Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

If you’re a startup founder currently raising funds, you know that the venture capital valuation process is complex, and rather daunting.

Startups usually lack past financial data and current operating income, which makes it difficult to determine their value.

This is why Venture Capitalists (VCs) consider a variety of qualitative factors (e.g. your team’s expertise) and use a combination of methods to come to an accurate value.

At my business valuation firm, we’ve valued hundreds of startups alongside VCs so we know the ins and outs of the process.

In this guide, I’ll take you through everything you need to know about venture capital valuation, including:

Key Takeaways:

Venture capital valuation is the process of determining how much a startup is worth when investors (like VCs) are deciding whether to invest. This can be both before and after the investment (“pre-money” vs. “post-money” valuation).

In short, it helps VCs decide how much equity they should get in exchange for their investment.

Throughout the process of pitching VCs and fielding investment offers, you might come across these common terms:

Term | What It Means | Why It Matters |

The value of your startup before receiving any new investment | It determines how much equity the investor will get in exchange for their money. | |

Post-money valuation | The value of your startup after the new investment is added | This helps in calculating the ownership percentage of the new and existing investors. |

Equity | The ownership interest in your company, usually represented as shares | You give equity to investors in exchange for funding. |

Capitalization table (cap table) | A spreadsheet or table that shows the ownership stakes, equity dilution, and value of equity in your company | It provides a clear picture of who owns what percentage of the company. |

Term sheet | A non-binding agreement outlining the terms and conditions of an investment | This serves as the basis for drafting the final, legally binding investment documents. |

Exit strategy | A plan for how investors will eventually sell their shares and realize a return on their investment | Your exit strategy outlines how and when investors can expect to make a profit. |

So, how do VCs value startups? Below, I break down the most common factors they evaluate.

Investing in startups is inherently risky, as the average success rate of a startup is 10-20% in the US. VCs also have limited funds which raises their stakes even higher.

To make the right investment decisions, VCs consider various qualitative and quantitative factors to assess risk, potential rewards, and future performance of a startup.

Here are the most common factors VCs consider when determining the value of a startup (and whether it’s worth investing or not):

Based on these factors, VCs determine which venture capital valuation model(s) is the most appropriate to use when calculating a startup’s value.

Need a ballpark estimate of your startup’s value? We’ve created this free startup valuation calculator to give you a quick starting point.

There isn’t a one-size-fits-all method to valuing startups.

Below, I dive deep into the seven most common valuation methods used by VCs and angel investors.

Understanding these methods will help you see how investors might value your startup and prepare you for your next funding round.

Despite its name, the Venture Capital Method isn’t the only way investors value startups. It’s only one of several methods we’ll cover.

This method determines a startup’s value before and after new capital is injected (a.k.a. “Pre-Money” and “Post-Money” valuations).

This method helps determine the ownership percentages for new and existing investors. It estimates the future exit value of a startup, and then discounts it back to the present using the expected rate of return.

This method is ideal for startups anticipating significant growth and planning to exit (via sale or IPO) sometime in the foreseeable future.

If,

Then,

The Berkus Method, also referred to as the Checklist Method, calculates the value of early-stage startups without relying on financial forecasts.

Instead, the Berkus Method assesses qualitative factors related to a startup’s operations and risks.

This method is ideal for early-stage, pre-revenue startups, particularly those expected to reach $20 million in revenues within the next five years.

It’s widely used in the tech industry.

The Berkus Method assigns a value ranging from $0 to $500,000 to each of five key factors, leading to a maximum valuation of $2.5 million:

Assuming a startup scores the following for each factor:

The total valuation would be all the values added up, which is $1.5 million.

The Scorecard Method (also known as the Bill Payne method) helps investors value pre-revenue startups using a series of weighted factors.

These factors are then used to calculate an adjusted average pre-money valuation.

Investors can tailor their valuations based on specific factors and their relative importance.

This method is best suited for pre-revenue startups with initial market traction but not much long-term financial data.

It’s especially useful for startups with many competitors in similar development stages, sectors, and locations.

The Comparables method compares startups to similar companies with publicly available financial data.

With this approach, investors use financial ratios such as:

This method is most effective for startups in industries with many public companies since there’s a lot of available data for comparison.

Value = Metric × Average Industry Multiple

Assume similar companies in the tech industry are trading at an average P/E of 25, and the company being evaluated has earnings of $4 million.

