Hi, I’m Chris Walton, author of this guide and CEO of Eton Venture Services.

I’ve spent much of my career working as a corporate transactional lawyer at Gunderson Dettmer, becoming an expert in tax law & venture financing. Since starting Eton, I’ve completed thousands of business valuations for companies of all sizes.

Read my full bio here.

Having helped thousands of companies with their Purchase Price Allocation (PPA), I’ve seen how crucial it is to get this process right for accurate reporting, tax compliance, and financial transparency.

At the core of PPA is IRS Form 8594, also known as the Asset Acquisition Statement. This form provides the IRS with a detailed breakdown of how the purchase price is allocated across different asset categories.

In this article, I’ll walk you through the details of Form 8594 – from when it’s required to how to complete it accurately, including best practices and common mistakes to avoid.

Key Takeaways

|

Form 8594, the Asset Acquisition Statement, is necessary for reporting the purchase price allocation (PPA) when a business changes hands.

The form serves as a record for the IRS, detailing how the purchase price is allocated among various assets to reflect their fair market value.

Since different assets carry different tax treatments, this form allows the IRS to:

As Shaun Bettman, Chief Mortgage Broker at Eden Emerald Mortgages, puts it, “For the buyer, Form 8594 establishes the starting point for depreciation or amortization of the purchased assets. […] On the seller’s side, Form 8594 matters because it influences the tax rate on the sale.”

That’s why both the buyer and the seller must file this form and ensure they report the same allocation values to maintain consistency and fairness, protecting them from potential discrepancies in tax treatment.

This is required when the total value of the assets transferred in a business sale is $10 million or more. Additionally, filing this form is mandatory if any single asset is valued at $100,000 or above.

Failing to file Form 8594, or filing it with inconsistencies, can lead to severe consequences:

Given these potential repercussions, buyers and sellers must complete Form 8594 accurately, verify the allocation, and retain all documentation supporting the reported values.

When a business is sold, assets can include everything from tangible items like real estate and equipment to intangible items like trademarks and goodwill.

Each category or class has different tax implications, from depreciation and amortization rates to potential capital gains liabilities. That’s why accurately reporting these helps ensure compliance and tax benefits.

The asset classes are:

Form 8594 captures these allocations, helping the IRS verify that both buyer and seller have accurately reported their values.

This compliance reduces discrepancies, making tax filings more straightforward for both parties.

After understanding the asset categories on Form 8594, the next step is correctly allocating the purchase price across these assets.

This allocation process ensures compliance and accurate tax reporting for both the buyer and seller.

Here is what you need to do:

After agreeing on the total purchase price of the business, including any cash paid, assumed liabilities, or other forms of consideration, determine the Fair Market Value (FMV) of each asset.

Fair market value is the price the buyer is willing to pay and the seller is willing to accept for an asset or liability – provided that both parties know the important details and neither is forced to buy or sell. It’s assessed using valuation methods such as income, market, or asset-based approaches.

It’s important to note here that intangible assets, like goodwill, can play a pivotal role in shaping tax outcomes and financial strategies. As Alan Andrews, Commercial Finance Specialist at KIS Finance, explains:

“One often missed angle is how intangible assets like goodwill are handled. For sellers, assigning more to intangibles can mean a better tax rate, often under capital gains, which lowers the tax bite. Buyers, on the other hand, can benefit from deductions on these intangibles over 15 years, boosting their cash flow post-deal.”

Distribute the purchase price across the asset classes in order as specified by the IRS. Start with cash and work through each class in sequence.

Any remaining value that cannot be attributed to specific assets will typically be assigned to “goodwill,” representing the business’s intangible value beyond identifiable assets.

Both buyer and seller must report the same allocation to the IRS. To avoid inconsistencies that could lead to IRS inquiries, it’s ideal to agree on the allocation in advance and include it in the final purchase agreement.

Alan Andrews also mphasizes this, noting that “If there’s a mismatch, the IRS might come knocking, and audits are a headache no one wants. Getting on the same page with asset values in Form 8594 keeps things smooth and avoids tax conflicts. So, double-check allocations to make sure they align.”

Record the allocation details on Form 8594 and submit it with your tax return for the year of the acquisition.

