 (Kruze Consulting citing Carta, 2024). This sharp drop illustrated investor caution and a pullback from late-stage deals.

The recovery has been uneven but notable. After bottoming at $80M in Q4 2022, Series B valuations rebounded to $100M in Q4 2023, then climbed to $110M in Q1 2024 and $117M in Q2 2024 (Carta, 2024).

Investor expectations have shifted alongside this. According to Michael Cardamone of Forum Ventures, “Seed round valuations haven’t dropped a ton from even the peak,” but “the bar to raise a seed [round] is a lot higher.” A priced seed round of $3 million at a $15 million pre-money valuation is still happening in 2024 — but now, founders are often expected to show $500,000+ in ARR before raising at those terms (Forum Ventures, 2024).

This reflects a shift from story-first fundraising (common in 2021) to traction-first requirements. Investors are still writing checks — but now they demand clearer proof of market fit and business fundamentals.

While the two methods above give you a good estimate of your pre-revenue startup valuation, there are multiple ways to increase your valuation further.

Here are key ways to do so:

The pitch deck template created by Silicon Valley legend Peter Thiel is highly recommended because it is structured to clearly present essential aspects of a startup:

Equally important as a good pitch deck, is to craft a compelling story.

Investors are not just investing in what your company is today, but in what it could become.

To get them excited about your vision, you need to paint a vivid picture.

“By nailing it on the storytelling, where you’re narrating what’s happening, what are you tackling, the why, the what, the how, people are going to get really excited to jump in and come in with you,” says Alxandro.

“It could get to a point where price is not an issue. They just want to be in.”

Getting interest from multiple investors, whether through storytelling or through other means, is a key way to get your value up.

“If there’s competition for your deal where multiple investors are fighting to get in, then you can negotiate for more,” says Fox.

However, he warns that having competition is very rare because investors will usually invest in only about one of 100 companies that they meet with.

Amidst tough competition, building your Minimum Viable Product (MVP) may give you an edge.

Cremades emphasizes the importance of launching your MVP early to gather market feedback and demonstrate your product’s appeal.

“You can use that as a way to tell the investor that what’s coming is really big, and… if they don’t jump in, then their ticket is going to be much, much more expensive down the line,” he says.

Just like building your product shows some actual evidence, Cremades also suggests to “get out there” and start selling “if you really believe that the revenue is something that is pulling you down on the valuation side”.

He adds, “You need to close customers, large accounts, whatever that is to continue to move the needle forward.

Because that traction, that progress around the sales and around the revenue is going to help that investor or that acquirer to understand that you are heading in the right direction, and maybe there are different multiples that they can use around your valuation.”

Just as product and sales might help, so would a good team in place.

The better your team is, the higher the valuation tends to be.

“If you have people that have done it before, that have really good bios, good CVs, then you’re going to be able to use that as a way for leverage to increase the overall valuation of the business,” Cremades explains.

Finally, don’t go first in the negotiation. Instead, Let the investors make their first offer.

And once they do so, you can negotiate based on comparable data or the valuation amount you’ve gotten from a trusted professional like Eton.

Say, “Actually, I’ve seen companies like ours priced in the range of X to Y,” or “Based on a third-party valuation, this is how much we’re worth.”

As SaaS Capital puts it: “Knowing where your business stands based on real-world data will give you an advantage in negotiating the best possible outcome for your company.”

Working with a third-party valuation specialist is particularly useful for pre-revenue startups because it brings objectivity and credibility to a process that can often be influenced by bias or guesswork.

When you rely on a third-party expert, you get an accurate, unbiased assessment of your startup’s worth, based on real data and market insights. This is crucial when dealing with investors—they trust independent valuations more because they know it hasn’t been influenced by internal interests or over-optimism.

A third-party specialist also ensures your valuation is compliant with financial regulations and audit-ready, reducing the risk of errors that could lead to costly delays or complications later on. We can also fight your corner—looking for higher comparables that get you the valuation you deserve.

It gives you a solid foundation to negotiate funding, plan your growth, or strategize an exit, all backed by a credible valuation that stands up to scrutiny. Simply put, it’s about getting an honest, reliable number you can trust and that others will too.

My team at Eton provides affordable valuation services to startups like Perplexity, Joby and Pinterest. Reach out to us here to chat and we’ll walk you through our processes and pricing.

At Eton, we usually deliver business valuations in 10 days or less.

Provided we have all the necessary documents, we can even complete it in as short as a day for an extra fee.