Value = 4M × 25 = 100M

The Discounted Cash Flow (DCF) method with long-term growth estimates the value of a company based on its expected future cash flows, discounted back to their present value.

This method is ideal for businesses with predictable, stable cash flows and a record of historical financial data. It’s particularly beneficial for startups with a clear growth trajectory.

The formula for DCF is as follows:

Value = CF₁ ÷ (1 + r)¹ + CF₂ ÷ (1 + r)² + CF₃ ÷ (1 + r)³ + … + CFn ÷ (1 + r)ⁿ + TV ÷ (1 + r)ⁿ

Where:

Assume a company generates $100,000 annual cash flows for 5 years, with a terminal value calculated using a growth rate of 2% and a discount rate of 10%.

Then, the final value is:

Value = $90,909 + $82,645 + $75,132 + $68,302 + $62,093 = $379,081.

The Discounted Cash Flow (DCF) method with multiple is another variation of the DCF approach. It estimates a company’s value by discounting its future cash flows and using a multiple to determine the terminal value, rather than a perpetual long-term growth rate.

This method is suitable for businesses with predictable cash flows. It’s most useful for companies with available industry or market comparables.

Follow the same formula as DCF with long-term growth, but apply an industry or market multiple (such as EBITDA multiple) to the terminal year’s cash flow.

🤔Want tailored advice for your venture capital valuation? 🤔

This article is great for general guidance on the venture capital valuation process but unfortunately, it can’t be tailored to your unique circumstances. And when it comes to valuation, circumstance determines everything.

If you want personalized advice to help you navigate your venture capital valuation, get in touch with us here. We can provide advice specific to you over a call.

Otherwise, please read on for the venture capital valuation process and a case study.

While every VC takes a unique approach to valuation, most follow a similar process when evaluating startups for investment.

Here’s what we’ve learned about the ins and outs of valuation after working with hundreds of VC firms over the years:

VCs first evaluate the size and growth potential of your startup’s market.

A large, expanding market suggests higher potential returns and growth opportunities. While startups operating in niche or stagnant markets may struggle to achieve high valuations.

VCs will also assess whether your product or service effectively addresses a significant problem.

They’ll look for a strong value proposition and unique solutions that differentiate your startup from competitors.

The more compelling the problem-solution fit, the more attractive your startup will be to investors.

VCs will scrutinize your startup’s revenue model to understand how it makes money.

This involves looking at different revenue streams, pricing strategies, and the predictability of revenue generation.

Scalable and sustainable revenue models are preferred.

Investors will then analyze metrics like Customer Acquisition Cost (CAC) and Lifetime Value (LTV) to ensure your startup can grow profitably.

A favorable LTV/CAC ratio indicates that your business can convert investment into revenue over time.

VCs also want to see evidence of traction, such as user growth, revenue, and market adoption.

Traction shows your startup can execute its business model effectively and is a strong indicator of future success.

VCs are more likely to invest in teams that can successfully execute the company’s vision and navigate challenges.

Founders with previous successful exits or significant industry experience are particularly attractive.

A well-rounded team with complementary skills is also crucial for a startup’s success.

VCs look for a balanced mix of technical, sales, and marketing expertise to ensure all aspects of the business are covered.

Investors will review your financial projections, including revenue, expenses, and profit margins.

They’re looking for realistic and achievable forecasts. Overly optimistic projections without a solid basis can raise red flags.

VCs will also assess your startup’s rate of capital spend, so they can understand how long the current funds will last and when additional funds will be needed.

A high burn rate without corresponding revenue growth can be concerning.

Based on their initial assessment and financial projections, VCs will then choose the most appropriate VC valuation model for the startup’s stage, industry, and available data.

Based on the valuation, VCs will then present a term sheet outlining the investment amount, ownership percentage, and other logistical aspects. The term sheet serves as a preliminary agreement before finalizing the investment.

The percentage of equity VCs will receive in exchange for their investment is heavily influenced by the startup’s valuation. This negotiation process balances the startup’s need for capital with the investors’ need for a reasonable return on investment.

VCs will conduct thorough research to verify any estimations and assumptions made during the valuation process. This includes market research, customer interviews, and financial audits to ensure your startup’s claims are accurate and achievable.

Once funding is secured, the startup must also comply with any regulations and avoid legal issues. This protects the investment and ensures the startup operates within legal boundaries.

Understanding the VC valuation process is essential for startup founders looking for investment.

