Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Navigating a divorce is never easy, emotionally or logistically.

Dividing up major assets like pensions only adds to the stress. But properly valuing it is an important part of reaching a fair settlement.

In this article, we outline:

💡 Key Takeaways:

When going through a divorce, all marital assets must be split between the two parties.

This includes major assets like the home and vehicles, but also retirement accounts and pensions that have been accumulated over the years. That’s because they’re a significant portion of a couple’s net worth.

Below are examples of assets that need to be divided during a divorce:

But accurately valuing a pension, especially a defined benefit plan, can be complex. There’s a number of variables, methodologies, and formulas involved in the process.

You could try to handle the valuation yourself, but there’s a real risk of getting it wrong.

And the last thing you want is an inaccurate pension valuation that’s contested or that shortchanges you somehow.

There are also legal considerations to worry about.

In some jurisdictions, pensions are viewed as fully joint property to be split 50/50. While in others, only the portion earned during the marriage is subject to division between spouses.

Whoever values your pension needs to be familiar with the nuances and prepared to handle any and all complexities.

What you need is to hire a reputable, fair-priced firm like Eton to do it all for you.

We’ll pull from our 15+ years of valuation experience and rely on Big 4 trained valuators to get you a valuation that stands up in court and is equitable for both parties.

Get in touch with me here to find out how we can support you through the divorce process with a defensible valuation.

🤔 Did you know? Business owners facing divorce will also need to get their business valued. This is a service Eton offers which we can do alongside a pension valuation.

Learn more about our business valuations in divorce services here.

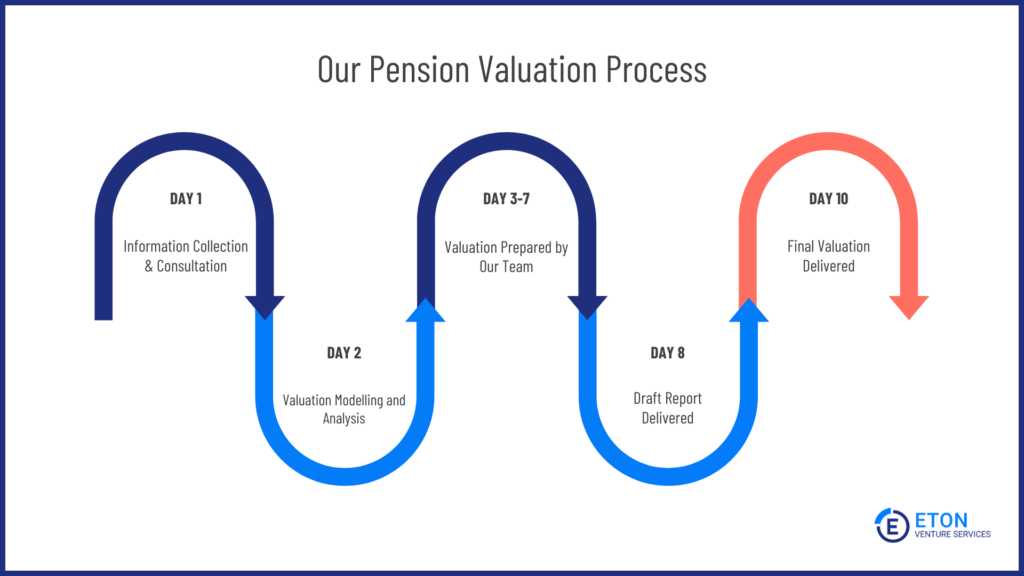

If you work with us, our team can complete the valuation within 10 days.

We can accommodate an expedited timeline for an additional fee but will always need at least one day from submission of your documents.

This is how a typical pension valuation process can look like:

Other firms may take longer. That’s because larger firms deal have a lot of internal back and forth built into their processes while smaller firms lack the resources to work quickly.

Eton’s size, experience, and approach makes it possible for us to work quickly while ensuring accuracy and a stellar customer experience.

If you were to take on the pension valuation yourself, the completion time can vary depending on your knowledge of the subject and your past experience.

We recommend you not to jump into valuing your pension without considering these three factors. They influence how and how much of your pension is up for division.

