Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

We value traditional businesses based on what they earn and own – revenue, profits, and tangible assets. A manufacturer, for example, is worth what it produces and sells. So, growth here is tied to expanding production lines or opening new locations.

The valuation of tech companies, on the other hand, is based on what they could earn in the future. A social media platform might be worth billions even if it isn’t making a profit yet, because investors believe it will generate massive revenue down the line.

This makes tech valuations more speculative, driven by potential rather than existing financial performance or tangible assets.

Based on my years of experience valuing tech companies across different stages, I’ve seen how certain factors consistently shape that potential:

Analyzing these factors helps buyers and investors assess risk and opportunity and gives them a clear understanding of the company’s future.

You can then translate these future expectations into hard numbers using valuation methods. Here’s a breakdown of how valuation methods work and when to apply them:

Key Takeaways

|

To value a tech company, we typically use one or a combination of the following valuation methods:

Each method translates a tech company’s potential – its user growth, intellectual property, scalability, and market size – into measurable financial figures.

Since tech valuations focus on the future, these methods capture expected revenue, profitability, and long-term growth through market multiples, projected cash flows, and expected exit values.

Because companies grow at different rates and face different risks, the right method depends on your company’s stage and financial outlook. Let’s look at how each method works, when to use it, and what it reveals about your company’s true value.

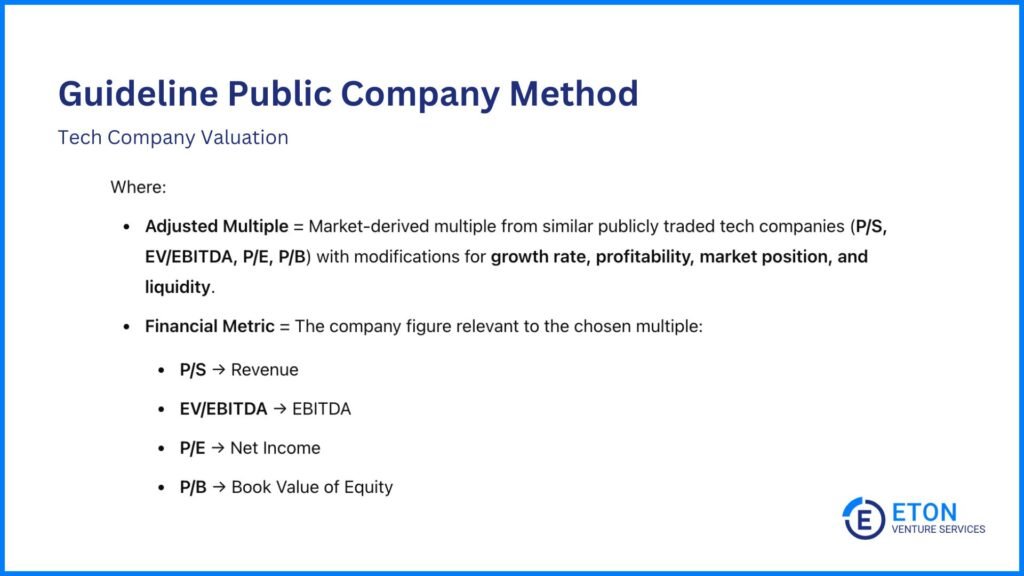

The Guideline Public Company Method values your tech company by comparing it to publicly traded firms with similar characteristics. These include business models, revenue structures, and growth trajectories.

To apply it, we find public companies that are a good match and look at their valuation multiples. These are ratios that compare a company’s value to figures like revenue or earnings.

For example, if similar public companies trade at 5x their annual revenue, and your tech company has $10 million in sales, we value it at around $50 million (5 x $10 million).

This method is best for mature tech firms with easily comparable public peers, such as SaaS providers, hardware manufacturers, and semiconductor companies.

It’s also useful for high-growth companies that generate revenue or EBITDA (profit before interest, taxes, and non-cash expenses). This is because it shows how the market values similar firms based on revenue potential or operating performance.

Here are the most common multiples we look at when applying this method:

You can find these multiples in financial databases, company reports, and online platforms that track financial data for public companies.

However, public companies aren’t always a perfect match. Their filings may not reveal traits like user retention, scalability, team strength, or the quality of a company’s technology, all of which can significantly affect value.