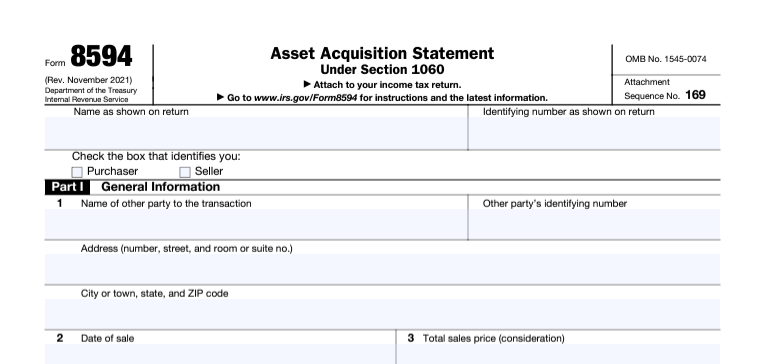

Form 8594 is structured into three main parts, each requiring specific information about the buyer, seller, and asset allocation. You can find and download the form on the IRS website.

Here’s a breakdown of the key sections and what to include in each:

This section covers basic information about the transaction parties and the sale itself.

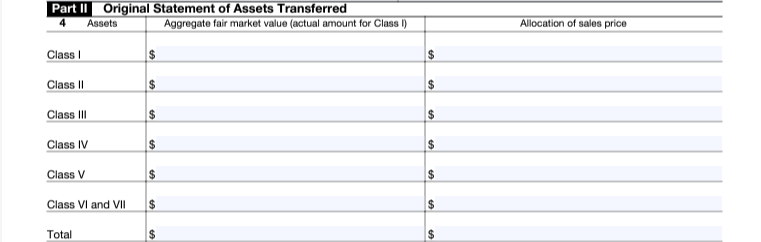

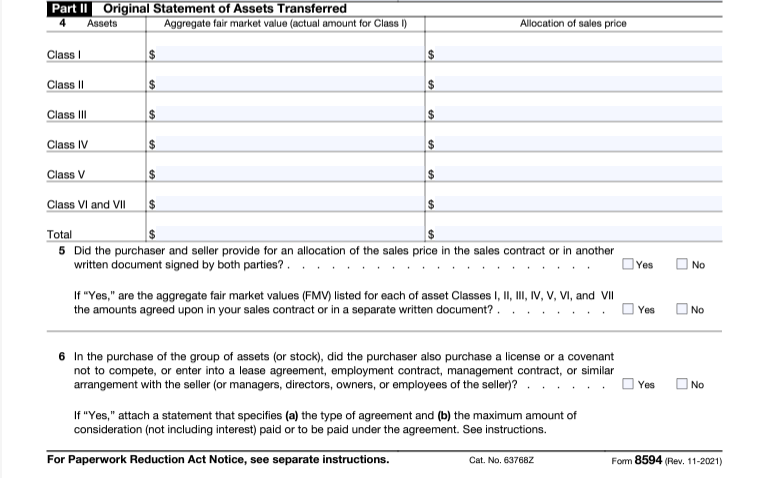

This part requires the allocation details for each asset class, along with fair market values.

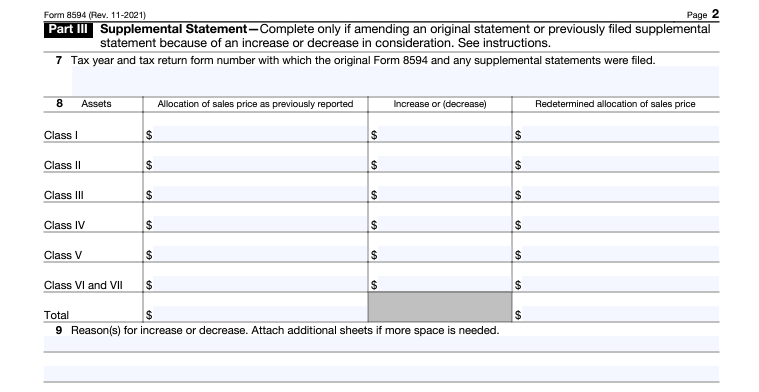

If the consideration paid changes after the initial filing, a new Form 8594, along with Part 3, must be completed for each year the consideration increases or decreases.

By completing these sections accurately and providing any necessary updates, both parties ensure that the asset allocation remains aligned with IRS requirements and that future changes are reported consistently.

To ensure accurate reporting and avoid issues with the IRS, there are several best practices to keep in mind when completing Form 8594. Following these guidelines will help both buyers and sellers stay compliant, maximize tax benefits, and reduce the likelihood of errors:

The PPA analysis is based on the business valuation report created during the acquisition process. Review this report to understand how the total purchase price was allocated to the acquired assets.