The two main pension plan types are:

Defined benefit plans provide a fixed payout in retirement based on a formula typically comprising years of service and compensation. Examples include:

Defined contribution plans, like 401(k)s and 403(b)s, have no guaranteed payout. The employee and potentially the employer contribute funds that can grow over time based on investment performance.

Valuing these different plan types requires tailored methodologies and assumptions by the appraiser.

In most states, only the portion of pension benefits earned during the marriage is considered marital/community property subject to division. Contributions made prior to the marriage would be classified as separate property.

Anything considered separate property won’t be included in your asset division. So you need to know how much of your pension falls under each classification.

To determine the marital share, appraisers may use methods like:

Pension treatment and valuation requirements differ across state lines.

Some states are “deferred distribution” where the marital portion isn’t split immediately but rather when the worker retires and begins collecting.

Other states require an “immediate offset” where the present value of the marital share offsets other assets.

For example, Illinois excludes disability and government pension benefits from marital property entirely. But New York treats all service credit earned during the marriage as marital property, regardless of the source of contributions.

An experienced valuation firm will ensure compliance with applicable state statutes and precedents to deliver an airtight, court-admissible, and equitable pension valuation.

There are very few people who should take it upon themselves to value their pension during a divorce.

The process and situation is complicated, requiring expertise most people don’t have. It also requires impartiality for the valuation to be accurate and indisputable.

Which means, there’s only one step to getting a pension valuation in divorce. And that’s to find a reputable, trustworthy valuation provider like Eton to do it all for you.

💡 How to know if you’re qualified to complete your own pension valuation:

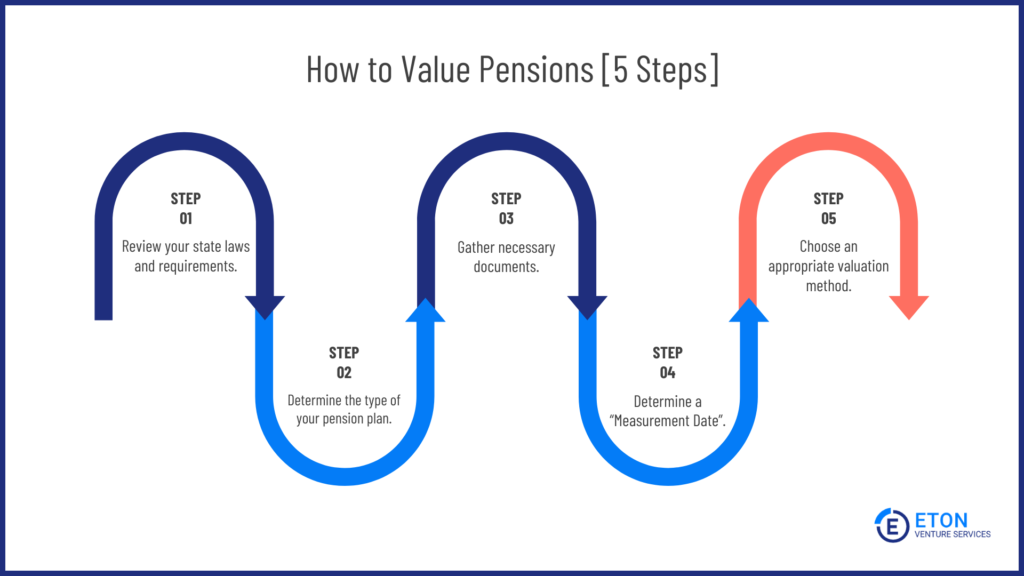

But if you’re one of the few who can value your pension without third-party expert involvement, these are the five steps you should follow:

Where you’re getting divorced plays a role in how your pension is valued and divided.

Some states may require the pension to be split equally, while others consider the length of the marriage and other factors. Familiarizing yourself with these regulations will provide a solid foundation for the valuation process.

See factor 3 above for more information.

We shared earlier that pensions can be classified into two main types: defined benefit plans and defined contribution plans.

A defined benefit plan provides a specific monthly payment upon retirement, while a defined contribution plan’s payout depends on the contributions and the plan’s investment performance.