That’s why we don’t rely on surface comparisons alone. We use professional judgment to interpret what may be influencing a public company’s multiple and assess whether those same strengths or risks apply to your company.

From there, we adjust the multiple to make the comparison more accurate. These adjustments account for things like:

For example, say we’re valuing a private SaaS company and comparing it to a similar public SaaS company that trades at a 10x P/S multiple.

The goal of these adjustments is to account for the differences that remain after finding the closest public comparisons.

Planning a merger or acquisition? Check out our list of the top M&A advisory boutique firms in the U.S. to find expert guidance tailored to your needs.

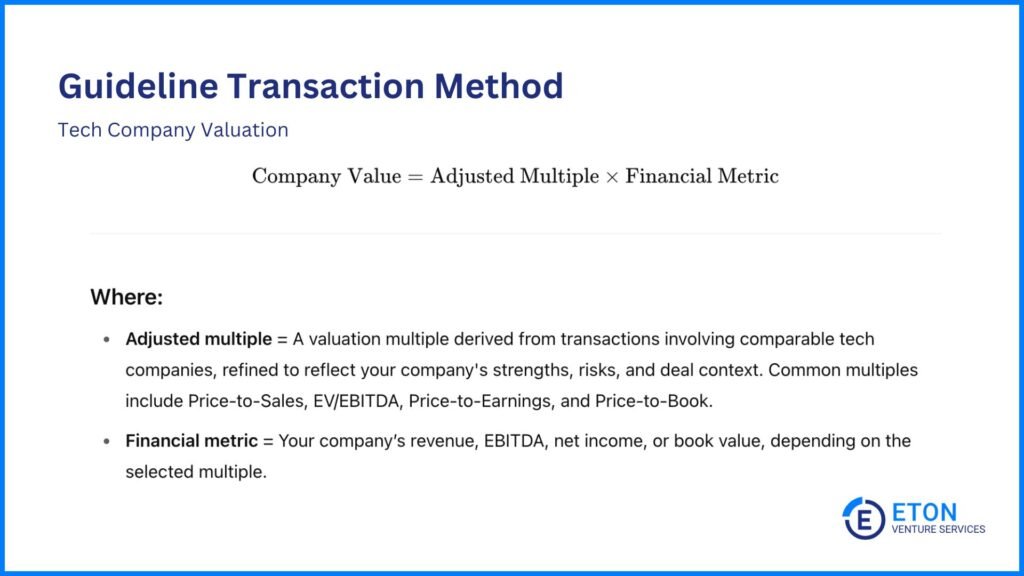

The Guideline Transaction Method values a tech company based on actual sale prices of similar firms. This makes it especially useful for M&A analysis and determining the value of your tech company in a sales context.

For example, if comparable deals show a Price-to-Sales multiple of 4x and your firm has $10 million in revenue, its value would be $40 million (4 × $10 million).

However, unlike public valuations, which shift based on investor demand, private deals depend on who the buyer is and what they’re looking for:

So, if you’re comparing your tech company to past deals where buyers paid premiums or negotiated discounts, you’ll need to adjust the multiple. That way, it reflects whether a similar premium or discount applies to your company.

For example, a buyer in a past deal might have paid more to acquire a company’s intellectual property because it gave them an edge in the industry. If your tech company’s patents don’t offer the same advantage, the multiple may need to come down.

On the other hand, a previous deal might have sold at a discount because the seller faced financial pressure. But if your company is in a strong position, the multiple needs to increase.

The goal is to separate the company’s true value from deal-specific influences.