While this guide provides a general overview, your specific circumstances will dictate the exact approach and considerations, so we highly recommend getting in touch for a free consultation.

Most of us own or know someone with a Ring smart doorbell, but did you know the company overcame some serious financial struggles before getting acquired by Amazon for $1.1 billion?

Entrepreneur Jamie Siminoff founded Ring under the name DoorBot in 2011. This groundbreaking home security product allowed homeowners to see and communicate with visitors via their smartphones.

However, Siminoff struggled to get the capital he needed in the company’s early days.

In 2013, Ring was an early-stage startup that desperately needed investment to continue its operations. A venture capital valuation was necessary to attract potential investors and validate its market potential.

Siminoff’s appearance on “Shark Tank” that year was a pivotal moment (albeit one that didn’t result in immediate funding).

Though Ring didn’t secure a deal with the Sharks, the exposure skyrocketed its visibility and sales, setting the stage for growth and success over the next five years.

Ring’s valuation involved a clear focus on the product’s mission and potential market impact.

Siminoff emphasized Ring’s goal of making neighborhoods safer, which resonated strongly with customers and investors alike.

Initially, the valuation method leaned heavily on market comparables, benchmarking against other tech companies to gauge Ring’s worth.

Despite facing numerous rejections, Siminoff remained undeterred. He continuously refined Ring’s value proposition, highlighting the unique security benefits and the growing traction in the market.

This persistent effort eventually caught the attention of high-profile investors like Richard Branson, who invested in Ring in 2015 and further solidified its market position.

The rigorous process of refining and validating Ring’s value in the market culminated in the 2018 Amazon acquisition, which left Siminoff with the title of CEO and 10% ownership in the company.

The deal allowed Ring to operate independently while scaling its operations, integrating with Amazon’s ecosystem, and expanding its product line.

However, it voided a $300 million venture round that Ring was set to close, which would have valued the company at $1 billion. Siminoff exited the company in 2023.

Ring remains a key player in the smart home security market. Under Amazon’s ownership, Ring has integrated seamlessly with other smart home devices and offers comprehensive security solutions that appeal to a wide range of customers.

The company’s focus on community security and continuous product development positions it for sustained growth and market leadership.

If you’d like expert support with your startup’s valuation, my firm, Eton, is here to help.

Since 2010, we’ve delivered thousands of audit-defensible startup valuations, covering fundraising, 409A valuations, M&A advisory, and complex securities.

We’ve also partnered with venture capital firms during due diligence, so we understand how investors think and how to position your numbers to maximize fundraising outcomes.

We’re a boutique team of Stanford Law lawyers and ex-Big 4 consultants. This means our valuations are built on rigorous methodologies that stand up to investor scrutiny, audits, and even court if necessary, helping you avoid costly mistakes and keep deals moving forward.

What sets us apart is our founder-first approach. Valuations can be complex and overwhelming, so we make sure you’re never left guessing. We’ll answer every question, guide you through tough calls, and keep you informed at every step. You’ll work directly with a senior valuation expert and always have direct access to me, the CEO.

Whether you’re preparing for a raise, issuing options, or planning long-term strategy, you’ll always have an expert in your corner.

But don’t just take it from me, hear what other startup founders have said about working with us:

You can find more testimonials here.

Ready to get started? Contact us today to discuss your startup’s valuation and see how we can support your goals.