The PPA analysis should align with the valuation methodology and conclusions in the business valuation report to ensure consistency and avoid discrepancies in IRS-required fair market valuations.

Properly classify acquired assets into the categories on Form 8594, such as cash, accounts receivable, inventory, real property, and intangible assets.

Assets should be categorized based on their nature and characteristics, not their intended use, to ensure alignment with IRS requirements and avoid potential challenges.

The allocations made on Form 8594 must be backed by independent evidence, such as appraisals, analyses, or reports.

Documentation should include proof of each asset’s fair market value and be retained in case of an IRS inquiry. Simply allocating purchase price amounts without supporting documentation could lead to IRS scrutiny.

Each asset’s classification impacts tax treatment. For example, inventory sold by the buyer may incur sales tax, while intangible assets can provide amortization deductions.

An allocation that minimizes taxes in the current year might not be optimal in future tax years, so it’s beneficial to work with tax professionals to develop a strategy that maximizes tax efficiency over time.

Use the residual approach to allocate to goodwill only after all other tangible and intangible assets have been accounted for. This approach ensures that goodwill allocation is appropriate and reduces the likelihood of IRS reallocation.

Verify that the total allocated matches the purchase price. Simple mathematical errors can create discrepancies, so consider having a second reviewer check the form before submission.

Even minor errors in filing Form 8594 can lead to significant complications with the IRS. By being aware of the following mistakes and knowing how to avoid them, both buyers and sellers can streamline the process and reduce the risk of costly issues:

Ensure all required information – such as buyer and seller details, transaction dates, allocation amounts, and valuation methods – is accurately provided. Missing or incorrect data can delay processing and may trigger IRS inquiries or amendments.

Avoid assigning inflated or unsupported values, as allocations appearing manipulated for tax advantages are likely to be challenged by the IRS. Use reasonable fair market values based on standard valuation methods, and retain documentation to support these values.

Confirm that allocations are limited to assets actually acquired in the transaction. Allocating to assets not included in the sale, or to goodwill when only tangible assets were purchased, can lead to IRS disallowance.

Filing Form 8594 can be challenging, especially when high-value or intangible assets like proprietary technology, goodwill, or ‘going concern value’ are involved. Professional valuations and PPA support help ensure these assets are accurately valued, which reduces the risk of IRS scrutiny.

Expert assistance can also optimize tax outcomes. By carefully allocating the purchase price across different asset categories, you can maximize tax benefits, like deductions for certain intangible assets, both now and in the future.

Additionally, if the IRS decides to review the transaction (known as an audit), certified appraisals and strong documentation provide the necessary support. These records can verify that valuations are accurate and help resolve any questions the IRS might raise.

For business owners dealing with complex acquisitions, our financial professionals at Eton offer the expertise to simplify Form 8594, enhance tax efficiency, and reduce the risk of audit issues.

Both the buyer and the seller in an asset acquisition are required to file the Asset Acquisition Statement, Form 8594, with the IRS.

This form is necessary when a business or its assets are sold, and it must be filed to report the agreed-upon allocation of the purchase price across different asset categories. Consistent reporting by both parties helps ensure compliance and minimizes potential tax discrepancies.

If you don’t file Form 8594, you could face serious consequences. The IRS may disregard any values associated with the transaction and reallocate the purchase price based on its own assessment, often resulting in less favorable tax outcomes.

Additionally, the IRS can impose substantial fines, with penalties reaching up to $50,000 depending on the size and specifics of the transaction. Filing accurately and on time is essential to avoid these risks.

For the buyer, the allocation affects depreciation and amortization deductions on acquired assets. For the seller, it determines the taxable gain or loss on each asset class. A well-structured allocation can maximize tax efficiency and reduce long-term tax liabilities for both parties.

Supporting documentation includes independent appraisals, valuation reports, and financial statements that verify each asset’s fair market value. Retaining this documentation is necessary if the IRS questions the reported values.

Schedule a free consultation meeting to discuss your valuation needs.

Chris Walton, JD, is President and CEO and co-founded Eton Venture Services in 2010 to provide mission-critical valuations to private companies. He leads a team that collaborates closely with each client’s leadership, board of directors, internal / external counsel, and independent auditors to develop detailed financial models and create accurate, audit-ready valuations.