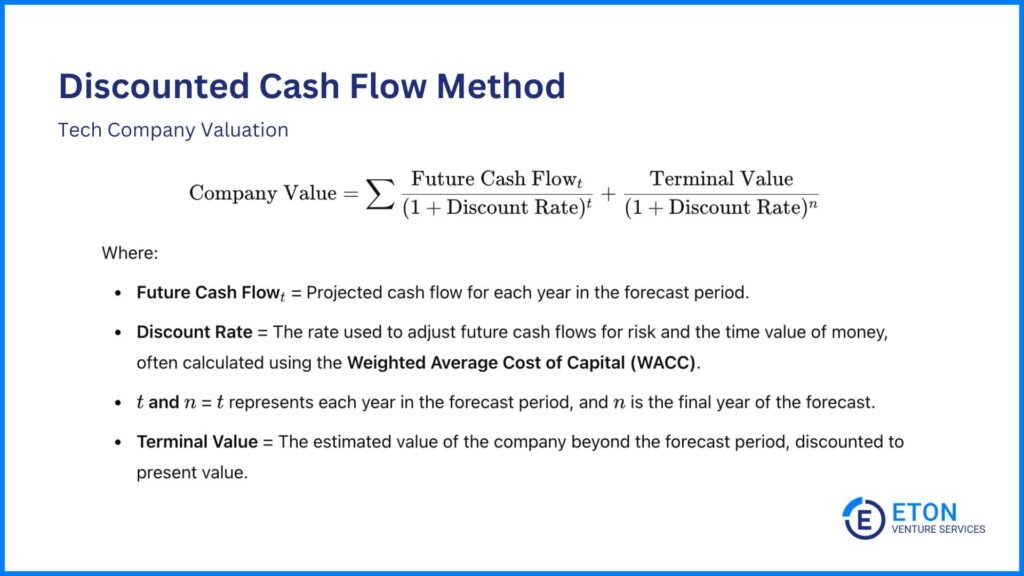

The Discounted Cash Flow Method estimates a company’s value by forecasting its future earnings and adjusting for growth potential, risk, and the time value of money.

In other words, this method doesn’t rely on past performance. Instead, it looks ahead to determine how much a business is worth based on expected cash flows. That’s why it’s best suited for growth-stage or established tech companies with predictable future cash flows.

To apply the DCF Method:

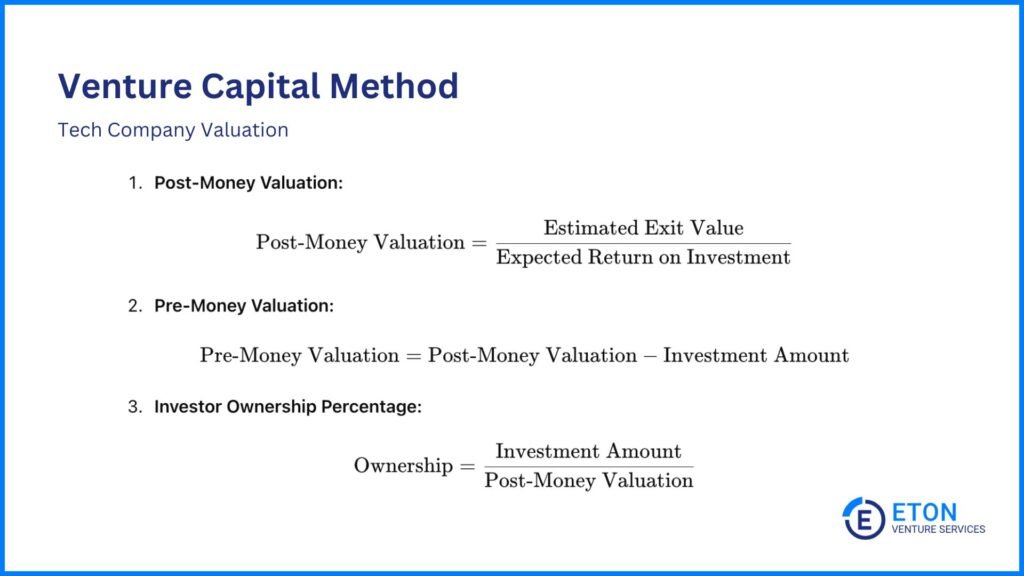

We primarily use the VC Method to value your startup if it needs funding, specifically if it’s an early-stage startup that lacks stable cash flows but has high growth potential.

Since a startup like this doesn’t generate consistent earnings, traditional valuation methods don’t work well. Instead, investors focus on the startup’s future exit value (what it could be worth at the time of a sale or initial public offering).

By estimating this value and working backward, they determine how much to invest today and what percentage of the company they should own.

This method is especially useful in fast-growing industries where market potential and investor returns drive valuation.

Here’s how it works:

Need third-party valuation help? Explore our guide to the top third-party valuation firms and find the right partner for your business.