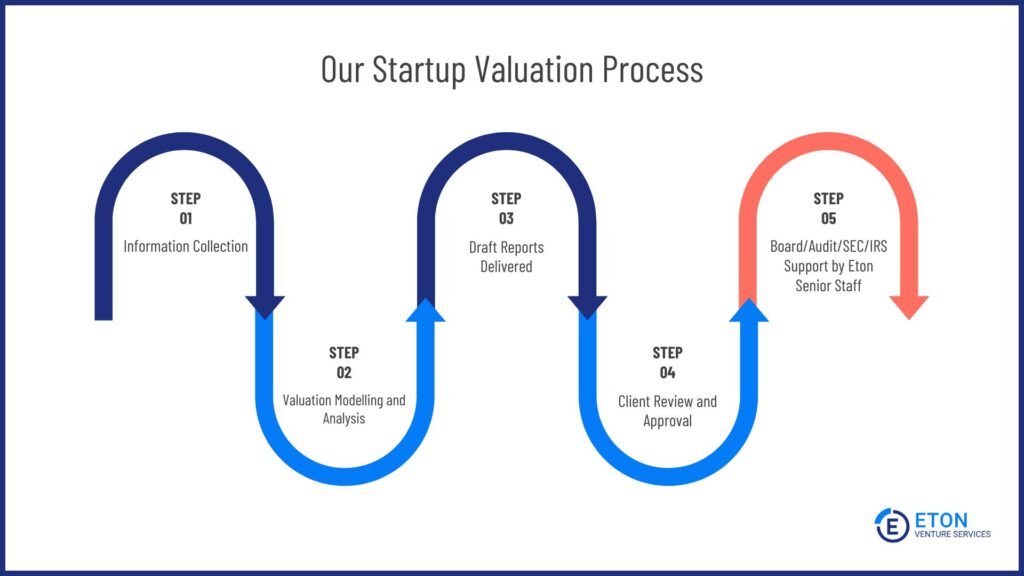

Here’s how our business valuation process looks like typically:

If you’re ready to partner with us for your pre-revenue startup valuation, or if you’d like more information, please get in touch with me here.

Otherwise, please read on for tips on how to increase your valuation.

I hope this guide has been helpful for figuring out how to value your startup. If you need any personalized advice, please feel free to reach out to me here.

I also highly recommend checking out these resources below to further understand the world of VCs and valuations.

Have more questions about valuing a pre-revenue startup? I answered them below:

For pre-revenue startups, the rule of thumb is to look at qualitative factors and future potential rather than financial metrics.

A common approach is the Venture Capital (VC) Method, which estimates your startup’s value based on its expected future exit value. Here’s how it works:

For example, if you expect your company to be worth $50 million in 5 years and investors are seeking a 10x return, your current pre-money valuation would be $5 million ($50 million / 10).

This method helps investors focus on your startup’s potential growth and market opportunities, providing a structured way to value your company even before generating revenue.

Other methods of valuing early-stage startups include:

For more mature startups with substantial revenue or earnings, these methods are suitable:

For detailed explanations of these methods and how to calculate them, please check out our startup valuation guide.

For startups with some revenue, a common benchmark is to value the company at multiple times its annual revenue.

This multiple can vary widely depending on the industry, growth potential, and market conditions.

In the tech and SaaS industries, for instance, startups might be valued at 5 to 10 times their annual revenue. I wrote more about SaaS valuation and you can find all the average multiples there.

However, for a startup with no revenue, investors will focus more on future potential, market size, and the strength of your business model rather than current revenue figures.

Startups need different valuations for different stages of their growth. Here are the most common ones:

1. 409A Valuation:

A 409A valuation determines the fair market value of a company’s common stock for tax purposes, particularly regarding stock options and other equity compensation plans.

2. Venture Capital (VC) Valuation:

Venture capital valuation is where venture capitalists assess the worth of a SaaS company when seeking investment.

3. Pre-Money and Post-Money Valuation:

Pre-money valuation is the company’s worth before new investment, while post-money valuation includes the new investment.

4. Mergers and Acquisitions (M&A) Valuation:

M&A valuation is important to determine a SaaS company’s worth in a potential merger or acquisition scenario.

5. Exit Valuation:

Exit valuation is conducted when preparing for an exit strategy, such as an initial public offering (IPO) or acquisition.

6. SaaS Valuation:

If you’re raising funds for your SaaS company, you might need a SaaS valuation done.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.