Identifying which type of plan you have is essential, because it influences the valuation method you’ll use.

To conduct a reliable pension valuation, you’ll need to collect and review a range of essential documentation, including:

These documents provide the information needed to assess the pension’s value accurately.

The “measurement date” refers to the specific point in time for which you’ll be calculating the present value of the pension assets or liabilities.

Pension values can fluctuate over time based on factors like investment performance and interest rates so it’s important to select a date that best represents the true value of your pension at a given point in time.

Ideally, the measurement date is mutually agreed upon between both parties involved and their legal counsel.

The goal is to establish a fair, logically determined date from which to base all valuation calculations.

There are various methods for valuing pensions.

Some common options include:

The methodology you choose depends on the pension type, provisions in the plan documents, and legal requirements in your jurisdiction.

Valuing pensions can be technical, often involving actuarial assumptions about life expectancy, interest rates, and future earnings.

That’s why it’s advisable to seek assistance from a pension valuation expert.

They can apply valuation methods accurately, ensuring the pension’s value is calculated in a manner that is fair and compliant with legal standards.

While divorce is never easy, valuing and dividing complex assets like pensions can create additional stress and complications.

Attempting a pension valuation on your own requires comprehensive knowledge of valuation methodologies, regulatory compliance, documentation requirements, actuarial assumptions, and more.

Even small miscalculations can lead to costly inaccuracies.

To guarantee accuracy, it’s best to rely on a reputable firm with decades of experience completing pension valuations to high standards.

At Eton, we’re prepared to deliver a fast, accurate, and fairly priced valuation service that will prove indisputable at court.

Get in touch with us and be on your way to a headache free valuation process.

Have more questions about pension valuation in divorce? I answer them below:

The percentage of your partner’s pension you’re entitled to after a divorce can vary quite a bit, depending on the state laws and the specific circumstances of your marriage and divorce.

It’s really important to understand that there isn’t a one-size-fits-all answer to this. Different states have different rules.

Generally, in many states, you might be entitled to a portion of the pension that was earned during the time of your marriage.

This doesn’t usually include the portion of the pension that was earned before you were married or after you separated.

As for the percentage, it can often range from 50% of the marital portion of the pension in community property states (like California and Texas) to a different percentage in equitable distribution states (like New York or Florida), where the court looks at what is fair, which might not always be a straight 50/50 split.

But these are just general guidelines. The actual percentage can be influenced by a lot of factors like the length of your marriage, other assets you and your partner have, and any agreements you might have made.

It’s really key to get advice from a legal professional in your state to understand exactly what you might be entitled to in your specific situation. They can give you the most accurate information based on your state’s laws and your individual circumstances.

Generally, yes.

In the United States, the division of pensions in a divorce falls under state law, and most states consider pensions earned during a marriage as marital property that can be divided in a divorce.

However, the specific rules and methods of division can vary from state to state. Here are examples from a few states:

These are just examples, and it’s important to understand that “equitable” does not always mean “equal.”

The division of pensions can be influenced by several factors, including the length of the marriage, the value of the pension, and other assets and income of each spouse.

It’s essential for anyone going through a divorce to seek legal advice specific to their state and situation to understand how their pension might be affected.

In the UK, the value of a pension in a divorce depends on various factors and can be quite complex.

The method for assessing a pension’s worth isn’t straightforward and hinges on considerations like the length of your marriage, both parties’ financial needs, and other shared assets.

There are different approaches to dealing with pensions in a divorce, such as ‘pension sharing’ where a part of your pension is transferred to your ex-partner, or ‘pension offsetting,’ where its value is balanced against other assets.

The type of pension you have (like defined benefit or defined contribution) also plays a key role in its valuation. A financial expert is often needed to determine the pension’s value, considering future payouts and other factors.

However, if you’d just like to have an idea of how much your pension is worth or work out how much you should pay out / receive during a divorce, this is a helpful resource: Pension Divorce Calculator

(Please note that this is not a substitute for legal advice.)

It’s crucial to get specialized advice from a financial advisor or a divorce solicitor, as they can provide guidance tailored to your specific situation, including the type of pension you have and your overall financial circumstances.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.