Valuing a tech company means looking beyond what it earns today and focusing on what it could earn in the future. This means that growth potential, competitive advantage, and market position all play a role in shaping its value. A company with a fast-growing user base, strong intellectual property, and the ability to scale efficiently is far more attractive than one struggling with high churn or limited market reach.

Understanding and accounting for these factors ensures you’re evaluating a tech company with the right perspective – one that captures both its risks and its potential.

Valuation experts play a huge role here. We analyze these factors, highlight their impact, and translate them into a clear picture of what the company is really worth.

Here’s a closer look at what matters most:

For tech companies, especially SaaS and platform-based businesses, the ability to attract and keep users is a major driver of value.

High user acquisition rates signal market demand. Strong retention shows that customers find ongoing value in the product. In turn, buyers and investors see a company with a low churn rate and growing monthly active users as more stable and scalable.

Consider a subscription-based SaaS company. If customers consistently renew their subscriptions and refer others, revenue becomes more predictable. This drives up the company’s valuation.

On the other hand, high churn forces a company to spend more on acquiring new users just to maintain revenue. This makes it less attractive to investors.

Patents, proprietary software, and unique algorithms help protect a company’s competitive position. They make it harder for others to replicate its offerings, which boosts valuation.

Investors also look at whether a company owns its core technology or relies on third-party providers. Companies that control their own infrastructure tend to be more valuable because they reduce risks like licensing costs, service disruptions, or reliance on external vendors.

Strong IP can also open up opportunities for licensing or strategic partnerships. This creates additional revenue streams that further enhance valuation.

Tech companies have the unique advantage of scaling with lower incremental costs. Unlike traditional businesses that require more physical resources to grow, a software platform can serve millions of users without a significant rise in expenses.

For example, a video conferencing platform may start with a small user base. But as adoption grows, the cost of serving millions of users remains relatively low.

This ability to grow revenue without proportional increases in expenses makes the company more profitable over time. In turn, it attracts investors who see potential for high margins.

The size of a company’s potential market, and how well it positions itself within that space, directly affects valuation.

A tech firm operating in a large and expanding industry has more room for growth than one in a niche market with limited demand.

However, market size alone isn’t enough; a company must also compete effectively to capture a meaningful share of that opportunity.

Take cloud computing as an example. The industry is worth hundreds of billions, but new startups can’t just rely on the size of the market to attract investors. A company going up against giants like Amazon Web Services and Microsoft Azure needs a way to stand out. This could be through specialized services, better pricing, or focusing on an underserved customer segment.

A startup that tailors cloud solutions specifically for healthcare providers, for instance, may be more appealing to investors than a general competitor struggling to gain traction.

A tech company’s value is closely tied to the strength of its leadership team and employees.

Founders with a track record of success, deep industry expertise, or strong networks can attract investors and top talent.

Skilled employees – especially in engineering, product development, and sales – help drive innovation and execution.

Investors often evaluate whether a company has the right team in place to grow and adapt as the business scales.

At Eton Venture Services, we provide accurate, independent valuations that support your decision-making, whether you’re planning for growth, preparing for a transaction, or structuring a transition.

Our team of experts is dedicated to offering the highest level of service in assessing the value of your tech company. We ensure that all key factors, such as user growth, technology, intellectual property, and scalability, are thoroughly considered.

Trust our experts to deliver insightful, tailored valuations that support your next move.

We mostly value tech companies based on future potential rather than current earnings. That’s because investors focus on what they could generate down the line through ads, subscriptions, or other models.

Strong user growth, a large market, and scalable operations indicate whether a company has the foundation to turn that potential into profitability, even if it isn’t earning money yet. This is why some tech companies are valued highly even without being profitable.

Investors assess risk by looking at competition, revenue stability, and market conditions.

In valuation, risk is factored in through discount rates in the DCF Method, valuation multiples in the GPC and GT Methods, and expected investor returns in the VC Method.

Higher risk usually means a lower valuation unless growth potential is strong enough to offset it.

Funding can increase a company’s valuation if it drives growth, but it can also reduce the value of each share if the company doesn’t keep up with expectations.

If a company raises money at a high valuation but underperforms, future funding rounds may come at a lower valuation. This can make it harder to attract investors.

In short, the impact of funding depends on whether it fuels real expansion or just helps the company stay afloat.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.