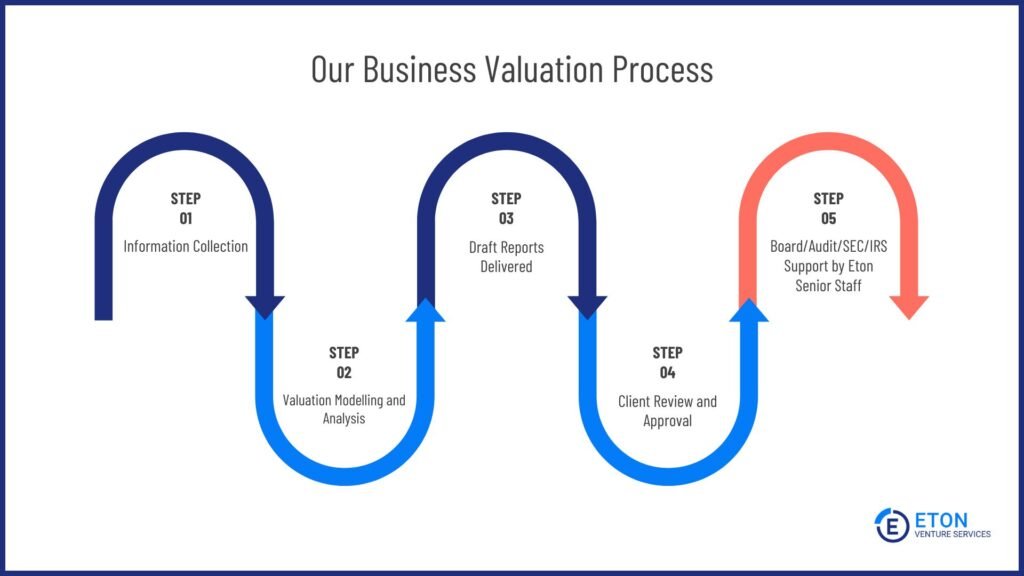

At Eton, we usually deliver business valuations in 10 days or less.

Provided we have all the necessary documents, we can even complete it in as short as a day for an extra fee.

Here’s how our business valuation process looks like typically:

If you’re ready to partner with us for your venture capital valuation, or if you’d like more information, please get in touch with me here.

Have more questions about venture capital valuation? I answered them below:

The VC method is forward-looking. Investors use it to estimate your company’s future exit value and then discount it back to today, which usually produces a much higher valuation.

A 409A valuation, by contrast, is a conservative, IRS-required appraisal of your common stock’s fair market value as of today, used mainly for setting stock option strike prices. In short, VC valuations are about growth potential, while 409As are about compliance and present value.

We break this down in more detail in our article: 409A Valuation vs Investor Valuation vs IPO Price | What’s the Difference?

To get the most accurate venture capital valuation, start by gathering comprehensive financial data and market research.

Be transparent about your company’s strengths and weaknesses, and highlight your team’s expertise and the potential for growth.

Engage with experienced valuators like Eton and regularly update your business plan and projections.

Here’s a table breaking down the key differences:

Aspect | Venture Capital Valuation | Traditional Valuation |

Data Availability | Relies on future projections and qualitative factors | Based on extensive historical financial data |

Valuation Methods | Venture Capital Method, Berkus Method, Risk Factor Summation | Income Approach, Market Approach, Cost Approach |

Focus on Growth | Emphasizes potential for rapid growth and scalability | Focuses on steady, predictable earnings and cash flow |

Risk Assessment | Higher level of inherent risk due to early stage uncertainty | Assesses more established businesses with lower risk |

Qualitative Factors | Weighs factors like team’s expertise, market potential | Emphasizes tangible assets and proven business models |

Investor Goals | Aims for high returns through equity in high-growth startups | Seeks steady returns through dividends or interest |

Valuation Frequency | Updated frequently based on new funding, milestones, or market conditions | More stable and less frequently updated |

Market Comparisons | Uses comparisons with other startups and industry trends | Compares with similar established companies and benchmarks |

Profitability | Values companies that may not be profitable but have growth potential | Focuses on companies with proven profitability and cash flow |

Use of Intangibles | Values intangibles like IP, brand potential, strategic partnerships | More focused on tangible assets like property and equipment |

You should revalue your startup whenever there are significant changes, like new funding rounds, major business milestones, or market shifts.

Regularly updating your valuation, at least annually, helps ensure you have an accurate picture of your company’s worth and can make informed decisions.

Here are some common ones I’ve come across:

Misconception: VCs only care about financial projections.

Truth: VCs heavily weigh qualitative factors like your team’s expertise, market potential, and competitive landscape.

Misconception: Higher valuations are always better.

Truth: Overvaluing your startup can lead to unrealistic expectations and challenges in future funding rounds.

Misconception: The valuation process is purely formulaic.

Truth: Venture capital valuation involves a mix of art and science, requiring both quantitative data and qualitative judgment.

Misconception: Valuations are fixed and don’t change often.

Truth: Startup valuations can fluctuate frequently based on new developments, market conditions, and business performance.

Misconception: A high valuation guarantees investment.

Truth: Even with a high valuation, VCs will consider overall fit, potential risks, and alignment with their investment strategy before committing.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.

🤔Want tailored advice for your startup valuation? 🤔

This article is great for general guidance on the startup valuation process but unfortunately, it can’t be tailored to your unique circumstances. And when it comes to valuation, circumstance determines everything.

If you want personalized advice to help you navigate your startup valuation, get in touch with us here. We can provide advice specific to you over a call.